Own The World 4 – Vehicles

Today’s post is our fourth visit to Andrew Craig’s book How to Own the World. This time we’re looking at investment vehicles.

Contents

Vehicles

Chapter 7 of Andrew’s book is about investment vehicles.

- Vehicles is not a term I’ve come across before in an investment context.

Unfortunately it seems to be a catch all for the three main layers of our Periodic Table of Investing Elements:

- Asset classes

- Products (wrappers), and

- Assets (the things you actually own).

Here’s Andrew’s list of the nine key “vehicles”, with my notes on where they fit in the Periodic Table:

- Cash (asset class)

- Property / real estate (asset class)

- Bonds (asset class and also an asset)

- Shares (asset, part of the equities asset class)

- Commodities (asset class)

- Funds (three products: ETFs, OIECs and investment trusts)

- Insurance (product)

- Foreign exchange / forex / FX (asset class)

- Derivatives (four products: spread betting, CFDs, options and warrants).

Much of the content of this chapter is likely to be already familiar, so the main aim is to map Andrew’s vision of the world onto ours.

Asset allocation

Andrew stresses the importance of asset allocation, and how poorly understood it is.

The four central asset classes for Andrew are:

- stocks

- bonds

- property, and

- commodities.

For more detail, see Asset Allocation matters.

General considerations

For Andrew, the two key questions are:

- How safe is your money?

- What percentage return might you expect?

We are concerned with both the return of our money and the return on our money.

Cash

Cash (in a bank account) is safe, but has low returns.

- In particular, it does not protect against inflation.

You need to keep most of your net worth in assets that produce a positive real return.

Andrew recommends keeping no more than one year’s expenses in cash.

- I think that’s fine in accumulation.

- But once you are retired, you might prefer to keep four or five years expenses in cash to protect against having to sell stocks during a market downturn.

For more detail, see Cash and Debt.

Property

Property is fairly safe (though losses can occur).

- Returns are variable and usually moderate (if the effect of gearing is ignored).

We covered property in detail in the previous article from Andrew’s book.

- The key point is that most people have too much of their money tied up in their main residence.

- Investors should also consider commercial property and overseas property.

Gearing (a mortgage) is readily available on property.

- This will increase returns in good times, and increase losses in bad times.

For more detail, see Property.

Bonds

A bond is simply a loan divided into many pieces so that it can be made by lots of people.

Bonds are relatively safe, but produce low returns these days.

Andrew discusses:

- primary issues

- the secondary market in bonds

- the difference between government (risk-free) and corporate (riskier) bonds

- the relationship between bonds and interest rates

He also has a bit of a rant about QE, its presumed inflationary consequences (which haven’t turned up yet) and the debasement of currencies.

For more detail, see Bonds.

Shares (stocks) are risky, but produce the highest returns available.

- Andrew is a big fan of stocks and the stock market, and discusses the benefits to the world (chiefly the enormous increase in living standards) that their creation has brought.

The reality is less “the stock market is only for rich people” and more “getting involved with the stock market has a high probability of making you a rich person”.

The two questions to ask before buying a stock are:

- Is this a good (very good) business?

- Am I paying the correct amount for my slice of this business?

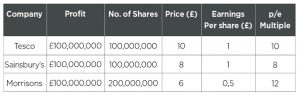

Andrew discusses valuing shares using the PE ratio / earnings yield, using supermarket stocks:

He also looks at Price to Book Value and Dividend Yield.

- For more detail, see Stocks.

Commodities

According to Andrew, the Wikipedia definition of a commodity is:

A good for which there is demand but which is supplied without qualitative differentiation across a market.

Basically, people don’t care where the item came from: oil from Russia or Venezuela is as good as oil from the US or the North Sea.

Andrew is a commodities bull, which is unsurprising since he wrote the first edition of his book during a raging bull market in commodities.

- Things are a lot quieter today, but I’m sure they’ll get hot again in due course.

Andrew points to increasing demand and decreasing supply for commodities, but the truth is that technological advances mean that the long-term price trend for most commodities is downwards.

Which is not to say that a small allocation in your portfolio won’t help with diversification and volatility.

- But commodities are not a get rich quick scheme.

Andrew separates gold and silver from other commodities because they have been used as money (though he notes that salt was used to pay Roman soldiers, hence the word salary).

Commodities are now a lot easier to access than they used to be, thanks largely to ETFs (strictly, ETCs).

- I haven’t written an article about commodities in general (yet), but I do have one on Gold.

Funds

There are three types of funds, and I have an article on each:

Funds can be active or passive (track an index) and cheap or expensive.

- Passive funds are usually cheaper.

Their key advantage is that they spread risk across a basket of many individual underlying holdings.

- They also allow the ordinary investor to access all the asset classes and geographies that they need.

Andrew also discusses funds that go short, but I don’t think these are suitable for most people because of the tracking error from the daily price-resetting.

- Spread bets (see below) are the way to go if you want to short.

He also touches on smart beta, which is a form of passive investing using factors known to outperform standard indices (value, momentum, low volatility, dividend yield, equal weight indices etc).

- I think this is a very interesting area and I will be writing more about it in the future.

Andrew also looks at the costs of buying funds.

- As we know, Costs Matter.

Finally, he looks at the difference between accumulation funds (OIECs that reinvest dividends) and income funds (OIECs that pay out a dividend).

- It doesn’t really matter whether you collect a dividend or not.

- The key point is not to spend it.

For more detail, see Dividends Don’t Matter.

Insurance

Andrew isn’t talking here about regular forms of insurance (which are discussed here).

- He means things like insurance bonds.

They are really funds that are taxed slightly differently.

- They are likely to be expensive and inflexible, and are best ignored by most investors.

- Those living or working abroad may find them of some use.

FX

This is another diversifying asset class, similar to commodities.

- FX is a zero-sum game, and the net trend of all currency pairs combined is flat.

FX is really a game for short-term traders.

- A better way for long-term investors to think about FX is to ensure that their portfolio is internationally diversified.

- This ensures that fluctuations in exchange rates with the home currency are hedged.

Derivatives

The two key features of derivatives are leverage and the ability to go short.

Spread betting is tax-favoured in the UK, and so is the most popular approach.

- CFDs, options and warrants are the alternatives.

Note that most people lose money, and leverage means that you can lose more than you deposited in the first place.

Conclusions

Today’s material has been largely familiar, but we have now completed the “education” section of Andrew’s book.

- The final three chapters are about working out what you need, and a simple and a less simple approach to getting there.

I’ll be back with a least one of those chapters in a few weeks.

Until next time.