Portfolio Construction – Counter-Cyclical Indexing

Today we’re going to look at a recent paper from Cullen Roche on Portfolio Construction. It recommends a technique called Counter-Cyclical Indexing.

Contents

- Counter-Cyclical Indexing

- The Asset Allocation process

- Modern Portfolio Theory

- Capital Asset Pricing Model

- Critiques of CAPM and EMH

- Fama and French factors

- 2008

- The Global Portfolio

- Active vs Passive

- The Savings Portfolio Scale

- Corporate profits

- Duration

- Building the Global Portfolio

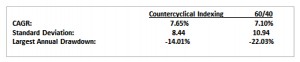

- Comparison with 60/40

- Counter-Cyclical Indexing again

- Conclusions

Counter-Cyclical Indexing

Cullen Roche writes a blog called Pragmatic Capitalism, and as well as his regular posts, he writes the occasional longer paper.

His latest is called Understanding Modern Portfolio Construction, and it has three sections:

- a review of the development of portfolio and asset allocation theory

- the problems with applying the theory to portfolio construction

- an alternative framework for constructing portfolios (Counter-Cyclical Indexing)

As always when we look at an industry paper, we recommend that you read the paper in full.

- You can find it here.

- But it’s a 13,000 word, 44-page read, so for those pressed for time, here is an overview.

The Asset Allocation process

Building a portfolio is a four-step process:

- Establish a set of financial goals (eg. x pounds required in y years time)

- Decide on a definition of risk and work out how much risk is appropriate (determine the investor’s risk tolerance)

- Purchase the assets most likely to meet the goals within the risk limits

- Regularly monitor and rebalance the portfolio back to the most appropriate composition for the current situation

Modern Portfolio Theory

Modern Portfolio Theory (MPT) began in 1952, when Harry Markowitz came up with mean-variance optimization (MVO).

MVO attempted to quantify the efficient allocation of assets by using price volatility as a proxy for risk, and looking at the amount of “risk” needed to achieve a certain level of return.

- This is the Efficient Frontier concept of portfolio construction.

But as we saw last week, volatility is not risk, and MVO is not really risk optimisation.

This is not to say that importance of diversification in creating superior returns by reducing total portfolio variance is overstated.

- It’s just that price fluctuations are only one way of looking at a portfolio.

As we’ve said before, the use of standard deviation of price returns as the proxy for risk was driven largely by the fact that it simplifies the maths in the underlying models.

Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) was created by Jack Treynor, William Sharpe, John Lintner and Jan Mossin in the 1960s.

CAPM split risk in two:

- systematic risk (undiversifiable market risk)

- non-systematic risk (diversifiable asset risk)

In 1976 Stephen Ross introduced Arbitrage Pricing Theory (APT), which identified multiple sources of systematic risk.

CAPM also split returns into two:

- market returns (beta) and

- excess returns (alpha).

Along with the CAPM came the Efficient Markets Hypothesis (EMH), which basically says that you can’t beat the market.

- So you either accept the market return, or you take on extra risk in order to receive extra returns.

These theories led in turn to the concept of tracking the market using a market cap-weighted portfolio (an index tracker).

- It should also be noted that most funds remained active, chasing the “impossible” excess returns (or for more cynical readers, creaming off high annual fees)

Critiques of CAPM and EMH

The 1987 market crash and the 1997 East Asian Currency Crisis led to a focus on tail risk (extreme, unlikely events) and CAPM and EMH were replaced by a search for market anomalies.

- Value at Risk (VaR) models that calculated the worst case scenarios for portfolios (using statistics) became popular

- Hedging portfolios with options and futures (portfolio insurance) became popular

- Hedge funds themselves multiplied in number

Fama and French factors

In 1992 Fama and French “expanded” the EMH by listing three factors – market risk, value and size – to explain market returns.

- In 2014, they added two more factors (profitability and “investment” – firms with high profitability and low asset growth will outperform).

- Other researchers have identified many other potential factors.

This has led to the Factor Tilting approach to portfolio construction, and to Smart Beta. ((To an extent, this is my personal approach – multiple distinct portfolios to exploit the various factors I believe in – value, size, momentum, dividends ))

2008

The 2008 crisis showed that in a global panic, all correlations increase significantly, and thus simple portfolio diversification offers little protection, just when you need it most.

- Thus simple portfolio diversification offers little protection, just when you need it most.

