Idle Investor – The Lessons

Today’s post is a summary of the lessons we can learn from the book The Idle Investor.

Contents

- Edmund Shing

- The Idle Investor

- Who is the book for?

- What knowledge is assumed?

- Eight lessons

- The systems

- Seven axioms

- DIY investing

- Asset classes

- Risk-adjusted returns

- Market anomalies

- Strategy foundations

- Strategy 1 – Bone Idle

- Strategy 2 – Summer Hibernation

- Mechanical Investing

- Strategy 3: Multi-Asset Trend following

- Conclusions

Edmund Shing

Edmund Shing is a Global Equity portfolio manager at BCS Asset Management, and a consultant for a French unit trust that invests in smart beta ETFs using the principles in Ed’s book.

- He previously worked at Barclays, BNP Paribas Julius Baer, Schroders and Goldman Sachs over 20 years in the markets in Paris and London.

The Idle Investor

Here’s how the preface describes Ed’s book:

This book contains three simple investing systems for long-term savings. Each of these systems require only a limited amount of your time per month and all use low-cost index funds.

Who is the book for?

Ed’s book is aimed at those who are frustrated by low interest rates on savings accounts, and would like to do better over the long-term (which Ed defines as at least three years).

- The reader is likely to be cash-rich, but time-poor, and worried by the two stock market crashes since 2000.

Ed says that:

There may be short-term periods of underperformance but the systems outperform in the long-term as long as you stick to them.

This will therefore require a good amount of self-discipline and patience, but should over time handsomely reward the disciplined, patient investor.

Ed also assumes that those wanting to apply the systems will have at least £10K to begin with.

What knowledge is assumed?

Ed assumes that readers have some experience of:

Unit trusts, ETFs, investment trusts, pension funds, life assurance products or even directly in individual shares.

He’s not aiming at the complete novice.

Eight lessons

The first chapter in the book is largely autobiographical, but in-between the sections of personal history, Ed lists a few lessons that he has picked up along a 20-year career:

1 – Don’t waste your time trying to forecast future levels of share market indices. There are so many macro-economic, geopolitical and share-specific factors at work that you have little chance of being consistently right.

2 – Long-term investment trends can last a surprisingly long time. They can be very profitable for those who (a) manage to identify the trend early on, and (b) have the confidence and resolve to stick with that trend. “

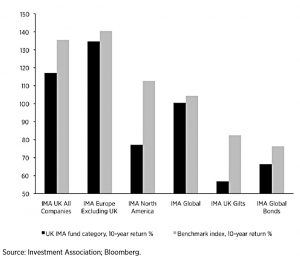

3 – The majority of active fund managers do not outperform market averages over time, and charge their clients handsomely for this failure

4 – Obsessive screen-watching is deleterious to your long-term financial and mental health, as you are tempted to panic into and out of investments. Full-time trading requires a remarkably cool temperament (as devoid of emotion as possible), and the development of – and adherence to – an investment system.

5 – Your best chance of investment success lies in keeping costs to a minimum (resisting the urge to trade too often), and in following a clearly-defined methodology or system. Risk management (e.g. when to cut your losses) is an under-appreciated but vital element.

6 – Asset allocation (diversification) is a very important way to reduce your risk over time.

7 – Momentum and trend-following have been surprisingly successful ways to invest in various markets over the long-term. However, they are subject to wide swings, and a robust method for controlling risk is also needed.

8 – Smart beta provides the retail investor with access to these investment strategies at low cost, presenting a challenge to actively-managed funds.

The systems

Ed’s resulting systems have four key features:

- they spread investment risk across asset classes

- they use momentum to follow market trends,

- they use low-cost, smart beta ETFs to outperform benchmark indices, and

- they are simple to operate, taking little time (a couple of hours per month).

Seven axioms

Alongside the eight lessons from the previous chapter come seven axioms:

- Keep investing simple

- Investing is about getting from your start point (existing and future savings) to a goal (retirement, school fees etc.)

- A simpler roadmap and rulebook is easier to follow.

- Ed is particularly unhappy with structured products built from derivatives, which he feels benefit the issue bank rather than the end client.

- I certainly agree that structured products aren’t for everyone, but derivatives (spread bets, options) and particularly listed, tradable structured products, can be very useful to sophisticated investors by allowing them to tailor their risk profile.

- Don’t invest in anything that you don’t understand.

- What Ed really means here is “if it sounds too good to be true, then it probably is“.

- He mentions the steady returns from Madoff’s ponzi scheme as an example.

