Cash from Selling a Flat

Today’s post is about what to do with the cash from selling a flat. Are the proceeds protected, and where is the best place to put them?

Contents

The story so far

Regular readers will remember that for the past year or so we’ve been trying to sell my mother-in-law (MIL)’s flat.

- She’s moved from North London to South so that her daughter can provide better care.

- And she’ll need the proceeds to pay for ongoing rent and living expenses.

Part of the plan is an IHT-resistant portfolio of AIM stocks (see here)

- But another part is a few years of cash so that no stock market investments need to be sold during a bear market.

- Her rent and living expenses will come to somewhere between £35K and £40K a year.

- So I’ll need to find somewhere safe to house potentially £120K.

The money is due to turn up next week, so I need to have a look around.

Protection

The first thing to consider is safety.

- Bank accounts in the UK (or rather, deposits with each banking institution) are insured by the government to the tune of £75K.

This used to be £85K, as it was an EU thing defined in euros, but the exchange rate changed.

- Following the Brexit vote and the slump in sterling, the government has agreed to put it back up to £85K again. (( I think the limit goes back up to £85K on 30th Jan 2017, a few days after I’m writing this ))

The MIL’s sale proceeds will be somewhere south of £900K, so that gives us an immediate problem.

- We would need 12 accounts (12 banks) each with £75K of cover to make £900K safe.

Luckily, another form of protection is avilable.

Since 2015, the Financial Services Compensation Scheme (FSCS) has also offered temporary protection for up to £1M held with a bank or a building society.

- This is another EU-driven rule, part of the European Deposit Guarantee Schemes Directive (DGSD).

The protection has a list of qualifying reasons, but proceeds from the sale of a flat is on there.

- The protection lasts for six months from the initial deposit.

There’s no need to register the high balance with the FSCS.

- If the bank or building society fails, you download a form and make an application.

- You need to provide “documentary evidence” of the property sale

- A lawyer’s letter or the sale contract should be fine, or you could use Land Registry records.

- Payouts take three months rather than the usual week or two for the standard £75K protection.

Which accounts?

The MIL is 83, so she can’t open a SIPP and put money into that.

- She can open an ISA, however.

As we are close to the end of the tax year, she can stash £15K into an ISA before the end of March.

- And then another £20K into an ISA (the same one, or another one) in April.

- Her initial pot of money is protected until July, so that’s no problem.

What she can’t do is take advantage of the many current account and regular savings offers available.

- She has a small state pension, but it’s not enough to set up a current account.

- And it’s far outweighed by her expenses, so she can’t make regular savings.

Premium Bonds

At first glance, Premium Bonds look like a contender:

- you can hold up to £50K of bonds

- the prizes are tax-free

- the prize fund averages out at 1.25% pa, which is currently competitive

The problem is that you need to hold quite a lot of bonds to get a decent rate. (( See MoneySavingExpert for more details on this ))

- With £13K of bonds, the median payout is £150, or 1.15% (tax-free).

- Only one in 180 savers win nothing.

- With £31K of bonds, the median payout is £350, or 1.13% (tax-free).

- Only one in 240,000 people would win nothing.

You can check your likely winnings for a particular holding at the Premium Bond Calculator (now part of MSE).

- With £45K of bonds (the MIL’s likely holding), the median winnings are £500, or 1.11% (tax-free).

So for large holdings, Premium Bonds remain a contender.

The Plan

So apart from ISAs, we’ll be looking at standard instant access savings accounts, and perhaps short-term (one year and two-year) fixed deposits, plus Premium Bonds.

With £85K (outside of ISAs) to find a home for, we’ll need two accounts.

- At least one of these needs to be instant access.

- The other could be instant access, too, or a 1-year account (if the interest differential is big enough), or premium bonds.

- If we need to use a 2-year account, then the ISA will the backup in a cashflow crisis.

- This means that the 2-year interest differential needs to be even bigger.

Our outline plan for April is therefore 3 accounts:

- £35K in an ISA

- £40K in an instant access account.

- £45K in an instant / 1-yr account / premium bonds

Providers

There are a lot of new kids on the block since I last looked at bank accounts, so a bit of investigation will be required.

- Accounts with name recognition may be beyond us, but some evidence of safety will be needed.

The MIL’s current account is with the Halifax (part of Lloyds, I think), so if they have a competitive account that will be a candidate.

Income tax

With interest rates so low, tax on savings interest is not likely to be a big problem.

- But things can change.

- We need to check out how the land lies so that we are prepared.

We can stick £35K into ISAs, so we only have the income on £85K to shelter.

- With deposit rates around 1%, that’s £850 a year.

The Personal Savings Allowance (PSA) of £1,000 a year will take care of that.

- We’d need to find a rate of 1.2% or more to go over the PSA.

