Water – How and Why to Invest

Today’s post is about how to – and why you should – invest in water.

Contents

Michael Burry

I’m sure that most of you have seen the Big Short, based on the book by Michael Lewis.

[amazon template=thumbnail&asin=0141043539]

It’s an entertaining film, though it doesn’t entirely tally with my own memories of the 2007-08 financial crisis.

- Christian Bale plays Michael Burry, a genius investor with an “interesting” personality.

- He correctly predicted the collapse of the credit and housing bubble and bet heavily against Wall Street banks.

Before that he was a well-known value investor and regular poster on bulletin boards.

Vintage Value Investing (VVI) breaks down his investment strategy:

- Invest with a margin of safety (rather than look for a catalyst)

- Perform bottom-up fundamental analysis

- He uses stock screeners to look at the EV/EBITDA ratio

- Intrinsic value is then determined by free cash flow

- He ignores PE and return on equity, but likes minimal debt.

- Look for great stocks in disfavored industries

- Portfolio management is as important as picking stocks

I like to hold 12 to 18 stocks diversified among various depressed industries, and tend to be fully invested.

I prefer to buy within 10% to 15% of a 52-week low that has shown itself to offer some price support.

If a stock breaks to a new low , in most cases I cut the loss.

Burry and Water

During the end credits of the film, we are informed that Burry is now investing in a single asset – water.

- It’s a neat story, though it may not quite match up to the facts.

Burry runs a hedge fund – Scion Asset Management.

- He previously ran a fund from 2000 to 2008 before shutting it outside investors.

- He started the fund up again in 2016.

Over on Activist Stocks, they track Scion’s holdings, but they aren’t packed with water stocks.

- In fact, I couldn’t find any.

Of course, it’s possible that he has most of his own money in water – we’d never know.

- Certainly the fund only lists around $80M of assets, and some / most of that will be from outside investors.

Burry himself probably has a lot more money than that.

- He made $100M in 2008, and most people have more than doubled their money since then. (( VVI say that he made close to $1 bn in 2008 ))

- So let’s guess that he has around $250M.

That leaves a lot of room for water.

The case for water

VVI stress how little useable water there is:

70% of the Earth’s surface is covered in water, but only 2.5% of that is freshwater. And only 1% of freshwater is easily accessible – most of the other 99% is trapped in glaciers and snowfields. So only 0.007% of the planet’s water is actually available to fuel and feed the world’s 7 billion people.

Whether you’re a believer in mad-made climate change or not, the planet seems to be getting hotter, and extreme weather is getting more commonplace.

- In addition, the world’s population will keep growing for another 30+ years.

- And increasingly, the population is concentrated away from the wetter, more temperate zones.

More of the global population is being lifted out of poverty and towards a middle-class, high water consumption lifestyle.

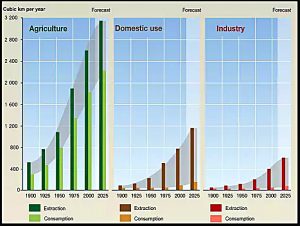

- Water use has grown at twice the rate of population growth over the last 100 years.

- But we still only use 30% of the total accessible and renewable supply.

Despite this, the UN expects 1.8 billion people to live in areas of water scarcity by 2025.

- And it’s estimated that there have been 195 conflicts over water since 2000.

Whether the people without water will have the resources to buy it in from other regions and drive up a global price is another question.

Of course, a shortage of water should mean that it is valued properly, and steps will be taken to guarantee a future supply.

- Governments and corporations are likely to invest more in water infrastructure.

“New” technologies like desalination (reverse osmosis) should become more popular.

- Desalination is used already in Saudi Arabia and the Canary Islands.

- There’s even a plant in London, which can only be switched on during sever droughts.

Recycling of “greywater” – commonplace in Australia, less so in the UK, and hardly used in the US – should also become more common.

And smart metering – on its way for electricity, but not yet for water – will be introduced.

- This will support variable pricing according to supply and demand.

Despite the likelihood of new tech and better behaviour, it’s still reasonable to believe that water will become an increasingly scarce resource.

- And new infrastructure and new technologies should provide new opportunities for investment.

The real problem is how to invest.

- Pure plays are hard to find.

- There’s no commodity market in water, like there is for oil, gold or silver.

Investing like Burry

VVI followed up on their profile of Burry by looking at how to invest like him.

