Own The World 6 – Taking it further

Today’s post is our sixth and final visit to Andrew Craig’s book How to Own the World. We’ll be looking at Andrew’s more sophisticated investment plan.

Contents

Taking it further

Andrew’s sophisticated approach involves dynamic asset allocation.

- This, in turn, requires a form of market timing.

Many people in the investment community (usually those who favour passive investments) believe that this is not possible.

Andrew disagrees (and so do I).

- He hints that his weightings might be driven by relative valuations between asset classes.

But it’s certainly not easy, especially from a psychological perspective.

- My personal opinion is that you need a mechanical system to tell you when to buy and sell.

Also, note that market timing may not lead to outperformance (versus, say, a 100% equities portfolio).

- You may instead prefer to trade some return for lower volatility and lower drawdowns.

Age

Andrew believes that older investors should be more conservative.

- This is normally called life-styling, and funds which transition to more bonds automatically are known as target date funds.

I believe that this philosophy is only suited to those people who plan to buy annuities at the start of their retirement (say at age 55).

- Since annuities are now poor value, this will not be many people.

In drawdown, keeping a high equity allocation produces the best results.

Trading

Andrew cautions readers not to abandon the simple approach we examined in the previous chapter of his book in favour of all-out trading.

His reccomended approach is:

- 40% longer-term investments in shares and funds

- 25% in precious metals and other commodities

- 10% in bonds

- 10% in real estate (not including your primary residence)

- 15% in short-term trades (perhaps including spread betting)

That sounds reasonable to me, though I would not put 25% into commodities myself.

Four key concepts

Andrew says that there are four components to investment success:

- understanding human psychology as it relates to investment decisions

- top-down (macro) analysis, to assist with asset allocation

- bottom-up analysis, to buy the right assets at the right prices

- keeping costs low

I would add tax efficiency to this list, though it’s possible tha Andrew includes it in his rather broad definition of how to keep costs down.

- See our sections on Behavioural Investing and Psychology – and our article on why Costs Matter – for more detail.

[amazon template=thumbnail&asin=007147871X]

Andrew recommends reading Trade Your Way to Financial Freedom by Van Tharp.

He also tells the story of the Turtle Traders – who we met when we profiled Richard Dennis and William Eckhardt – to illustrate that people can learn to trade well.

[amazon template=thumbnail&asin=007148664X]

Andrew recommends Curtis Faith’s book about the experiment, called Way of the Turtle.

[amazon template=thumbnail&asin=1612680194]

He also recommends Rich Dad, Poor Dad and Think and Grow Rich.

[amazon template=thumbnail&asin=0990797600]

In the top-down arena, Andrew recommends identifying themes and trends, and working out their consequences:

- people in the developing world are becoming more middle-class

- good for agriculture / energy / construction?

- people in the developed world are getting older

- good for healthcare / pharma / nursing homes?

- climate change is on the global agenda

- good for clean energy?

Andrew admits that some things are just too hard to analyse.

He gives two examples:

- financial services companies

- companies dependent on government contracts (eg. defence companies)

For top down analysis, he recommends MoneyWeek magazine.

Bottom-up – PEG

Andrew’s key bottom-up valuation tool is the PEG.

- This is the ratio of the PE ratio to the annual earnings growth in percentage terms.

The idea behind this is that it is worth paying more (a higher PE) for companies that are growing more quickly.

So if a company is growing by 20% pa and is on a PE of 10, its PEG would be 0.5.

- The lower the PEG, the better.

Andrew also uses the raw PE, the dividend yield and the price to book ratios.

When you have all these numbers, you should carry out a peer analysis within a sector to work out which company is best positioned.

The two final steps are to compare the winning companies numbers with its historical numbers, and then to compare the stock market as a whole (and the relevant sector) with its own history.

Andrew recommends Peter Lynch’s book One Up On Wall Street as an introduction to bottom-up analysis.

[One Up on Wall Street]

Andrew also discusses bottom-up analysis of other asset types:

- bonds are too hard for the private investor, who should stick to funds

- property is valued by the rental yield, plus an allowance for (positive or negative) capital growth

- commodities are generally analysed using supply and demand (plus storage capacity), but they are also appropriate for technical analysis

- FX is also suitable for technical analysis

Technical analysis

We have written a number of posts on technical analysis – the study of past price and volume data in order to anticipate future prices.

Technical analysis is really about waiting until other people are investing in something and then jumping on the bandwagon.

So Andrew’s focus is momentum, or trend following.

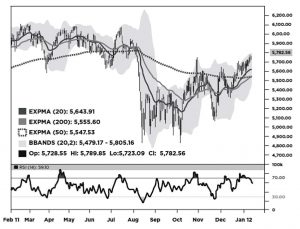

He uses mainly (exponential) moving averages, Bollinger Bands and the RSI oscillator, each of which we have looked at before.

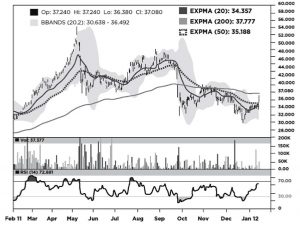

Here are some MA / BB / RSI daily charts, for silver (ETF), the FTSE 100 and gold:

Andrew recommends the book Big Money, Little Effort by Mark Shipman (written in 2004).

[Big Money, Little Effort]

Shipman uses the 30-week and 50-week (150 & 250 day) MAs to find buy and sell signals.

- When the 150-day is above the 250-day, buy the market.

- When the 250-day is above the 150-day, sell the market.

This kind of analysis is not infallible, but the 70%+ hit rate is enough to generate excess returns.

[Naked Trader Spreadbetting]

Andrew also recommends The Naked Trader’s guide to Spread Betting, by Robbie Burns, and the broker IG Index.

Afterword

There’s an afterword that intends to describe changes between the two editions but is largely taken up with a justification for Andrew’s high allocation to precious metals.

For the record, I think Andrew’s multi-asset allocation is a very good idea.

- But I think his allocation to precious metals is too high.

- I also think that crypto currencies have a non-zero change of stealing some of gold’s role as a safe haven in a crisis.

He also writes about the role of financial advisors, and seems to have softened his view that DIY is best.

- This could be because he now offers an introduction service, matching his readers to IFAs.

Conclusions

This has been a rather disappointing chapter for me, as I was expecting a systematic approach to active investing (along the lines of the fund that Andrew runs).

- The closest we got to this was some decent stuff on technical analysis.

That said, the rest of what was covered is pretty reasonable:

- psychology

- top-down analysis for asset allocation

- bottom-up analysis for stock-picking and entry points

- low costs

- market timing

My main area of disagreement today is that investors should stick with stocks, rather than transitioning to bonds as they grow older.

That’s it for Andrew’s book.

- I’ll be back in a few weeks with a summary of all the key points in a single article.

Until next time.

Mike. I have to thank you for such a comprehensive series of articles on my book. This is the deepest of deep dives on it that anyone has done. As you might imagine, I disagree with the few things that you disagree with me on (inflation particularly) and would love to speak to you about that / interview with you for intellectual curiosity / fun if you’re so inclined. But most importantly, thanks for poring through it in such detail and you should know that I have taken some of your criticism on board for the next edition which will be published by Hodder in 2019. Do please give me a shout on andrew.craig@plainenglishfinance.com as would love to meet you to discuss the bits you’re criticised! I think you do great work on this site and we are v. close philosophically. Best wishes. Andrew Craig.