Rich Dad Poor Dad 1 – Assets and Liabilities

Today’s post is our first visit to a new book (new to us at least) – Rich Dad Poor Dad.

Rich Dad Poor Dad

Rich Dad Poor Dad is a very famous work by Robert Kiyosaki.

- It has spawned more than a dozen sequels, many lucrative consciousness-raising tours and even a board game.

We don’t normally cover the “self-help” end of finance, but I thought that it was about time that I looked at a couple of the more popular works.

Although I’ve never read it before, I have heard a few things about the book – not all of them good.

- My perception is that it’s a property-based system that encourages you moved from having liabilities that cost you money to assets that earn you money.

- Robert would term this “passive” income – though I wouldn’t call property rentals passive.

The CASHFLOW (TM) system involves a quadrant of four sectors that you move through and also a pyramid (both trademarked).

The central conceit is that growing up, Kiyosaki had two “dads” (in real life one was the father of a friend, I think) – one rich and one poor.

- The rich dad was able to pass on “secrets” that the wealthy tell their children, but of which the poor and middle-class remain ignorant.

Regular readers will know that I’m no fan of property:

- it has lower returns than stocks (unless you use leverage)

- returns are quite closely correlated with stocks

- it has high transaction costs

- it is illiquid

- it is lumpy (you can’t buy it in small amounts)

- the tax treatments is inferior, particularly in the UK and particularly over recent years (the government seems determined to put small landlords out of business)

So it will be interesting to see whether Robert can convince me to change my mind.

Two dads

The introduction to the book contrasts the two dads, one rich and one poor, one educated and one not.

Robert has some contrasting quotes to illustrate their approaches:

The love of money is the root of all evil vs the lack of money is the root of all evil.

I can’t afford it vs How can I afford it?

The rich should pay more in taxes to take care of those less fortunate vs Taxes punish those who produce and reward those who don’t produce.

When it comes to money, play it safe – don’t take risks vs Learn to manage risk.

Our home is our greatest asset vs My house is a liability, and if your house is your largest investment, you’re in trouble.

Money doesn’t matter vs Money is power.

Robert says that he learned six main lessons from his rich dad, repeated over a period of 30 years (until he was aged 39).

The rich don’t work for money

In Chapter One we learn that the Rich Dad is in fact the father of Robert’s friend Mike.

He owned warehouses, a construction company, a chain of stores, and some restaurants.

- Robert’s dad was a teacher.

Robert wanted Mike’s dad (Rich Dad) to teach him how to make money, but instead he offered him work – three hours every Saturday in a mini-mart.

By Wednesday of the fourth week, I was ready to quit. I wanted to learn to make money from Mike’s dad, and now I was a slave for 10 cents an hour. I had not seen Mike’s dad since that first Saturday.

Robert went to ask for a raise but the lesson was that the poor and the middle class work for money.

- The rich have money work for them.

Of course, you’ll probably have to do some work in the first place to get together the money that you can put to work.

Rich Dad also explained about fear (of being fired etc.) vs the anger and passion of those who want to take control of their lives.

He’s talking about greed, but he prefers to call it desire.

- He also cut Robert’s pay to zero.

- Later he offered $5 an hour (an adult wage), at the cost of the lessons stopping.

Luckily Robert turned him down.

- That was a test of whether they could avoid giving in to their emotions.

Rich Dad told them to look for opportunities that others might miss.

Soon they had set upap comic book reading room using out of date comics from the store they worked in.

- And they employed Mike’s sister as librarian, so they earned money when they weren’t physically there.

But after some bullies from another neighbourhood started a fight in the library (actually a spare room in Rich Dad’s basement), they were forced to shut it down.

Assets and liabilities

Chapter Two is supposed to be about financial literacy.

It’s not how much money you make. It’s how much money you keep.

We’ve all heard stories of lottery winners who are poor, then suddenly rich, and then poor again. Or professional athletes, who at the age of 24 are earning millions, but are sleeping under a bridge 10 years later.

