State of the Market – AltFi P2P Lending Review

Today’s post looks at the recently published AltFi P2P lending review.

AltFi P2P Lending Review

It’s getting on for two years since we looked at the P2P lending market, so this summary from AltFi is well-timed.

- AltFi themselves should need no introduction – they are one of the leading commentators in this space, headed up by David Stevenson (though this report was edited by Daniel Lanyon).

Before reading the report, my take on P2P is the same as it has been for the past couple of years:

- It’s riskier than people think

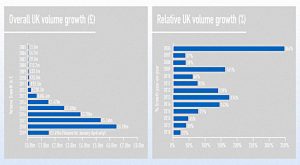

- And riskier than it used to be following a massive expansion (from £92M in 2011 to £6.1 bn in 2018) – and with a recession looming in the next couple of years.

- The returns are too low for the risk.

- The tax situation is problematic, with only the first £1K of interest safe from tax and any use of the IF-ISA eating into your regular (more flexible) S&S ISA allowance.

- Diversification using IF-ISAs requires a large commitment to P2P (say £100K), which won’t be suitable for most investors.

I haven’t invested in P2P for close to 10 years now, and to change that I would really need higher returns and a better tax shelter.

- The one loophole is that some platforms allow investment from a limited company – here interest would just become part of the regular income of the company.

If a firm had a large cash balance earning say 1% pa, then P2P could look interesting.

Growth

The introductory section from the editor offers a mixed picture:

Annual increases in volumes are slowing. Some investment trusts have begun to wind down or pivot strategies.

Equity investors have been hard convinced to back Funding Circle’s valuation at its IPO price and many industry observers are preparing for an anticipated regulatory crackdown.

In addition to slowing growth, loss rates are going up, bringing net yields down.

- Gross lending was up 20% in 2018, after two years of 40% growth.

As the sector’s stock of existing loans grows so the value of repayments increases rapidly each year making it progressively harder to generate growth.

Sectors

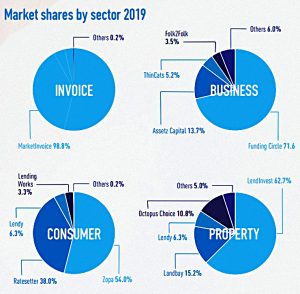

The market has four sectors:

- Business and Consumer lending run at around £2 bn per year each

- Property and Invoice lending run at around £1 bn per year each

Each sector is dominated by one or two groups:

- Business by Funding Circle and Assetz Capital

- Consumer by Zopa and Ratesetter

- Property by LendInvest and LandBay

- Invoice by MarketInvoice

So a first-glance diversified portfolio might involve these seven firms.

Returns

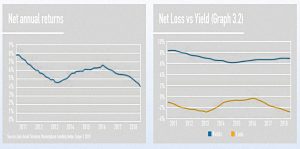

Net returns have been falling for a couple of years and are now at 4% pa.

- This is mostly because of increasing loss rates.

- Headline returns are around 7% before 3% of losses are removed.

These are not great numbers, though they look better when compared to inflation and the rates on savings accounts.

The average duration of P2P loans is around 3.5 years, and AltFi uses this number to compare them with conventional bonds.

- Three-year UK gilts are at around 0.7%.

P2P also offers higher returns than corporate bonds and even junk bonds (as you might think it should, given the risk profile).

Listed direct lending

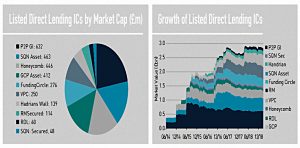

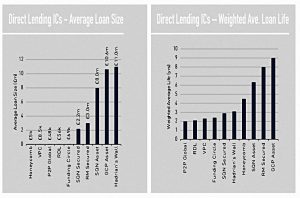

As well as the platforms, there are ten listed funds (effectively investment trusts) with a market cap of £2.84 bn.

- The sector dates back to the 2014 listing of P2P Global investments.

These funds were well received at first, following the withdrawal of the main banks from the direct lending sector, but they have largely failed to live up to their potential.

Most funds now focus on the UK, whereas historically there was more US exposure.

- Some funds focus on corporate credit, others on consumer lending.

- There are also asset-backed funds and investments in renewable energy and property.

Loan sizes vary by market, with consumer loans much smaller than others.

- These loans are also of shorter duration.

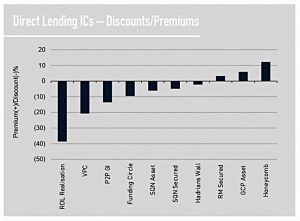

NAV returns have been “solid” but share prices have largely derated as inflated expectations were not met.

- Most of the listed funds now trade at a discount to NAV.

AltFi identifies four reasons for the somewhat disappointing returns:

- The high cost of hedging particularly against US income, as US interest rates have risen before UK rates.

- High management fees and no hurdle rates for performance fees

- Increasing defaults as loans age (“seasoning”)

- IFRS 9 accounting provisions have reduced returns on unsecured loans by up to 2% pa

But they remain upbeat about the sector:

We believe there remains a place for the Direct Lending sector to generate returns in areas of specialist lending that have been neglected by banks since the financial crisis.

We … favour GCP Asset Backed Income and SQN Asset Finance Income and also see recovery potential in P2P GI.

Conclusions

It’s a decently interesting report, but it hasn’t changed mind about the sector:

- Net returns are low-ish

- Losses are rising

- The listed firms have disappointed

There’s probably a place for direct lending in a large diversified portfolio, but it’s not a big one.

- I’m guessing something like 1-2% of a listed passive portfolio for the ITs, and 1-2% of non-listed assets for the platforms.

And at such low allocation levels, it seems a lot of hassle when compared to globally-diversified, multi-asset ETF portfolio.

I’ll try to find time in the coming weeks to look in more detail at the seven dominant platforms, to try to answer the following questions:

- What are the net returns?

- Can I invest as (i) an individual (ii) a company?

- What is the minimum investment

Let’s see if we can put a reasonable portfolio together for less than £50K that will yield more than 4% pa net.

Until next time.