Warren Buffett’s Annual Letters – 2015

As part of our series on Warren Buffett’s Annual Letters, we look at the letter for 2015, which was released over the weekend.

Contents

Buffett’s Annual Letters

We’ve previously looked at Warren Buffett’s letters that cover 2014, 2013, 2012, 2011, 2010, 2009 and 2008. Today we’ll examine the 2015 letter, which was published over the weekend.

As usual, I won’t repeat everything that we’ve come across before – there is always a lot of overlap between the letters.

Performance

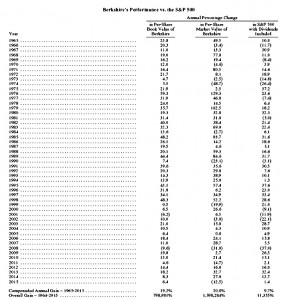

From 1965 to 2015, Berkshire Hathaway (BH) performance was as follows:

- Compounded annual gain:

- in BH book value per share: 19.2%

- in BH share price: 20.8%

- in S&P 500 (dividends included): 9.7%

- BH book value outperformance: 9.5% pa

- BH share price outperformance: 11.1%

- Total gain for the period:

- in BH book value per share: 7,989 times

- in BH share price: 15,982 times

- in S&P 500 (dividends included): 113 times

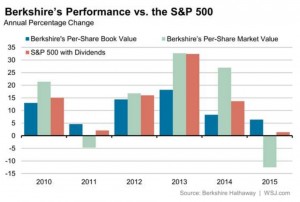

In 2015, the increase in BH book value was 6.4%, significantly better than the S&P 500’s 1.4% gain.

- However, the BH share price fell by 12.5%, significantly underperforming the index.

The 6.4% gain in net worth added up to $15.4 bn.

Since the 1990s, when BH moved from a focus on holding quoted shares to the outright ownership of businesses, accounting rules have pushed the book value of BH below its intrinsic value:

- Losers are written down, but winners are never revalued upwards.

- This is why BH will repurchase shares when they are priced below 120% of book value

Events of 2015

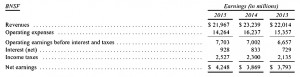

- The big news according to Warren was the improved performance of BNSF, BH’s railroad, which had a bad year in 2014.

- $5.8bn was invested in BNF, triple the depreciation charge

- in total, BH invested $16 bn in 2015

- The “Powerhouse Five” earned $13.1 bn in 2015, up $650M.

- only BH energy was owned in 2003, when it earned $393M

- the $12.7bn gain in earnings over 12 years has resulted in 6.1% dilution in the number of BH shares in issue

- The Powerhouse 5 will become the Powerhouse 6 in 2016, as Precision Castparts (PCC) has been bought for $32 bn in cash.

- PCC is the world’s leading supplier of aerospace components

- BH now owns 10 ¼ (the ¼ is 27% of Kraft Heinz) of what would be the 500 biggest companies were they stand-alones.

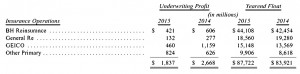

- The insurance businesses operated at a profit for the 13th year in a row and increased their float to $88 bn.

- 29 bolt-on acquisitions were made at a cost of $634M

- The partnership with 3G Capital grew when Heinz merged with Kraft

- BH didn’t put in any more money and its share of the joint venture fell from 53% to 27%

- Whilst 3G are excellent partners, BH would in general rather buy companies that are already efficiently managed, than look for firms with opportunities to cut costs (the 3G approach)

- BH will look for future partnership opportunities, but only in friendly acquisitions

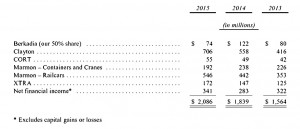

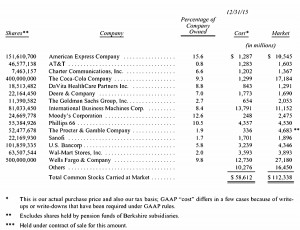

- BH increased its share of Amex (to 15.6%), Coca-Cola (to 9.3%), IBM (to 8.4%) and Wells Fargo (to 9.8%).