- They now produce an “Official Water Stock Guide”, but it’s behind a paywall.

- Judging from the stocks they do mention in their articles about Burry, they will be US-listed in any case. (( In fact, some of the global water ETFs they talk about do include UK stocks, which are covered later on in the article ))

They came up with three options:

- Purchase water rights

- Yes, these are a thing – in the States, at least.

- You might not even have rights to the rain that falls on your land.

- Invest in water-rich farmland

- Invest in water utilities, infrastructure, and equipment

Here’s what Burry himself had to say:

Transporting water is impractical for both political and physical reasons, so buying up water rights did not make a lot of sense. Food is the way to invest in water. That is, grow food in water-rich areas and transport it for sale in water-poor areas. A bottle of wine takes over 400 bottles of water to produce.

So Burry is buying land.

- According to VVI, he’s been buying almond farms.

It takes 1 gallon of water to produce a single almond, and 80% of them are grown in California (a noted drought area).

- And you can’t get an almond tree through a fallow (drought) year.

This looks like an interesting strategy for Burry, but not so much for the average UK DIY investor.

- So we’ll focus on option 3.

How to invest in water

Let’s begin with the UK-listed water stocks.

- Before investing in utilities, think about regulatory risk.

- Utility profits are under threat in the current political climate.

Most UK water companies have been sold to foreign firms over recent years, but the global water ETFs mentioned by VVI include a few UK stocks:

- United Utilities (UU)

- Severn Trent (SVT)

- Pennon (PNN)

- Halma (HLMA) – see section on MoneyWeek article below

- Rotork (ROR)

The “Themes” section of our Investment Trusts page includes three relevant trusts – how relevant you will need to judge for yourself:

- Impax Environmental Markets (IEM) – a clean energy and water fund.

- Utilico Emerging Markets (UEM) – an emerging utilities fund

- Ecofin Global Utilities and Infrastructure (EGL)

There’s also Ecofin Water & Power Opportunities (EGL), which wasn’t on the list.

- And Premier Energy & Water Trust (PEW)

Our Exposure Stocks list includes some renewable energy stocks, but nothing for water.

There are also two Water ETFs.

- Since our ETF list is for core holdings rather than Theme ETFs, I’ll add these to the Exposure Stocks list:

- iShares S&P Global Water 50 (IH2O)

- Lyxor World Water (WATL)

MoneyWeek had a feature on investing in water last year.

- But four of the five stocks they recommended were listed in the US.

The exception was Halma (HLMA) which has massively outperformed the FTSE over the last 5 years, despite a PE in the 30s.

Halma specialises in safety, health and environmental technology products, and operates in more than 20 countries.

Subsidiary Halma Water Management, designs and makes monitoring and communications equipment for water, wastewater and gas networks.

Halma has grown its dividend by more than 5% a year every year for the past 37 years.

So it’s not a pure play, but it does tap into the more general environmental theme.

- I’ve added it to our exposure stocks list (along with the rest from the VVI article).

And I also came across Water Intelligence (WATR), which “provides leak detection and remediation services”.

Conclusions

I feel like we’ve only just scratched the surface today.

- Water seems like a promising theme, but it’s far from a “no-brainer”.

We have six stocks and seven trusts to invest in.

- But we could do with a few more.

So over to you – what do you think?

- Will water become more scarce?

- Will this drive up the price?

- Do you know of any other ways to invest?

Let me know in the comments.

Until next time.

As an investor of HICL the infrastructure fund for some years, I notice that very recently (May in fact) they took close to a 40% equity stake in Affinity Water which is supposed to be the UK’s biggest water only supply company. I think HICL paid close to £270m for their stake.

I was a bit nervous of the investment as I had been comfortable with HICL’s strategy of buying into mature PFI/PPP projects with a long pipeline of income, but this does indicate a shortage of just investments out there and greater competition for what is availble.

However Affinity seems to have a lot going for it -profits of around £60m per annum, it has a long record (130 years) and it supplies the part of the country (SE) where population growth is expected for the next 25 years+, is not responsible for waste water and sewage (unlike other water companies) and is regarded well by OFWAT.

I think Morgan Stanley had been the benefical owner of Affininity and sold it for a total of £1.6bn.

Perhaps such a stake in such a company is good business and fits what HICL’s investors want which is low risk, long term high payouts. The talk is that they will next look at the gas and electricity regulated assets too…