Investment Trust Portfolio 2 – Money Week

Today we are going to catch up with our Investment Trust Portfolio, and look at another published portfolio for ideas.

Contents

The story so far

Back in March we looked at John Baron’s five Investment Trust portfolios, and synthesised one of our own from them. We ended up using 36 of John’s 42 trusts, so we also put together a simpler portfolio containing “only” 23 trusts. ((Initially it looked like we had used 38 trusts, but we included SEC under two categories – UK small cap and Private Equity – and JETI under two categories – Europe and European Income – so in fact there were only 36))

Since then, we picked up an extra property trust for the main portfolio, as part of a review of some Investors Chronicle ETF portfolios for income. So the main portfolio now has 37 trusts, out of a maximum of fifty.

More data needed

Now that we are going to compare trusts from different sources, we will need more data in order to choose between trusts. Morningstar is a good source of data on investment trusts, and we can use the following factors:

- Market capitalisation

- Yield %

- Premium / Discount to Net Asset Value

- Average Premium over past 12 months

- Gearing

- Ongoing charges

- Country of domicile

- Launch date

- Share price performance over 1, 5 and 10 years

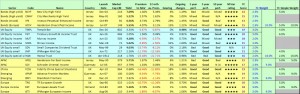

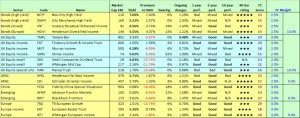

Here’s the portfolio with all that data added:

The portfolio has a weighted average ongoing charge of 1.28% (a far cry from the 0.35% of the ETF portfolio) and a weighted average quality score of 16.6. The “simple” 23 trust portfolio has an ongoing charge of 1.27% and an weighted average score of 17.0.

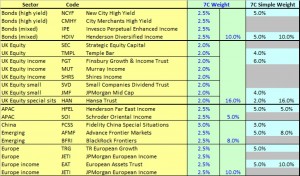

Sector Weightings

As with the ETF portfolio, our target is to have 25% to 33% of assets in non-equities. At the moment we have 28%:

- Bonds = 10%

- Commodities = 9%

- Property = 9%

Within equities, we will be underweight the UK, and overweight sectors which are otherwise difficult to access (themes, private equity, frontier markets etc). The current breakdown is:

- UK = 16%

- APAC = 5%

- Japan = 5%

- Emerging markets = 9%

- Europe = 9%

- Global = 6%

- Themes = 18.5%

- Private Equity = 3.5%

The obvious gap is US exposure.

MoneyWeek IT portfolio

The MoneyWeek IT portfolio dates back to June 2012, when Merryn broke a promise to herself never to build a model portfolio. The risk of choosing funds that didn’t do as well as expected was high, and her preference for long-term, capital-protection funds might seem dull to the magazine’s readers.

When she finally gave in to reader pressure, she chose investment trusts:

- they have a record of beating unit trusts

- they tend to be cheaper

- their closed structure makes it easier to take long-term value positions

The funds were chosen by a panel:

- Simon Elliott – Winterflood

- Alan Brierley – Canaccord Genuit

- the Rossie House team ((An Edinburgh private client manager where Merryn’s husband works))

Each member chose five trusts, and Merryn chose which made the grade.

The near misses

First, the ones that didn’t make it:

- Murray International (MYI), which is already in our portfolio. It’s run by Bruce Stout, who Merryn describes as a realist. Unfortunately MYI stood at a premium of 8% in 2012 (it’s now at 6.5%).

- Edinburgh Investment Trust (EDIN), run at the time by Neil Woodford, but standing at a premium of 3%. Merryn didn’t approve of the tobacco exposure, either.

- The smaller sister to EDIN, Perpetual Income and Growth (PLI), is smaller and has more flexibility to invest in mid-caps.

- Biotech Growth (BIOG) is already in our portfolio.

- Standard Life European Private Equity (SEP) was at the time on a 40% discount to NAV.

- F&C Commercial Property (FCPT), based mostly in London and the southeast, with an “attractive yield”.

