Bonkers Portfolio 6 – November 2017

Today’s report is an update on the sorely neglected Bonkers portfolio.

Contents

Tidying up

This year, I’ve started my annual tidy up early for once.

- In recent weeks, we’ve caught up with the SmallCap Growth AIM Portfolio, in order to sort out any potential overlap with this year’s AIM IHT Portfolio.

- And we also reviewed the PiggyBack (Main Market) Portfolio, which has done less well, but is still ahead of its index.

Today it’s the turn of the Bonkers (Momentum) portfolio, which has perhaps been the most neglected of the lot.

A potted history

The portfolio has been in existence – albeit largely ignored – for getting on for two years now (it’s three months short of its birthday).

- So we probably should start with a catch up for any new readers.

During this time we’ve managed five articles about the portfolio (this is number six).

- That’s one every four months or so, which sounds okay until we walk through them.

In the first article we introduced the concept of the Bonkers Portfolio, a name I stole from Fund Expert.

- Interestingly, the original article that I looked at back in February 2016 is now “exclusive content for Gold Members”.

I’d planned to get started on a momentum portfolio using spread bets, but was having trouble raising cash outside tax-sheltered accounts.

The Bonkers approach didn’t need spread bets – you just buy the best performing funds or stocks from the previous period.

- From 1995 to 2016, this returned 3,000% – 12 times the average UK active growth fund.

- Annualised growth was 18.9% compared to 6.5% for the average fund.

- The Bonkers approach was more volatile, with bigger drawdowns.

Method

The Fund Expert team were just (simulating) buying the best performing fund (OEIC) that had more than £50M in assets, but I decided to complicate things.

- For one thing, their review period was six months, which I thought wouldn’t be “interesting” enough for readers of a blog

- I thought that one month would be better – tempting fate, there – but settled on 1 month for (free-switching) funds and three months for stocks.

I also went for a pyramid structure:

- The top fund or stock would get 40% of the available cash,

- The second stock would get 30%,

- The third would get 20%,

- And the fourth would get 10%.

To spread the risk even further, I wanted to use multiple pyramids.

Costs

This is where costs come in:

- The cheapest way to implement this is on a fund platform, with free switches at a mid price.

- I’m moving away from funds to ETFs and ITs, but I still have plenty left in legacy accounts.

But fund prices are harder to track than for stocks and ETFs, so I ended up doing both, with three pyramids:

- A set of index funds on the Fidelity platform

- The FTSE-100 stocks

- The AIM-100 stocks

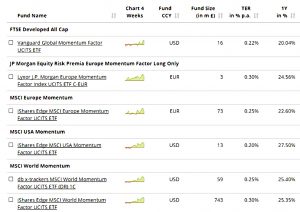

I also threw in a specialist momentum ETF – iShares MSCI World Momentum Factor (LSE:IWFM).

- So the portfolio was intended to comprise 8 stocks, 4 funds and an ETF.

It was to be a £35K portfolio, split 10:10:10:5 between the four sections.

Historic performance

After the first month, the portfolio was up 2.7%, but was pretty volatile:

After nine months – despite not implementing the portfolio updates that we should have – we were up 24.3%.

- That was 18.3% ahead of the FTSE All-Share.

I gave the excuse of skipping summer activity because of macro concerns (Brexit & Trump), and switched to quarterly analysis.

By March 2017, the portfolio was up 32%.

- This was only 13.9% ahead of the FTSE All-Share, which had recovered.

DeGiro

I also decided to include a new brokerage account from DeGiro, with fees of less than £2 a trade.

- I also pledged to look again at the spread bets account, and even shorts, but neither of those happened.

The snag with DeGiro is that they are regulated in Holland.

- Which means that compensation is limited to around £18K (€20K).

This has meant that I don’t feel comfortable putting a lot of money into the account.

- Which means in turn that including the account in the Bonkers Portfolio was a mistake.

The second big problem is that they don’t offer ISA or SIPP accounts, despite promising them for some time.

- This is a shame, because otherwise I like the account.

Lessons

The big lesson for me is that portfolios split across multiple investment accounts are just too much hassle.

- There’s always too much to do in investment, and its the more difficult things (either administratively or emotionally) that don’t get done.

So we need to simplify our arrangements somehow.

Interestingly, working the other way around (two portfolios in a single account) can just about work, as long as you keep good records elsewhere (eg. in a Google Sheet).

- It always surprises me that most brokers don’t offer portfolios within accounts, or even a notes field so that you can manually label holdings.

The second lesson is about not getting ahead of yourself.

- I wanted to use spread bets for momentum trading, but I had cashflow problems.

I should have waited until I had the cash together, and not tried to use accounts that didn’t fit the project so well.

I also shouldn’t have tried to start so many portfolios at once.

- My priorities when I started the blog were to learn about AIM (in preparation for the IHT portfolio I expected to have to build) and to see what other private investors were up to.

I should have focused on the SGAP and the PiggyBack, and then built the IHT portfolio when it was needed.

- Only then would I have the capacity to do the Bonkers Portfolio justice.

Which neatly enough brings us to today.

