FinLife – Financial Life Coaching

Today’s post is a look at an article on how the world of financial advice is evolving away from investment management and towards Financial Life Coaching.

Contents

Michael Kitces again

It’s a funny old world, writing a blog.

- You go eighteen months without referencing an article from a famous blogger like Michael Kitces and then two relevant an interesting articles come along within a couple of weeks.

Last week we looked at how to measure success in retirement.

- Today we’re going to look at the evolution of financial advice.

Michael is writing as a financial planner himself, with paying clients, and also from a US perspective.

- We’ll be looking at the issues he raises from the perspective of a private investor in the UK.

Perhaps we have nothing to worry about over here.

History of financial advice

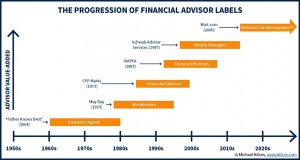

Michael’s article starts by looking at the services provided over the past 50 years by “financial advisers” in the broadest sense, and the labels used to provide them.

- Or more correctly, to sell them, since the changes at each stage are driven by the invention of new business models – of new ways to take money from us, the investing public.

- Luckily (?) I am old enough to remember all the stages that Michael covers, and can testify – from the consumer side of the fence – which were improvements, and which were a waste of time.

The basic sequence has been as follows:

- insurance salesmen

- stockbrokers

- financial advisers (and in the US particularly, financial planners and wealth managers)

- and now the new stage – “financial life managers”

Insurance agents

For most people who weren’t born with a silver spoon (and who could therefore afford to deal with stockbrokers, perhaps via their bank), their first contact with the financial industry came through the insurance salesman.

- I never understood this stage.

They came door to door, even to the poorest areas, selling life and term insurance to the whole family, not just the breadwinners whose wages would be missed. ((When I turned 18, my Dad got £100 – about a week’s wages – not even enough to pay for a funeral had the policy paid out prematurely ))

Stockbrokers

The financial world in general and London in particular became dominated by stock broking following deregulation in the mid 1980s and the removal of the separation between the various stages of trading.

- But even though (because) I was working at one of the new integrated firms, I was barred from using their services, and their competitors.

Financial advisers mostly pointed people like me at clunky products from insurance companies, scraping off a hefty commission along the way.

Qualifications

Michael says that the US market place became too crowded, and advisers turned to qualifications for differentiation.

- This was the first stage along the “know your client” route that eventually led to IFA advice being too expensive for most.

As stock broking commissions shrank, financial advisers took up the slack, and began to offer advice without sales. ((It would take regulation – the RDR – to make this happen in the UK ))

Execution only

From a UK customer point of view, by this point I had been put off commission-based advisors for life.

- Cheaper, execution-only IFAs took the their place, selling a succession of ISAs (then called PEPs) from individual asset managers with discounted and rebated commissions.

These in turn were replaced by the platforms (originally called fund supermarkets) – like Hargreaves Lansdown and Fidelity – that allowed you to consolidate all the ISAs in one place.

- Pensions were still of the limited contribution, expensive, sold by insurers variety.

A-Day

Pensions liberation in the UK came with A-day in 2006, which we discussed a couple of weeks ago.

Financial Life Management

I thought that the next step was going to be AI and robo-advisors, but according to Michael the new thing is Financial Life Management, or possibly even “FinLife”.

- The new term seems to have been invented by United Capital, a US advisor that hasn’t made it to the UK as yet.

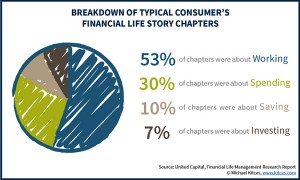

The new direction is driven by survey findings on the customer perspective of finance.

For most of the industry – and I must admit, myself – the financial focus of an individual’s life is seen as working towards financial independence (or a safe retirement, if you prefer to think in those terms) through saving and investment.

- But it turns out that people don’t see their “financial life story” as revolving around their savings and investments, but instead around work and spending behaviours.

Saving and investing are a by-product of these areas.

- So the new focus will be on providing advice around work (“managing human capital”) and spending.

Finlife is about taking a holistic view of and providing advice at the intersection of a household’s life and financial decisions. – United Capital.

Instead of just managing the client’s investments (wealth), the focus is on all the intersections of the client’s life and financial decisions. – United Capital.

Pick out of that what you will.

The key turning points in life for most people involved significant financial tradeoffs:

- where to live and work

- which schools to send children to

- whether or not to take a high-pay, high-stress job

- whether to stick with a long-term employer or start a business

And these decisions are not made in monetary terms, but by aligning the outcomes with personal values.

- People strive towards becoming their “ideal selves”, and only then look at the financial consequences of doing this.

Life coaches are obviously a thing already, particularly in the US, so perhaps FinLife is less of a completely new thing, and more of a merger of two existing things.

- But from my limited experience of life coaches, they aren’t the kind of people I would trust with my money.

- Merging these two skill sets might be harder than people imagine.

Michael worries that IFAs don’t have the skills or tools to manage human capital (maximising your earnings, essentially) or even cash flow and spending.

A new business model

Moving away from portfolio management means moving away from a percentage fee / assets under management model.

- This has already happened for IFAs in the UK, though not for asset managers on the whole.

A monthly / annual retainer or combined retainer / income / net worth measure will probably evolve.

- This should mean that more people have access to FinLife than to current IFA services, though there will likely still be many people who can’t afford it.

Conclusions

I’m prepared to believe the research results.

- I certainly feel that I have been trying to move towards my “ideal self”, though for me at least that has required quite a significant financial journey from where I started out.

I’m also sure that many (most?) people never get to the saving and investing stage of finance.

- And even if they did, in the UK at least, the RDR has meant that flat fee advice is unaffordable for all but the richest.

But more people need to and should get there.

So leaving aside the fact that most advisers wouldn’t have the skills or the tools at the moment to move over to cover work and spending – that’s “just” a training issue at the end of the day – I’m not convinced that the answer is to find a new way for advisors to make money off them.

- They should be getting earlier, better and cheaper (if not free) advice so that they do make it through the spending and working decisions, and into the area where to saving and investing becomes more important.

We need to put the horse before the cart.

- Advisers should help investors to do the right thing, not find a way to make money out of them doing the wrong thing (or at least, the second best thing).

Until next time.