Weekly Roundup, 26th December 2017

We begin today’s Weekly Roundup in the FT, with an article about the big story in finance this year – Bitcoin.

Contents

Bitcoin

Before we get started on the news, a brief update on my own crypto trading.

- Despite current volatility, I expect the price to go higher in 2018 (and then probably crash lower).

Here’s my plan, such as it is:

- IG is still not taking long bets (at least whenever I check)

- HL has two ETNs, but has delisted an ETF.

- The Bitcoin Investment Trust was delisted by HL for not complying with new EU regulations that come into force from January 1.

- The problem with using HL is that I know nothing of how to set trailing and / or guaranteed stops on their platform – but perhaps now is a good time to learn

- City Index have been emailing me that I can trade Bitcoin there

- I have an old account that I could revive, but I need to wait for some cash to turn up from my pension

- Social Trading is my final idea, and eToro is probably the one that I’ll try

- Again, this is waiting on cash to turn up (in January, I hope)

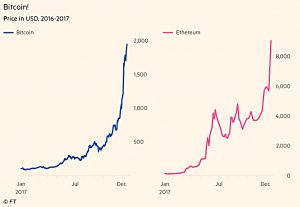

The FT article covered Bitcoin’s “big crash”.

- The price almost hit $20K on 17th Dec, before falling back to $11,000.

- It was back up at $15K the last time that I looked.

Of course, Bitcoin has had many crashes before this, and has always recovered to spectacular new highs.

- The difference is perhaps that the previous tumbles didn’t make the lead story in the FT.

Gillian Tett had an article on a more positive potential use for the blockchain.

- Hernando de Soto, a developmental economist from Peru, wants to fight poverty by establishing a decentralised digital register to record property holdings within poor communities.

De Soto believes that property rights are fundamental to tackling poverty and avoiding conflicts.

- Property rights allow poor people to access credit, and to improve their lot.

I would go further, and argue that property rights are fundamental to civilisation.

- That’s why I’m opposed to governments and political parties (such as a Corbyn-led Labour party) that don’t respect them.

More evidence of the mounting mania around crypto comes from MoneyWeek, where there were three articles this week.

Edward Chancellor called it a “mania that can only end in disaster“.

Charlie Morris took the opposite view, saying that it would “change the world forever“.

The pseudonymous Quintus Slide column sided with Edward, making a Hitchhiker’s guide reference to “the worst currency in history“.

My own take is that blockchain looks important, but Bitcoin has problems to which there are no current solutions.

Even more evidence comes from an article by John Stepek on the effect of blockchain-style company names, and “sexy” company names in general.

- In October, Bioptix rebranded as Riot Blockchain, and it’s share price went up by 1000% over the next two months.

- Here in london On-line changed its name to On-line Blockchain and its price increased by 400%.

- This week, Long Island Iced Tea (which makes soft drinks rather than the cocktail) changed its name to Long Blockchain and its price surged by 500%.

John reported that the same thing happened in the dot com boom, when stocks with names that suggested an internet connection went up 74% in the two weeks after a name change.

- And the same thing happened in 2007, when US-listed Chinese stocks that sounded Chinese out-performed those that were Chinese, but didn’t sound so.

My final piece of evidence comes from the Evening Standard, which reported the story of a cabbie in Jersey driving an investment banker.

- “Have you heard about this digital bit thing? I was thinking about starting to trade it.”

Without even knowing it’s name.

- I think we might be near the top.

Hindsight LLC

Each year, John Authers summarises the investments of Hindsight LLC, which makes trades in January that we know have worked out well by December.

The first thing is to relocate to the major country with the weakest currency, so that FX gains flatter returns.

- This year it was the turn of the US, and the dollar.

- In euros the S&P gained only 6.2% – in dollars the gain was 19.6%.

The next obvious thing was to buy Bitcoin and Ethereum.

- They were up 1300% and 1900% respectively.

The third bet was to short volatility.

- Via an ETN this made 191%.

The fourth was to go long momentum

- The MSCI World Momentum index was up 31%.

The fifth play was to buy the BATs (from China) and the Fangs (from the US).

- These were up 80% and 61% respectively.

The final four trades were:

- Long e-retailers, short US stores

- Buy the Chinese consumer (the MSCI China index)

- Short GE, long Boeing

- Long coal, short natural gas

Elderly care

Bronwen Maddox, the Director of the Institute for Government (a think tank) had a column in the FT on inheritance and paying for elderly care.

- This think tank is new to me, but since Bronwen has a full-page spread in the FT, it seems safe to assume that it’s left of centre. (( Or at least, left of my centre ))

She begins by describing the burden of dementia:

To support an adult … you need another adult.

This one-to-one scale of care is true at the moment, but perhaps the robot cavalry is rushing to save us.