- Law Debenture Corporation (LWDB). This “combines a diverse investment portfolio of mainly UK shares” with a stand-alone trustee business. The dividend was 3.7% and the total expense ratio (TER) was over 0.5%. The apparent premium of 8% reflects the the fact that the trustee business is not included in the NAV.

- Troy Income and Growth (TIGT)

- HICL Infrastructure (HICL) – low-risk exposure to an asset class with long-term target returns of 7%-8%

- Pantheon International Participations (PIN / PINR) – another private equity fund at a discount of 35%-40% ((Not sure what the difference between the two codes is – more investigation required))

Merryn thought all these funds were good, but preferred not to have a portfolio of 16 trusts.

The initial MoneyWeek portfolio

Six trusts made the grade:

- Personal Assets Trust (PNL) – big, liquid and with a a discount defence strategy so that it trades around NAV. “With its emphasis on absolute returns, wealth preservation and zero discount policy, we see this as a core defensive holding.” It holds cash, inflation-linked government bonds, gold and conservatively managed large stocks.

- BH Macro (BHMG) – effectively, the Brevan Howard Master Fund, a defensive US-based hedge fund, inversely correlated with equity markets.

- Scottish Mortgage (SMT) – Baillie Gifford’s largest trust (£1.6bn) focuses on companies with long-term growth potential. It is also cheap (TER around 0.5%).

- Finsbury Growth and Income (FGT) is already in our portfolio. Managed by Nick Train, it’s a concentrated of around 25 holdings, with low turnover and a discount control policy to keep kit trading around NAV. There is a performance fee however.

- 3i Infrastructure (3IN) – a “more absolute return income-generating pick” with 5% plus yield. This fund invests in operating assets rather than contracts.

- RIT (RCP) – chaired and part-owned by Lord Rothschild, with a good long-term record, but not so good short-term one. Investments are diverse (including listed firms, hedge funds and private equity).

So that gives us thirteen of the sixteen funds to investigate.

January 2013 update

There were no changes to the portfolio at the first update, though at least some members of the panel expressed doubts about most of the trusts.

A number of new trusts were discussed as potential replacements:

- Henderson Smaller Companies Investment Trust (HSL)

- NB Private Equity (NBPE)

- HarbourVest (HVPE) – more private equity

- Electra Private Equity (ELTA)

- Baillie Gifford Japan Trust (BGFD) – this is the large cap sister to BGS which is already in our portfolio

This takes the number of funds for us to investigate up to eighteen.

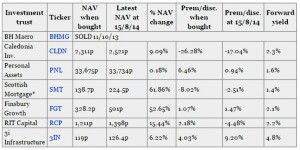

October 2013 update

At the second review, BH Macro was replaced by Caledonia Investments (CLDN), which invests internationally in quoted and unquoted companies, and was trading at a 20% discount.

Other new trusts discussed as possible replacements were:

- Diverse Income Trust (DIVI) – UK small cap income

- Templeton Emerging Markets Investment Trust (TEM)

- Blackrock World Mining (BRWM)

- Graphite Enterprise (GPE) – more private equity

- Battle Against Cancer Investment Trust (BACIT) – low-cost access to hedge funds

We now have twenty-four trusts to investigate.

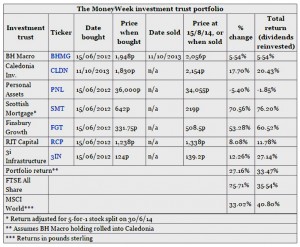

August 2014 update

This is the most recent update, so it’s time to look at some tables.

There were no changes to the portfolio during the August update, and no new alternative trusts were discussed. We still have twenty-four trusts to investigate.

Conclusions

After all that data entry on our existing portfolio, it was a relief to find that the MoneyWeek IT portfolio held only 6 trusts, and had only ever held seven.

Unfortunately / fortunately, after reading through the discussions, we now have 24 trusts to look at. This analysis will have to wait until next week.

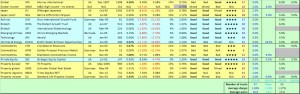

Our portfolio as it stands is shown below, with some of the less important columns removed for legibility.

Until next time.