Performance to date

When I reviewed the portfolio in March, the eight stocks (held in an iWeb account) were:

- AAL, RR, PSON, IHG, PLUS, FPM, PWS and WINE.

- PWS has been taken over, of course.

I identified the following Buys in the DeGiro account:

- Buy £3K of Burberry

- Buy £3K of Telit

- Buy £2K of Earthport

- Buy £1K of Highland Gold

- Buy £1K of Ashtead

All of these seem to have taken place. There were also three Buys for the iWeb account:

- Buy £4K of Glencore

- Buy £4K of Fevertree

- Buy £2K of Unilever

These don’t seem to have happened, and the iWeb account still holds the original seven stocks.

So the first thing to do is add the DeGiro trades to the Google Portfolio, before the service is withdrawn

- This also means that I need to add £10,000 of extra cash to the portfolio, meaning that the initial capital was £45K.

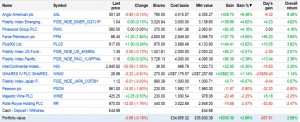

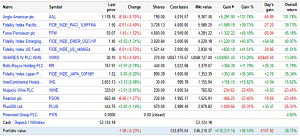

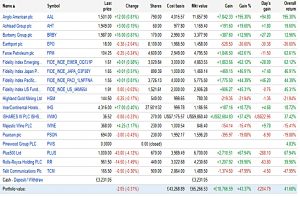

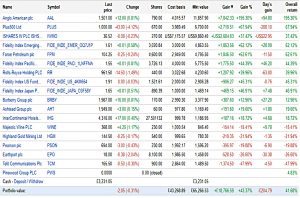

Here’s how the portfolio looks in Google format (for the last time):

Here it is again by gains:

- The portfolio is up to £65,266, a gain of £20,266

- That’s 45.0%, rather than the 41.7% shown in the table.

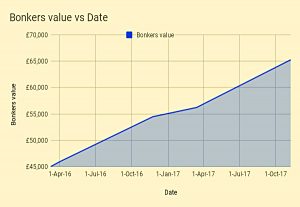

Here’s the chart:

- This appears to confirm that the portfolio is worth just over £65K.

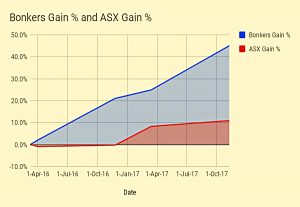

And here’s the chart relative to the FTSE All-Share:

- This shows the portfolio at only 30% gains, just ahead of the FTSE All-Share.

Even more confusingly, the FTSE All-Share is shown as being ahead for most of the time, even though the valuation in March 2017 told the opposite tale.

There are three possible explanations:

- FX moves on the IWMO holding – the pound is up around 4% since the last valuation, so any error should only be in the order of £400.

- Adding an extra £10K to the original capital completely throws everything.

- Google Portfolios is giving up the ghost a week early.

I suspect that number two is the most likely, but given that the service will be withdrawn in a few days, I’m unlikely to get to the bottom of it.

- The key takeaway is that the much-neglected version 1 of this portfolio turned £45K into £65.3K between March 2016 and November 2017.

- This was a good period for momentum, though not particularly so for the broad equity index.

Bonkers 2.0

As you might expect, there will be some changes to the future operation of the Bonkers Portfolio.

- I’m going to close the DeGiro account and move the cash into the existing spread bets account.

- This will be the main focus for the momentum portfolio from now on.

- The Fidelity index funds will also be dropped.

- The iWeb positions will be reviewed for their suitability for the SGAP and Piggyback portfolios going forward

- The IWMO ETF will be retained as “ballast” for the spread bets, and indeed will likely be added to.

- Source of stocks (to bet on):

- The recent movers on the FTSE-100 and AIM-100 will be retained.

- Using Stockopedia, I hope to add more indices (SmallCap, FTSE-250 etc.)

- I also hope to develop more sophisticated momentum factors.

- I will also consider “high-flyer” stocks from the SGAP whose PE has become too extended (BOO would be a good recent example).

- I’ll look to re-base the portfolio closer to £100K.

- With stop losses of 15%, my effective gearing is 6.7x

- So that would need around £10.5K of real money.

- That gives a maximum loss per bet of £212, and an underlying position size of £1.4K

- All this assumes up to 50 overlapping bets – we might not find that many.

I also expect to have to build my own tracking sheet, since Google Portfolios is being withdrawn and Stockopedia is not suitable for tracking spread bets.

- Perhaps there are some IG analytics that I can use.

Here’s a first attempt at graphing the raw valuations of the portfolio and the index:

Not as many data points as the Google graphs, but possibly more accurate.

- I’ll try to add something about money-weighted returns in the next iteration.

I’ll be back in a couple of weeks with more on the design and implementation of Bonkers 2.0

Until next time.

Mike,For your info—Fund Expert has gone more “up-market” and you now need a subscription to get to most,but not all, of the articles and ideas which were previously given for free

So when you look back fr an older article Fund Expert have encapsulated it in their “Gold” standard subscription account.- and in doing so you get this Gold standard title statement for yr original Bonkers portfolio article.

They do still do some free articles for their “Bronze” members (nosubscription required) but now of gretly reduced significance as a free site.

Kind Regards

Barry