Costing Basic Income for the UK

Today we’re going to look at whether Basic Income for the UK is a practical proposition, by looking at the costs involved and how they can be funded.

Contents

Basic Income for the UK

We first came across Basic Income (BI) during the 2015 General Election, when the policy was proposed by the Green Party.

- I promised to revisit the numbers at some point, and seeing a number of articles on the topic in recent weeks convinced me that now might be a good time.

I won’t focus today on the fundamental advantages and disadvantages of BI, as we covered those last time. Instead, we’ll look at the numbers, starting with the

- Instead, we’ll look at the numbers, starting with the Green Party proposal and then looking at a few variations on the theme.

- We’ll be using 2015/16 numbers since that’s what the consultation paper does.

The Green party plan has four parts:

- new BI payments to all UK citizens

- withdrawal of many (but not all) existing welfare (social security) payments

- changes to the income tax system (including pensions tax relief) to raise more revenue

- changes to the national insurance system to raise more revenue

The new payments

The Greens propose five new payments:

- the basic BI for people of working age (£80 / week)

- a reduced BI for children (effectively a new Child Benefit)

- this will be increased dramatically from the present £20.70 / week for the first child and £13.70 / week for subsequent children, to £50 / week for each child to the age of 18

- an alternative BI for pensioners (a new State Pension of £155 / week, similar to the 2016 State Pension)

- a supplement for lone parents (an extra £80 / week – in effect a doubling of BI)

- a supplement for lone pensioners

- an extra £25 / week, designed to take the Basic Pension up above the official poverty line

- note that this is a relative definition, based on 60% of national average income

Disability benefit (£30 / week) and means-tested housing benefit would be retained.

- So would sick pay, maternity pay and carer’s allowance.

The point of today’s article isn’t to get into the moralities or politics of these choices:

- It seems odd to me that there are these single supplements at all, and that single people of working age are excluded, but let’s focus on the money

- In practice, the supplements don’t account for that much of the total as the numbers of people involved are small

Eligibility

- Qualification is based on being born in the UK, or having lived here legally for a year.

- No contributions are required.

- After three months abroad, BI is suspended until citizens return to the country (apart from armed forces staff).

- The pension is paid even abroad though the Greens plan to pro rata it depending on the proportion of time someone has spent in the UK.

- Certain exceptions will be made for hardship cases (children under 18 living independently, asylum seekers etc).

These edge cases shouldn’t affect the overall maths too much, as the number of people in each group will be small.

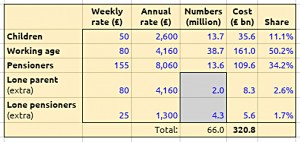

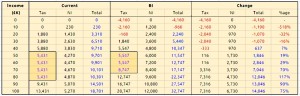

The table below shows the 2015 cost of the various BI payments:

Funding Basic Income

The Greens assume no changes in behaviour with regard to working or not working.

- I think this is naive in the extreme, but we’ll come to that later

They also assume that the number of UK citizens abroad and not receiving BI will be offset by short-term (but longer than 1 yr) visitors to the UK.

- They do assume administrative savings of £8 bn per year.

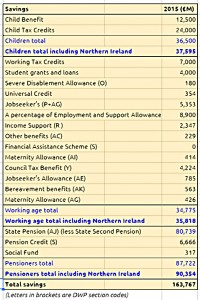

The table below shows the benefits savings that would be made:

Note that the benefits savings total £164bn pa – less than half the cost of funding Basic Income for the UK.

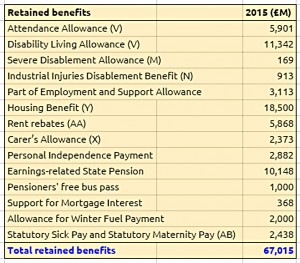

The next table shows the benefits payments that would be retained:

Tax and National Insurance changes

To plug the gap between the welfare savings and the cost of funding Basic Income for the UK, the Greens propose six changes to the tax and NI system:

- Abolition of the personal income tax allowance

- Removing the primary threshold for National Insurance contributions (below which employees don’t pay NI).

- Removing the secondary threshold for National Insurance contributions (below which employers don’t pay NI).

