Inheritance Tax Review

Today’s post is about the recent second report from the office of Tax Simplification on the Inheritance Tax Review.

The OTS

The OTS (Office of Tax Simplification) is an “independent” adviser to the government which makes recommendations on simplifying the UK tax system so as to make it easier to use and to reduce the associated administrative burden.

- It has no regulatory power – the government and parliament need to implement any changes.

The OTS was asked to look at the inheritance tax (IHT) and has now produced its second report following a consultation process.

There were nearly 3,000 responses to an online survey, a further 500 emails from individuals and over 100 written responses from experts.

The report has 11 recommendations, which the OTS has grouped into four “packages”, but for our purposes, there are two main subject areas:

- Lifetime gifts, and

- Business exemptions.

Perhaps surprisingly, the report has nothing to say about the passing down of family homes worth more than £325K, or whether IHT should be replaced by a lifetime gift allowance.

- This is because the focus of the OTS is on simplification rather than major policy changes.

In addition, the OTS notes that:

Since the residence nil rate band is still relatively new, more time is needed to

evaluate its effectiveness before recommendations can be made on how best to

simplify it.

State of play

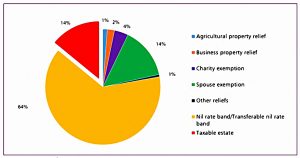

IHT is paid (at 40%) on estates over £325K.

- Gifts to spouses are exempt, and your £325K exemption can be transferred to a spouse.

- Gifts to charities and political parties are also exempt.

There’s an additional exemption for £175K of cash from a primary residence, so long as this goes to a child or grandchild (ie. a direct descendent).

- This relief can also be passed to a spouse.

Gifts made more than 7 years before death are also exempt.

- And qualifying businesses and farms are exempt.

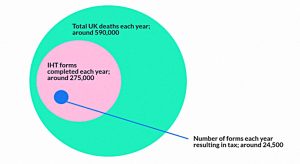

Fewer than 5% of estates pay IHT – just 25K people per year.

- But a lot more people worry about paying it – it’s often described as the most hated tax (because it’s a tax on money that has already been taxed).

Inheritance Tax is often said to be unpopular and raises strong emotions, not least because it affects people only occasionally, in sometimes significant and surprising ways, and at a sensitive time.

The effective rate of IHT works out at 14% since the other 86% of estates is covered by one of the reliefs.

Lifetime gifts

Currently, there are four main gift exemptions:

- £3K per year

- any gift of less then £250

- gifts on marriage

- regular gifting out of income.

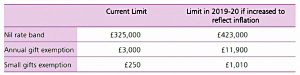

The OTS is proposing a single annual gift allowance.

- No level has been specified, though the OTS Tax director called for the allowance to be set at “a sensible level”.

- If the £3K annual limit had been indexed since its introduction, it would now be close to £12K.

The OTS also recommends a higher exemption for small gifts and the removal of the “gifts from income” exemption.

They also propose that the 7-year period for gifts falling out of IHT should be shortened to five years, and the taper relief on gifts above £325K should be abolished.

- The idea here is to reduce the workload on the executors of wills – apparently, most banks only store six years of statements.

Apparently, only £7M of £4.38 bn in IHT raised in 2015/16 came from gives made more than five years before death.

Businesses

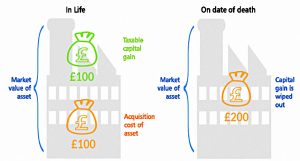

The OTS looked at the interaction between IHT and CGT (which does not apply on death).

- They have recommendations to address “distortions” that families face when making decisions on how to pass assets to the next generation.

The idea is that the CGT exemption on death puts people off from passing on assets while they are alive (which would crystallise the CGT assessment).

There is no explicit suggestion that Business Property Relief (BPR) should be removed from AIM shares, thought the OTS does suggest that:

The government should review the treatment of indirect non-controlling holdings in trading companies.

This seems to refer to holding companies and joint ventures rather than individuals holding AIM shares.

The OTS seems to question whether AIM relief serves the original purpose of BPR, but they are also aware of the government’s desire to support investment in growth companies (as also evidenced by the VCT and EIS/SEIS reliefs and the Patient Capital Review of 2017).

In relation to third-party investors in Aim traded shares, business property tax relief is not necessary to prevent the business from being broken up or sold in

order to fund the payment of IHT.This raises a question about whether it is within the policy intent of business property tax relief to extend the relief to such shares, in particular where they are no longer held by the family or individuals originally owning the business.

AIM is the only market in the world where investors can receive an inheritance tax

benefit. Supporting a market in this way is a different policy objective from supporting passing a business down the generations.

There is however a catch concerning the interaction between IHT and CGT:

Where an asset is exempted or relieved from Inheritance Tax (for example, certain business property or farmland, or where the spouse exemption applies), the capital gains uplift means the asset can be sold shortly after death without either Inheritance Tax or Capital Gains Tax being payable.

Where a relief or exemption from Inheritance Tax applies, the government should consider removing the capital gains uplift and instead provide that the recipient is treated as acquiring the assets at the historic base cost of the person who has died.

Effectively this would mean that where BPR applies, CGT also applies.

- AIM IHT portfolios would need to be “turned over” regularly to avoid the build-up of large profits that would lead to CGT when the assets are sold by the investor’s descendants.

Even that might not be sufficient if the government decided to use the initial portfolio size as the transfer valuation.

It’s hard to see how this change could be described as a simplification.

If BPR relief were to be removed from AIM shares, it’s likely that the market would crash.

- Investor’s Champion reckons that around one-third of all the money invested in Aim is via wealth managers for IHT planning.

Other recommendations

There are two that will be of interest to many investors:

- The IHT treatment of furnished holiday lets should be aligned with their treatment under income tax and CGT (where they are treated as trading activities).

- Holiday lets do not at present qualify for the BPR exemption from IHT.

- Death benefit payments from term life insurance should be exempt from IHT on the death of the life assured without the need for them to be written in trust.

Next steps

The Treasury said it would respond to the recommendations in due course.

The OTS review was commissioned by Philip Hammond, who is unlikely to remain as Chancellor once the new PM is in place.

- And the new minister is likely to be preoccupied with Brexit considerations.

So it’s far from clear whether any of these proposals will actually make it into the statute book.

Until next time.