Weekly Roundup, 12th May 2015

We start today’s Weekly Roundup with the FT’s Chart that tells a story.

Contents

AIM listings

Jonathan Eley took a look at the number of companies listing, and the amount of money raised, on the AIM market over the past 20 years.

The peak was in 2005-06 – 519 companies joined the market in 2005 and £10bn was raised in 2006. In 2007 there were 1,649 companies listed on AIM. The drivers for all this were bull markets in shares generally and commodities in particular. Many of the new listings were small oil, gas and mining companies, often already listed on exchanges in Canada or Australia.

The financial crisis ended the boom and companies left AIM. By 2013 there were only 1,087 companies. But new listings are on the up again.

Although small growth companies are obviously risky, the AIM market has a couple of advantages over the main list. Most companies are free of inheritance tax if held for more than two years, and there is no stamp duty on share purchases. Their major disadvantage was removed in 2013 when they became eligible for ISAs.

Long-term performance of the market as a whole is poor, with an annual loss of 1.6% since AIM began. So to make money you need to choose your stocks carefully.

Columnists’ portfolios

Jonathan also revealed that this was his last column for the FT Money supplement. ((He’s heading off to write for the Lex column)) As a parting gift he revealed his personal portfolio.

He has a smaller companies and an emerging markets investment trust, plus a much larger holding in the BlackRock MSCI All World total return ETF. The fund charges 0.2% and his platform an extra £45 a year. ((I’m guessing this is a Hargreaves Lansdown ISA)) Including dealing costs, annual charges are 0.34%, which is pretty good.

Although this is a surprising portfolio – I don’t know anyone willing to hold what is basically a single fund on a single platform – the more interesting point for me was that we rarely know much about the portfolios held by the commentators we follow.

Many columnists ((Including 7 Circles)) run real or dummy portfolios whose details are published, but they rarely represent the entire investment wealth of the author.

Whilst it’s completely understandable that people prefer to keep their finances private, this is a shame. Knowing which products a columnist used themselves would be very helpful when deciding how to take their advice.

Dividends

Merryn’s column was about dividends. As most people know, the majority of long-term investment returns are from the compounding of re-invested dividends.

In the UK, the payout ratio ((The percentage of company profits that are paid as dividends)) has risen from 35% to a record 65%, and the FTSE-100 dividend yield is 3.4%. This payout ratio is about as high as a sustainable dividend can go, and so growth in corporate profits will be needed for us to see larger dividends.

Merryn’s view is that high levels of debt and adverse demographics mean that low growth is likely and so dividends will not in general grow quickly. Her tips for better than average dividends include Japan, small to medium European stocks and UK small-caps (in particular, the “immature income stocks” in funds like Gervais Williams’ Diverse Income Trust and Miton UK Microcap Fund).

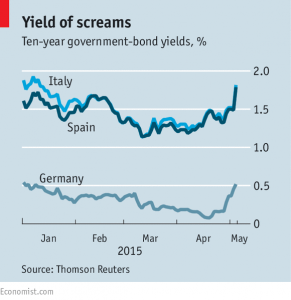

Bond yields, liquidity and pension deficits

Merryn also talked about bond yields, which have been rising in recent weeks (ie. bond prices have been falling). She pointed out that one group who will benefit are companies with large pension fund deficits. Calculations of how big their funds need to be are based on bond yields, and if these go up, the deficit goes down.

There are 5,000 UK companies in deficit and by mid-2014, 6 firms in the FTSE-100 had pension liabilities greater than their market capitalisation. The total deficit for the FTSE-100 is £80bn, and payments last year to reduce it totalled £7bn. Firms like Tesco, Sainsbury, BT, BAE, Shell and IAG should all benefit from rising yields.

Judith Evans also wrote about the bond price falls, focusing on the fear of liquidity issues. Bonds are not traded on a central exchange which makes transactions more difficult.

Since the financial crisis, banks have reduced their bond trading, and funds now hold a larger proportion of the bonds in issue. If many investors try to exit the funds at once (eg. in response to price falls as a result of interest rate rises) it may be difficult to find buyers other than at bargain prices.

Many funds have the ability to restrict redemptions in such circumstances. Funds have also been moving into more liquid (but lower yielding) bonds like UK gilts, and even into cash. Shorter-term bonds are also useful as they can be held to maturity and their prices will be impacted less by interest rate rises.

The Economist also looked at the bond market reverse. Higher yields would be good news if they were driven by improving economic data, which made people happier to hold equities. That is not the case – analysts at the Royal Bank of Canada called it “the wrong kind of sell off”.

Yields fell in early 2015 because of deflation fears (in turn driven by the oil price crash) and anticipated demand for bonds from the ECB QE programme which began in March. The prospect of QE also drove the euro down against the dollar, facilitating the borrowing of euros to buy appreciating bonds.

Recently the oil price has come back, and the threat of Grexit has returned; this supports bond yields and makes European equities attractive. Weaker growth in the US means that interest rate rises there will be delayed, halting the rise of the dollar against the euro.

Deciding whether this is the end of long bull market in bonds, or just a temporary blip, remains difficult.

P2P trusts

Back in the FT, Judith also wrote about fund managers accessing P2P lending via investment trusts. Neil Woodford and managers at F&C and Axa have bought the trusts for their target yield of 6% to 8% and because their low correlation with other asset classes offers diversification benefits.

P2P Global (LON:P2P) launched in 2014 and VPC Speciality Lending Investments (LON:VSL) launched in March 2015. A third fund, Ranger Direct Lending (LON:RDL) launched last week.

