Digital Banking – State of the Market

Today’s post looks at a report from AltFi on the state of the Digital Banking Market.

Digital Banking

I usually begin these articles with a comment on my personal use of the products under discussion.

I have opened four digital banking accounts:

- A Tandem credit card, which paid cashback, but then started charging too much

- I replaced this with a Santander cashback card which is cheaper

- The premium Tandem card failed and was withdrawn, and Tandem has pivoted to be a green lending bank.

- A Starling Business account, which offers free banking (not so common in the corporate world)

- I’ve since added a personal Starling account, which I would use for spending abroad (if I were able to take a foreign holiday)

- A Marcus savings account

- I’m counting this as digital since there are no branches (though there’s also no app)

- A Curve card, which allows you to amalgamate your other cards into one, and to choose which one is used for each transaction (via an app)

- You can also use it to duplicate a card, in case you need it to be in two locations at once

I’m very happy with Starling, Marcus and Curve and have no plans to leave.

- But I’m a long way from switching my current account – which I’ve had with the same high street bank for 40 years – to a digital player.

And I haven’t been tempted by two of the most popular digital options:

- Revolut doesn’t have a UK banking licence

- Monzo seems like a slightly worse version of Startling to me

AltFi is more bullish about the sector:

Digital banking has just about proved any naysayers wrong. The largest three UK names – Revolut, Monzo and Starling – have millions of customers between them and are starting to see revenues grow.

Yes, but none of them is profitable – though Starling is about to turn the corner, having had its first monthly profit in October.

- Monzo, on the other hand, reported in July that the pandemic meant that there were doubts about its ongoing viability.

Starling is better set up for the pandemic, with more domestic transactions meaning that it is less dependent on travel.

Market penetration

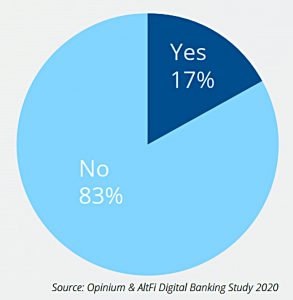

A second issue for the sector is that market penetration remains low.

The vast majority of people have still not used any digital banking apps.

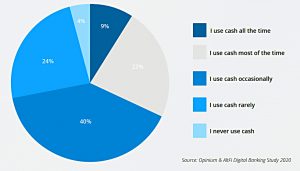

And physical cash remains stubbornly popular with a sub-section of the population, despite Covid.

Brand awareness

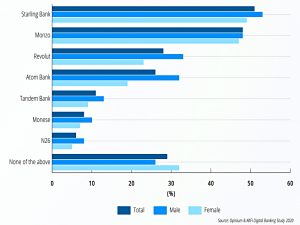

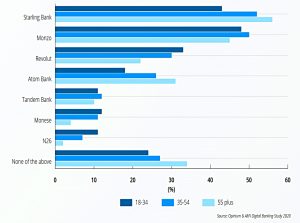

The report presents brand awareness data by gender and by age.

There’s not too much to see in the gender chart.

- Revolut and Atom have a male skew, but Monzo and Startling are pretty neutral

Startling and Atom play well to the older crowd.

- Monzo and Revolut are more popular with youngsters.

User numbers

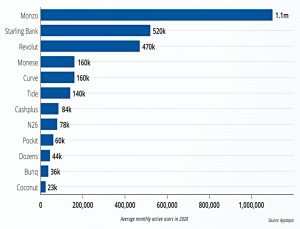

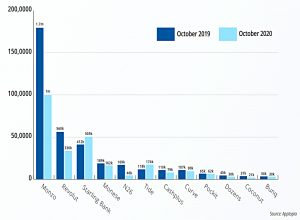

The report presents the same usage data (users per month) in a number of ways.

Here are the numbers for this year as well as last.

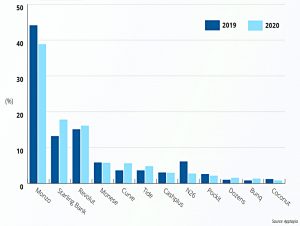

Here’s the same data presented as “market share”.

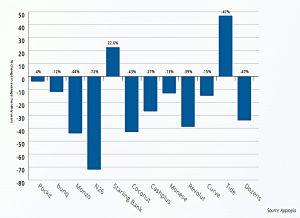

And here are the changes from last year to this.

- Amongst the brands I’m familiar with, Monzo is the big loser and Starling the big winner.

Tide is another bank targeting SMEs, which from memory was charging a monthly fee.

- I just checked again and there is a free tier, but all transfers – in or out – are charged at 20p

So even a low activity account like mine would cost £30 to £40 a year.

- Interestingly, the £10 a month version only buys you 20 “free” transfers (@ 50p each).

New entrants

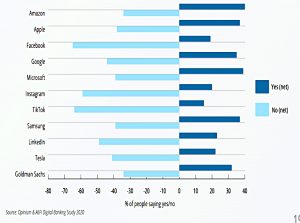

A big problem for digital banks is that rival services could be introduced by more popular/better-known brands.

- Amazon, Apple, Google, Microsoft and Samsung are all pretty popular.

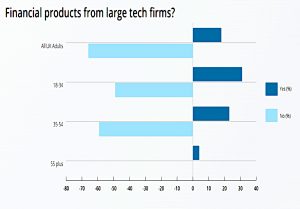

Young people in particular seem open to these services.

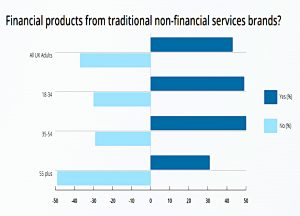

When the question is widened from tech to all non-FS brands, these services become much more popular.

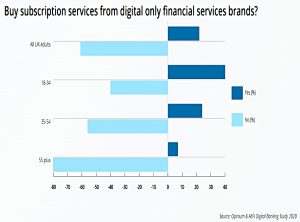

More popular than the idea of buying subscription services from digital brands.

Conclusions

There are two big problems for the new digital banks:

- Too few people trust them enough to make them their core bank

- Which would give them a better chance of cross-selling more lucrative services

- People have more trust in adjacent brands from tech, who could easily launch rival services

- Though not directly comparable, witness the ease with which Goldman’s established their Marcus savings account

- Amazon, Apple, Google, Microsoft and Samsung – not to mention PayPal – could do something similar for day-to-day banking

- UK supermarkets got into trouble with this plan a few years ago, but they outsourced the tech, and the tech firms have global scale in their favour

So I expect most of the digital banks to fail, or to consolidate together.

- And the ones that ultimately survive will probably be bought out by a high-street bank, or perhaps an insurance or investment firm.

Curve has a useful niche, but it looks hard to defend from the phone/phone OS manufacturers, or from PayPal.

- Until next time.