- And he points out that Buffet ignored the dot com boom and bust because he didn’t understand it.

- Ed himself ignores Biotech.

- Don’t follow the markets on a daily basis.

- This is Ed’s version of Cut Out The Noise.

- This rule is much easier to follow – though less so than in the past – for those with a full-time job, rather than those who are full-time investors.

- In practice, what Ed means is that you shouldn’t buy a share on a piece of good news, only to sell it on the next piece of bad news.

- He recommends “the Economist and the weekend edition of the Financial Times” – so do I, but with less enthusiasm than I did a few years ago.

- “The vast majority of so-called business news is simply chatter that does not have any significant bearing on the long- term direction of shares or markets.”

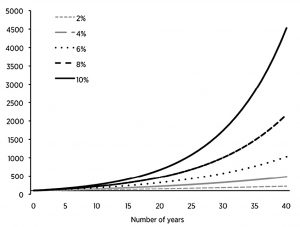

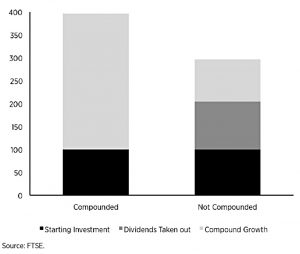

- Make use of compound interest.

- This is another one that we’ve covered before.

- Over the long-term, even 0.5% pa can be significant (see keep costs low – next bullet).

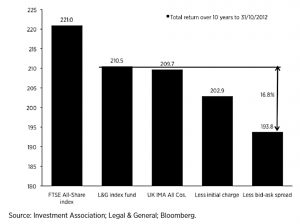

- Keep costs low.

- Or as we put it, Costs Matter.

- Like me, Ed likes to use ETFs, which have no entry or exit charges, low annual fees, narrow spreads and no stamp duty on purchases.

- You do need to pay commissions on your trades, so a discount broker is recommended – iWeb is the cheapest I have found that is UK regulated.

- Ed does consider active management (Investment Trusts, for example) in certain sectors (small-caps, Japan, high-yield bonds).

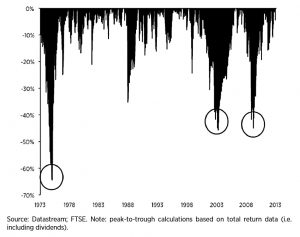

- Keep the faith when markets tumble.

- Or as Ed (and Corporal Jones) puts it: Don’t Panic.

- This doesn’t mean that it’s never right to retreat from the market, but the largest drops are rare.

- A 10% correction shouldn’t scare you away.

- It’s one thing to sell out when you feel the market will crash (or spot it starting to happen), but quite another to buy back in at the bottom, when fear is the greatest.

- This is one of the ways in which shares are not like other goods – when they are on sale they are often less attractive.

- See Behavioural Investing for more on this.

- Ed notes that the third of his three strategies incorporates some market timing.

- Keep a cash buffer.

- This might seem odd advice in a time of low interest rates.

- There are three reasons:

- for unexpected spending in life, or to cover a break in employment (an emergency fund)

- to take advantage of investment opportunities (crashes and corrections)

- (particularly in decumulation or retirement) to avoid having to sell investments to create income (cash) when markets are low.

DIY investing

Chapter Three of Ed’s book explains why DIY investing is the best.

- He begins with the difficulty of choosing an active fund.

Of course, active managers also charge more and (on average) they don’t beat their benchmarks.

Ed makes a good argument for passive investing over active (in general – there are sectors and assets where active makes more sense) but less so for DIY over Do It For Me.

I think Ed is mostly trying to say that handing over responsibility to an active manager is not as simple as it sounds.

Asset classes

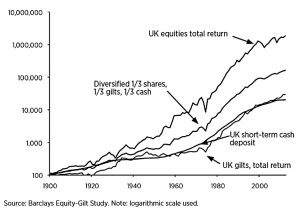

Chapter 4 of Ed’s book is about asset classes, or as he calls them, “Investment Building Blocks”.

Ed uses only three:

- stocks

- bonds

- cash

While I agree these are the central three, I would also consider property, commodities, FX, private equity, multi-asset funds, hedge funds and infrastructure.

Ed explains that he uses compound annual growth rate (CAGR) to compare returns across investments and asset classes.

- This gets around the problem of differing time frames.

Risk-adjusted returns

The next section introduces the concept of risk, which Ed defines as:

The probability of getting less than you expect.

- Including perhaps less than you started with.

