Irregular Roundup, 27th December 2023

We begin today’s Weekly Roundup with commodities.

Commodities

Joachim Klement looked at the impact of financialization on the commodities asset class.

There used to be two schools of thought on commodities:

Gary Gorton and Geert Rouwenhorst [argued] that commodity futures provided excess return over cash and low correlation with equities and bonds and thus should be part of a well-diversified portfolio. Claude Erb and Campbell Harvey that showed that commodity futures may make sense tactically, but don’t do so as a permanent strategic allocation.

I was somewhere in the middle, attracted by the low correlations rather than any expectation of excess returns.

- Joachim used to side with Gorton and Rouwenhorst but after looking at new research from Fahiz Yara and Massimiliano Bondatti he now thinks that both sides were wrong.

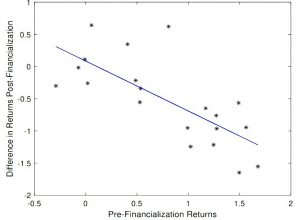

The new study looks at systematic returns from commodities before and after financialisation.

This started in 2004 when institutional and later retail investors moved more and more money into commodity futures and when ETFs on commodity indices became widely available.

This new money focused on short-term futures, which changed the term structure.

Many commodities that historically traded in backwardation suddenly dropped into contango and stayed there forever. This meant that the roll yield for commodity future investments turned significantly negative most of the time, reducing total returns for investors.

This removes the “excess returns” argument of Gorton and Rouwenhorst but also invalidates the Erb and Harvey thesis.

Erb and Harvey claimed that i) investments in commodities with the more attractive term structure vs. commodities with the less attractive one (a so-called ‘carry strategy’) have historically outperformed but may cease to do so in the future. And they claimed that ii) using a momentum strategy in investing into the commodity futures with the best historic return have shown relatively high returns.

Unfortunately, since financialization, almost all commodity investment strategies have produced significantly lower returns.

Only two strategies keep on working today. And ironically one of them is the simple carry strategy that Erb and Harvey said is likely to lose its efficacy. Meanwhile, the strategy that Erb and Harvey expected to do well – momentum – doesn’t work at all anymore.

The other strategy that still works is buying commodities with the most negative skewness of returns in the last 12 months (and shorting those with the most positive skewness).

Essentially, this strategy invests in commodities that have been distressed or under pressure in the past and shorts commodities that have rallied significantly or boomed.

So this is a mean-reversion strategy.

There’s also a strategy that used to have poor returns but has improved:

- buy commodities with the highest producer hedging pressure and short those with the lowest

The intuition here is that commodity producers will have to increase their positions in futures where there is the largest hedging pressure, which in turn will drive up commodity prices and shift the term structure.

But Joachim will be sticking with a carry strategy for commodities.

Bankruptcies

John Authers looked at the risk of companies going bust – something that was supposed to happen in 2023 but hasn’t (by and large).

WeWork was the largest US company to go bust since the Global Financial Crisis, while the Austrian property group Signa, whose assets include a share in New York’s Chrysler Building, became Europe’s biggest post-GFC insolvency. But if widespread corporate failures did arrive, they might provide just the catalyst to bring along the much-delayed recession.

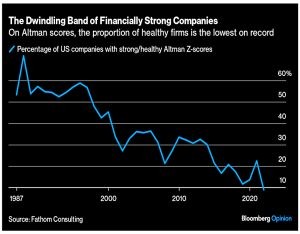

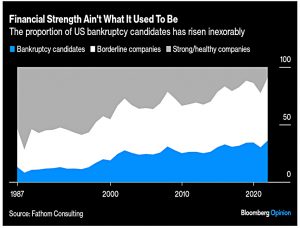

The proportion of US firms with healthy Altman Z-scores (a measure of bankruptcy risk) jas fallen from more than 60% in the 1990s to less than 10% today.

And the number of candidates for imminent bankruptcy has been rising.

The Altman system may be outdated by now, as intangible assets make up a far greater share of balance sheets and generally do have value. But the idea that credit quality is degrading still stands.

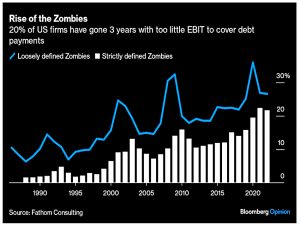

The number of Zombie companies (“companies that are no longer able to grow or even produce enough profits to cover interest expenses, but can survive because their interest costs are so low”) has been increasing, to more than 20% of US firms (even on a strict definition of zombie).

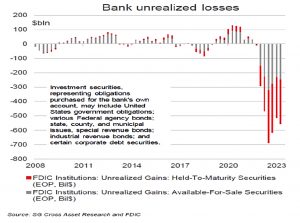

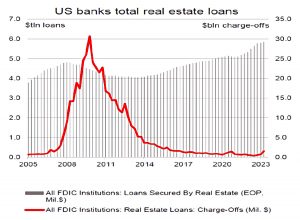

Banks’ unrealized losses remain alarmingly high, while charge-offs on commercial real estate loans, which have grown significantly in the years since the GFC, have only just started to pick up.

