Richard Russell – Rich Man, Poor Man

Today’s post is a profile of Guru investor Richard Russell, who appears in John Mauldin’s book Just One Thing. His chapter is called Rich Man, Poor Man.

Contents

Richard Russell

Richard Russell wrote and published the daily Dow Theory Letter from 1958 until his death in 2015.

- This the longest continuously published investment newsletter by a single person.

He appears in John Mauldin’s book Just One Thing.

- His (short) chapter is called Rich Man, Poor Man. (( I wanted to use a picture of the 1970s TV series above the title of this post, but was persuaded by my partner that it was an outdated reference ))

John is very impressed with him:

He is my business hero. He was the first writer to recommend gold stocks in 1960. He called the top of the 1949 to 1966 bull market, and called the bottom of the bear market in 1974 almost to the day, predicting a new bull market.

Russell provides a few of his favourite rules on investing.

To survive you’ve got to have money. For most people, making money entails a lot more than predicting which way the markets are heading. Making money requires a plan, self-discipline, and desire.

Compounding

Compounding is the royal road to riches. Compounding is the safe road, the sure road, and fortunately, anybody can do it.

All you need is perseverance, and time to let the compounding work.

- It’s worth pointing out that compounding had a better track record at the time the article was written.

Real returns in the future are likely to be lower than those in the last few decades.

But there are two catches. Compounding may involve sacrifice (you can’t spend it and still save it). Second, compounding is boring – b-o-r-i-n-g – especially at first.

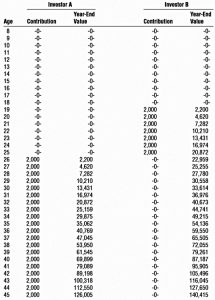

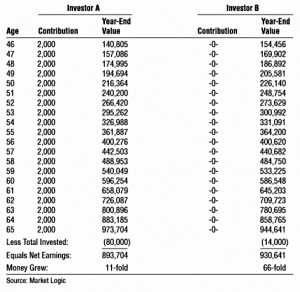

Russell persuaded his own children of the value of compounding by presenting them with a “bible” of compounding tables.

Here are a couple from the article (I would have preferred a graph myself):

The show the classic comparison of investing while young (seven years from age 19) beating investing the same amount for much longer (26 to 65) when a bit older.

Don’t lose money

This is one of my own favourite rules, and one quoted by investors as unlike as Warren Buffett, Paul Tudor Jones, Seth Klarman and Mark Minervini.

The basic problem is that the way that geometric returns (and compounding) work, one bad year can do a disproportionate amount of damage.

- If you lose 50%, you need to make back 100% to get back to square one.

Wealthy people don’t need markets

By wealthy, Russell means people who already have all the income they need.

- We would call these people financially independent (the FI part of FIRE).

I see what Russell is getting at, but I wouldn’t phrase it as “they don’t need the markets”.

- They still need historical market returns, but they can afford to not pay too much attention to the progress and the process of getting them.

Wealthy investors never feel pressured to “make money” in the market.

When bonds are cheap and bond yields are irresistibly high, they buy bonds. When stocks are on the bargain table and stock yields are attractive, they buy stocks. When real estate is a great value, they buy real estate.

The wealthy investor puts his money where the great values are. And if no outstanding values are available, the wealthy investors wait.

I would argue that everyone could learn this approach to asset allocation / rebalancing (or market timing, if you prefer to see things that way).

The little guy always feels pressured to “make money.” He’s always pressuring the market to “do something” for him. But sadly, the market isn’t interested.

The little guy doesn’t understand values, so he constantly overpays. He doesn’t comprehend the power of compounding.

He’s never heard the adage, “He who understands interest, earns it. He who doesn’t understand interest, pays it.” The little guy is in hock up to his ears.

I would certainly agree that avoiding debt is a good idea.

If, from the beginning, the little guy had adopted a strict policy of never spending more than he made, if he had taken his extra savings and compounded it in intelligent, income-producing securities, then in due time he’d have money coming in daily, weekly, monthly, just like the rich man.

Look for value

Your investment returns are largely driven by the price at which you buy into assets.

The only time the average investor should stray outside the basic compounding system is when a given market offers outstanding value.

I judge an investment to be a great value when it offers (a) safety; (b) an attractive return; and (c) a good chance of appreciating in price.

Of course, these are all relative statements – there’s no such thing as absolute safety.

Beat time

All investing and speculation is basically an exercise in attempting to beat time. Time is the single most valuable asset you can ever have in your investment arsenal. The problem is that none of us has enough of it.

Russell imagines compounding $20K in bonds at 5.5% pa, which doubles your money every 13 years.

If you could do that for 200 years (if you had as much time as you wished) you wouldn’t know what to do with all the money.

- And you wouldn’t have taken much risk.

With enough time, everyone would wind up rich, just by compounding any small real return.

- Since we can’t do that, we need to find investments that “beat time” – that show a positive real return (the larger the better).

Hope is dangerous

We usually hear this one these days as “Hope is not a strategy”.

“t’s human nature to hope. Hope is the opposite of negativity. Negativity in life can lead to anger, disappointment, and depression.

Ironically, it doesn’t work that way in the stock market. In the stock market, hope is a hindrance, not a help.

Hope will keep you riding a stock that is headed down. Hope will keep you from taking a small loss and, instead, allowing that small loss to develop into a large loss.

One of the first rules in investing is “Don’t take the big loss.” In order to do that, you’ve got to be willing to take a small loss.

In other words, cut your losses.

Forget the siren, hope; embrace cold, clear reality.

Action is everything

The most important lesson I’ve learned comes from something Freud said:`Thinking is rehearsing.’ Thinking is no substitute for taking action.

JP Morgan was “Master of the Universe” back in the 1920s. One day a young man came up and said, “Mr. Morgan, I own some stocks that have been acting poorly, and I’m very anxious. Worrying about those stocks is starting to ruin my health. What do you think I should do, sir?”

Morgan said, “Young man, sell to the sleeping point.”

Once again, there’s no substitute for acting. Thinking is not going to do it for you. You must learn to act.

Conclusions

It’s a short chapter, and light on investing technique.

- But it makes up for that with its attitude.

And the rules themselves are pretty good as a framework within which to judge things.

Until next time.