Weekly Roundup, 10th September 2019

We begin today’s Weekly Roundup in the FT with The Chart That Tells A Story, which this week was about annuities.

Contents

Annuities

Josephine Cumbo wrote that the bond market rally was a blow to pensioners as it means that annuity rates have fallen further.

- This is misleading, as rates already offered such poor value that no pensioners should be interested in the first place.

The “chart” this week was actually a table of annuity rates taken from Hargreaves Lansdown.

- But the FT edited away some of the most interesting parts so instead I’ll present the full table direct from HL.

The baseline rate for a single life at age 65 is 4.7% (£100K produces an income of £4,667 pa).

- But the rate that a private investor would be interested in – RPI escalation at age 55 – is just 1.7% (£100K produces £1,747).

Which means that the LTA for pensions of £1.055M would produce an inflation-linked income of just £18,340.

- The failsafe SWR of 3.25% would give an income of £34,288.

Annuities are bad value for money.

Big tech

As always, Ken Fisher was bullish on the prospects for the markets.

- He says that big tech will continue to drive our portfolios.

For Ken, the lack of tech and communications stocks – rather than Brexit worries – explains why the UK market lags the US.

- He thinks there will eventually be a post-Brexit boost for the UK, whatever the final outcome.

But for the remainder of this bull market, he recommends staying clear of the UK.

- Late bull markets are best for the largest global stocks, and most of them are in the US.

The UK’s big companies don’t have the necessary growth profiles and high margins.

- Even pharma and healthcare firms suffer from regulatory threats.

Ken advises a 25% allocation to Big Tech and a further 10% to communications services stocks.

- You can add the UK healthcare and energy stocks if you like.

The key is fat margins and cash on the balance sheet.

Unfashionable investments

Merryn Somerset Webb has the opposite advice.

- She thinks that it’s time to seek value in unfashionable investments.

Over the past decade, US stocks have outperformed those of the rest of the world by 100 per cent.

Of the top 10 [fund] performers of the last decade, nine have been heavily focused on US equities and in particular US technology stocks.

She points out that in the decade before last, 8 of the 10 worst-performing funds were in tech.

- Commodities were on top then.

Merryn accepts that tech companies will continue to dominate.

- But that’s not the same thing as making us money.

She cites tech in the 2000s, commodities in 2010 and even the railways as big ideas that were right but unprofitable.

- She tips energy, Japan and UK retailers as unfashionable sectors that might hold value.

In her MoneyWeek column, Merryn looked at how negative yields could destroy the stock market.

She quotes Seema Shah in the FT:

Companies will “surely focus more on bond markets than equity markets”. Why, when you are paid to borrow, would you look to the public markets instead?

Expect then a long-term environment in which bad companies are propped up by stupidly cheap debt and in which the usual pipeline of investable public companies slowly dries up.

The only companies you will see coming to market are those that no one in their right mind would ever lend money to.

She cites WeWork (now WeCompany) as an example.

Corbyn watch

Jim Pickard of the FT had lunch with John Mc Donnell.

- He reported that McDonnel wants to ban bankers bonuses, which “offend” people.

He also wants to ban all share options, golden handshakes and golden goodbyes.

- And he wants to remove voting rights from shareholders of less than two years standing.

Companies would also be forced to disclose the identities of those earning more than £150K and the income tax paid by those earning more than £1M.

He ruled out a mansion tax but re-affirmed plans for a right-to-buy for private tenants.

- And firms who want government contracts will need to establish a 20:1 ratio between bosses’ and workers’ pay.

There will also be some version of a four-day week (most likely flexible hours).

AIM fundraising

Nikou Asgari reported that fundraising on AIM had slowed to a trickle.

- £300M has been raised so far this year, on course for the lowest annual total in 20 years.

AIM has a bad reputation for lax regulation and poor scrutiny.

Which is not to say that there aren’t any decent companies on there – you just need to choose carefully.

Over its first two decades, investors lost money in 72 per cent of all Aim-listed companies, according to a study in 2015 by professors at London Business School.

Recent scandals include Patisserie Valerie, Goals Soccer Centres, Eddie Stobart and a short attack on private investor darling Burford.

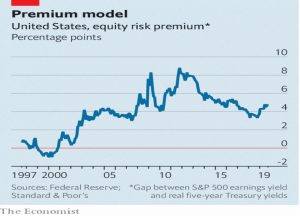

Earnings yield

In the Economist, Buttonwood argued that earnings yields are the best guide to future stock market returns.

- He looked at a 2011 paper from John Cochrane.

The paper noted a change in emphasis from predicting future cash flows to looking at the risk preferences of investors (as reflected in discounting rates).

The old-school view was that when stock prices are high relative to earnings or dividends (ie, yields are low), it implies these cash flows are expected to grow quickly in future.

The new school says it is changes in risk appetite that explains much of the variation in asset prices. If prices are high and yields are low, that implies investors are willing to accept lower returns in future.

With the rise of share buy-backs, earnings yield has become a better predictor than dividend yield.

In practice, the signal from yield is too weak to be relied upon to catch turning points profitably.

But you could use the equity risk premium instead.

The higher the risk premium on stocks, the more the odds favour investors tilting their portfolio away from bonds.

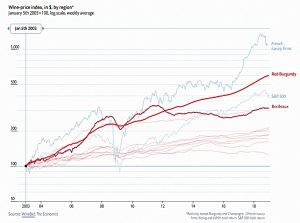

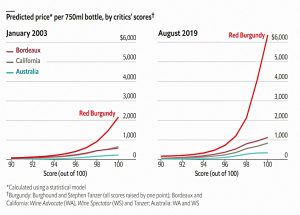

Wine investing

The newspaper also looked at wine prices.

Wine connoisseurs tend to move towards Burgundy, though there was a boom in Bordeaux a decade ago, as the fewer wines made in larger batches from this region caught on in Asia.

- A Chinese government clampdown on lavish gifts put an end to that.

But hundreds of varieties in volumes a low as 300 bottles per year make reliable prices for Burgundy hard to find.

- WineBid provided the Economist with auction records for all wines sold more than ten times since 2003.

By 2018, Burgundy was up by 497%, compared with 279% for the S&P 500.

- Volatility was also lower.

But at $3,000 a bottle, further appreciation depends on the whims of the rich.

Quick links

I have six for you this week:

- UK Value Investor was Selling SSE

- The FT explained why Germany’s bond market is increasingly hard to trade

- Michael Burry warned of a bubble in index funds

- Alpha Architect had part two of How to Crisis-Proof your portfolio

- Flirting with Models looked at sector momentum, and

- David Stevenson had a wake-up call for portfolio projections.

Until next time.