The £1M Portfolio and The 7 Circles 100

Today’s post is an introduction to a master list of ETFs & Investment Trusts that can be used as the basis of any portfolio. It’s called the 7 Circles 100.

The 7 Circles 100

Regular visitors will know that I maintain several lists of stocks and funds already.

The two that are relevant to today’s post are:

- The ETF master list

- The Investment Trusts master list

Funds get onto these lists for several reasons:

- They are cheap.

- They have been recommended by somebody I respect.

- They have a good track record.

- They allow exposure to an asset class or geography that is otherwise difficult to reach for a UK private investor.

But funds are not often removed from the lists, which as a result become longer over time.

- The ETF list currently has 43 funds.

- And the IT list has 219 funds, to give a total of 262 funds across the two lists.

Friends and readers have complained that this is too many to handle.

- So the purpose of today’s post is to produce a “house list” as used so successfully by platforms like Hargreaves Lansdown and Fidelity.

The task

We have to reduce our list of 262 funds down to a maximum of 100.

- The obvious approach would be to aim for a 50 / 50 split between ETFs and ITs.

- Since we only have 43 ETFs, we can keep them all, and add up to 57 ITs to the list.

- This cuts the size of today’s task in half.

We might also add some extra ETFs from the Exposure stocks list.

- But we are unlikely to move above 50 ETFs.

We will also allocate a hypothetical portfolio of £1M across these funds, according to our asset allocation rules (see below).

- The list can obviously be adapted to fit much smaller budgets.

Before we get to the asset allocation, the portfolio is based on some other assumptions:

- This is a “market” portfolio which excludes portions of an investor’s net worth which are tied up in physical property, DB pensions and cash.

- We’re aiming for a 50 / 50 split between passive and active funds.

- This needs to be adjusted to account for a separate “active” portfolio of individual UK stocks (which are held by the vast majority of investors that I meet).

- This active UK portfolio could be between 0% and 50% of the market portfolio.

- We’ll assume that this active UK portfolio amounts to 15% of the market portfolio. (( I’ve chosen this figure because it’s the nearest round number to my personal allocation ))

- That means that the remaining 85% needs to be split 50 / 35 in favour of passives.

- Grossing back up to 100%, we need 59% of the £1M in ETFs and 41% in ITs.

- I am expecting a global downturn in the next 18 months, so I will err on the side of caution when choosing between funds.

- The resulting portfolio should have a defensive tilt, and be even more diversified than usual.

Asset allocation

The first thing to point out is that I generally under-allocate to bonds compared with most people, for several reasons:

- Bonds are historically expensive, and likely to fall in price in the future.

- Bond yields are at all-time lows, and so their risk/reward profile is currently poor.

- I have a large non-market portfolio (58%) in cash, property and DB pensions.

- This ballast means that I can run a higher equity allocation than normal.

At the highest level, the asset allocation is between three categories:

- Equities

- Bonds

- Alternatives (or diversifiers)

My normal allocation would be something like 70 / 15 / 15 across these three.

- Adding a defensive tilt because I am expecting a correction in stocks might get me to something like 65 / 15 / 20.

We also need to subtract 15% in equities from the top, to account for the side portfolio of UK stocks.

- This takes the allocations to 50 / 15 / 20.

Grossing back up to 100%, we have approximately 60 / 17.5 / 22.5.

- This is our rough target for the first pass.

Equities

Within Equities, we have the following geographical splits:

- UK

- Europe

- US

- APAC

- Japan

- China

- Emerging Markets

We also have Global and Theme allocations, to give a total of 9 sub-sections.

We need to reduce our UK allocation from its normal 50% to take account of the active UK portfolio.

- We’ll aim for 40% instead.

The remaining 60% will be allocated roughly as follows:

- Europe 10%

- US 10%

- Emerging Markets 10%

- APAC 5%

- Japan 5%

- China 5%

- Global 5%

- Theme 10%

These allocations will vary between ETFs and IT depending on the two products’ suitability in each area.

