Weekly Roundup, 20th December 2022

We begin today’s Weekly Roundup with a new era for investing.

New Era

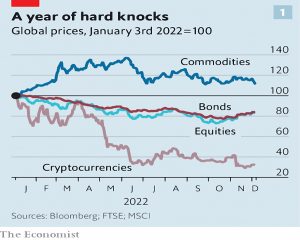

The Economist said that we are now in a new era for investing – one of higher interest rates and scarcer capital.

- Not to mention resurgent inflation.

A second article provided more detail.

The newspaper lists three new rules:

- Expected returns will be higher

- Falling interest rates during the bull market turned future income into present capital gains, leading to lower expected returns.

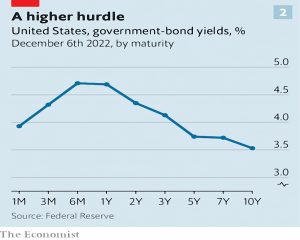

- The reverse is now happening – yields on 10-year TIPS (a proxy for real risk-free returns) are up from minus 1% to plus 1.2%.

- Time horizons have shortened

- Higher interest rates degrade the present value of future income streams, making investors impatient.

- This works against tech firms and will revive sectors that looked finished, like European banking and legacy carmakers.

- Investment strategies will change

- The winning bet since the 2008 crisis has been passive (index) investing in public markets and active investing in private markets.

- Indexes may not do as well as before, but high-fee private investments that aren’t marked to market will eventually deliver losses.

It’s important to note that as far as financial history is concerned, this is a return to normal – it was the recent era of cheap money that was unusual.

Though markets expect interest rates to fall after a peak next year, the odds that they will collapse back to next-to-nothing seem slim. Inflation is likely to be hard to tame. Nearly two years of it have raised expectations of price rises, which can be self-fulfilling.

We still have tight labour markets and increasing demands on public spending from deteriorating demographics and a pandemic-induced dependence in the population.

So inflation protection will be more important in portfolios going forward, but also easier to achieve:

Commodities, as a frequent source of inflation, also provide a good means to hedge against it. They are now substantially more “financialised” than they were in the 1970s.

Infrastructure and property can also provide inflation-linked revenues, though property valuations may slump.

Higher yields on bonds also raise questions about the attractions of private equity and credit:

Can they keep their appeal now that rising government-bond yields have resurrected the alternatives? For leveraged buy-outs, which by definition are extremely sensitive to the cost of borrowing, the answer is almost certainly no.

There will also be a change in the types of stocks that are attractive:

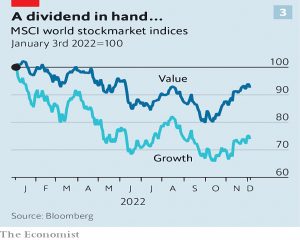

During the TINA years “growth” stocks, whose value depends on the promise of spectacular profits in the future, stormed ahead of their “value” counterparts, which offer steady income but less scope for growth. But as interest rates rise, they erode the present-day value of future earnings, making growth stocks less appealing.

Contrarian Sovereign Wealth

In the FT, Robin Wigglesworth (who is Norwegian) looked at a change in direction for the Norway sovereign wealth fund.

- The fund, pumped from the country’s oil and gas revenues, is the world’s largest – so large that on average it owns 1.5% of every listed firm.

CEO Nicolai Tangen said:

The fund will become a more vocal shareholder and plans to vote against companies that fail to set a net zero emissions target, overpay their top leaders, or do not have sufficiently diverse boards.

He also said that the fund (run by a team within the central bank called NBIM) needs to take advantage of its long-term perspective and be “more contrarian”.

- This term is a bit like “quality” – everybody is in favour and they all have their own definition of what it means.

Robin agrees:

Contrarian investing seems to be a fancy way of saying: “Will blame long periods of underperformance on central banks and claim personal credit every time they enjoy six good months of returns”.

The fund would also appear to be quite constrained:

About 70 per cent of NBIM’s money is in equities, and roughly 30 per cent in fixed income. It is gradually building up a real estate portfolio that will in time account for 3–7 per cent.

It can also invest up to 2% in renewable infrastructure.

- The government takes 3% out of the fund each year, which is supposed to be the real long-term return.

The fund’s strategy report explains the new approach:

We will vary active risk as market conditions change. This allows us to take advantage of the best opportunities when they arise. Variations in asset prices can be related to behavioural factors or leverage causing procyclicality.

