Weekly Roundup, 15th November 2021

We begin today’s Weekly Roundup with Tesla.

Tesla

John Authers wrote a couple of newsletters about Tesla.

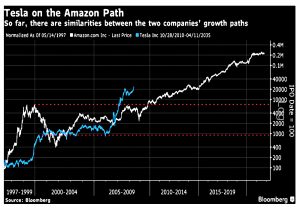

- The first looked at whether Tesla will turn out to be Cisco or Amazon.

No company has ever reached a trillion-dollar valuation on such small revenue. Its market cap takes an immense amount of success in the future for granted. It’s possible to imagine a version of the future in which today’s price looks like a good deal. There are far more futures in which Tesla looks like a disaster.

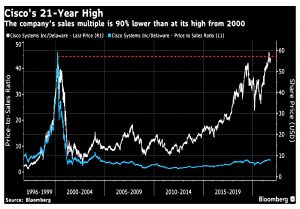

Cisco [was] briefly the world’s largest company, and in 2000 the dominant provider of the internet’s physical infrastructure. Anyone who bought at the top 21 years ago is still sitting on an outright loss.

Cisco wasn’t a flop as a company, and the internet did turn out to be important.

- But that couldn’t support a price of 46 times revenue, and it now trades at 4.6 times.

Amazon had a ten-year fallback, but anyone buying at the 1999 top would have made 17% pa since then.

- Interestingly, Amazon also peaked at 45 times price-to-sales and is now below 4 – but the sales are much bigger.

Of course, that would have been hard to spot in 1999, when Amazon was just a loss-making online bookstore.

Is Tesla’s valuation similarly dependent on the company using its dominant position in EVs to take advantage of opportunities that don’t exist now but will be around a decade from now?

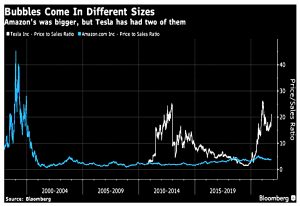

Tesla’s price-to-sales peaked at 26 (the S&P 500 is currently at a record 3.14) but after crashing, it recovered to more than 20.

- Unlike Cisco and Amazon – and Microsoft, Facebook and Google (but perhaps somewhat like bitcoin) – this is not Tesla’s first bubble.

When two such phenomena come along at once, the most likely explanation lies in the conditions and psychology surrounding them, not in Tesla and Bitcoin themselves.

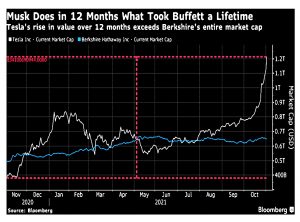

John’s second note compared Tesla to Berkshire Hathaway.

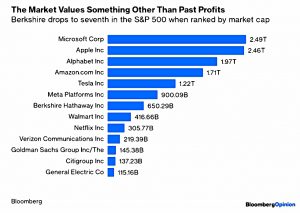

A year ago, Berkshire was the larger company. The increase in Tesla’s market cap has been equivalent to more than the entire market cap of Berkshire Hathaway. What it took Buffett an entire career to create, the market has bestowed on Elon Musk’s Tesla in just 12 months.

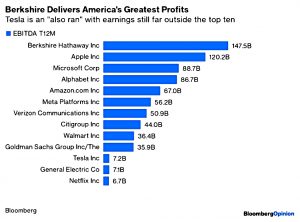

I tried ranking the S&P 500 companies by earnings before interest, tax, depreciation and amortization. Below you see the top 10, as well as Tesla, and two other companies with similar profits to Tesla’s — General Electric Co. and Netflix Inc. Berkshire leads in terms of the amount made over the last year, and it isn’t particularly close.

Yet Musk is three times richer than Buffett and worth more than Bezos and Gates combined.

- Funnily enough, it’s this billionaire comparison that brings home to me the strangeness of the Tesla situation.

Usually, when someone becomes the richest man on the planet, I can see why.

- Other than entertainment value, Musk has had no impact on my life, and might never do so.

The market doesn’t care about earnings – TSLA is worth twice the value of BRK, despite earning 20x less.

Tesla is a real company making genuine profits. But the increase in its market cap owes nothing to its results, or any news concerning an improvement in its prospects, and everything to a belief that its share price will keep going up.

But that doesn’t make it any easier to predict when it might start going down.

More budget

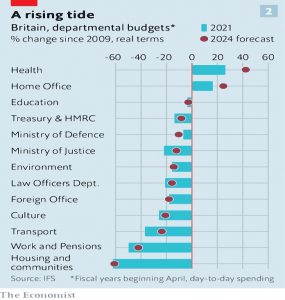

We covered last month’s budget on the day, but here are a couple of charts I’ve come across subsequently.