Bonds

Within bonds we have four dimensions to allocate across:

- Government / corporate

- Fixed rate / index-linked

- UK / Global

- Short-dated / long-dated

We are likely to be overweight in UK, Government, Fixed-Rate, Short-dated bonds.

We will also look at alternative finance and asset-backed lending funds.

Alternatives

Here we have six categories:

- Commodities

- Infrastructure

- Private Equity

- Property

- Hedge funds

- Multi-Asset funds

There are no pre-defined preferences here, we’ll just see what the better funds look like.

First pass

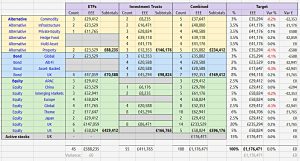

I’ve worked my way through the two lists to get something that approximates our target.

- We have 100 funds, of which 45 are ETFs and 55 are ITs.

Note that we have no US, European, APAC or Japanese ITs, with the whole allocation provided by ETFs.

- This is a consequence of trying to balance the passive and active allocations.

- Some areas have many passive funds while others have none.

This approach is probably fine for the US and Europe, but perhaps sub-optimal for APAC and Japan.

Here’s what the front page of the new workbook looks like:

There are obviously many ways to skin a cat, and this is just one of them.

- The list is just a first pass – a proof-of-concept – and will probably evolve in due course.

- You can find a live version of the workbook here.

Any suggestions or observations on the the first pass and the way forward are welcomed in the comments.

Until next time.

One problem I have with ETF’s is that typically brokers charge a lot more to invest in them.

Would love to know if you’ve found a cheap broker for monthly ETF investing.

Sam

Hi Sam,

When you say “more” I you mean presume in comparison to OEICs. I don’t buy OEICs. The platforms make their money on OEICs through the platform charge, which works out more expensive over time.

I don’t do monthly investing, either. I wait until I have enough cash to buy whatever my deal size is at the time, then place an order.

iWeb is £5 a deal so dealing charges are not really a big issue. De Giro is less than £2 a deal, but they are regulated in the Netherlands.

Mike

Sam -Both Fidelity and Hargreaves Lansdowne offer competitive charges for monthly ETF investing – they charge £1.50 a month and if you hold them outside of their ISAs there is no charge to hold them- so cheaper than holding OEICs or Unit Trusts in that respect.

You are right that dealing charges for ETFs apply and for lump sum investments Fidelity are around the cheapest with just a £1 dealing charge for say a £1,000 ETF investment -again, hold it in one of the above share accounts and there is no holding charge. Simples!

Nice article. My worry would be with such a large number of ETFs and ITs the cost of transferring brokers could be a lot. If say HL changed their platform charges to be uncapped on ETFs because we all swapped out of OEICs for example. Maybe some simpler portfolios based on the 100 for given desired asset allocation and portfolio size? If you had a master list on a sheet it might be possible to slice, dice and filter with pivot tables, maybe you do this already.

I buy ETFs for £1.50 a trade with AJBell. What I did was set up a monthly investment trade to buy a set of ETFs I invest in regularly. But if I want to do a large deal to start or increase a position I adjust the trade sizes and ETFs I want online and add cash to the account just before the trade date. You just need to time it right with them because their regular investment date can move a few days.

After 30 years I’m already way past that point. It’s a constant struggle to move away from platforms that once were cheap to ones that are cheaper now. I don’t use regular investing (I’m already in decumulation) so the AJ Bell deal doesn’t help me.

The problem with using just a few trusts is that as your portfolio grows, you end up with enormous positions. That’s a bit risky with ETFs but a lot risky with ITs and individual stocks. I work from position size, not number of positions.

I don’t ever expect to hold fewer than 100 positions. I have more than that in the 4 main portfolios that I report on here on this blog.

There are other lists of funds on the site (see links at the bottom of the page). The ETF master list has three sizes of portfolio and the IT master list has several hundred funds to choose from. Everyone has different priorities so there is no “one-size-fits-all”.