- the current holdings provided $4.7 bn in earnings ($1.8 bn in dividends) to BH

- averaged over the four companies, each 1% increase in ownership produces an extra $500M in earnings

- BH prefers “owning a non-controlling but substantial portion of a wonderful company to owning 100% of

a so-so business” - BH’s willingness to buy “either operating businesses or passive investments doubles our chances of finding sensible uses for Berkshire’s endless gusher of cash”

- In an election year, where the candidates must necessarily focus on America’s problems, Warren re-affirms his faith that the best years for America lie in its future ((Warren has publicly announced support for Hilary Clinton ))

- He notes that GDP per capita of $56K is six times (in real terms) what it was in 1930, the year he was born

- Even a low growth rate of 2% pa will produce a 34% increase ($19K) in per capita GSP over 25 years (after accounting for immigration)

The BH blueprint for success remains unchanged:

- constantly improve the earning power of subsidiaries;

- increase earnings through bolt-on acquisitions;

- benefit from the growth of listed holdings;

- repurchase BH shares when they are available at a discount from intrinsic value (in practice, <120% of book value)

- occasional large acquisitions;

- infrequent share issues.

It’s better to have a partial interest in the Hope Diamond than to own all of a rhinestone. – Warren Buffett

If you want to guarantee yourself a lifetime of misery, marry someone with the intent of changing their behavior. – Charlie Munger

The advantage of being bisexual is that it doubles your chance of finding a date on Saturday night. – Woody Allen

Insurance

Warren warned once again that the float (now $88 bn) will be difficult to grow as National Indemnity’s reinsurance division has a lot of run-off contracts where the float shrinks.

- Warren expects the float to shrink by no more than 3% a year

- Earnings on the float are depressed by low interest rates

Warren complained again about the accounting treatment of the float.

- He sees it as a revolving facility replenished from year to year and from day-to-day, rather than a true liability

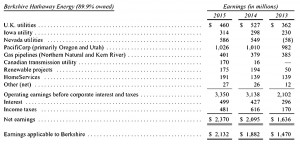

Regulated, Capital-Intensive Businesses

- Between them, BNSF and BHE accounted for 37% of BH’s 2015 after-tax operating earnings

- They invested $11.6 bn in plant and equipment last year

- They are both more than able to service the large amounts of long-term debt needed to fund investment

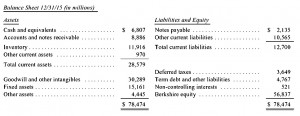

Manufacturing, Service and Retailing Operations

This set of businesses earned 18.4% after tax on $25.6 bn of net tangible assets.

- Note that BH paid substantial premiums to net tangible assets for most of these companies, so this is not the return on BH capital invested

These figures – as usual – exclude $800M in amortization of some intangible assets, as Charlie and Warren feel the GAAP numbers are misleading.

- software loses value over time, but customer relationships (goodwill) does not

- writing this value off depresses profits

- depreciation of tangible assets on the other hand, is largely correct

BH’s approach should not be confused with other companies’ willingness to re-state earnings after deducting costs like “stock-based compensation”.

- to Warren, this is a deliberate attempt to unfairly boost profits

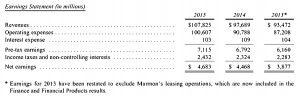

Finance and Financial Products

CORT leases furniture, XTRA leases semi-trailers and Marmon leases freight train cars, shipping containers and cranes.

Clayton Homes sells “manufactured homes” to low-income customers; the firm now has 45% of the market.

Clayton also provides mortgages against these homes:

- Warren stresses that in contrast to the dodgy practices that led to the 2008 financial crisis, Clayton has a 100% retention policy – when they originate a mortgage they keep it

- This means that lending to the wrong people has consequences, and so they are careful in granting credit

Clayton does lend long-term and borrow short-term, which under some circumstances would be risky.

- But with interest rates at rock bottom, a sudden increase would only benefit BH

Investments

BH also has the option to buy 700M shares of Bank of America at any time prior to September 2021 for $5 bn; as these are currently worth $11.8bn, the option is likely to be taken up just before expiration in 2021.