The Fed’s survey of lending standards is now in the 90th percentile of tightness, which normally points to a recession, but the banks’s share of corporate credit has been falling and now stands at just 15% of the market.

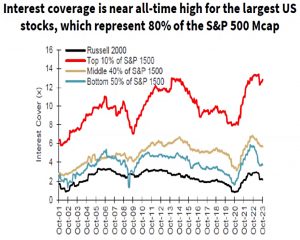

John highlights the polarisation of the market, with the largest 150 companies (80% of the S&P market cap) scoring close to an all-time high for interest cover.

- But small caps have been weakening over the past couple of years.

As a share of employment, the mass of severely indebted smaller companies could do serious damage.

And if small caps fail, the market becomes even more concentrated, with implications for competition and monopoly.

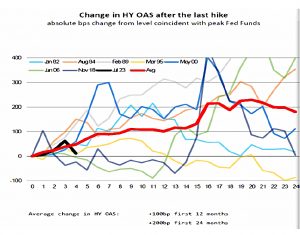

The key reason for no bankruptcies to date has been the locking-in of low interest rates after the pandemic, but the average time left on junk bonds is now dropping as these firms can’t afford to reissue at higher rates.

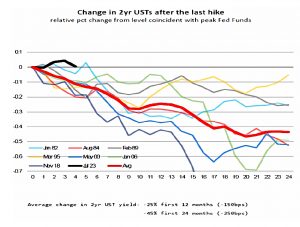

There’s also the issue that if the Fed is done hiking, then 2-year yields should be falling, and they are not.

The spreads between junk bonds and Treasuries should also increase, and they haven’t.

Like the calm way the market responded to the WeWork and Signa bankruptcies, this is mighty strange. [There is] little doubt that they will widen, and quite possibly overshoot. The question is how much they’ll widen, and how much damage defaults will do by [then].

Simplified Advice

Having recently abandoned the idea of excluding advice on cash savings under £10K and on S&S ISAs from the general regulations, the Financial Conduct Authority has instead published three proposals on the advice/guidance boundary:

- clarifying when firms can give consumers support without giving regulated financial advice

- allowing firms to provide support tailored to groups of people in similar circumstances

- a new form of simplified advice to support personal recommendations to investors with small pots at a more affordable cost

Executive Director Sarah Pritchard said:

We want to open the door for more people to get the right advice or support to manage their money at the time they need it and at a cost they can afford. This review will help us produce new rules to deliver this important step change for industry and consumers.

Things that would be allowed under the new “targeted support” approach include:

- explaining the different ways you can access a pension

- explain how holding too much cash can be a poor long-term solution, and suggest more appropriate products

- help a customer invest a one-off sum, without taking into account their wider financial situation

- review the funds held by a customer who feels their risk tolerance has changed, and recommend substitutes

Pension decumulation decisions around drawdown, UFPLS and annuities will be excluded.

A few years ago, I would have been quite excited about the potential to help people with small pots without falling foul of regulation.

- But now I think it’s more of a demand issue than a supply one.

People with small amounts of savings are generally not interested in sensible investing advice, or in putting their funds at risk.

- Perhaps the solution is a government-administered product like Premium Bonds, which invests up to £85K (the FSCS compensation limit) in a globally-diversified multi-asset portfolio, at no cost to the consumer.

It would solve the problem for most small investors, but I can’t see the industry being in favour.

Foreign funds

The FCA has also published proposals for how a new Overseas Funds Regime (OFR) could operate.

- The idea is that funds domiciled in a jurisdiction that the FCA determines is “equivalent” to the UK would be able to be marketed to UK retail investors.

This would be a really big deal for me, as the ETFs available in the US are vastly superior to those available in the UK, and the US is a slam-dunk to be deemed equivalent.

The FCA has issued a consultation that runs until 12th Feb 2024, so it will be quite some time before the funds are available – but it’s a mouth-watering prospect.

The FCA said:

The FCA has proposed the categories of information that overseas schemes will need to submit to become recognised by the FCA under the OFR. The FCA has sought to design a regime that is efficient and effective.

The FCA has also put forward new measures to make sure investors are aware of the protections they have, such as access to the Financial Ombudsman Service and the Financial Services Compensation Scheme, if they invest in an overseas fund.

Sarah Pritchard added:

We want to balance making the transition into the new regime as smooth as possible for firms, while also meeting our primary objective to protect UK retail investors. With our proposed rules and guidance, we set out what we think a strong but proportionate model looks like.

I should point out that the FCA announcements make no mention of foreign ETFs specifically, and it’s always possible that they are targeting less useful products.

The main reaction from the industry has focused on the costs to IFAs, who would be required to explain where FSCS protection did not apply.

- The FCA has pointed out that the OFR would be voluntary, so only scheme operators who think that the benefits outweigh the costs will take part.

Quick Links

I have four for you this week, the first two from The Economist:

- The Economist asked Can the carbon-offset market be saved?

- And wondered Can anyone bar Europe do luxury?

- Alpha Architect found Momentum Everywhere, Including Equity Options

- And asked Can Machine Learning help to select mutual funds with positive alpha?

Until next time.