I Wish Money Had Never Been Invented

I wish money had never been invented.

Not my words, but those of a stranger. Let me explain.

I’m on holiday this week, down in Cornwall. We are staying in St. Ives and yesterday we visited the Tate gallery.

Contents

Moving out onto space

The current exhibition is called Images Moving Out Onto Space.

The exhibition brings together eight artists, with works spanning 50 years, and asks questions such as:

- What happens when art works are set in motion?

- When they move around the gallery or out into the world?

The title is borrowed from a series of psychedelic kinetic sculptures made by Cornwall-based artist Bryan Wynter in the 1960s.

I wish your wish

But the artwork that I want to talk about is by Brazilian conceptual artist Rivane Neuenschwander. Neuenschwander was born in Belo Horizonte, but she studied at the Royal College of Art, and now lives and works in London.

Neuenschwander’s art investigates the role of chance, control and collaboration and explores narratives about language, nature, geography, the passing of time and social interactions.

I Wish Your Wish is a room full of thousands of multicoloured ribbons. The ribbons are tucked into holes in the gallery walls.

Each ribbon bears a message, one of 60 wishes made by local residents over the previous few months.

Visitors are allowed to take away a ribbon. Most people then write a wish of their own on a small piece of paper. They roll up the paper and put it into the hole where they took their ribbon from.

The idea is that you tie your ribbon to something – your bag, or your wrist – and when the ribbon wears away and falls off, the wish written up on it will be granted.

So the installation moves the art out of the gallery and into the town and beyond.

The wishes

As you might expect, there were several wishes to do with money:

- I wish for no recession

- I wish to pay my debts

- I wish for financial security

- I wish to own my own home

I wish money had never been invented

But the ribbon that I took home was:

I wish that money had never been invented.

I can only guess at the sequence of events that lead to someone – someone living in St. Ives, in 2015 – thinking like that. They have my sympathy.

But I also know that they are wrong.

One of civilisation’s greatest inventions

Money is one of civilisation’s greatest inventions. In fact, without money there would be no civilisation.

Money is maths.

It makes human productivity predictable and calculable. It frees us from one-to-one (or family to family) obligations.

Money marries the future with the past.

Without money, people have to do everything for themselves – grow their own food, make their own clothes. You get the picture.

Without money, things would be a lot worse.

Just ask anyone who’s lived through an episode of hyperinflation, where people lose trust in money.

All that’s left is barter, and life reverts to a daily struggle for survival.

Sharing

The earliest people lived like animals, eating plants and hunting other animals. Food was shared within the family, and then the tribe.

Sharing helped survival – it was a competitive advantage.

At some point, we stopped the nomadic hunting and gathering and became farmers.

And soon after that, we started to trade with the tribes and families next door.

Barter

But barter has problems. For now, let’s focus on timing – harvest is only once a year.

So we needed a system of borrowing against the future. A farmer needs to be able to eat before his crop comes in, and then repay his debts when he harvests.

So something scarce needed to be used for trade.

Money was originally based on commodities – most commonly gold and silver, but also copper, salt, peppercorns, tea, large stones, decorated belts, shells, alcohol, and cigarettes.

Silver and gold seem obvious to us now, but animal furs were probably the first currency.

The key thing is that it shouldn’t be a product that is easily controlled. If there is only one gold mine, or one sheep farmer, that’s a problem.

Physical goods also have issues with price stability – if someone finds a new gold deposit, or there are a lot of sheep one year, the value of the currency drops. Prices rise and debts are inflated away.

Fiat money

The next step forward was representative money, where pieces of paper acted as claims on an underlying commodity (for example, a pound of silver). ((It seems the Chinese invented paper money back in the 11th century; I am terrible at history, but I vaguely remember that Europe had no paper until Marco Polo brought it back from China))

Nowadays we just let the government make the money. Today’s money is fiat money, effectively a government debt.

Fiat money is controlled by society as a whole, rather than by single special interest group.

Conceptually, it represents all the goods and services available in society, as a kind of “grand average”. This means that its price should be relatively stable.

In practice, we use a representative basket of goods and services (( Actually more than one basket – CPI and RPI )) to signal fluctuations in the value of the currency to the population.

Predictable, low values of inflation do nothing to harm the usefulness of fiat money. (( Deflation and hyperinflation can have terrible effects )) The interest rates set to fix the price of money should compensate in the long run. (( Interestingly we are living through a long period – seven years and counting – of interest rates held artificially lower than the rate of inflation – this is known as financial repression ))

In theory, this stability and neutrality should support the development of a balanced economy. As it happens, at least in Western democracies, it actually does so in practice, too.

Functions of money

Concentrate – here comes the science bit.

Money has three functions:

- a medium of exchange;

- a unit of account;

- a store of value;

Without money, exchange of goods and services depends on barter, which suffers from the “coincidence of wants” problem.

- When A trades with B, he may not receive something in return that can be used to trade with C.

- Wikipedia uses the example of a bar musician “paid” with food and drink, which cannot then be used to his rent.

- If the landlord held a party that the musician could play at, this would be a coincidence of wants.

We’ve already mentioned the additional problem of timing – seasonal goods like foods can only be traded when they are available. To directly trade fruit for wheat, there needs to be a period when both are harvested at the same time.

A unit of account makes contracts involving debt possible. Here money is acting as a standard of deferred payment.

A unit of account needs to be:

- divisible into smaller units

- fungible – one unit is the equivalent of another (this makes unique items like art and diamonds unsuitable)

- available in fixed sizes (hence the milled edges of gold coins, which highlight any removal of material)

To act as a store of value, it must be possible to save, store, and retrieve money.

The value of money should also be stable over time.

Inflation affects the ability of cash to act as a store of value, which is why so much of investment is the allocation of capital into alternative assets.

I hope you can see that despite its flaws, money is one of civilisation’s greatest inventions.

The real problem today is that financial education is so poor that many people run into difficulties.

So much so that they wish that money had never been invented.

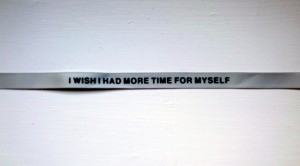

I wish I had more time for myself

The other wish that caught my eye at the gallery was:

I wish I had more time for myself

That was my own motivation for working towards financial security.

Successful investing is just a means to an end. Sometimes we forget that. The real goal is to be able to do what you want with your life. (( Just make sure that when you get there, you don’t spend all your free time writing a financial blog ))

Until next time.

Barter is a post money phenomenon – there is no evidence of barter in pre-money societies, although we can’t see the pre-money society’s we cam from. Early money was implicit “credit” – I’ve helped you, you will help me/ we are family/tribe and help each other share. Such systems don’t scale and require personal knowledge for trust. Money is a change to a trust in a commodity that all accept as valuable today and tomorrow, or a system (such as we have now). All modern money is created as credit – a promise to do some work or create something tomorrow for money today.

http://www.bankofengland.co.uk/publications/Pages/quarterlybulletin/2014/qb14q1.aspx