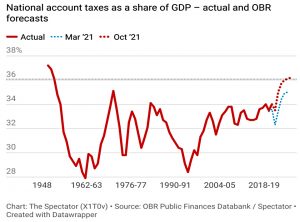

- This one is from The Spectator.

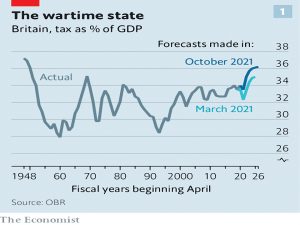

And here’s the same chart from The Economist.

It’s quite shocking for me to see a nominally Conservative Chancellor taking the tax burden up to its highest level since the end of World War Two.

- Taxation will be at 36%, the highest level since the 1950s.

Government spending will account for 40% of GDP, a level not seen since the 1970s.

As always, the NHS is the main culprit – it will account for 44% of day-to-day government spending in 2024, up from 27% in 2000.

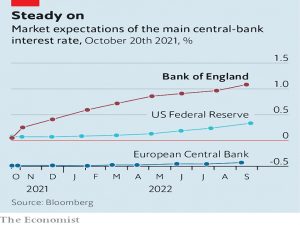

UK interest rates

The Economist also warned against the Bank of England raising interest rates sooner than it needs to.

Comments by Andrew Bailey, the bank’s governor, led traders to place about an 80% chance on a rate increase on November 4th. Our reading suggests that the markets are getting ahead of themselves. The governor has promised only to be vigilant.

Inflation is past 3% and heading to 5% but the newspaper thinks that a lot of the drivers (such as energy price increases) should be temporary.

- Similar things happened in 2011 and 2016 (after the Brexit referendum crashed sterling and inflated imports) without rate rises (or persistent inflation).

The difference this time could be an overheating labour market.

- The end of the furlough scheme and a return to pre-Covid (lower) rates of welfare might help in the coming months, and tax rises could chip in from April 2022.

But the bank should wait and see rather than raise rates now, even though its likely that the UK will eventually be the first to raise rates.

Concentration

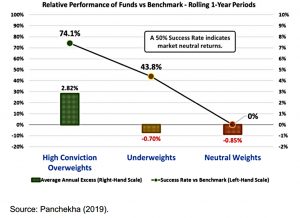

This week’s catchup with Klement looks at a couple of posts written by Joachim back in September, on the topics of active management, concentration and conviction.

- The first post began with Joachim reminding us of a rant he’d made against benchmarking, which encourages closet indexing.

He provided us with evidence that fund manager performance comes from their high conviction overweights.

- This suggests, of course, that there si money to be made by copying these high conviction positions.

This leads some fund managers to try to create high conviction funds as a defence against charges of closet tracking.

- It turns out that concentrated portfolios require different skills in terms of identifying potential positions.

Worse than that, a higher active share will increase underperformance as well as outperformance, so it might not be in the fund manager’s best interests.

- It’s good for investors though, as poor performers should suffer outflows and eventually leave the marketplace.

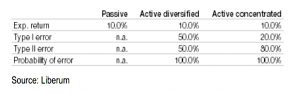

The second article looked at the arithmetic of high conviction portfolios.

- It was triggered by a reader response to the first article pointing out the work of Bessembinder (which we have covered in several previous articles).

Bessembinder’s key point is that equity returns are concentrated in a few superstar stocks and that most stocks lose money relative to bonds over their lifetime.

This, Bessembinder argues, means that more diversified portfolios should have a better chance of good performance because they cast a wider net and thus have a higher likelihood of catching these superstar stocks.

I have previously argued against this being the only possible conclusion from Bessmbinder’s data, and Joachim also disagrees (for different reasons):

While a more diversified portfolio has a higher likelihood of being invested in these superstar stocks, the performance contribution of these stocks to the overall portfolio is smaller.

Joachim imagines a market of 100 stocks, where 99 return 0% and one returns 1000%.

- An equally-weighted tracker would return 10%.

He also imagines three investors:

- the passive manager with 100 stocks at 1% weighting

- an active manager with 50 stocks at 2% weighting

- a concentrated high conviction manager with 20 stocks at 5% weighting

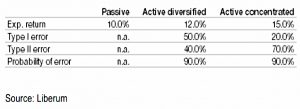

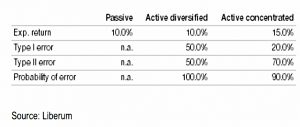

The type I error is the probability of accepting a truly unskilled manager as skilled based on her outperformance. The type II error is to falsely classify a skilled manager as unskilled based on her underperformance.

