Weekly Roundup, 4th July 2022

We begin today’s Weekly Roundup with scale-ups.

Scale-ups

The Economist reported that the UK is a good place to start a company, but a bad place to scale it up.

Britain’s financial-services industry employs 1.1m people, generates 7% of the country’s economic output and contributes a tenth of the Treasury’s tax revenue. But too often, when it comes to scaling a promising startup into a domestic heavyweight, equity capital dries up along the way.

The newspaper notes the difference in large company ages:

Of America’s five biggest firms by market capitalisation (Apple, Microsoft, Alphabet, Amazon and Tesla) three were founded after 1990, and the others in the 1970s. Four have valuations in the trillions.

The average age of the five biggest firms with headquarters in Britain (Shell, AstraZeneca, Linde, HSBC and Rio Tinto) is 135. None is worth over $250bn.

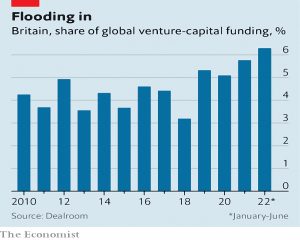

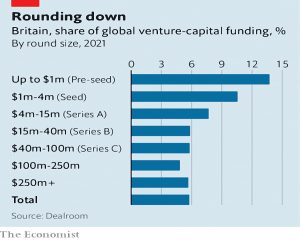

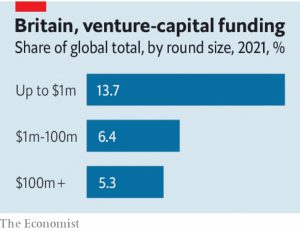

The UK has a lot of early-stage VC money, but less in later stages (though it still bats above its weight, which is 3% of global GDP).

- The situation is worst for “deep tech” where there is a long cash-burning journey towards profits.

Just 49% of British deep-tech firms reach their second funding round, compared with 63% for American ones. By the sixth funding round, the average American deep-tech firm has raised £113m; the average British one just £25m. After adjusting for GDP, deep-tech firms in America, China, Israel and Sweden are all better funded than British ones.

In the UK, we want earnings today, not the promise of growth tomorrow.

A second article looks at a possible solution – allowing pension funds to invest in these firms.

The top priority is to direct the £4.6trn ($7.4trn) of assets held in British pension and insurance funds into more productive areas. Less than 1% of these assets is in unlisted equities. Defined-benefit pension schemes’ allocation to the British stockmarket has sunk from 48% to below 3%.

The key obstacles to more PE and VC investment are a pension-fee cap which excludes high-fee arrangments, and accounting rules which make it safer to buy gilts than stocks.

- A third recommendation is to combine small pension funds (including 90+ local government schemes) into funds with scale.

Green Bonds

In FT Adviser, Sally Hickey reported that the NS&I Green Savings bonds have flopped, raising just £288M.

- Core NS&I products raised £4.4bn, including £10.3 bn from Premium bonds and £7.8 bn of outflows from Guaranteed Bonds and Income Bonds.

Proposed green projects included zero-emissions buses, offshore wind, low-carbon tech and flood defences.

The low take reflects the low rate, of just 0.65% pa over three years.

- The second issue in February 2021 offered 1.3% pa.

Rumours around the original launch date of October 2020 suggested that the Treasury’s target for the bonds was £15bn.

- This would be quite a shortfall, but that target included Green Gilts, which did raise that amount.

Laura Suter, head of personal finance at AJ Bell, said:

Those that have handed their money over to help fund government green projects might also be slightly dismayed to learn that the government has two years in which to invest the funds, meaning that for two-thirds of the bond’s term the money could be sitting in an account doing no good.

Sarah Coles of Hargreaves Lansdown said:

NS&I has discovered the hard way that we weren’t willing to plough our cash into something with a green label regardless of the rate – even when it came from an incredibly trusted brand.

Green Bonds remain one for hugely committed green savers with an unbreakable commitment to NS&I. Everyone else will be looking elsewhere for better returns.

NS&I don’t seem worried. CEO Ian Ackerly said:

This has been a successful year for NS&I, in which we have met all of our financial targets and restored customer service to our normal high standards.

After a challenging period during the pandemic, I am proud of the work we have done to bounce back and deliver what our customers deserve – the ability to save in our unique products with fast, responsive and friendly customer service.

The Fed

I promised more reaction to the Fed’s last interest rate rise.

