AIM IHT Update 7 – November 2017

Today’s post is the regular monthly update on the AIM IHT portfolio.

AIM IHT Portfolio

Before we check on the status of the portfolio, a reminder of the rules:

- It’s a 50-stock portfolio, designed to shelter a portion of family assets from inheritance tax.

- The idea is that it will be relatively safe (for AIM) and will protect the original capital.

- We are not trying to shoot the lights out in terms of capital growth.

- The idea is to build an “AIM tracker”, but one which avoids the dodgier end of the market.

- Racier AIM stocks can be found in the SmallCap AIM Growth Portfolio (SGAP).

I’m using Stockopedia to implement the following selection criteria:

- No financials, property companies, miners or energy stocks.

- No market caps below £50M.

- No loss-making companies (PE missing)

- Risk Rating of Conservative / Balanced / Adventurous (3 from 5).

- Positive or Neutral Stock Style.

- Stock Rank above 50, sub-Ranks all above 20.

- PE below 20 (ideally) or 25 (hopefully) – we’ve had to take a few more expensive stocks.

Last month

At the end of October, the portfolio was up 2.8%, albeit with Accrol suspended and likely to return to trading at a much lower price.

- So realistically we we up more like 0.8%.

No stocks needed to be removed and replaced, so we carried forward our original 50 selections.

This month

As of 30th November, the portfolio is up 0.1% – we’ll get to the reasons for the pullback later.

Here’s the chart:

As you can see, it’s been a rocky performance.

- The reason the red line (cash invested) jumps up twice is because of the way Stockopedia handles dividends.

- It basically doesn’t, so I need to add them as cash each month.

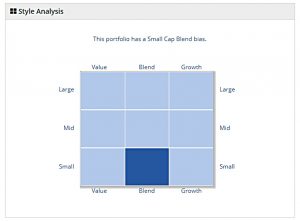

Here’s the style analysis – it’s still a Small Cap Blend portfolio:

Here’s the Health analysis – everything is the same as last month:

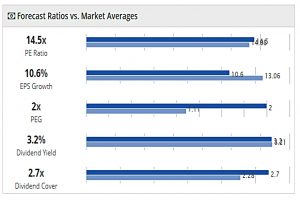

Here are the Ratios relative to the market:

- The PE has come back from 14.7 to 14.5

- EPS growth has fallen from 10.8% to 10.6%

- The PEG has come back from 2.1 to 2.0

- The dividend yield is up from 3.1% to 3.2%

- And the dividend cover is up from 2.6x to 2.7x

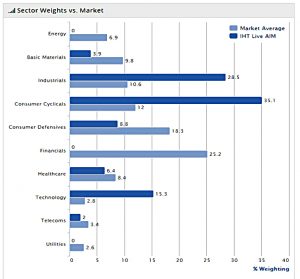

The Sector analysis shows a slight improvement:

- Consumer Cyclicals are down from 35.5% to 34.9%

- But Industrials are up from 28.2% to 28.4%

Here are the sectors relative to the market:

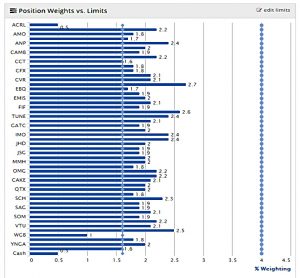

And here are the position weights:

I’ve changed the limits here:

- The lower limit is now 1.6%, to reflect a 2% initial weighting with a 20% stop loss.

- The upper limit is now 4%, to reflect a doubling of the initial position.

This shows that two stocks are below the lower limit (with another two just on the border).

- Together they make up 1.5% of the portfolio.

- Adding in the 0.5% of cash means that we would have 2% of cash if both were sold.

- And we would need only one new stock to replace them, shrinking the portfolio to 49 stocks.

Note that one stock (ACRL) had breached the limits before I changed them.

- I didn’t receive a notification from Stockopedia when that happened.

Bad stocks

We have two rules for weeding out bad stocks:

- Share price fall of 20% (stop loss).

- Stockopedia score below 50 (or sub-ranks below 20).

Here are the holdings that have lost more than 10%:

- ACRL came back from suspension at a massive loss, and the share price has continued to slide.

- WGR issued a profit warning and has almost halved.

Both these stocks will be sold.

Here are the 10 stocks with the lowest ranks:

Only two stocks score below 50:

- JHD – we discussed this last month, and it’s chart still suggests that it is in (slow) recovery mode

- WGB – already identified to be sold

Only two stocks have sub-ranks below 20:

- ACRL and WGB, both identified to be sold.

Further up the table, VCP still has a low value score, but it’s chart still looks good (though not as good as last month).

So we have just the two stocks to sell.

Replacements

As discussed above, the two sales will only leave us with enough cash for one purchase.

The top ranked stock on my AIM watchlist is H&T.

- This is a pawnbroker, so not really suitable for this portfolio.

- And I already hold it in the SGAP.

Next up is Flowtech Fluidpower.

- This is already in the AIM IHT portfolio.

Third on the list is Sanderson (SND).

- This will be our new purchase, and the portfolio will shrink to 49 stocks.

Gold list

The Gold List is a list of stocks that have appeared in professional IHT portfolios.

- There were no new submissions this month and the list remains at 90 stocks.

IHT Clock

When the portfolio was plummeting mid-month, I started to think about how far I was prepared to let it fall before I considered bailing on the AIM IHT plan.

- I came up with the idea of the IHT clock.

We are aiming to save 40% of IHT over a 24-month qualifying period.

- So to come out ahead, each month the portfolio needs to fall by less than 1.67%.

We are now 2.1 months into the qualifying period.

- Which means that we can afford to be down by 3.5%

We are actually up by 0.1%, so we are 3.6% ahead of target.

- That translates to 1.7% per month, or 41% over two years.

So we are on track, and the project continues.

Hedging

I have also been thinking about hedging the portfolio, or at least the 40% of it that reflects the IHT gain.

- Using spread bets with 10x effective gearing (10% stop-losses), this could be quite affordable.

- I don’t expect the portfolio to fall by 40%, but stranger things have happened.

The problem is that there is no good proxy for the portfolio.

I would like to use shorts on a mixture of UK indices:

- FTSE 100

- FTSE 250

- FTSE Small Cap

- FTSE Fledgling

- FTSE AIM index

But I think that I can only bet against the two largest indices, which is not a great hedge against 50 AIM stocks.

Here’s a comparison of those two indices against the AIM index, over the last two years:

There’s a 20% tracking error, which is not great.

- But it’s better than nothing.

I could hedge the stocks individually, but that’s a lot of work and probably more expensive.

More thought needed here.

That’s it for today.

- It’s not been a great month, but the project remains on track.

Until next time.