Reinstating the LTA

Today’s post looks at Labour’s plans to reinstate the LTA, and what private investors should do about it.

Reinstating the LTA

The abolition of the Lifetime Allowance on withdrawals from pensions was finally announced by Jeremey Hunt in March 2023, but Labour immediately vowed to reinstate it should they form the next government (which still looks very likely).

- They also said there would be special arrangements for NHS doctors so that they were not incentivised to retire because of the LTA.

At the time of writing (December 2023) the LTA still exists, but there are no penalties for exceeding it.

- Following the Autumn Statement, the formal abolition of the ceiling was included in a new Finance Bill that should pass before the looming General Election (and indeed, before April 2024).

LCP paper

Pension consultants Lane Clark and Peacock (LCP) have published a report analysing Labour’s plan and found that reinstating the LTA would be “far from straightforward”.

Amongst the issues are:

- Would transitional protection be offered to those who have built up their pensions following the 2023 announcement to a level exceeding the new Labour limit (which could be the old Tory limit)?

- Given that pensions are deferred salaries, more protection might be expected to avoid charges of retrospective taxation.

- There is also historical precedent for protection both in 2006 when the LTA was introduced and for each of the reductions in the the limit over the last decade.

- How would Labour discourage or prevent those affected from crystallising their pots before or immediately after the general election to avoid the penalty tax?

- Some details about Labour’s proposal would seem to be required before the election to prevent a large number of moves into drawdown.

- Without this, those with unused pension allowances from previous tax years would be tempted to use them up before the election (and then crystallise).

- The impact of both these strategies would be that Labour would raise less tax on pensions than by not introducing the LTA.

- The industry could find the rapid implementation of Labour’s regulations (in time for the tax year starting in April 2025, say) very difficult.

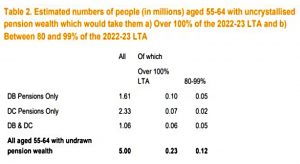

- More people are affected than is commonly thought.

- LCP estimates that 4-6% of people close to retirement – some 250K people – would be concerned.

SPP paper

The Society of Pension Professionals also produced a short paper on the topic, which questioned the need to reintroduce the LTA:

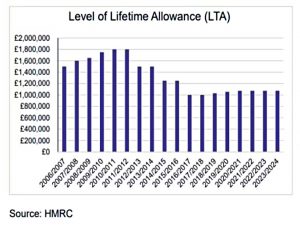

The LTA was first introduced with the annual allowance at £215,000, rising to £255,000 by the 2010/11 tax year. In practice, the annual allowance was relevant to only a very small number of people, and it was the lifetime allowance that really served to provide a cap on individuals’ pension benefits.

The annual allowance was reduced to £50,000 in the 2011/12 tax year and is currently £60,000. The annual allowance is also now tapered for high earners. This restricts a high

earner’s ability to build a large pension pot.Given the significant reduction in the amount of the annual allowance, people have been questioning the need for the LTA for a number of years. It is perceived by some to be an unnecessarily punitive taxation, given there is also a restriction on the annual amount of tax relieved pension savings an individual can make.

I would agree with all of that.

The SPP also noted that lots of people are affected by the LTA.

The LTA being abolished and then reinstated at a later date will increase complexity for a pension system which is already in dire need of, dare we say it, simplification. The cost of

abolishing the LTA for schemes is not insignificant.The cost of then re-instating the LTA should not be underestimated, nor should the inevitable complexity of these changes for both schemes and, importantly, their members who may ultimately pay for these changes.

Reactions

For LCP, former pensions minister Steve Webb said:

Whilst reinstating the LTA may be attractive from the perspective of political messaging, the practicalities and risks associated with doing so would appear to be daunting. It is not as simple as just pasting back into legislation every line which has been taken out.

Even in the run-up to the Election there could be a flurry of activity as people seek to make the most of their pension savings before a lifetime limit is reintroduced. Emergency legislation might be needed to avoid a haemorrhaging of tax revenue as people rush to draw their pensions.

Although this issue has been talked about as one which affects only ‘the top 1%’, in practice hundreds of thousands of people who are within a decade of retirement will be taking a very close interest in what any prospective new government says about its plans for the Lifetime Allowance.

On his Age Wage blog, Henry Tapper wrote:

Rachel Reeves has made very few policy statements and this one may well hang around her head like an albatross. I don’t expect that Labour will want to reverse the LTA in isolation but use it as the trigger to look again at pensions taxation in the round.

The LTA is an unexploded bomb that the Labour party need to defuse if it is not to risk blowing up their carefully laid plans.

After these comments, Rachel Reeves announced that Labour plans to review the entire UK pension system, under the guise of redirecting capital to fund growth.

Conclusions

I was extremely happy to see the back of the LTA, and I have been taking advantage of the opportunity to add more money to our pensions.

- Unless Labour makes a convincing commitment to ring-fence all contributions made before the election, I will be crystalising all of our remaining pensions before the General Election – and I suspect I won’t be the only one.

This will leave me with a lot of taxable cash to find a home for, but sooner that than pay the LTA surcharge.

- Until next time.

Mike, what about the already retired & crystallised cohort looking at the 75 years old LTA test?

Not sure I understand the question, but until we get some detail from Labour, we won’t know when they plan to test any new limit. If you are fully crystallised, you’ve taken all the action that you can.