- This led to a new search for alternative asset allocation strategies that might do better.

This has led to a focus on how to best define risk, and also to an increasing focus on behavioural finance, which looks at how real humans behave in various situations.

- They behave irrationally, in contrast to the “rational market operators” imagined by the EMH.

Another theme to emerge from the wreckage of 2008 is a focus on costs.

- The measures taken by governments and central banks to deal with the crisis have led to a low-interest rate, low-growth world.

- In this context, the 1%+ boost to returns (in the UK) from replacing active managed funds with passive trackers and ETFs is hard to resist.

- By the same logic, the use of tax-efficient shelters for investment (in the UK, SIPPs and ISAs) has also become more attractive.

Taxes and costs – what Cullen calls “frictions” – are the most controllable parts of a portfolio.

The Global Portfolio

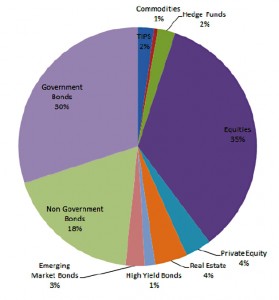

At the aggregate (macro) level, there is a Global Financial Asset Portfolio (GFAP) of all outstanding financial assets.

- Its composition will change over time, but this GFAP generates the “market return”

- An “average” asset allocation will follow the GFAP and generate the same returns (minus taxes and fees)

By definition, the aggregate of all portfolios cannot “beat the market”.

- But also, unless all assets have the same returns, then some asset allocators must outperform other asset allocators,

- And some portfolios must beat the market.

The real question is whether anyone can beat the market over an extended period of time.

- I think that they can – there are numerous examples of individual investors, and the factors mentioned above are further evidence

- Cullen thinks that they can’t – for him there is no “alpha”, and only different types of beta

As Cullen points out, generating alpha – whether or not this is possible – is not a requirement for most investors.taking

- taking the market return in a low-fee, low-tax way will be good enough for most people in the long run

He also points out that the false pursuit of alpha is what drives many of the asset manager behaviours that are not aligned with the best interests of their customers.

- In particular, close benchmarking to indexes (closet tracking) and short-term performance comparisons are bad ideas.

I could not comprehend how the management of money by institutions had degenerated from sound investment to this rat-race of trying to get the highest possible return in the shortest period of time. – Ben Graham

For the asset manager, risk (in this case, career risk) is the fear of (local) benchmark underperformance.

- Investors are worried about loss of purchasing power, and interested in absolute rather than relative performance.

Active vs Passive

The GFAP is the only true benchmark – any deviation from that allocation is an active weighting, so we are all active investors in that sense.

- The only real distinction between what are generally known as active and passive strategies are trading frequency and costs

- There are of course active stock pickers like Warren Buffet and Terry Smith who have low portfolio turnover, but in general self-styled active investors will trade more

Cullen also notes that “passive” investors need “active” investors since their index funds are piggy-backing on the trading activity of active investors.

- Without active investors, asset prices would never change.

The Savings Portfolio Scale

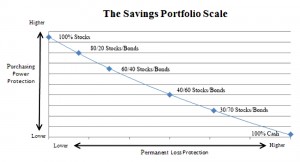

Cullen splits the risk to the investor into two:

- the risk of purchasing power loss

- the risk of permanent loss (a crystallised loss)

I prefer to think of these as a single dimension, and to protect against permanent loss by keeping a certain amount of cash on hand.

Using Cullen’s approach, we can visualise how to protect against risk using the chart below:

- a focus on permanent loss risk leads to holding more cash

- a focus on purchasing power risk leads to holding more stocks

- in between, various proportions of bonds are added to the portfolio

Corporate profits

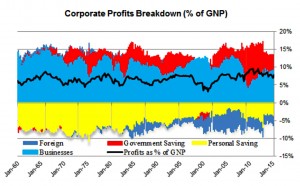

The inflation-proof returns on stocks come from corporate profits, which are in turn driven mainly by net investment, dividends, and the government deficit.

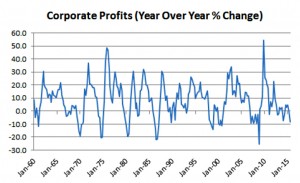

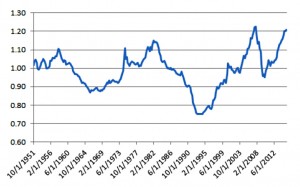

The problem is that corporate profits are cyclical. The next chart shows the year-on-year percentage change in profits:

This variability leads to the uncertainty around the value of stocks, and hence to stock price fluctuations and market returns.

