Own The World 5 – the route and keeping it simple

Today’s post is our fifth visit to Andrew Craig’s book How to Own the World. We’ll be looking at mapping our investment route.

Contents

The route

We’ve now completed the “education” and “call to action” parts of Andrew’s book. Today we being to look at what you need to do.

For Andrew this has two parts:

- Working out how much money you need.

- Choosing a strategy to get you there.

Andrew offers two strategies, a simple (and less time-consuming) one and a more complicated one.

- The first is passive and the second is active.

- The first is recommended for those with less than £50K. (( Bizarrely, Andrew suggests that the minimum size required to trade individual shares successfully is around £10K per share; I would argue that you can do well at a half or even a quarter of that size, and I have run successful experimental portfolios at £1K per share ))

How much?

We looked at how much money you need in one of our earliest posts – Do The Math.

- Be warned, it’s probably more money than you expected.

Our approach was to:

- take a target income

- convert it to the lump sum that can safely produce that income each year, and then

- work backwards to where you are starting from (in terms of net worth).

Andrew starts a step earlier, by working out a budget.

- And not just the budget for the life you live today, but also a budget for “the life of your dreams”.

I think this is a pretty strange angle.

- You might well have an idea of how much you could spend if you had it, but the first step is to secure the income that you will*need to spend.

- That alone will be enough money to scare most people.

For example, I need to spend around £25K pa, but I could probably spend three times that if I tried.

- The first income needs a pot of around £750K (not to mention a house to live in).

- Whereas the second income needs a pot of more than £2M.

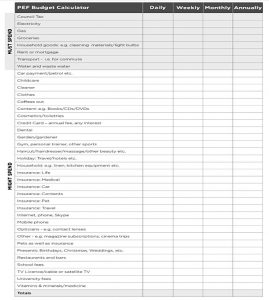

Here’s Andrew’s budget template:

You can find our own financial statements here and here.

- And there’s more on why you need a budget here.

To convert the budget to a target pot size, Andrew uses an annuity rate of 4%.

- Annuity rates vary by age and the amount of inflation protection you need.

- The rate I prefer to focus on is an index-linked annuity taken at age 55, which yields closer to 2.5% pa.

That’s pretty poor value – since your capital is lost on death.

- So it’s more likely that you will use a diversified portfolio under some kind of drawdown / UFPLS arrangement to fund your retirement.

- Safe withdrawal rates from such schemes are in the 3% to 3.3 pa range.

Andrew expects to return much more than 4% pa, so he won’t be buying an annuity either.

- I think Andrew massively exaggerates the ease with which you can make 8% or 12% pa real (after inflation).

- It is much safer to work on the principle that you can withdraw 3.3% of your pot each year.

Andrew also expects to work part-time into his 70s, and to relocate to a low-cost country.

Keeping it simple

If you are going to take the simpler, more “formulaic” approach to investing, you will want to ensure that you quite simply “own the world” and “own inflation”.

Andrew’s simple solution involves buying some passive funds each month.

- Owning the world simply means geographical and asset class diversification.

- See Asset Allocation Matters for more detail.

He mentions the advantage of dollar cost averaging, but since equity markets trend up, that doesn’t actually work in the most important markets (see The Best Time to Start is Now for more details).

Of course, if you are saving from your monthly paycheck, you have no option but to wait for it to turn up each month before you invest.

- Monthly saving is also less stressful than investing a large lump sum.

- And averaging does work in the non-stock markets (which don’t trend upwards).

Inflation

For Andrew, precious metals and other commodities are the best inflation hedge.

- Over the long-run, I think that stocks and property do just as well.

- Even bonds usually beat inflation (though not by much).

Inflation-linked bonds offer the best protection, but returns from these have been low since interest rates were reduced to fight the 2008 financial crisis.

In any case, we are now on the edge of moving from quantitative easing (QE) to quantitative tightening (QT).

- When / if this happens, the value of real assets can be expected to fall, not to rise further.

Smart money

Andrew points out that other famous investors have taken a similar approach to his:

- Harry Brown and the Permanent Portfolio (more on this in a moment)

- Harvard and Yale endowments (more diversified than Andrew’s simple approach, including assets like private equity).

- Alexander Green’s Gone Fishing portfolio.

There are actually many versions of such “lazy portfolios”.

- We looked at a variety of asset allocation strategies when we reviewed Meb Faber’s book Global Asset Allocation.

- El Erian’s widely diversified portfolio came out on top.

