Smart Portfolios 5 – Top-Down, Assets, Alternatives

Today’s post is our fifth visit to Rob Carver’s book Smart Portfolios.

Contents

Top-down

Today we’re going to be looking at asset classes, and in particular, the alternatives to bonds and equities.

- I’m hoping that the content might be a bit easier to digest than what we’ve seen from the book so far.

Rob believes that it’s almost impossible to predict risk-adjusted returns, so it’s better to focus on diversification rather than stock-picking.

- I wouldn’t go quite that far, but I restrict stock-picking to s small portion of my overall net worth, and even then I use factor approaches (like momentum) as filters.

Like me, Rob believes in a top-down approach to portfolio construction/asset allocation.

- You choose your asset classes first, then your countries/industries and firms (for stocks, as an example).

Top-down counteracts home bias and “favourite industry” bias.

- It also deals with people who are obsessed with stocks (often small caps) or with another asset (usually property, or gold).

Top-down also comes with a process – instead of selecting dozens of assets from a universe of many thousands, you have a series of relatively simple decisions to take.

- And a top-down approach maximises the diversification of smaller accounts, for which a random bottom-up selection is more dangerous.

Allocation diagrams

Rob’s book has a series of asset class breakdowns, showing both risk allocation weights and cash weightings.

- Where volatilities are equal cash weights and risk weights will be the same are the same.

Note that Rob’s allocations have no home bias to the UK, whereas I would keep some, for several reasons:

- I plan to spend (my money and my life) in the UK (so there’s no currency risk)

- I have more information about the UK economy, and

- I can invest more cheaply at home.

Rob uses minimum ETF allocations of £3,600 in his tables, based on a £6 commission.

- For iWeb (£5) you could use £3K, or for YouInvest (£10) you could use £5K.

New kid on the block Freetrade has a £1 charge, which would support trades as small as £600.

- But their range of ETFs is not wide enough at the moment.

Asset classes

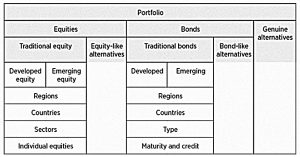

Here’s Rob’s top-down map of assets.

The key difference to what I’ve presented in previous articles about portfolio construction is that Rob is more rigorous about alternatives.

He splits them into three:

- genuine alternatives

- equity-like alternatives

- bond-like alternatives

Rob does not include SWAG or exotics like BitCoin.

- He also ignores derivatives like futures and options – they are a complicated method of gaining exposure to an asset class, rather than a class themselves.

The reasoning behind Rob’s classification reasoning is the behaviour of each group of assets during the 2008 financial crisis.

I’m less concerned than Rob about abnormal correlations during a crash because I expect to hold enough cash to be able to ride it out.

- Rob doesn’t believe in holding cash, whereas I include it within the Bonds section.

At the same time, I believe that Rob’s classification should lead to an allocation plan that is superior to mine, so I have adopted it.

Max SR

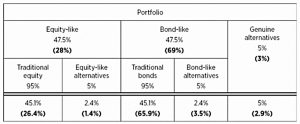

Rob assumes that correlations between equities, bonds and true alternatives are close to zero and identical.

This lead’s to Rob’s first-pass max SR portfolio, with 55% (cash weight ) in bond-like assets, and a total of 66% in alternatives.

- This will be scary to most people, and Rob suggests that a 10% allocation is more reasonable.

Rob offers some reasons why alternatives might get a lower weight:

- They have “badly-behaved” risk (what Rob has called elsewhere “risky risk” – they tend to become much riskier very quickly.

- They are usually more expensive to access, and so their post-cost SRs are lower.

- There’s also the potential for embarrassment when straying too far from the classic 60/40 portfolio.

Here’s Rob’s max SR portfolio with a 10% alternatives cap:

There’s still way too much allocated to bonds for me (and therefore too low a return on the portfolio).

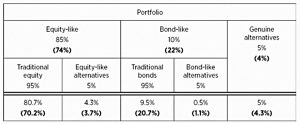

Max return

To get maximum returns, Rob also caps bonds at 10% (by risk, equal to 22% cash).

This will be my starting point when I review my own allocations (in a future post).

No alternatives

Rob also offers allocations that exclude alternatives entirely.

Alternatives

True alternatives

Let’s start with insurance-like assets.

- These instruments generally have negative (real) returns, as well as negative correlations with bond and equities

Rob’s list is:

- Gold, silver and platinum

- Long volatility funds (put – and call – options on indices)

- Tail protect hedge funds (cheap option strategy)

- Short-biased equity funds

- Insurance currencies (Swiss franc, dollar, yen)

There are two true alternatives:

- Managed futures (CTAs, which go long and short)

- Global macro hedge funds

Exposure

Rob said that he couldn’t find any UK ETFs with Hedge fund exposure.

There are two Brevan Howard funds (Macro and Global), which I suppose count as investment trusts.

- Most of the other listed hedge funds are activist-style, but there are also Highbridge multi-strategy and Boussard and Gavaudan Holdings – I’m not sure what their styles are.

There is also a UK ETF that tracks the VIX (the S&P 500’s volatility).

Rob also couldn’t find a way for UK investors to hold Swiss Francs directly, other than in a brokerage account.

- There are no UK ETFs, either, it would seem.

You could use spread bets, but I would imagine that the holding costs are prohibitive.

Note that holding stocks and bonds from safe-haven countries will provide some exposure, so you could overweight here.

Gold and other precious metal ETFs are more straightforward.

Rob’s allocation splits 50/50 between insurance and true alternatives, then sub-divides equally amongst two true alternatives and five insurance-like products.

Equity-like alternatives

Here’s Rob’s list:

- Private Equity & Venture Capital

- Property

- Commodities (industrial metals and energy)

- Other hedge fund strategies (equity neutral, fixed income relative value, FX carry, volatility selling).

Exposure to PE is via ETFs or more expensive ITs.

- You may already have some exposure to VC through VCTs and EIS (as I do).

Property exposure of many flavours is readily available via ETFs and REITs.

- But most investors in the UK have too much property exposure already, through their (expensive) home.

Commodity exposure is available via ETFs (ETPs), which suffer from contango drag.

- Or there are spread bets, which I would expect to be expensive in the long run.

There are also funds for things like forestry, timber and agro-businesses.

The UK has no hedge fund ETFs, but we have the ITs I mentioned above.

Bond-like alternatives

Here’s Rob’s list:

Private investors have quite a lot of options in this space now, though arguably not a lot of it is high quality.

- There are infrastructure and asset-backed ITs, plus direct P2P (including sophisticated options like Wise Alpha) and P2P ITs.

For me, the problem with direct P2P (apart from low returns for the level of credit risk) is the tax treatment.

- You can only shelter the income by using up your ISA allowance, so you need a compelling reason to invest.

Rob prefers high-yield (junk) bond ETFs to P2P.

ETF suggestions

Rob provides a few suggestions for ETFs that could be used in the alternative space.

- There are five genuine alternatives ETFs – mostly precious metals

- Rob says he would never hold more than 8% in metals, and that 2.5% would be more reasonable.

- There are seven equity-like ETFs.

- There are four bond-like ETFs.

Conclusions

The going has been a bit easier today, and we’ve covered a lot of ground.

- I won’t know quite how useful it has been until I build a model allocation and compare to both my current holdings and my existing target allocation.

But before that, we have to get through the next three chapters on equities and bonds.

- Until next time.