- Note that in the long run the returns from a stock will reflect the firm’s profitability (the voting machine / weighing machine model)

Duration

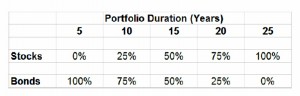

Cullen is interested in applying the bond concept of duration to stocks.

A company can finance its operations either from debt or from equity (or as almost all firms do, from a mix of the two).

Debt is usually cheap since the cash flows are stable, modest and of short duration.

- The aggregate bond index has an effective duration of 5.5 years

- This, in turn, means that the sensitivity of the bond price to its effective return is modest

Equity is expensive since the future returns (share of profits) are variable (“risky”) and unknown, and equity holders will demand a higher rate of return.

We can calculate the duration of the stock market using the ratio of price to yield change, or through a break-even analysis for a set of probabilistic outcomes.

- Cullen estimates an average equity market duration of 25 years

- Equities will therefore behave more like long bonds, with higher returns and greater price sensitivity

Cullen views duration as fundamental to asset allocation.

- Since financial timeframes are often shorter than the durations of some assets (stocks),

- investors must balance their exposure to stocks, bonds and cash to produce a portfolio with the appropriate duration.

The real problem is an asset and liability mismatch.

- investors have liabilities (outgoings) over time

- the approach they take to protect their financial assets from risk (asset allocation) needs to be balanced against the process used to create certainty over spending needs

This means that the long-term outperformance of stocks needs to be balanced against the risk of “permanent loss” by selling assets to finance spending needs that occur continuously through their lives.

- As previously noted, a simplistic approach to this problem is to keep enough cash on hand to ride out an equity downturn

Using the equity duration of 25 years and bond duration of 5.5 years, Cullen suggests a formula for working out the split between the two assets:

Portfolio Duration (PD) = 25*Stock %age + 5.5*Bond %age

So for a 45-year-old investor – with 20 years to go to retirement – a Stock %age of 75% and Bond %age of 25% would give a PD of 20.

The table below shows PDs for various allocations:

Adapting this to include cash (with a duration of 0) rather than bonds, gives us:

Portfolio Duration (PD) = 25*Stock %age + 0*Cash %age

This is easier to calculate, and for the same 45-year-old investor gives a Stock allocation of 80% (plus 20% cash).

Using additional asset classes complicates the picture.

Building the Global Portfolio

Cullen sees the GFAP as the default portfolio for an investor but notes that there is currently no low-cost index fund that tracks it.

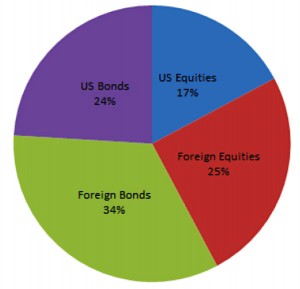

Instead, he proposes an approximation based built from four funds:

- US stocks

- US bonds

- International stocks

- International bonds

There are two points to note here:

- it’s possible to get much closer to the GFAP using more than four funds (see for example our ETF portfolio) but this involves more work

- the question of home bias is easier to solve for US investors since their home market is such a large proportion of the global market

I still believe that it is appropriate for UK investors to overweight UK stocks and bonds.

- The amount to which you do this is a personal decision

Comparison with 60/40

The usual benchmark for asset allocation is 60% stocks, 40% bonds

- in the US, this generally involves only US securities

- elsewhere, global funds might be used

The GFAP does not outperform the US 60/40 portfolio:

- since 1959 the 60/40 index has shown historical compound annual returns of 9.61 with a standard deviation of 10.9, a Sharpe ratio of 0.58 and a Sortino ratio of 0.81

- the GFAP has shown 8.7% compound annual growth with a standard deviation of 9.99, a Sharpe Ratio of 0.55 and Sortino Ratio of 0.78.

