Stockopedia for AIM #5 – Consolidation

Today’s post is our fifth in a series on Stockopedia for AIM – we’re working towards using the screening tool to put together an AIM IHT portfolio.

The story so far

We’ve used Stockopedia to produce nine screen and portfolios designed to find AIM stocks suitable for an IHT portfolio:

- The Stockopedia “Screen of Screens”

- A “safe” AIM screen

- The AIM stocks in our Family Firms portfolio

- The AIM 100 (minus those stocks that might not be eligible for BPR)

- An Economic Moats screen from Ben Hobson

- A neglected Stocks screen (again from Ben)

- A ready made Stockopedia screen based on Richard Beddard’s investing approach

- A hand built screen based on Phil Oakley’s investing approach

- A “Gold” list of stocks that have been selected by professional IGT Portfolio asset managers

Today’s task is to consolidate these lists into one and select the best 50 stocks for our portfolio.

- At a future date, we’ll add a 10th “Silver” list of stocks that have been highlighted on Twitter or in the public portfolios of selected investors.

Consolidation

Downloading a CSV file from each of the screens and portfolios is straightforward in Stockopedia.

- I downloaded 8 files and imported them into an Access database

My Access skills are pretty rusty – I haven’t used it in five years, and the version I now have (2007) is one I have never used at all.

First I had to work out how to create append queries to add all the data into a master table.

- Using the ticker as an index key (and disallowing duplicates) meant that I got a list of uniques.

- I also had to change all the relevant field types to numeric, since everything imported as text.

The master table has 148 records, so we need to start filtering some out.

Market cap and profitability

The first step was to exclude stocks with a market cap of less than £50M.

- That gets us down to 135 stocks.

The second step was to exclude stocks that aren’t making a profit.

- This shows up as a missing PE ratio.

- And it gets us down to 123 stocks.

Risk and Styles

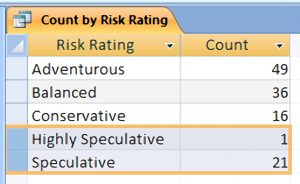

Next up is a query to count the stocks by Risk Rating:

By sticking to the three lowest risk groups, we can eliminate another 22 stocks.

- That gets up down to101 stocks.

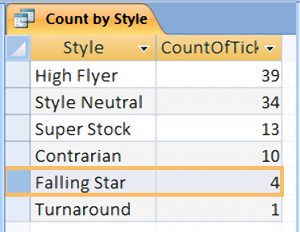

Next up are the Stock Styles:

There are six Styles in the list:

- Two are positive styles (Super Stocks and High Flyers) – there are 52 in this group

- Three are neutral styles (Neutral, Turnaround and Contrarian) – there are 45 in this group

- One is a negative style (Falling Star) – there are four in this group.

So we can eliminate another 4 stocks, to get down to 97.

Ranks and sectors

Now we can start to set minimum Rank values to further reduce the list:

- Setting the minimum Stock Rank to 50 gets us down to 88 stocks.

- Setting the minimum Value Rank to 20 gets us down to 65 stocks.

- Setting the minimum Momentum Rank to 20 gets us down to 63 stocks.

- Setting the minimum Quality Rank to 20 keeps us at 63 stocks.

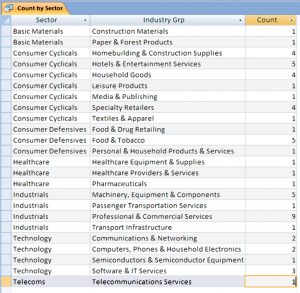

Let’s look at the spread of sectors and industry groups:

We can exclude the financials sector, which gets us down to 57 stocks:

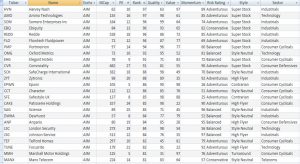

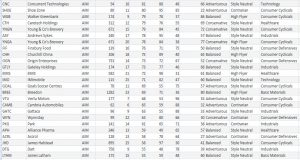

Here’s what we’re left with:

Given where we are in the economic cycle, I’m not crazy about the large number of consumer cyclicals we’re left with, but that’s where we are.

- I’m going to have to trust that the Stockopedia algorithms know what they are doing, and will get me out of any stocks that start to deteriorate.

To get down to 50 stocks, I plan to just leave out the 7 with the highest PE:

If there are any red flags when I come to buy the stocks on the final list, I can use these stocks as reserves.

So by setting the maximum PE to 27, we have our list of 50 stocks.

- I noticed that Dewhurst is on the list twice, so I’ve removed DWHT (the more expensive of the two tickers)

- That means putting the PE limit up to 28 to reinstate Conviviality to the list.

So that’s it for today – time to start buying some stocks.

- We’ll review the numbers around a month after I finish building the portfolio.

Until next time.

Mike,

fantastic work

FYI—I notice that you have YNGA down twice

Kind regards

actually Its Young & Co’s Breweyry—-both versions of share

Regards

Yes – that got fixed during implementation. There were three duplicates I think, though one was sorted out earlier in the process.

The “final” (or initial, depending on how you want to look at it) list is here: https://the7circles.uk/september-2017-trades-tips-funds/