Copy Trader Diversification

Today’s post looks at diversifying across traders we will copy on eToro.

Contents

Copy Trader Diversification

Last time out, we looked at the eToro copy trading facility.

We came up with four dimensions that I will try to diversify across:

- Country

- Assets

- Declared trading strategies

- Time horizon (long-term/swing/day traders)

For countries, I plan to use a similar high-level geographical split to the one I use in my passive risk-parity portfolio:

- UK

- US

- Europe

- APAC

I’ll aim to have equal numbers of traders from each of these regions.

I might also add Emerging Markets as a separate category if it turns out that there are lots of traders from those countries.

- I think there will probably be a lot of traders from Europe and APAC and not enough from the US and the UK, but we’ll do our best.

There are six asset classes/products on eToro, which the site refers to as Markets:

- Stocks

- ETFs

- Indices

- Commodities

- Currencies

- Crypto

The Copy Trader portfolio is intended to be diversifying relative to my core portfolio, so I want to spread assets across all these categories. My target split is:

- Stocks = 20%

- ETFs = 10%

- Indices = 10%

- Commodities = 20%

- Currencies = 20%

- Crypto = 20%

If we bunch ETFs and Indices together, that gives us five equally sized markets and four equally sized geographies.

- This in turn means we have enough boxes for our starter portfolio of 20 Copy Traders.

Trading style and time horizon will have to wait until/if the portfolio grows larger.

Filters

Last time out, we identified 11 possible filters:

- Return – deciding on a suitable threshold won’t be easy

- Risk score

- Max drawdown (probably yearly)

- Portfolio size (20 to 50 holdings would be ideal)

- Age of account (at least a year)

- Total number of trades (say a minimum of 50)

- Average/minimum position size (less than 10%/more than 0.5%)

- Number of trades per week (1 to 5 would be ideal)

- Average holding time

- Percentage of profitable weeks

- Expected profit per trade (if I can work out how to calculate this easily)

For the purposes of selecting our first trader to copy, I’ll run these against UK Stock Traders.

Returns

I also need to choose a return target and a lookback period, as these appear on the main filter bar.

- My minimum return target is my actual withdrawal rate plus inflation.

- That works out this year at 0.7% + 2.4% = 3.1% pa

- Or I could use my nominal target SWR plus inflation – 3.3% + 2.4% = 5.7% pa

- Next up is my blended benchmark, which is running at around 11.3% pa.

- Or I could use my actual returns, which are around 11.1% over the last year

- London property is making me underperform slightly at present

- Or I could use my listed portfolio, which is running at around 16.4% pa.

So whilst even 4% would still be useful, realistically I should aim for 11% pa.

For simplicity, I’ll start with a 12-month lookback.

- Other default settings include a risk score of 1 to 6 and verified traders only.

UK stock traders

That first pass gives me thousands of results so we can clearly do some refining. I added:

- a 50% minimum stock allocation

- 40% minimum profitable trades

- more than 50 trades in total

- an average position size of between 2% and 8% (ie. 12 to 50 positions)

- a maximum daily drawdown of 3%

- a maximum weekly drawdown of 5%

All of these were easy to apply using the Refine dialogue.

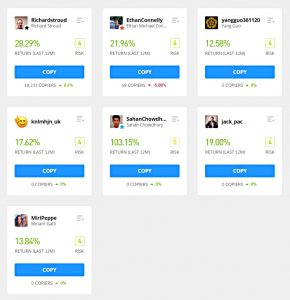

Now I only have seven results!

- Three of them have coloured stars against their names – I don’t know what that means yet.

Only two of them have copiers.

RS

Let’s take a quick look at the first of them – Richard Stroud.

- Richard has 18,053 copiers and $5M of AUM!

He picked up most of them more than a year ago, after returns of 41% in 2019 and 60% in 2020.

- 2021 isn’t going nearly so well and Richard is only up 6.3%.

His risk scores and drawdowns look fine (max annual drawdown is 7.33%).

He’s 78% stocks and 64% profitable over a total of 131 trades.

- He makes 2.4 trades per week and holds for 8 months.

He’s been active since March 2018 and has 63% profitable weeks.

- I had a quick look at his current portfolio (41 positions) and there’s nothing weird in there.

Richard’s two-year chart is decent, but he’s been running out of steam recently.

- He’s still above the 200-day MA, though.

All in all, I would be prepared to copy Richard, but I’m not wildly excited about it.

Building a watchlist

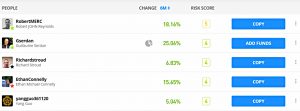

I repeated the same process with all seven traders on my filtered list, adding four of them (including Richard) to my UK Stocks Watchlist.

- I also added another trader suggested by eToro, who also happens to fit my criteria.

Five UK stock traders should be plenty for the foreseeable future.

My first copy

And so it was time for my first copy.

- I decided to go with Gserdan (whose recent chart looked best) – that’s why there’s a pie chart symbol next to his name in the watch list, and the call to action button says “Add funds” rather than “Copy”.

The Copy process is pretty straightforward – you just choose a copy amount (minimum $200) and decide whether you want to copy the trader’s existing trades or wait for him to open new ones.

- There were no charges apparent for the copy, though the position began at a loss of a fraction of a per cent of its value.

This could be down to spreads, or just to immediate price fluctuations.

- It was a bad afternoon in the markets, and half an hour later I was down 0.5%.

You can also set a stop loss on the entire copy link, which I did.

- The stop loss can be in currency terms or as a percentage, though if you don’t want one of the preset levers you’ll need to manually enter the value you prefer.

I went for 20%, to begin with.

And so we’re off and running.

- I’ll be back with another update when I’ve chosen a trader for each of the combinations of geography and market.

There could be some areas without any suitable traders, in which case I’ll need to double up somewhere else.

- Until next time.

Interesting – looking forward to the next instalment.