Smart Portfolios 6 – Equities and Bonds

Today’s post is our sixth visit to Rob Carver’s book Smart Portfolios.

Contents

Home bias

Chapter Ten of Rob’s book looks at Equities across (between) countries.

- Rob doesn’t believe in home bias, so his country weightings will treat the UK as just another country in Europe.

I do allow for some home bias, for a number of reasons:

- I plan to stay in the UK (( Notwithstanding a Corbyn government )) and spend my money in pounds.

- The cash I keep in UK assets is not exposed to FX risk.

- The UK markets are cheaper to access, especially for active strategies (Rob is focused on a passive allocation at this stage).

- I have more information about the prospects for the UK economy and UK companies.

- The research suggests that a certain amount of home bias (say a 20% to 50% allocation to the home country) does not impact returns.

The market cap allocation of the UK within the developed equities category is around 7%.

- But I would be happy with a 20 to 50% allocation to the UK.

- The exact number will be driven by active strategies (stock-picking). (( I’m currently targeting 22.4% allocation to the UK in my passive portfolio, but I actually have 23.4%; overall I have 14.4% of my net worth in UK stocks and a 64.6% exposure to Sterling ))

Note that I don’t condone allocating all your portfolio to the UK.

- 50% international allocation is a minimum for long-term success.

On a similar note, I allow an allocation to “global” equities.

- This is usually allocated not to funds which track the World index, but to theme ETFs and global ITs.

Non-country-aligned would be a more accurate name, but that’s a bit of a mouthful.

Regions

Rob uses the MSCI indices to provide a list of countries.

- This gives 46 in total, of which 23 are emerging markets.

There are another 24 markets in the Frontier Index which Rob ignores, but which can be accessed by ETFs and ITs.

Rob dislikes the “one fund” approach to equities because of the massive overweight to the US – as do I.

- Using two funds (US / RoW) just moves this problem down to other large countries like Japan and the UK.

Rob likes a regional approach that treats EMs as separate (since they correlate more with each other than with developed markets).

- Within the larger regions (North America, EMEA, APAC), you can allocate separately to countries as you wish.

Note that even this approach leaves us open to sector concentration, but this is a smaller problem than country concentration.

- If you get the countries right, individual concentrations should cancel each other out to some extent.

The problem can also be addressed within the countries to which you have the largest allocation by using a sector approach there.

A formal optimisation process would give a racy 53% of stocks to EMs.

- Rob prefers 25% in risk terms (17% in cash, which is what I use).

He suggests 40% as an EM risk cap (27% in cash terms).

An alternative approach is to split each region into a large country, and use an “Ex-fund” to access the remainder.

- EMs can be split into three regions if you want to – APAC, LATAM and EMEA.

- APAC has 70% by market cap, but Rob limits this to 40%.

I use a simpler China / other EMs split.

Countries

In the next section, Rob looks at breaking down each of the regions into countries.

- I won’t go to this level of detail.

Equities within countries

Chapter eleven is mostly about when to drop down from funds into individual stocks, as representatives of their sectors.

- Sector allocation with funds is difficult outside the US, and may be too expensive for the benefit it brings.

Once again, the country allocation is more important than sector allocation.

Sector allocation via direct holding of stocks is unlikely to be viable outside the UK (and for larger investors, perhaps the US).

- Rob only holds individual shares in the UK.

- I have a few US stocks as well.

Size

Rob does accept that a split between large cap and small cap equities is useful

- Although in this section of the book he is “pretending” than risk-adjusted returns are equal, the higher risk of small stocks would, in any case, imply higher returns.

Rob will accept a premium of 0.2% to 0.35% on mid-cap and small-cap funds over their large-cap equivalents.

- He would ideally allocate 60/20/20 to large-, mid- and small-caps.

So I end up with:

- UK large mid and small

- US large mid and small

- Europe large mid and small

- Japan large and small

- APAC large and small

- China

- Other EM large and small

- Global and theme

That’s a total of 18 equity ETF categories.

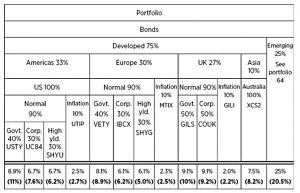

Bonds

Rob says that two things count with bonds:

- who is borrowing your money, and

- how long they want it for.

Longer bonds should pay more because of the longer term that capital is at risk, and because they are more sensitive to changes in interest rates.

- Riskier borrowers should pay you more.

So we might need a spread of maturities and a spread of credit risk levels.

Rob has previously warned against using too many low volatility (and low return) assets and warns here about letting the duration of a bond portfolio get too low (less than 4 years).

- My preference for keeping a fair chunk of my portfolio in cash would fall foul of this rule.

On credit risk, governments are safest, then other public sector bodies (cities in the US, government organisations).

- Next come blue-chip companies and finally high-yield (“junk”) bonds.

- Junk bonds are those rated below what is known as “investment grade”.

We also have to take into account the country of the issue – developed nation bonds are safer than those from EMs.

- And EM countries often issue bonds in dollars or Euros, which can cause problems (insufficient FX reserves) in a crisis.

There are also index-linked bond and asset-backed bonds to consider.

- Convertible bonds are in effect backed by the equity of the issuing firm.

Bond allocation

Rob doesn’t recommend buying individual bonds, so all his allocations use ETFs.

- As with stocks, a single fund would give a significant overweighting to the US.

Here’s Rob’s hierarchical process for allocating to bonds:

- Emerging and developed markets

- Regions (we’ll skip Countries)

- Bond type (standard, inflation-linked, foreign currency)

- Bond maturity

- Credit rating (government quality, municipal, government agency, investment grade corporate, high yield corporate)

- Backing (none, asset-backed, covered bond, convertible)

In practice, you can’t implement this, since the funds don’t exist.

- But for once, the UK has more funds than the US (particularly for bonds from outside the US).

You can get bond funds that cover the UK, US, Europe and EMs.

- Within these, you can get government, corporate, linkers, high yield and foreign currency bonds (for EMs).

Rob’s portfolio has fifteen bond fund categories in total.

Example portfolios

In Chapter 13, Rob looks at some example portfolios:

- Example 1: Sarah: US-based institutional investor (risk tolerance: brave)

- Example 2: David: UK investor with £500,000 (risk tolerance: average)

- Example 3: Paul: US investor with $40,000 (risk tolerance: ultra safe)

- Example 4: Patricia: UK investor with £50,000 (risk tolerance: brave)

David is the closest to what we are looking for, but the risk tolerance is wrong.

- So instead I will build my own example portfolio, starting from the next article in this series.

Conclusions

It’s been another very useful visit, with example portfolios for all levels of investor and some variations according to risk appetite.

The next step is to put it all together for a UK investor with a max-return objective.

- And to work out what is the minimum portfolio size for the optimum allocation.

We’ll start to look at that in the article to come.

- Until next time.