Digital Wealth – State of the Market 2021

Today’s post looks at a recent report from AltFi on the state of the Digital Wealth Market.

Digital Wealth

This is AltFi’s second annual report on Digital Wealth, focusing on what I call robo-advisors.

- We looked at the same report last year (though I forgot to publish the article for a long time).

I remain disappointed with this sector (as well as with P2P lending and equity crowdfunding).

- I wanted to save time and effort by offloading some of my portfolios to robos.

- But they are too expensive and what they offer is too vanilla/boring.

I do like the trading apps (Trading 212, Stake, LightYear, eToro and Freetrade) but they don’t have the backing for me to place large sums of money with them.

Report structure

The report has eight sections:

- The survey

- Asia

- Wealth Dynamix (sponsored)

- Betterment CEO interview

- More from the survey

- Ethical investing

- Crypto

- Meme stocks

Our focus is on sections one and five.

- I had a quick look at parts seven and eight, but they weren’t too interesting.

The survey

Opinium surveyed a nationally representative sample of 2,000 UK adults with 68 detailed questions on their savings, financial knowledge and investment habits over

the past 12 months and their attitude and plans for their future finances. The fieldwork was conducted between 11 and 16 August 2021.

The big feature this year is recovery from the pandemic (when last year’s survey was carried out, we didn’t have a vaccine).

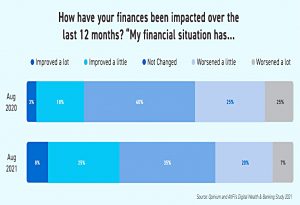

34% saw an improvement in their finances, 35% said things had not changed and 27% said things had got worse.

- This is a very high-level picture, but that sounds like too much government intervention to me.

Surely the worst pandemic for a century should mean that the majority take a hit to their finances?

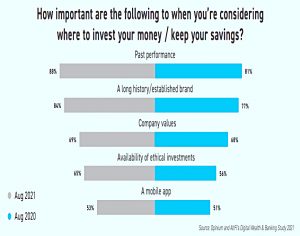

The next chart looks at how people choose their investments and savings, and it’s a depressing list (in descending order):

- Past performance

- Brand

- Company values

- Availability of ESG options

- Mobile app

Good look following those targets.

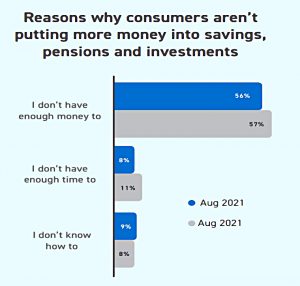

The chief reason why people are not saving and investing remains their perception that they don’t have enough money.

- This area could have done with further investigation (into where the money was going) since for most people this view really reflects a time preference for the present over the possibly distant future.

We really need to do more to educate people on the consequences of not saving, but I don’t hold out much hope of this.

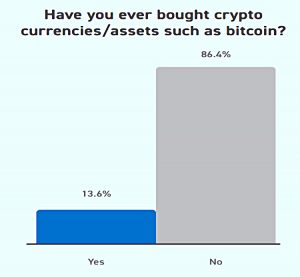

Just 14% of respondents had bought crypto, though even that figure is surprisingly high to me.

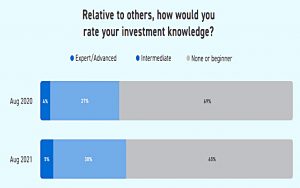

65% of respondents rated themselves as novices when it comes to investment.

- This is refreshing, but it does undermine the value of their other responses, and it might have been better to split responses to other questions on the basis of replies to this one.

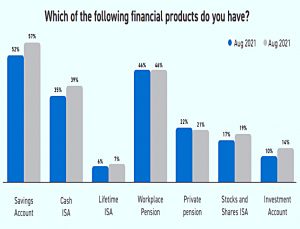

Product take-up remains depressingly tilted towards cash – 39% have a Cash ISA but only 19% have a Stocks and Shares ISA.

- It’s nice to see workplace pension penetration at 46%, though I’m puzzled as to why this figure isn’t higher (I thought we had more workers than that).

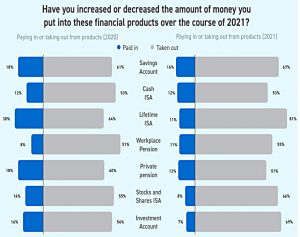

The charge on changes per product during 2021 is confusing.

- For every type of product, more people took money out than paid money in.

It’s not great to see 66% of people taking money out of an S&S ISA, and only 8% paying in.

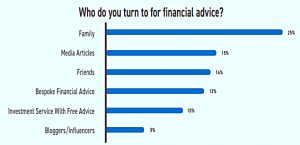

The last chart looks at where people go for financial advice. It’s another worrying list:

- Family

- Mainstream media

- Friends

- Real financial advice (paid for)

- Free advice (guidance)

- Bloggers

With the honourable exception of the top-quality bloggers, I would skip most of these.

- Books are where it’s at.

I have to say it’s a pretty disappointing report.

- There’s a lot of rent-a-quote from industry figures, and charts are only supplied for eight of the sixty-eight survey questions.

There’s very little on the current market structure of digital wealth, or on potential product innovation in the future.

- Perhaps we’ll have better luck in 2022.

Until next time.