Cullen offers a couple of explanations for the under-performance:

- A market cap weighted allocation reflects the trends of capital raising by the underlying firms, which could be influenced by interest rates:

- when interest rates are high, firms might prefer to issue equity, which would overweight equities at a time when bonds are much more attractive to savers

- The GFAP treats all bonds as being equal, but US bonds have outperformed

Counter-Cyclical Indexing again

As an improvement on the GFAP, Cullen proposes a Counter-Cyclical Indexing strategy:

- this will better align the risk profile of the asset allocator with how he perceives risk through the market cycle

- this will reduce the behavioral risk of loss aversion and imbalanced exposure to permanent loss

The use of systematic counter-cyclical policy is common in macroeconomics, but not portfolio construction.

The problem with the 60/40 strategy is that it will tend to be overweight equities when they are most risky (that is, it will exhibit procyclicality):

- this is because equities become more risky as they rise in value and less risky as they decline

- in 2008, the 60/40 portfolio lost more than 30%

- the 60/40 portfolio has 70% of the negative volatility of the S&P 500

Cullen rules out Factor Investing as a solution as he believes that factors are easier to identify in retrospect than in advance, and that once factors are publicly identified they tend to lose their significance.

- I disagree with this, as there are strong behavioural reasons for why factors like value and momentum should persist

Cullen’s method is based on the work on Risk Parity by Ray Dalio, and by William Sharpe’s Adaptive Asset Allocation Policies

- Sharpe recommends rebalancing to account for changes in the financial markets.

To illustrate the cyclicality of markets, Cullen uses one of Warren Buffett’s favourite measures, market cap to GDP:

This measure shows a tendency to mean revert.

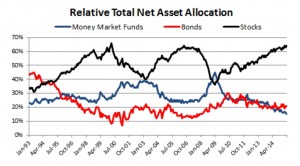

The same tendency is even clearer in the graph of total net asset allocation (between cash, bonds and stocks):

Cullen recommends a strategy that inverts the current relative asset allocations

This “inverted GFAP” has worked very well in the past.

The countercyclical portfolio matches the performance of 60/40 during turbulent bond markets and outperforms during turbulent stock markets.

I’m attracted to these countercyclical “market timing” approaches (see also Half and Half and VAMO Hedge) but in this particular case, I’m not certain how to get hold of the relevant net asset allocation data for the UK.

Conclusions

- Classical portfolio theory has several problems

- it uses price volatility as a proxy for risk

- it says that you can’t beat the market, despite the existence of numerous factors for outperformance

- it underweights tail risk

- it assumes market participants are rational and ignores behavioural finance

- The 2008 crisis showed that simple diversification is no protection in a global crash

- the low-interest rate, low return environment since 2008 has led to an increased focus on low-cost investing, and on the use of tax shelters

- The Global portfolio (GFAP) is the market portfolio that produces market returns

- most investors don’t need to beat this market return

- most portfolios deviate from the GFAP allocations and in this sense, they are active portfolios

- chasing alpha leads to closet tracking of indices by asset managers and an incorrect emphasis on short-term performance

- Applying duration to stocks allows three asset portfolios (stocks, bonds, cash) to be constructed with average duration to match any investing time horizon up to 25 years (100% stocks)

- The GFAP can be approximated (for US investors) using four funds:

- US stocks

- US bonds

- International stocks

- International bonds

- This four-fund portfolio does not outperform the classic 60/40 portfolio

- this is probably because stocks become riskier as they increase in price, and the GFAP would be overweight stocks when stock prices are high

- Counter-Cyclical Indexing (an “inverted GFAP”) outperforms the 60/40 portfolio

- net asset allocation (cash / bonds / stocks) can be used as an inverse weighting indicator

- Counter-Cyclical Indexing looks like an interesting approach (see also Half and Half and VAMO Hedge) but in this particular case, I’m not certain how to get hold of the relevant net asset allocation data for the UK.

Until next time.

This is certainly easier to follow than the original was.

Is Mr Rouche trying to say that:- GFAP= 60 shares/40 bonds.

Inverted GFAP= 40 share/60 bonds.

The “Inverted GFAP” is the less risky of the two and produces almost as good a result. If so he is stating the obvious, in a long complicated and unclear way.

If not, can someone please explain it to me in a way I might understand.

Not quite – GFAP is the whole investable world.

He’s recommending that when everyone else piles into stocks, you edge out into bonds. When everyone piles into bonds, you move out into stocks.

He has simplified the assets involved for clarity – you can have more assets and then you don’t need to move so much money around.

The basic idea (like Half and Half and Vamo Hedge) is that being counter-cyclical will boost returns with no extra risk.

Stocks only guys try to do almost the same thing by hedging during bear markets.