Ed also talks about finding out your own risk tolerance or capacity for loss.

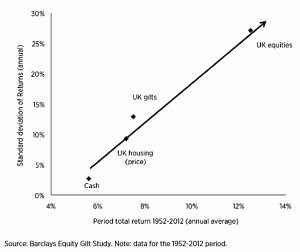

Risk is linked to return:

- The higher the level of risk you can tolerate, the higher returns you can expect.

- If investors were not compensated for taking greater risks, they would leave all their money in the bank.

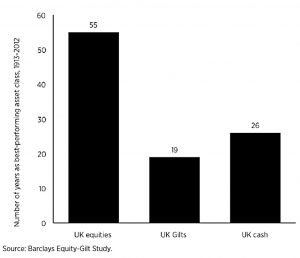

Shares perform best on average, but don’t do well when economies are heading into recession.

- In general (but not always), government bonds do well when shares go down.

Ed proposes that as a basic principle, his strategies will invest in stocks when they are rising, and switch to bonds when stocks are falling.

- Cash will be used as a last resort asset, when both stocks and bonds are falling.

This is of course, market timing, which most advisors today would warn against.

- But it is also trend following and momentum factor investing, which most people agree works well.

Rather than use plain index-tracking funds (ETFs) to access the three asset classes, Ed will exploit known market-beating effects.

Market anomalies

Ed identifies five market-beating anomalies (or phenomena, as he calls them):

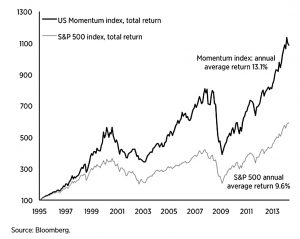

- Momentum

- shares that have outperformed tend to continue to outperform

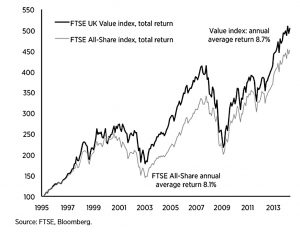

- Value

- cheap shares (according to price/earnings or price/book value), tend to outperform expensive shares (and the market)

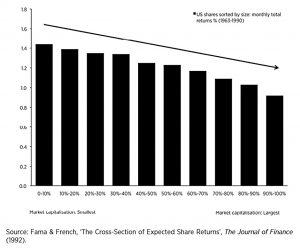

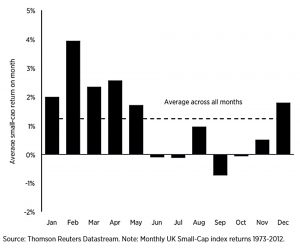

- Size

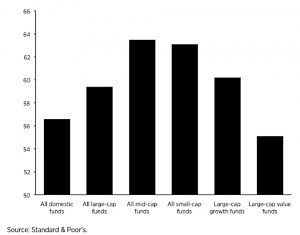

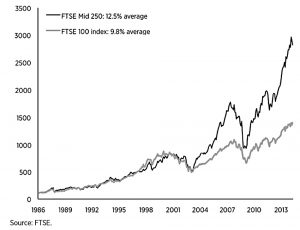

- mid-cap and small-cap shares do better than large-cap shares

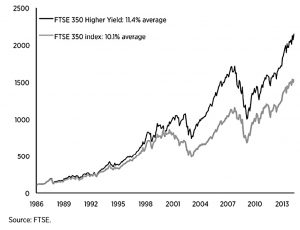

- Dividends

- Low Volatility

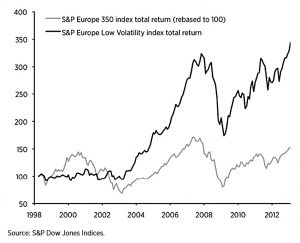

- shares with more stable prices tend to outperform, and offer much better risk / return ratios

Regular readers should be familiar with all of these outperformance factors by now, but Ed adds a few points:

- momentum works best over 3 to 12 months (eg. 3 month look-back implies outperformance over next 3 months)

- 6-month momentum works best

- high dividend yield, low price/book ratios and low P/E ratios are Ed’s favoured value measures of value

- Ed favours FTSE-250 ETFs over FTSE- Small Cap ETFs for exploitation of the size effect

- this is because they have better liquidity (are easier and cheaper to trade)

- the low volatility effect is surprising because CAPM predicts that riskier assets have higher returns

- of course, CAPM uses price volatility as a measure of risk, which it isn’t

Strategy foundations

As well as the anomalies above, Ed’s three strategies have some other things in common:

