Family Investment Companies

Today’s post takes a look at family investment companies – when might they be useful?

Context

I’m coming into this article with a blank slate – I’ve never used a family investment company (FIC), and I don’t know much about them.

I can only think of three possible reasons why they could be useful:

- They might have some special tax advantages

- Note that this won’t be Business Property Relief (as with AIM) since that exemption from IHT only applies to trading companies.

- In fact, given what little I know about Family Trusts (( Which will be the subject of a separate article )) I would be very surprised if there are any advantages at all.

- They allow for fractional ownership of large assets (like houses)

- This is really a sub-clause to the first point since the key point with fractional ownership would be lower taxes through gradual (annual) changes in the ownership structure.

- They allow for the pooling of assets and therefore could provide greater diversification benefits than individual company members could achieve on their own.

- This would be the most attractive aspect for me, but it rarely seems to be discussed.

- Truly diversified portfolios are hard to implement with less than £100K, but ten people each subscribing £10K would be able to achieve the same result.

Note also that I am not limiting the discussion to companies where all the shareholders are family members.

- Any investment company which is under close control (ie. is controlled by five people or fewer) would fit the bill.

Establishment

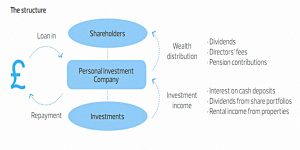

An FIC is just a limited company used for family wealth creation and succession planning.

- It may have bespoke articles of association and/or a shareholder’s agreement which specifies how shares can be transferred between existing and future members.

The company could also be unlimited.

- Unlimited companies don’t have to file accounts with Companies House.

With no trading or borrowing, limited liability protection does not offer much value.

- Holding property within the company could open it up to claims.

The founding members will either subscribe for shares (possibly preference shares) or perhaps provide loans to the company.

- Both options allow for the return of the original capital without tax being due, though loans would be simpler.

I’m unclear as to whether these loans can charge interest, and if so, how that interest would be taxed.

- Loans can also come from retained profits in a parallel trading company.

Assets could also be placed directly into the company in exchange for shares.

- Note that such transfers could crystallise capital gains liabilities and might attract stamp duty (in the case of property or shares).

Operation

There may be multiple share classes with different voting rights, perhaps used to distinguish between family generations.

- This can allow parents to pass on assets with IHT efficiency but without losing control immediately.

Share classes may also have varying rights to dividends.

A family member may be employed to operate the investment activities of the company and can be paid a salary as a regular employee.

Taxation

The FIC would pay corporation tax on both income and capital gains.

- The current rate is 19%, but this falls to 18% in April 2020.

- This is lower than the main rate of CGT (20%), but individuals have an annual £12K exemption from CGT.

Dividends are exempt but foreign dividends could be subject to withholding tax in the country of origin.

- This is a “small company” exemption, which applies to companies with fewer than 50 employees, and turnover and assets below £10M.

Since dividends above £2K pa are now taxable on the individual, they no longer offer a tax-efficient way to distribute gains.

- Some company members could sell shares up to their CGT limit, but this requires willing buyers (which might include the company itself).

- Any individual buyers of shares would only be building up a bigger tax problem down the line.

Tax relief on interest on borrowings is available.

- Such borrowings could be used to leverage an investment portfolio.

Individuals cannot claim relief on interest payments in this way.

- Nor can they offset the expenses of managing their share portfolio against tax.

With regard to IHT, the two key advantages to the parental generation are:

- growth in value of assets after they have been transferred to the FIC will be ignored for IHT purposes

- minority shareholdings in the FIC will benefit from a valuation discount due to the lack of control

Conclusions

An annual corporation tax levy of 19% (or even 18%) is a deal breaker to me.

- Dividends are free of tax within the FIC, but then taxable on the individual above £2K pa.

If the dividend allowance hadn’t been introduced, there would be a slight gain against income tax (and a large gain against higher rate tax).

- But unfortunately it has, and there’s no sign of it going away.

Share buy-backs look like the only way of extracting money cleanly

- Even then, any capital gains will have taken the 19% corporation tax hit.

So it’s not clear why anybody would want to wrap assets within a corporate structure, other than for continued control of assets that will be eventually passed down without incurring IHT.

- To the child-free (like me) there’s no attraction.

I suppose in comparison to a taxable account for a high-rate tax-payer, FICs offer modest protection.

- But most of us would be better off sticking with SIPPs, ISAs, VCTs and a primary residence.

Until next time.