- Abolition of the NI upper earnings limit (above which employees pay only 2% NI)

- Abolition of Child and Working Tax Credits

- Removing 44% of the tax and National Insurance relief on pension contributions, probably by capping relief per individual

- this will probably mean reducing the annual allowance down from £40K to around £22K, or introducing a flat rate of relief – I’ve assumed the former

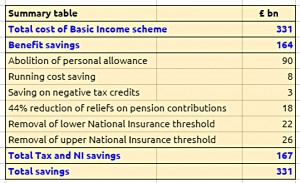

Summary costing

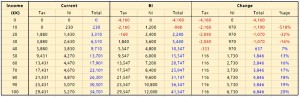

The table below adds up all the costs and savings to make things “balance”.

But of course they don’t balance really:

- the BI scheme costs £331 bn pa

- the welfare savings are only £164 bn pa

- extra taxes of £167 bn pa are needed to make things balance

So the majority of BI is being funded by an increase in taxation.

To put this into context, total government spending for 2015 was around £750 bn while taxes raised were around £667 bn, to give a deficit of around £83 bn (source).

- So funding Basic Income for the UK needs an increase of 25% in the tax base

- And would be the equivalent of tripling the annual budget deficit

The key point is that taxes are going up a lot to pay for this – we’re not just transferring money from one pot to another.

Of course, some people who didn’t receive any welfare at all under the current system will get a boost from BI.

So we need to look in more detail at who the winners and losers will be.

- First let’s look at what the Greens have to say about this.

Personal allowance vs BI

The first thing to clear up is that BI is worth more than the 2015/16 personal income tax allowance of £10.6K.

- Under BI, on an income of £10.6K you would pay £2,120 in income tax (at 20%) and £1,272 in National Insurance (at 12%).

- We’ll ignore employer’s NI for now.

You’d also get £4,160 in BI, so in total you receive £4,160 + £10,600 -£2,120 – £1,272 = £11,368.

- Under the existing system, you’d pay no tax on the £10,600 but NI at 12% above £5,824 (= £573), so your take-home is only £10,027.

So BI is better for people on low incomes.

General comparisons (Greens)

- Working people earning less than £40K (approx. 80% of workers) will gain, those earning more will lose

- My own calculations disagree slightly – I think there’s an error in the Greens’ NI threshold

- Many people on benefits only will do better under BI, especially if they have a lot of children

- Lone parents with lots of children get the biggest boost

- I think this is a key weakness in the Green’s proposal

- People on benefits who transition to work will do much better because their benefits will not be withdrawn in tandem

- this incentive to work (strictly speaking the removal of a disincentive to work) is a key plus of BI

- Pensioners don’t do so well, other than lone pensioners, who have their income boosted to beat the relative poverty threshold; this supplement counteracts the removal of the tax allowance below an income of £100K

- The Greens’ paper ignores the effects on pensioner couples, who will be paying 20% of their pension in tax, and so will have an after-tax income of just below £13K per couple

- this is less than on the 2015 new State Pension

Working people

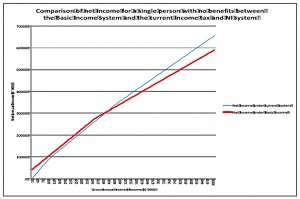

The chart below shows the Greens’ calculations of the impacts on working people with incomes from £0K to £100K: ((Apologies for the quality, it’s straight from the Greens’ paper ))

I thought that this graph made Basic Income for the UK look pretty low-impact, so I did some calculations of my own.

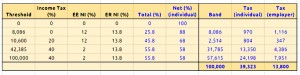

Here are the tax bands under the current system: ((Simplified slightly ))

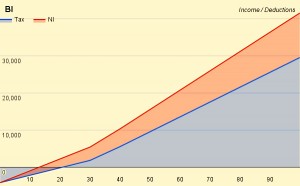

And here are the tax bands under Basic Income for the UK:

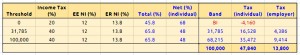

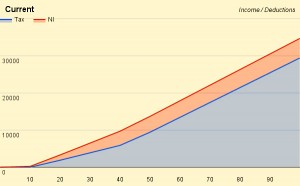

Here are the deductions for people on incomes between £0K and £100K, under both systems:

Here are the deductions under each system in graphical form:

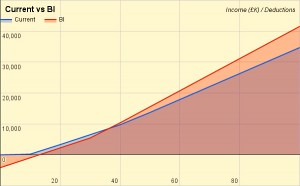

And here’s the comparison between the two systems:

My cross-over point for where people become worse off under BI is around £35K, but things still look pretty benign:

- the increase in deductions ranges from 7% at £40K pa, up to 20% at £100K pa

But I was forgetting something.