Rich Dad taught the kids a form of accounting, using pictures at first.

- Later he added numbers.

For Robert, the big distinction is between assets and liabilities.

- The rich have assets.

The poor and middle class have liabilities (some of which they think are assets).

- This misidentification is supposedly at the root of why some people get rich and others do not.

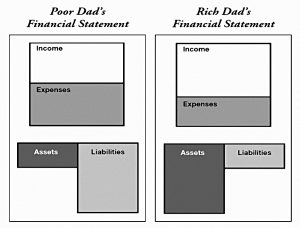

The diagrams that Rich Dad used are based around a version of the income statement and balance sheet familiar from accounting.

- income is on the top of in the income statement, expenses are at the bottom

- below this, assets are on the left of the balance sheet, and liabilities on the right.

Of course, this isn’t how the statements are actually arranged in your annual accounts.

For Robert and Rich Dad, assets provide income.

- Rich Dad showed this with an arrow from bottom left to the top.

Of course, in the real world, not all assets provide an income.

- They can be owned because they are likely to appreciate in value.

Or they could represent a prepayment of future consumption.

- The house you live in is a good example of this, and a tax-efficient one at that.

A liability is something that “takes money out of your pocket”.

- The arrow runs from bottom right to the middle (and then out of the picture entirely).

This is not true either.

- A liability is a debt or obligation – it’s money that is owed in the future.

- It will take money out of your pocket, but it hasn’t done so yet (or it would be an expense).

Unsecured debts, and debts secured against depreciating assets (eg. cars) are a bad thing.

- They increase the amount you pay for something (by adding interest).

Debts secured against appreciating assets (eg. your house, over the long term) are not so bad.

- And borrowing may be the only way that you can buy something very expensive (again, your house) in the first place.

At the same time, you should try to pay down your mortgage as soon as you can (particularly when interest rates are above 5%), and avoid the temptation of “releasing the equity” that builds up in it (or in plain English, borrowing more).

- Similarly, don’t extend the term to reduce the monthly payment.

And don’t own more house than you can reasonably make use of.

- WIth a larger house comes larger expenses (bills and maintenance) and a larger liability (bigger mortgage).

On the plus side, Robert does not restrict his list of assets to property.

- He also include includes stocks, bonds and intellectual property (IP, which produces royalties).

- Regular readers will be aware that I have a much longer list of asset classes.

Later in the chapter, Robert warns about allowing your expenses to increase alongside your income.

- This is a good point – you should Never Try to Keep up with the Joneses.

The number one expense is tax – not just income tax, but also National Insurance (from you and your employer) and (in the UK) VAT.

- That’s why we say that Taxes matter.

Robert provides a diagram contrasting the relative sizes of income and expenses, and assets and liabilities for a mythical Rich Dad and Poor Dad.

- As you would imagine, Rich Dad has more income than expenses and more assets than liabilities.

Conclusions

That’s it for today.

- We’re about a quarter of the way through the book, so you can expect another three articles in this series, together with a summary.

The core message that you need to build up assets rather liabilities is hard to argue with.

For me the big issue is whether your house is an asset or a liability.

- The house is an asset, but the mortgage is a liability.

When you’ve paid off the mortgage, you have an asset.

- It doesn’t produce an income, but it does represent the tax-efficient pre-payment of your future shelter needs.

Too much house will lead to more expenses, and impact your wealth.

- But in all likelihood, so will too little house.

Ideally, you would allocate your spare cash each year in some desired proportion between property and other assets.

- But houses are so expensive, particularly in southern England, that this is not practical.

You need to first buy a house with a mortgage, then simultaneously pay down that mortgage and build up an investment portfolio.

- None of which is easy.

Where I do agree with Robert is that you need to turn a profit each year, and you need to invest that surplus into productive assets.

- It’s just that I have a much broader definition of what constitutes an asset.

Until next time.

1 Response

[…] brigade) and those that view it as a liability (it costs you money!) For more information, 7 Circles has a great review of his book(s – since they are all the same […]