- compounding

- diversification

- ETFs (to keep costs low)

We’ve covered each of these before:

Ed adds a couple of points here, too:

- diversification means not just lots of shares (via ETFs) but also lots of asset classes and geographies (and share sizes, etc)

- diversification reduces returns as well as risk, but optimises the risk / return ratio

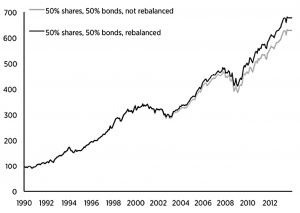

- rebalancing is an important aspect of diversification

- it acts as a contrarian value strategy, taking money out of the best-performing assets (say each year) and putting it into underperforming assets

- note that this is the opposite of a momentum strategy and so it is important not to rebalance too often

Strategy 1 – Bone Idle

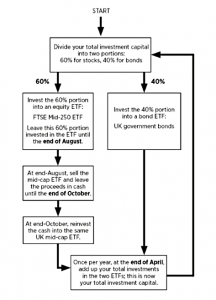

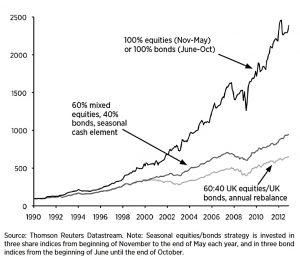

This is a basic 60% shares, 40% bonds strategy.

- You rebalance once a year (Ed says in April, which I think is based on seasonal effect rather than the UK tax year)

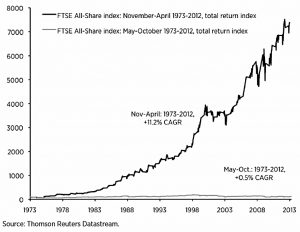

Ed tweaks this basic system by using mid-caps rather than the FTSE-100 (size effect) and staying out of stocks in September and October

- These are the worst months of the year for shares – a seasonal effect.

The 60/40 allocation would suit someone with a moderate risk tolerance, but the ratios can be moved up or down without destroying the outperformance.

- Note that there would be a trade off between increased returns (from more equities) and increased volatility.

Note also that the key feature of this strategy is not stellar outperformance, but lower volatility.

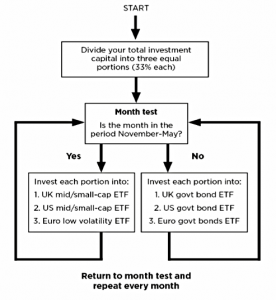

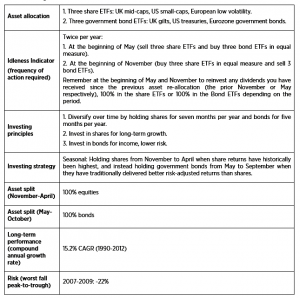

Strategy 2 – Summer Hibernation

Ed’s second strategy is more aggressive in its approach to seasonal effects.

- It sits out of stocks over the summer, essentially using the old market adage:

Sell in May and go away; don’t come back until St. Leger’s day.

I have mixed feelings about this one, which I have discussed in a previous post:

Strategy 2 also abandons the 60 / 40 split between stocks and bonds, in favour of 100% stocks in the winter and 100% bonds in the summer.

- You switch twice a year, at the beginning of May and the beginning of November.

Ed has two problems with Strategy 1:

- it didn’t fully protect against the 2008 crash, falling 14%

- low bond yields mean that future performance won’t be as good (( Note that bond yields have continued to fall since Ed wrote his book, but I see what he is getting at ))

Strategy 2 has much better performance overall than Strategy 1 (5% pa better at 15% pa) but would have done even worse in 2008, losing 22%.

- Strategy 2 also has regular long periods where it either loses money or stalls.

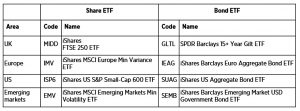

Ed uses three ETFs when in shares:

- UK mid-caps (iShares FTSE 250 ETF, code: MIDD)

- European low volatility (iShares MSCI Europe Minimum Volatility ETF, code IMV), and

- US small-cap (iShares S&P SmallCap 600 ETF, code ISP6).

He uses three bond ETFS when in bonds:

- UK gilts (Vanguard UK Government Bond ETF, code VGOV),

- Euro government bonds (iShares Core Euro Government Bond ETF, code SEGA), and

- US government bonds (iShares US Aggregate Bond ETF, code SUAG).