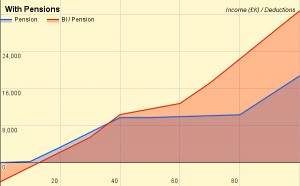

Effect of Pensions

The Green’s scheme is partially funded by restricting tax relief on pension contributions.

- They want to claw back 44% of existing contributions

For a single worker, the simplest way to model this is to assume that a higher rate taxpayer behaves rationally and makes maximum pension contributions.

- Currently, this would be £40K a year

- Under BI, we can assume the annual allowance has been reduced to £22K

- I’ve assumed for simplicity that contributions start above £40K pa of income, where 40% relief is available

Now things look a lot worse:

- by £70K pa, a worker is paying 70% more in annual deductions

- by £80K pa this is up to 117% more

- and by £100K pa it’s still a 75% increase

The average from £70K pa to £100K pa is an 88% increase in deductions (tax).

The graph makes things look even tougher:

Dramatic changes like these are bound to have an impact.

Alternatives – LVT

Some commentators prefer to replace / reduce the extra tax burden on those earning more than £40K pa (or in some proposals, more than £20K pa) by introducing some form of wealth tax, most popularly a Land Value Tax (LVT).

Apart from the obvious selfish reason that I am a homeowner, I think this is a bad idea because:

- It makes no sense to tax one kind of asset and not others

- It is unfair to retrospectively start to tax an asset, and so transitional arrangements for existing holders would delay the government receiving much tax

- LVT would probably replace stamp duty, council tax and business rates and so would not raise as much money as expected unless set at a high rate

- Land values vary remarkably in the UK and a 1% annual rate would translate in London to between 20% and 50% of the national average salary

- A rate of 1% or more would be unsustainable

- as a property owner for 50 years, I would eventually hand half of my money to the state

- house prices would probably fall by 33% to 50% in due course, with irreparable damage to the UK economy

The only argument in favour of LVT is that it would be difficult to avoid, other than by selling your house / land.

Conclusions

I have four problems with Basic Income for the UK.

The first is that – as proposed by the Greens – this isn’t Basic Income.

- The Greens are proposing a £4K “pocket-money” allowance, plus free housing

- Or if you are a single mother with three children, £16K plus free housing

- A real BI system would replace all welfare spending, with only minor supplements for special needs cases

- How would we fund that level of BI?

Second, and my biggest problem is that BI is presented as if it’s just a matter of shifting around existing pubic spending.

- It isn’t – the Greens’ proposal is less than 50% covered by savings from the existing welfare budget

- The remainder is funded from extra taxation on those earning more than £35K pa, and particularly from those earning more than £70K pa

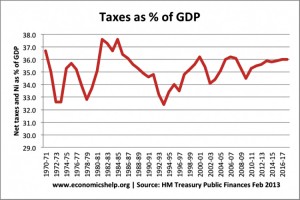

- History shows that collecting more than 36% of UK GDP as tax is extremely difficult

- We should focus on spending that 36% wisely, rather than introduce measures that would likely lead to an increase in the budget deficit

The third issue is incentives.

- It’s true that the disincentive for those on welfare to find work is removed

- But this is countered by a massive disincentive against those on around £35K to £40K pa to work harder and earn more

- It’s unlikely that these two effects will cancel each other out

And the biggest winners of all under the Green’s proposal are lone parents ((In the context of the UK, mainly lone mothers )) with many children.

- In the context of a booming economy and shrinking population, incentives to breed might be seen as reasonable

- But the most likely driver for the introduction of BI is the replacement of human labour with AI and robots

- In such a scenario, boosting the number of welfare claimants seems reckless

Finally, the international context needs to be considered.

- Unless BI is introduced simultaneously around the world, the UK would become even more of a magnet for immigration

- A one-year residency qualification for BI doesn’t seem like much of a hurdle

So while I remain attracted to the concept in the abstract, I can’t see how BI can be practically implemented in the UK under current economic conditions.

Until next time.

Hi Mike, very interesting, although I disagree that BI can’t be implemented, or that it can’t be tax revenue neutral (or positive or negative, if that’s what the government wanted).

I would prefer an incremental approach. Start BI off at a low level and adjust it and other benefits gradually overtime, as our experience with the system grows.

The problem is the 36% tax ceiling.

To give people a meaningful BI you either have to cut a lot of services or kill the economy by taxing the middle-classes to death.

Hello there Mike, exceptionally fascinating, despite everything I concur that BI can’t be executed, or that it can’t be assessment income impartial or positive or negative, if that is the thing that the administration needed. Begin BI and conform it and different advantages progressively extra time, as our involvement with the framework develops.