Long-term investors are well-positioned to take advantage of such variations. We will seek to buy when others want to sell and sell when others want to buy.

The fund will be more opportunistic and aggressive in share lending, IPOs and rights issues.

More controversially, the report mentions:

- sector rotation

- under-exposure to stocks where forensic accounting and behavioural analysis indicate future underperformance

- overexposure to “quality” stocks expected to outperform

- use of external managers in certain markets

- investments in unlisted (pre-IPO) companies

It all sounds quite dramatic, but Robin is not convinced that the changes will have much impact:

The fund is just too big and the mandate too restrictive. These are just tweaks around the edges. The harsh reality is that attempts to time markets — whether it is in cute tactical asset allocation shifts or sectoral tilts — is a fraught business.

John Lee

John Lee’s regular update in the FT advised us to keep faith even in the darkest times.

- Adverse correlations, rising interest rates and high inflation mean that this has been a tough year, but I can imagine darker times.

John has been through a few:

There have been four major Black Swan events over my investment life: the secondary banking crisis of the early 1970s; the subprime crisis in 2008; the Covid-19 pandemic of 2019-20; and more recently Russia’s invasion of Ukraine.

I’m too young for the first one and I wouldn’t count the last, so my personal tally stands at two.

- For John, the secondary banking crisis was the worst:

It showed me at first hand the impact of such unexpected events. In this case, it was that shares can plummet, with nobody buying despite blue-chip yields of 20 per cent. And it demonstrated why one should never buy shares on borrowed money.

I would be drawn to a 20% yield, so I can only assume the expectation was that the dividends wouldn’t turn up (or there was a punitive dividend tax in place).

- I’m not so hardline on leverage either – you need to understand your overall exposure and how you will cope with an adverse move, but that doesn’t mean you can’t use a little juice at the right time.

John’s advice for a crisis is to stick with it:

Once prices have tumbled, I am clear that investors should stay aboard and await the recovery which usually occurs. One has to take a moderately optimistic view of the future.

He also likes to avoid the trading costs of getting and back in, along with missed dividends and the possibility of takeover bids when stocks are cheap.

- John also has a portfolio biased to large positions in small-caps stocks, which makes selling and re-buying even more difficult/expensive (and sometimes impossible).

What a crisis will do is throw up buying opportunities for an investor like John.

- Unfortunately, during the recent Covid crash, he missed most of them:

I should have given more thought to the commercial beneficiaries. It did not require rocket science to spot companies in the healthcare sector, or those which sold over the internet, delivery companies, and packaging companies like DS Smith and Smurfit.

John remains concerned about CGT, as he was the last time he reported in.

- He has some big gains outside tax shelters and was worried that the CGT rate would rise in the Autumn Statement (and then again when a Labour government is formed after the next election).

In the event, the rate stayed the same, but the annual allowance will be cut to £3K.

- Nevertheless, John has been selling down his positions.

Redwood

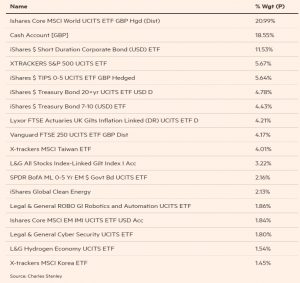

John Redwood’s regular update said that US long bonds offered hope.

- It’s been a bad year for John’s portfolio as both stocks and bonds have struggled.

He’s down 11.4% for the year as of 1st December.

I kept the bond part of the portfolio in short-dated index-linked bonds and in cash and near cash for much of the year, waiting for the US Federal Reserve and the other leading central banks to get on with increasing interest rates and forcing bond prices down.

But he’s been buying longer US Treasuries in recent weeks.

The recent Santa rally has come from many investors hoping that the Fed is nearing peak rates and will have to start to reduce borrowing costs as early as sometime next year in response to economic slowdown or recession. A slowdown followed by a pause in rate rises will be needed in the new year.

He plans to add more US bonds as the pause approaches.

- He won’t buy stocks until he has more data on the size of the coming downturn (recession) and the extent of company earnings downgrades.

Quick Links

I have five for you this week.

- UK Dividend Stocks asked Is WH Smith an Attractive Dividend Stock?

- And wrote that Recessions are an opportunity as much as a threat

- Alpha Architect said that Volatility scaling is useful for factor timing

- And looked at Machine Learning and The Cross-Section of Emerging Market Stock Returns

- And Mauldin Economics said rates would be Higher for Longer.

Until next time.