Wise Alpha

Today’s post is about Wise Alpha, an investment that doesn’t quite fit into any boxes. It’s a bit like a bond fund, a bit like P2P and a bit like a robo-adviser.

Contents

Wise Alpha

Mini-bonds have a bad reputation.

- They are debt issued by small, usually retail firms, marketed to retail investors and not listed on an exchange.

They often have attractive interest rates, but as well as being illiquid they are high risk because the companies offering them are quite likely to go bust.

- Luckily they are going out of fashion – the trend is towards diversification.

First we had the investment trusts that packaged up P2P loans (to be fair, a few of these have had problems, too).

- Then came the packaging platforms like Goji, which lumps together loans to categories like renewable energy.

- And there is Orca, which lets you diversify amongst (second-tier) P2P lenders within a single IF-ISA.

Closing the circle is WiseAlpha (WA), which offers something similar to mini-bonds, but against better lenders (bigger companies).

- And they have a robo offering (Robowise) to make diversification easy.

Rezaah Ahmad

The founder of WA is Rezaah Ahmad, who has a Cambridge degree in Economics and a Part II in management (like an MBA).

He also has a banking background – not surprisingly, in corporate loans and bonds.

Institutional debt offers compelling returns – markedly different from the smaller returns on offer in the retail corporate bond market.

I thought – this is a multi-trillion pound asset class currently unavailable to retail investors – and it should be. Let’s build a platform to provide access in the most economic way.

We believe in a fairer investment world where everyday investors aren’t shut out by the financial elite from accessing the biggest and best investments.

We believe that lending to some of the largest and most established companies in Britain is an attractive proposition for the discerning investor looking at diversifying their portfolio and doing something more interesting with their savings.

Our investors value the peace of mind that comes with lending to large and often long-established brand name companies versus loan investments in small businesses or more opaque and risky types of loans.

Participation notes

WA describes itself as a “compelling alternative to low-yielding savings accounts, the stock market and P2P lending marketplaces”.

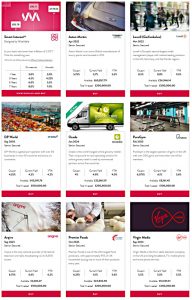

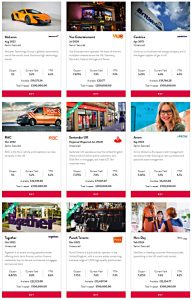

It invests in senior secured corporate debt from well known names such as the AA, the RAC, Aston Martin, Virgin Media, Vue Cinemas, New Look, WorldPay, Eddie Stobart, United Biscuits, Pizza Express and Enterprise Inns.

- The money to buy these bonds comes from larger investors in WA.

In many cases, senior secured loan creditors are ahead of bondholders in the queue during a liquidation event.

- These bonds are normally issued in block sizes too large for private buyers (often £50K or £100K).

WA then slices these up into small portions (“participation notes”) that can be bought by retail investors.

These notes are:

Designed to reflect the key terms of a specific loan-based investment or other investment issued by established companies in the United Kingdom and mainland Europe

The minimum investment is £100 and net yields are typically in the 4% to 8% pa range.

- That doesn’t include the 1% pa fee that will be deducted by WA from your interest payments.

Many of the loans are priced relative to Libor, so the interest rate can change with the Bank of England rate.

Here’s how the first 18 entries in the marketplace looked this morning:

Diversification

If you prefer, you can by into a ready-made pool of these loan notes.

- Originally these were 1-, 3- and 5-year fixed-term bonds

This appears to have been rebranded as Smart Interest, with an additional 7-year term and yields from 3% for 1 year to 7% for seven years.

- And now the Robowise product has been added.

Funding Circle – one of the leading P2P platforms – recommends that investors spread their money between 100 or so loans in order reduce risk.

- There will usually only be a handful of loans on the QA platform.

- But since they are much less risky individually, that may be all the diversification that you need.

Robowise asks investors to choose between a balanced or an adventurous managed portfolio.

- These yield 6% and 7.35% pa respectively.

The adventurous portfolio is 50% allocated to a High Yield Market.

- The bonds in this market are not secured debt.

The buying or selling of bonds within the portfolios incurs no fees.

- Investors also have the option to eliminate specific companies or sectors from the portfolio.

Crowdcube

WA raised a lot of its internal finance on CrowdCube (more than £1M).

- So if you wanted equity rather than debt there have been a couple of opportunities to date.

- I think the equity raises came with EIS relief, too.

Risks

It’s important to be clear that – like all P2P – this is not a savings account.

- Your money is at risk, and there’s no FSCS guarantee.

There are two levels of risk:

- The primary risk is that the borrowing firm doesn’t pay.

- This is the same risk as with mini-bonds, but smaller since the names involved are more reputable.

- A secondary risk is that Wise Alpha goes bust.

- In this case all the assets should be ring fenced and the loan notes should run down in parallel with the underlying “real” bonds.

Secondary market

WA notes normally have to be held for up to five years.

- But WA also provides a secondary market, where you can sell your notes early if you no longer want them.

There’s a 0.25% charge for selling in this way.

Tax

There’s no ISA as yet, though WA would like to have one.

- And you can’t hold WA notes in your SIPP (again, WA would like to change that).

This is one downside compared with bonds, including retail bonds.

It’s possible to open an account in the name of a company, which – with some planning – could have tax advantages.

- You would need to do a long-term cash flow projection, to see if you have enough spare cash to tie up for the required amount of time.

Or you could just accept that you would need to pay the 0.25% fee to get out.

- This is the equivalent of two-weeks notice on a portfolio yielding 6% pa.

Conclusions

Wise Alpha certainly have an interesting product, which is not quite robo, not quite P2P.

- But I’m yet to be convinced that it beats a bond fund in a SIPP or an ISA.

The tax treatment, liquidity and degree of diversification all seem inferior.

- The gross yield is a bit higher, but that’s offset by the tax position.

I can see the potential benefits to a company, if they have cash they are prepared to tie up for years.

- So I guess I need to schedule in a cash-flow projection at some point.

Another issue is that the website funnels you towards the packaged products.

- The marketplace is noisy and hard to take in all at once.

- If you want to put your own portfolio together, it’s not easy to compare yields, durations and yields to maturity.

But I probably need more of an incentive in order to do the work myself at the moment.

Until next time.