And if rates do rise, there’s quite a gap between the MIL’s state pension and her annual allowance of £11K (rising to £11.5K in April).

- But is the gap big enough?

The MIL will also have around £750K to £800K invested in the markets.

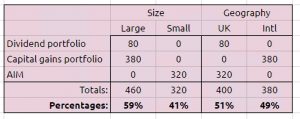

This is split into three portfolios:

- Dividend portfolio of £80K,

- this should yield perhaps 5% or £4K pa

- Capital gains portfolio of £380K

- this will be in international ETFs, so the natural yield will be fairly low

- if we choose ETFs with “reporting” or “distributor” status, gains are subject to capital gains tax

- but dividends are still subject to income tax

- so we’ll probably have 2% income here, or £7,600

- AIM IHT portfolio of £320K

- this might yield 1% or 2%, so £3,200 to £6,400

It’s worth pointing out here that even with accumulation units (usually in OEICs, but also in some ETFs), the accumulated dividends are still taxable outside a SIPP / ISA.

- All you do by choosing these over income / distributing units is to increase the amount of record-keeping that’s required.

So we’ll have an estimated 4 + 7.6 + 6.4 = 18K of dividend income.

- Plus £3.5K of pension.

- And around £1K of savings interest.

That’s an annual income of £22.5K.

Against that, we have:

- £11K of annual allowance (£11.5K by the time the dividends mount up)

- £5K of dividend allowance

- £1K of savings allowance

It looks as though the final £5K of dividend income will be taxed at the new Basic Rate for Dividends of 7.5%

- That’s £375 of tax to pay.

- And a tax return to complete.

So having a dividend portfolio for the MIL looks like a bad idea.

- 1.5% to 2% income on £800K is £12K to 16K of dividends without trying.

So instead of seeking high dividend payers, we’ll need to look at ETFs and stocks with low yields.

- We could switch the dividend portfolio into UK growth stocks instead, which would help a bit.

We could also look into ways of turning income into capital gains, but I’m not sure that any of those exist these days.

- The only options that I can think of offhand are FX profits, structured products and spread bets.

- None of these feel ideal for an octogenarian.

Top rates

After a bit of research, this is my shortlist.

For normal savings accounts and “bonds”:

- Tesco – 1%

- NS&I – 1%

- RCI Bank Freedom Savings Account – 1.01% (( RCI is a French bank ))

- Post Office Online Saver – 1.01% (but includes a 1-yr bonus of 0.76%)

- Secure Trust Bank 90-day notice account – 1.32%

- Atom Bank 1-year bond – 1.4%

- Atom Bank 2-year bond – 1.6%

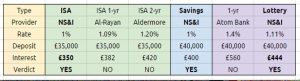

For ISAs:

- NS&I easy access ISA – 1%

- Al Rayan Bank 1-year ISA – 1.09%

- Aldermore 2-year ISA – 1.2%

All of these accounts are guaranteed, but there are some unfamiliar names on the list.

Rate comparisons

We need to look at the following:

- NS&I savings account (1%)

- Atom Bank 1-year bond (1.4%)

- Premium Bonds (1.11%)

- NS&I ISA (1%)

- Al-Rayan 1-yr ISA (1.09%)

- Aldermore 2-year ISA (1.2%)

So, bizarrely, it looks as though we might be putting all of the money with NS&I:

- The instant access ISA pays only £32 less than a 1-yr ISA, and £70 less than a 2-yr ISA.

- The instant access savings account has no competition from brands with name recognition.

- And the premium bonds pay on average £130 less than a 1-yr bond, (( The extra is partially taxable, so it’s actually a difference of around £124 )) with the bonus excitement of a potential £1M payout.

At least the NS&I are as safe as things get.

Update – NS&I cuts rates

So I wrote this post a couple of weeks ago, and almost immediately NS&I cut their rates by up to 0.25% pa (ie. according to the papers, they “slashed” rates).

Premium Bonds got away relatively lightly – the effective average interest rate was cut from 1.25% to 1.15% pa.

- As we saw above, the actual rate you get varies with the amount of money that you invest

But compared to other non-ISA savings accounts, Premium Bonds still look ok to me.

But the NS&I ISA is being cut to 0.75% pa and the Direct Saver account to 0.7% pa, neither of which is really good enough.

For the ISA, it looks as though the Virgin Money Defined Access ISA might be best.

- This pays 1.01% but only allows three withdrawals a year.

For the taxable account, the best option looks to be Tesco, at 0.96% pa, including a first year bonus of 0.56%.

- Tesco were also in the papers because they suspended applications to their 3% pa current account, but the savings accounts appears to still be available.

If we want to avoid the bonus structure, we may have to go with a non-household name.

- the RCI Bank Freedom Savings Account at 1.01% pa has the top rate.

Until next time.