Productivity

Warren closed the letter by revisiting the topic of productivity. He began with farming:

- in 1900, 40% of the US workforce (11M people) worked in farming

- 90 million acres were used to produce 2.7 bn bushels of corn (30 bushels per acre)

- now, 85 million acres produce more than 13 bn bushels of corn (at 150 bushels per acre)

- and only 3M people (2% of the workforce) work on farms

Closer to home for BH, there have been similar productivity gains in railroads, insurance and electricity generation.

Warren acknowledges that these improvements often severely impact the careers of workers in disrupted industries.

- Innovation is too important to restrain, but safety nets are needed

- Warren favours the Earned Income Tax Credit which would boost the after-tax income of displaced workers who can only find lower-paying jobs

Climate change

A proxy motion at the annual meeting asks the BH board to report on the dangers that climate change might present to the company’s insurance operations

Warren is not worried. Climate change is a major problem for the planet, but insurance premiums will rise each year with the increased exposure to losses.

If anything, insurance companies are likely to become more valuable.

Livestream

For the first time ever, BH’s annual meeting this year will be webcast worldwide.

For me personally, this is great news, as I was never likely to make it out to Omaha. ((And not forgetting that Warren is 85 and Charlie is 92, so we don’t know how many more times this double-act will perform ))

- So make a note in your diaries: 9 am Central Daylight Time on Saturday, April 30th

- I make that 4pm on British Summer Time

- The URL is https://finance.yahoo.com/brklivestream

Conclusions

After 2014’s blockbuster 50th anniversary letter, the 2015 version was bound to be a let-down, and I’m afraid that by Warren’s high standards it is.

- There are almost no new insights relevant to either BH itself, to or to the private investor.

- It also has the fewest quotable lines of the eight letters that I’ve now looked at

Here’s what we’ve learned today:

- Precision Castparts is BH’s largest ever acquisition

- Warren defended Clayton Homes (a lot) and 3G (less so)

- each of these companies has had some negative press in the past year over predatory lending practices and ruthless cost-cutting respectively

- Contrary to expectations, there was no comment about the turmoil in the oil markets

- The buy-back policy remains in place but is rarely activated

- publicly announcing that the stock is cheap at 120% of book value effectively sets a floor price in the market

- Warren remains convinced that America’s best days lie ahead

- Warren clarified that he is not against activist investors and hostile takeovers in principle, but it’s not something that BH will get involved with

- Warren is not worried about the threat to BH from climate change

- insurance premiums will rise in line with potential losses and insurance companies are likely to become more valuable

- Productivity is the engine of prosperity

- it is too important to restrain, but those disrupted by innovation needs support (the Earned Income Tax Credit)

- BH is joining the 21st century and the Annual Meeting with be streamed across the internet

Until next time.

This post is one of a series on the Warren Buffet Annual Letters. To read the other summaries, go to the Warren Buffet Quotes and Annual Letters page.

Thanks for the review Mike.

Slight rant coming up:

On the climate change issue asking about insurance companies is far too narrow, and it depends what they mean by climate change. 1% and it’s no bid deal, 2% it could be a major problem given that we’d probably have to move London and New York and many other major cities, and 4% is probably game over for anything that could reasonably be called a civilisation. So it would be more useful if he framed the reply in terms of degree rather than “it’s not a problem”, because it very obviously is a massive problem.

He also refers to the Y2K as being another dire problem where the experts were wrong. But Y2K really was also a massive problem and potential “game over” for civilisation. But we fixed it (me personally, in a very minor way). It wasn’t like Y2K wasn’t a problem. There was a problem, we spotted it in time and fixed 99.999999% of the issues by spending probably millions of man-years on it in the 1990s. Climate change is the same sort of thing, but fixing the problem is probably going to be many orders of magnitude more difficult.

I think if I were 85 years old I would struggle to worry about climate change!

Seriously, though, I think he’s decided to interpret the proxy vote in the most narrow financial sense to avoid the annual meeting being hijacked.

I worked on Y2K as well, and there was a lot of bullshit involved. It was the Boy Crying Wolf moment for IT.

I believe in climate change, but sadly I see no evidence the world will do what it takes to avoid its effects.