Bronwen moves on to:

The end of inheritance [for some, and] … the dementia tax.

That the dementia tax is unfair because it penalises those who get dementia – compared with those suffering from cancer or heart disease, which is covered by the NHS – is one of the few opinions that I share with jeremy Corbyn.

Bronwen expects that at some point, people will be encouraged to:

Look to the equity in their homes as a resource.

She acknowledges that cheaper and more flexible products than the current equity release will be needed.

- But this ducks the issues that the burden does not fall equally on all, and that the potential cost is open-ended.

That means that socialisation (via the NHS, or some insurance scheme) is potentially appropriate, and a cap on personal contributions – with the rest underwritten by government – is required.

Patriotic gifts

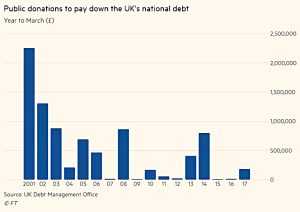

On a probably unrelated note, Vanessa Houlder wrote that the amount of money donated by individuals to the Treasury to pay down the national debt – known as “patriotic gifts“, and dating back to the Napoleonic wars – has fallen by more than 75% since the 2008 financial crisis.

- The numbers involved are small – there have been just 200 such gifts since 2000.

As you can imagine, as a believer in small government, this is not something I have ever been tempted to do – though my patriotism remains undimmed.

- But I do wish that those who bleat about “austerity” as the national debt spirals ever higher would put their money – rather than mine – where their mouth is.

Intangible assets

Over in the economist, Buttonwood looked at how intangible assets are changing investment.

A new paper looked at earnings forecasts by imagining that investors could buy stocks which wold beat estimates and short those which wold underperform.

- The premium for this hindsight strategy has fallen from 4% per quarter to “only” 2% per quarter.

The authors think this is because of the way that intangible assets are treated in accounting:

If a company buys an intangible asset, such as a patent, from another business, it is classed as an asset on the balance-sheet. But if they develop an intangible within the business, that is classed as an expense, and thus deducted from profits.

A company pursuing an innovation strategy based on acquisitions will appear more profitable and asset-rich than a similar enterprise developing its innovations internally.

This means that earning are no longer such a good guide to profitability.

- When they split companies into quintiles based on intangibles, the hindsight excess return was negatively correlated with them.

One of the problems with intangibles is that one firm can fund the R&D, but others in the industry may profit from it.

- And the risks of failure (unsuccessful intangibles have little resale value) can deter sufficient investment in the first place.

This may explain why corporate profits remain high relative to GDP.

- With tangibles, more investment would have been expected, and this should increase competition and drive down profits.

So there is a silver lining for investors up to now.

- But the lack of investment should limit future growth,.

In the future, there may be few growth stocks, and their attractions will be so well-understood that they will have stratospheric valuations.

- BATs and FAANGs, anyone?

An economist’s Xmas, part 2

The Economist also looked at the “deadweight loss of Christmas“, which we have covered more than once at this time of year, including last week.

- Basically, people don’t value your gifts and hospitality at the amount that you spent on them.

Depending on which study you prefer, between a tenth and a third of the total value is destroyed.

- Cash would be a much better gift, but is socially unacceptable.

- Gift cards are a more acceptable compromise.

Of course, there are intangible benefits that could outweigh the monetary loss – sentiment and signalling, participation in a mass social ritual (( I think that multiculturalism, and the separation of religion and the winter festival has hit this one hard, at least in the UK )) and the pleasure that the giver takes in giving.

- But we can’t easily measure these, or translate them into currency.

So I’m sticking with the idea that Xmas is a waste of money, in the narrow sense.

- But I’ll keep it to myself over the holidays.

Twitter pics

I have three for you this week.

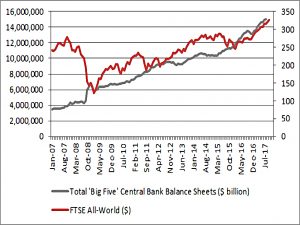

The first shows how closely world stock markets have been correlated to central bank balance sheets since the 2008 crisis.

- So the obvious question is what will happen when central banks try to shrink back their balance sheets to “normal” levels?

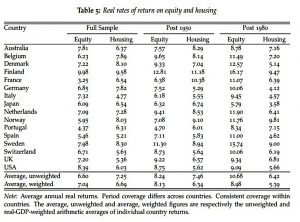

The second shows that stocks beat houses, pretty much everywhere, and at almost all times.

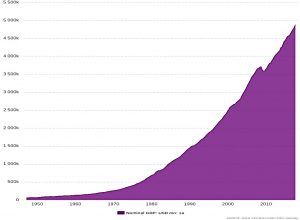

And the final chart shows the relentless rise of US GDP.

- There’s no need to worry about capitalism just yet.

Until next time.