- Joachim Klement thinks that Jerome Powell and Andrew Bailey will go down as the worst policymakers in his lifetime.

Until early January, both the Fed and the Bank were arguing for a moderate path of rate hikes while the markets priced in a much faster pace to some 2% at the end of 2022. In their January policy meetings, both Powell and Bailey suddenly changed tack and came out with very hawkish statements, that essentially followed the guidance of the markets.

Joachim compares the Ukraine supply shock to the oil crisis of 1973 and the Kuwait invasion of 1990.

In 1973 the Fed panicked and started to hike interest rates in order to rein in inflation. Today we know this was one of the biggest policy mistakes in the history of central banking and the start of the stagflation of the 1970s. Compare this to 1990 when under Alan Greenspan the Fed did… nothing.

The key is to differentiate between supply- and demand-driven inflation:

Supply-driven inflation from supply chain disruptions or boycotts of energy exports cannot be tamed with monetary policy measures. These supply-driven events act as a tax hike and I don’t think anyone would appreciate it if central banks would hike interest rates to fight inflation caused by a 5% increase in VAT.

The central banks in 1991 had learned not to fight supply shocks with rate hikes and the 1991 recession was mild, with inflation starting to fall six months later.

To know how much you must hike rates you have to know how much of core inflation is due to this demand shock. Plus, you must focus on core inflation, not headline inflation that includes volatile food and energy prices.

Core inflation is already falling, and Joachim is not looking forward to a recession:

It is no longer a question of ‘if’ we get into a recession, but ‘when’. The faster the Fed and Bank of England hike rates, the sooner this recession will start.

And there may be worse to come:

I fear that if Mr. Powell and Mr. Bailey don’t find their spines, they will be bullied by the market into cutting rates just when inflation was coming down anyway and the demand was accelerating.

Rainy day funds

In FT Adviser, Sonia Rach reported on pensions minister Guy Opperman’s idea that firms should offer a savings product alongside their workplace pension.

Guy thinks (probably correctly) that young people are not excited by pensions:

If you speak to young people about what they are really interested in, first of all, for a bloke it is mainly buying a car. And if you’re a couple, it’s definitely buying a house deposit. If add on savings as part of the sign-on package, it’s amazing for staff retention.

I’m no expert on recruitment and HR issues, but I would suggest that’s outside the remit of a pensions minister too.

He wants to see a % workplace savings levy:

It’s not a situation where you are giving enhanced pay, but you are being paid and creating a 1 per cent savings pot which very quickly would build up a cushion that everybody wishes to have. We should have a rainy day savings as a de facto policy.

We need to save more during our working years, but there are two options for this new pot:

- There are severe restrictions on when/how it can be accessed, in which case it’s a mandatory 1% allocation to cash within your workplace pension (not a great idea over the long-term)

- There are no restrictions, in which case this pot will not survive to retirement, and serves no long-term purpose

The better news is that Guy sees the auto-enrolment contributions being increased from 8% to 12%.

Holiday Lets

After cracking down on small buy-to-let landlords, the government has turned its sights on short-term holiday lets, which still benefit from the earlier, more generous tax regime.

- A formal review of the market (in England only) has been launched to both ensure that accommodation is “up to standards” and to address concerns that locals are being priced out of popular destinations.

There are two obvious issues here:

- Short-term holiday accommodation is rarely ideal for long-term occupation as a primary residence (it’s small), and

- People are priced out of everything that is popular (as measured by demand relative to supply) – that’s how price works.

Tourism minister Nigel Huddleston said:

We’ve seen huge growth in the range of holiday accommodation available over the last few years. We want to reap the benefits of the boom in short-term holiday lets while protecting community interests and making sure England has high-quality tourist accommodation.

Housing minister Stuart Andrew said:

This review will give us a better understanding of how short-term lets are affecting housing supply locally to make sure the tourism sector works for both residents and visitors alike.

I had been thinking about buying a seaside cottage but maybe I’ll wait and see.

Quick Links

I have five for you this week, the first two from The Economist:

- The Economist looked at what past market crashes have looked like

- And at the great Silicon Valley shake-out.

- Alpha Architect wrote about combining factors in multi-factor portfolios

- Musings on Markets looked at risk capital and markets to decide whether we have a temporary retreat or a long-term pullback

- And UK Dividend Stocks said that the S&P 500 CAPE says that the bear market could have a long way to go.

Until next time.