The first scenario is that all three investors have no stock-picking skills.

Because the more diversified portfolio has more stocks in it, there is a 50% chance that some unskilled manager will accidentally stumble on the superstar stock and outperform the market due to the higher weight of the superstar stock in the active portfolio vs. the market. Meanwhile, in the concentrated portfolio, there is only a 20% chance.

Concentration makes it harder for an unskilled manager to pass as skilled.

Scenario 2 is that both active managers have only 20 high conviction ideas and their skill is a 50% greater-than-chance ability to classify the superstar stock as a high conviction idea.

The concentrated portfolio outperforms but the diversified portfolio offers the manager greater protection against being falsely classified as an underperformed (type II error).

- Concentrated portfolios increase career risk.

In Scenario 3, the diversified active manager increases high conviction weights to 3%.

- This means that the low conviction positions drop to 1.33% (20*3 +30+1.33 = 100).

The diversified active manager now has no outperformance over passive.

In a more diversified portfolio, a skilled manager has less room to create outperformance, which increases her career risk.

The probability of a type II error also increases, and the probability of a type I error remains high – the worst scenario.

- This leads Joachim to conclude that the risk of investors sticking with an unskilled diversified manager – or firing a skilled one – is at least as high as (and sometimes higher than) the probability of error in concentrated portfolios.

AGM voting

Interactive Investor, who describe themselves as the UK’s second-largest DIY investment platform (not sure if this is by AUM or number of investors, but I have noticed that ii have taken over quite a few smaller players in recent years) have announced that they will allow private investors to vote at company AGMs.

- This is not something that I’m interested in doing, so I couldn’t tell you how many of the brokers I use offer this service.

The only one that comes to mind is AJ Bell, where I seem to get a notice about a company action most weeks.

- iWeb and X-O also send me a few of these, but less frequently

Apparently, ii always offered this option, so the announcement is really that instead of being an “opt-in” feature it will now be the default (and therefore “opt-out”).

- This is apparently big news because previously only 20% of ii’s 400K investors bothered to opt-in, which might reflect the general level of interest.

I’m not sure PI’s will ever have much of a voice when so many shares are held by institutions, and in particular by the big passive funds, which have little incentive to vote.

- Many companies and funds have taken advantage of Covid to dispense with physical AGMs entirely.

Let’s see if they return.

Finimize

I was surprised to hear that Abrdn, the comically-named asset manager formerly known as Aberdeen Standard, had bought Finimize.

- Finimize offers a free daily email and free webinars (which pre-covid were often physical meetings in central London).

For £60 a year you get access to more articles, but I’ve never subscribed so I don’t know what the paid service is like.

- Neither can I see what Abrdn would get from the current service, though a recent interview with Finimize CEO Max Roufagha gives some clues:

We plan to be the platform you check before making any financial decision. I use Expedia to book a holiday without a travel agent, choose a restaurant by checking TripAdvisor – it’s just bizarre that this is yet to happen in finance. This barrier between information and people is unsustainable, and we want to be at the forefront of the change.

Abrdn recently bought robo-advisor Exo Investing so perhaps some combination of the two services might be possible.

Quick Links

I have seven for you this week, with three each from The Economist and Alpha Architect:

- The Economist reported that Uber, Doordash and similar firms can’t defy the laws of capitalism

- And wondered whether the craze for crypto startups will ever produce the next tech giant

- And provided a whodunnit on Zillow.

- Alpha Architect explained that the momentum factor results from a behavioural bias, not risk

- And that the current market is not that crazy after all

- And wrote about the vanishing illiquidity premium.

- Musings on Markets provided an updated valuation model for Tesla.

Until next time.

Is it really that surprising that taxation has risen to these levels?

I would have thought a key Q would be: is it persistent or temporary?

It’s surprising to me, given the way that the election was won less than two years ago. It will be persistent, since the NHS can never be starved, and we have now added the new god of Net-Zero.

See: https://www.conservatives.com/our-plan

That’s not the flyer that came through my door, though I would argue that there’s been a change of emphasis even from your link. Note also that the tax pledge has been broken, which is the one I was commenting on.

I guess that I was too busy worrying about Corbyn to notice that Boris’s plans look like something Gordon Brown would have come up with.

Interesting isn’t it – and it was just two years ago!

It may even be argued by the next election that the tax pledge has not been broken as by then the NI hike should have been re-labelled as “Health and Social Care Levy”.

Covid was unforeseen too.

Not sure I even want to speculate where we would have been had JC won?