Gary Shilling – The Long Bond

Today’s post is a profile of Guru investor Gary Shilling, who appears in John Mauldin’s book Just One Thing. His chapter is called The Long Bond.

This article is part of our ‘Guru’ series – investor profiles of those who have succeeded in the markets, with takeaways for the private investor in the UK.

You can find the rest of the series here.

Gary Shilling

Gary Shilling is a Forbes columnist with a good record of forecasting. He appears in John Mauldin’s book Just One Thing, where his chapter is called The Long Bond.

One Big Idea

Gary’s big idea is that you need to find a single big investment theme that is both non-consensus and long-term, and to stick with it through your investment career.

- So you need to be a contrarian thinker, and possibly quite fortunate in your timing.

- Shilling also recommends blocking out the noise from the news and from the markets.

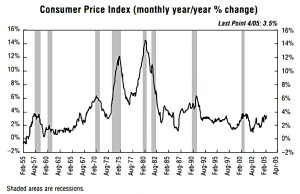

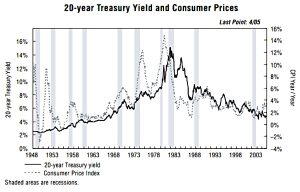

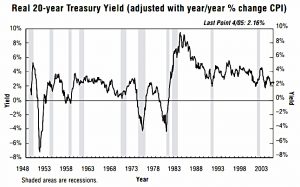

His theory fits well with his own career, which has focused around the single big idea that inflation would keep falling.

- He came up with this in the late 1970s, when inflation was rampant and most people thought it would continue forever.

- So it was a good call, and it was non-consensus and long-term.

And it was possible to make money from it.

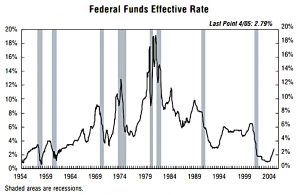

- As inflation fell, so did long-term interest rates.

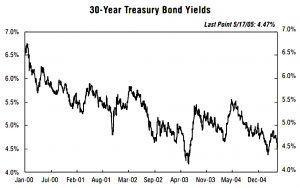

- This in turn pushed down bond yields from 15% to 4% ((How high even that lower figure seems now )), which pushed up bond prices.

Buy and Hold

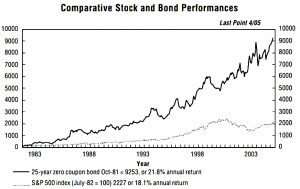

Shilling says that the best strategy to take advantage of his insight would have been to “to buy long Treasuries in 1981 and then take a vacation in the intervening 24 years on some island where there are no newspapers or securities quote machines”.

- But he admits that buy-and-hold is difficult to stick to in the real world.

Shilling himself dipped in an out of the market, sometimes making heavy losses.

- But by the mid-1980s he was financially independent through aggressive investment in “the long bond” (the 30-year Treasury).

Rally of a lifetime

Shilling called it “the bond rally of a lifetime”, and it continues to this day.

Only when the herd stampedes into my corral will I worry that “the bond rally of a lifetime” is ending.

I certainly wish that I had invested in it.

- But how someone would make a similar call today is less clear to me.

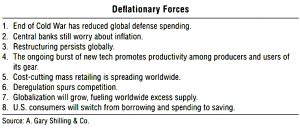

At the time the book came out (2006), Shilling was predicting that inflation would go to zero and beyond, with eventual deflation of 1% – 2% pa.

- He listed eight deflationary forces which would be responsible for this.

- He sees this deflation (which hasn’t happened yet) as the “good” kind – excess supply – rather than the bad kind – deficient demand.

He expected this to drive the long bond yield down to 3%, which he thought would be a bottom.

- Ten years later, the 30-year bond yield is actually at 2.26%, while US inflation remains barely positive (0.8% pa as of July 2016).

Conclusions

This is one of the most disappointing book chapters we have covered to date. It’s just a self-vindicating run through one man’s career, with few takeaways for the private investor.

- Instead of “The Long Bond”, the chapter should be called “I Told You I Was Right” or “Let Me Tell You About That Time I Nearly Bought A Boat”.

For possibly the first time, I can’t recommend that you read it for yourself.

- Perhaps the only lesson I will take away is to check my own work for the error of recommending a solution that would have worked in the past (eg. buy the long bond in 1982) but probably won’t work – and might not even be available – today.

Until next time.