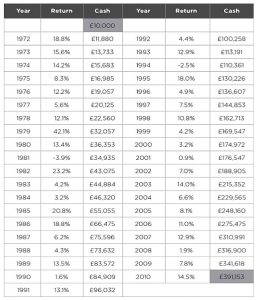

Andrew uses the example of Brown’s portfolio, which is split equally between stocks, bonds, cash and gold.

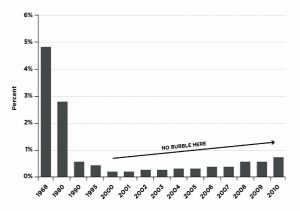

Here are its returns since 1972:

The simple portfolio

Before investing, Andrew suggests that you clear your debts and have at least a month’s salary as an emergency fund.

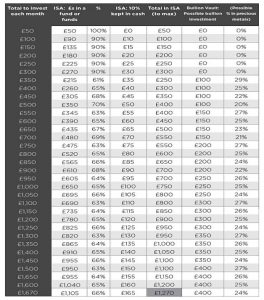

Andrew’s simple portfolio is allocated as follows:

- 65% “the world”

- 25% “inflation”

- 10% cash.

Here’s how the pot might be split, depending on how much you have to invest each month:

Owning the world

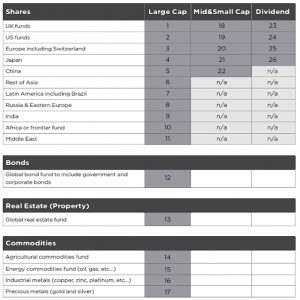

Andrew provides a table of the 26 funds that you might need to have a truly diversified portfolio:

I think that you could probably shrink that down to say 20 (largely by using fewer emerging markets geographies).

- As Andrew points out, you could also increase the number of funds by adding thematic and sector funds (tech & biotech, pharma etc).

Depending on the size of your portfolio, I see no problem in owning 100 funds or more.

Andrew points smaller investors to his website for a “one fund to own the world”, but I couldn’t find which fund he likes.

- I suspect that his recommendation would now be his own fund, which we looked at here.

Owning inflation

As we have already seen, Andrew likes gold and silver best as inflation hedges.

- He makes an argument for owning gold in particular.

Here’s a table of gold’s share of global financial assets, to demonstrate that the bull market in force when Andrew was first writing might have further to go (it didn’t):

He also discusses the development of money, and the advantages that precious metals have:

- portability

- relative scarcity

- durability

- fungibility

- divisibility

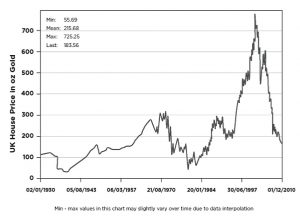

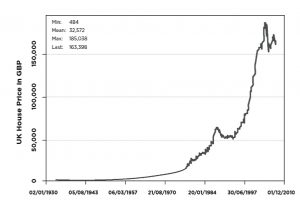

Here’s a table of gold vs UK house prices, which makes gold look like a much better store of value:

It also appears to show that house prices were “more expensive” around 2006.

- But house prices have gone up a lot since then (after this chart ends).

It’s always dangerous to measure one thing in terms of another.

- I used to measure prices in pints of beer or restaurant meals in order to make them seem cheap (so that I could buy them).

Pricing things in your home currency remains the safest way to go.

- But an argument can be made for comparing the size of markets to say GDP or the global pool of financial assets.

I’m no gold bug, and I remain unconvinced that anyone should have more than a few percent of their wealth in precious metals.

How to own precious metals

Andrew used to like precious metal ETFs (I still do), but now he prefers physical metal.

- That’s because there are more theoretical claims on gold than there is actual gold in the world.

- But it’s possible to buy ETFs that actually own physical gold.

Andrew recommends Bullion Vault.

- Note that owning bullion is not tax sheltered (unless it’s in the form of legal coins like sovereigns).

Rebalancing

Andrew recommends annual rebalancing back to your target asset allocation.

- He also recommends investing a lump sum over twelve months.

Conclusions

I like Andrew’s approach to diversification / asset allocation.

Where we don’t agree is that he is much more afraid of inflation than I am.

- And he thinks that gold is the best protection against it.

- I think that you will do fine through your regular diversified portfolio.

I also think that Andrew is too optimistic about investment returns, and hence about safe withdrawal rates.

- 3.3% pa is as high as I would go.

That’s it for today.

- I’ll be back in a few weeks with the final chapter of Andrew’s book, which covers a more sophisticated approach than the one that we’ve looked at today.

Until next time.