Mechanical Investing

Before Strategy 3,Ed describes his ideal investing system:

- Needs input only once per month, and doesn’t take much time.

- Does not require any special knowledge – uses only information from the internet.

- Relatively consistent returns, with no large drawdowns.

- Deals well with bear markets in stocks.

- Diversification across asset classes and geography.

- Uses low-cost funds (ETFs).

After looking at the academic studies, Ed concludes that trend-following is best, because it avoids heavy losses during crashes.

- At the same time, it produces high returns by exploiting momentum.

- And it has low volatility (because it avoids large drawdowns).

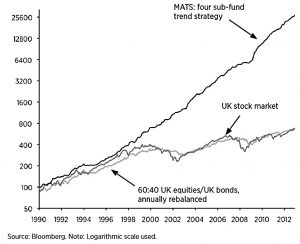

Such systems can underperform buy-and-hold during long uptrends (2003 to 2007, 2009 to now) but will outperform in the long run.

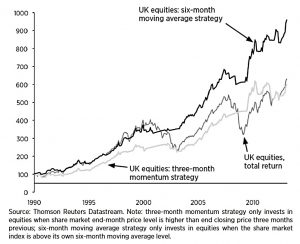

A six-month moving average strategy works better than a 3-month momentum strategy (buy / hold when the price is higher than it was three months ago) in the UK.

- Even the 3-month strategy performs as well as buy-and-hold, but with lower volatility.

The 6-month strategy returned 9.9% pa compared with 8.0% for the index, and fell only 135 in 2008, compared to 43% for the index.

- The 3-month strategy held equities for 62% of the time and the six-month strategy for 67% of the time.

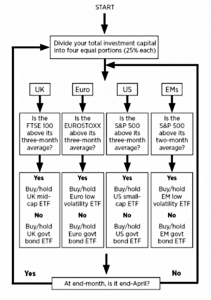

Strategy 3: Multi-Asset Trend following

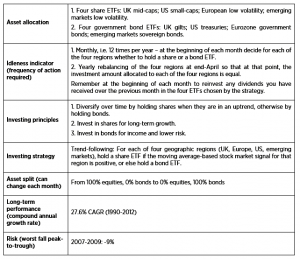

Ed’s third strategy checks once a month to see whether it should hold a variety of equity ETFs, or bonds instead.

- The portfolio is always 100% invested in something.

The system uses four stock-bond pairs:

- the UK

- Europe

- the US

- Emerging Markets

Here are the ETFs Ed uses:

- UK mid-cap equities versus UK government bonds.

- European low volatility equities versus European government bonds.

- US small-cap equities versus US government bonds

- Emerging market equities versus emerging market government bonds

The decision on which fund to choose is based on the most popular indices for each region:

- The FTSE-100 for the UK

- The Euro Stocxx 50 for Europe

- The S&P 500 for the US

Interestingly, Ed also uses the S&P 500 to test emerging markets.

- I would be more inclined to use the index that each equity ETF tracks, or even the ETFs own price action.

Ed uses the 3-month moving average in each region apart from emerging markets, where he uses 2 months.

Dividends are held within the sub-fund and invested on the next sale and purchase.

Once a year (at the end of April), Ed rebalances the four sub-funds back to an equal amount in each.

- Ed chose April because it is the last month where equities outperform on average.

Over 23 years (1990 to 2012), Ed says that this MATS system (Moving Average Trend-following Strategy) would have returned 27% pa, with no down years after 1995.

- The main advantage was avoiding the 2000-03 and 2007-09 bear markets.

The worst falls were in 1994, the only year when equities and government bonds fell at the same time.

- But the drawdown was only 8%.

Ed expects future performance to be worse, as the long bull market in bonds comes to an end.

- But he expects emerging market currency gains to continue.

Conclusions

The first two systems Ed describes are too simple for me, and their returns are much lower than those of System 3.

- They might be useful to novice investors, or those put off by the complexity of System 3.

I really like Ed’s third strategy (the MATS), and I plan to implement a version of it for myself.

- My version will be more complicated, using many more asset classes.

I put together a list of twenty assets as part of my investigation into spread betting back in 2016.

- In particular, this post and this follow-up post look at assets.

I’ll return to the implementation of this modified strategy in a later post.

- And that list will be my starting point.

Until next time.

Interesting article. Where would you get the 2/3 month rolling averages of the 4 indexes.

Hi Malcolm,

I think a lot of people just use charts from their broker.

I want to scan a lot of funds so (as you’ll see in the next post) I use a sampled moving average from Google Finance.

Mike