Behavioural economics

Buttonwood looked at a new book by Richard Thaler – Misbehaving: The Making of Behavioural Economics.

[amazon text=Amazon&asin=1846144035&text=Misbehaving: The Making of Behavioural Economics&template=thumbnail]

The article began with a sample list of our behavioural quirks:

- cab drivers make more money in bad weather or during conventions, but instead of working longer hours on those days to maximise takings, they work shorter hours, as if they have a mental target of income for the day, and knock off when it is reached

- we value things we already own more highly than equivalent objects we could buy

- we treat windfall gains differently than regular income

- we think that charges for paying by credit card are unfair, but a discount for cash is fine

None of this is too surprising, but economic models still generally rely on people acting rationally in their own self-interest.

Thaler describes how the initial behavioural results were dismissed as irrelevant – even if ordinary people were flawed, the serious professionals who made the important decisions would think straight. He uses US football coaches as an example that they do not – they over-emphasise the importance of their first picks from the annual draft.

Thaler is the co-author of Nudge, the book that inspired the UK government to set up a behavioural insights team. Some nudges, like pension auto-enrolment (opt-out rather than opt-in) make a surprisingly large difference. Telling people about other people’s behaviour (eg. everyone in your street has already paid their tax) is very effective.

Demographics and inflation

The Economist also looked at the relationship between demographics and inflation. The accepted wisdom is that ageing populations lead to slower growth: output falls as the workforce shrinks, and pension liabilities rise as a proportion of GDP.

Japan’s two decades of deflation have been seen as supporting evidence, and the recent failure of Abenomics to produce price inflation only confirmed this. But a new paper from Japan suggests that deflation may not be inevitable.

Mitsuru Katagiri of the Bank of Japan and Hideki Konishi and Kozo Ueda of Waseda University separate the effects of a falling birth rate and those of increased lifespan. The former gives fewer people to tax, tempting the government to inflate away its debts. The latter produces more pensioners, who would lobby for low inflation to protect their savings.

The key driver in Japan has been increased longevity. The net effect has been an annual 0.6% of deflation over the last 40 years.

Another factor is the effect of ageing on financial assets. People should smooth consumption by purchasing assets during their peak earning years and selling them to fund their retirement. In practice, stock markets often don’t decline as countries age.

An IMF working paper looked at the decline in Japan’s net savings rate from 15% disposable income in the early 1990s to zero in 2011. A key point is that most of the liquidated savings had been in foreign assets. As these were sold and the proceeds repatriated, the yen rose. This added to deflation by making imports cheaper. Abenomics might have corrected this.

A recent paper from the BIS suggests that Japan is not typical. Looking at 22 countries between 1955 and 2010, they found that high inflation was associated with a large number of dependents (young and old) and that a larger workforce tended to produce low inflation.

The explanation is that countries with more consumers than producers will have excess demand, which is inflationary. Excess producers leads to excess supply and deflation.

So why has Japan suffered deflation? Possible causes are the debts left over from the 1980s asset bubble, or the tight monetary policy before Abenomics. But surprisingly, demographics might yet come to the rescue.

A radical agenda

Since we have a surprise all-Tory government in power, I thought I would follow in the footsteps of Tim Harford last week, and suggest a radical conservative agenda for their consideration.

Here are my top 10 areas for action:

- Scotland – the SNP has a clear mandate to govern Scotland, so let’s get on with it:

- hand over full fiscal responsibility

- remove the subsidy from the Barnett formula

- exclude Scottish MPs from voting on English issues (resolve the West Lothian issue)

- The Public Sector

- public sector spending is too high and needs to be cut; with the prohibition on new taxes this is inevitable

- public sector pensions need reform – eventually we need to move to a DC scheme, but a first step would be to move to DB pensions linked to career average salaries, with higher qualifying ages (same as the state pension)

- regional wages should be introduced since living costs in the north are much lower

- public sector trade unions are too powerful and restrictions on their ability to disrupt services are needed

- Infrastructure spending

- get moving on HS2

- start building CrossRail 2 immediately after the completion of CrossRail 1

- add a new runway to either Heathrow or Gatwick

- high speed broadband across the country

- tax breaks for companies working in robotics and software automation

- decide where we stand on fracking and get started if we are in favour

- abandon the commitment to green energy and commission nuclear power stations

- The NHS

- maintain spending levels but prepare for the demographic impact of the future by including some charges for use – the waiting times at A&E need to be fixed

- get GPs working for their patients again

- Education

- more free state schools

- allow schools to compete for pupils and therefore allow underperforming schools to wither away

- underperforming teachers need to be eased out of the system

- get rid of the idea of “prizes for all” – replace continuous assessment and project based work with exams that are too hard for everyone to pass

- establish the idea that Britain is competing on a world stage – we need our children to be better than those in Korea and Singapore and China

- Welfare to work

- reduce the benefits cap to double the minimum wage (or for single parents, to 1 minimum wage plus 2 child benefits)

- make work pay by significantly reducing the clawback of benefits below a threshold wage level

- Housing

- create some low red tape planning zones and get building – we need a lot of houses, especially within commuting distance of London

- Defence

- sort out a replacement for Trident

- The BBC

- the licence fee model is unsustainable in the modern media landscape and needs to be replaced by subscriptions, ads or a combination of the two

- much of the entertainment output (soaps, the shiny floor shows on Saturday night) have no place in a public service broadcaster and should be left to the commercial stations

- salaries need to be brought into line with other civil service jobs

- Europe

- This is the tricky one – Cameron needs to renegotiate the terms of membership and hold a referendum, without this one issue dominating the government’s time and splitting the party

That lot should keep them busy.

Until next time.