AIM IHT Update 10 – February 2018

Today’s post is the regular monthly update on the AIM IHT portfolio.

Contents

The rules

First, the rules:

- A maximum of 50 AIM stocks, designed to shelter money from IHT.

- Relatively safe (for AIM): the goal is capital protection, not strong growth – it’s a “Safe AIM tracker”.

- Racier AIM stocks can be found in the SmallCap AIM Growth Portfolio (SGAP).

I use Stockopedia to implement the following selection criteria:

- No financials, property companies, miners or energy stocks.

- No market caps below £50M.

- No loss-making companies (PE missing)

- Risk Rating of Conservative / Balanced / Adventurous (3 from 5).

- Positive or Neutral Stock Style.

- Stock Rank above 50, sub-Ranks all above 20.

- PE below 20 (ideally) or 25 (hopefully).

Last month

At the end of January, the portfolio was up 3.0%.

- It held 49 stocks.

- The January action was to sell Conviviality and Safestyle, and to replace them with Majestic Wine and Craneware.

AIM IHT Update 10 – This month

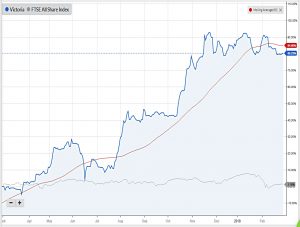

As of 28th February – after another bumpy ride – the portfolio is now up by 1.1%

- That’s not great, but it has looked worse during the month.

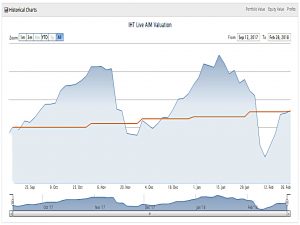

Here’s the chart:

And here’s the regular warning that the vertical scale runs only from 98% to 104% of the original capital.

- The red line (initial cash invested) creeps up each month as I manually add the dividends.

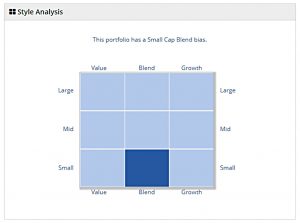

Here’s the style analysis – it’s still a Small Cap Blend portfolio:

Here’s the Health analysis – not much has changed:

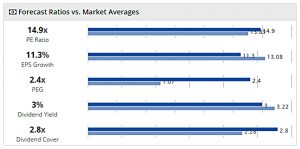

Here are the Ratios relative to the market:

- The PE remains is up to 14.9 from 14.7

- EPS growth is up again to 11.3% from 10.6%

- The PEG has fallen back to 2.4 (still too high) from 2.7

- The dividend yield remains at 3.0%

- The dividend cover is up again, to 2.8x from 2.7x

Another mixed bag this month.

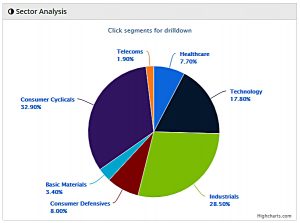

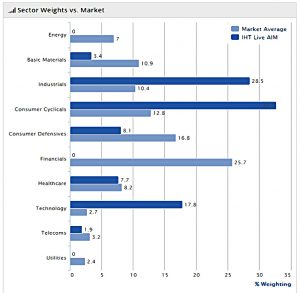

The Sector analysis shows another slight improvement:

- Consumer Cyclicals are down from 33.9% to 32.9%

- But Industrials are down from 28.6% to 28.5%

Here are the sectors relative to the market:

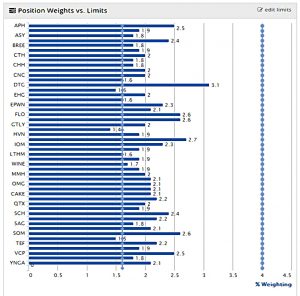

And here are the position weights:

The lower limit is 1.6%, to reflect a 2% initial weighting with a 20% stop loss.

- The upper limit is 4%, to reflect a doubling of the initial position (at which point I will consider top-slicing).

Three stocks are below the lower limit.

Bad stocks

We have two rules for weeding out bad stocks:

- Share price fall of 20% (stop loss).

- Stockopedia score below 50 (or sub-ranks below 20).

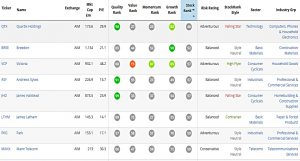

Here are the six stocks in the portfolio that have fallen more than 10%:

- GATC, EBQ and EMIS need to be sold.

Here are the stocks with the ranks equal to or below 60:

- QTX scores below 50.

- VCP has a value sub-rank of less than 20.

- Further up the table, CRW also has a value rank of less than 20.

- QTX and JHD have negative styles (Falling Star).

- There are no negative styles further up the table.

Of these four stocks, CRW has a good chart:

VCP’s is OK:

QTX’s chart is acceptable:

But JHD has a fairly ropey chart:

If we didn’t already have three sell candidates for this month, I would think about getting rid of it.

- I still might, if I can find four good replacements.

Replacements

As always, getting rid of a poor stock depends on finding a better one.

As in January, I ran the low volatility screen that I’ve been working on for the new Defensives portfolio, but it didn’t return any AIM stocks.

Gold list

The Gold List is a list of stocks that have appeared in professional IHT portfolios.

- It has 91 stocks on it.

Those with Stock Ranks above 90 – or even above 80 – are all mostly already in the AIM IHT portfolio.

Those that are not are in the SmallCap AIM portfolio instead:

- NAHL

- DWHT

- NWF

- IGR

WJG (stock rank 88) is the first one that’s not in either portfolio, bu the chart is mediocre.

- GHH (84) is another possibility, but that’s currently in the Defensives portfolio.

- SAA (82) is not in any portfolio, and will probably be bought (the chart looks good, too).

- STAF (81) is another potential candidate, but it’s classified as Speculative & Contrarian – so it would be a better fit for the SmallCap AIM (SGAP) portfolio.

It seems that this month’s replacements (other than SAA) will be from the SGAP.

- So I’ll need in turn to find some replacements for those before I make the changes.

IHT Clock

We are aiming to save 40% of IHT over a 24-month qualifying period.

- So to come out ahead, each month the portfolio needs to fall by less than 1.67%.

We are now 5.1 months into the qualifying period.

- Which means that we can afford to be down by 8.4%.

We are actually up by 1.1%, so we are 9.5% ahead of target.

- This translates to 1.8% per month, or 45% over two years.

In January we were 9.9% ahead of target (2.4% per month, or 55% over two years).

- So we’ve fallen back slightly, though things are still fine.

Hedging

We’ve missed the boat on hedging for now – the tiny gains we have at the moment put me off making the laborious arrangements.

If we can get back to 3% or 4% ahead, I will look at using spread bets with 10x effective gearing (10% stop-losses) for protection.

- To hedge the 40% of IHT gains would only require an extra 4% in capital.

There is no good proxy for the portfolio, so I will need to use a selection of the stocks within the portfolio (assuming that I can open short positions on them).

- I still need to research how many bets we need to be reasonably safe, and what is the smallest size of bet I can place on such stocks.

The cash for the hedging is now available, so I might get around to it in March.

That’s it for today.

- It’s been a turbulent month, but things are better at the end than in the middle.

The project remains more than on track.

Until next time.