Stockopedia for AIM #3

Today’s post is our third in a series on Stockopedia for AIM – we’re hoping to use the screening tool to put together an AIM IHT portfolio.

The story so far

In our first post in the series:

- We signed up for a free 2-week trial, worked out what we were looking for and took a look around the site

- We looked at the daily Stock Report for a company.

- And nosed around in the Guru Screens, particularly the “Screen of Screens”, which initially returned 61 stocks.

- This returned only 14 stocks to choose from (we need 50 for our portfolio), and only 5 of these were suitable – but at least we had discovered how to run our own screens.

In the second post:

- We built a “safe” AIM screen, which returned only six stocks.

- We analysed the AIM stocks on our Family Firms page, which produced around a dozen plausible candidates.

- We analysed the AIM top 50, which we had previously reviewed back in May – this produced proportionally far fewer firms, but added maybe another half dozen.

- And we relaxed the criteria on our Safe AIM screen to grow it to 28 plausible stocks.

The agenda going forward (not all for today, and not necessarily in this order) is:

- Export these screens and portfolios, and combine them in Excel or Google Sheets (or even in Access).

- Work our way through Stocks 51 to 100 on the AIM-100 list.

- Create a “Gold” list of dead-cert companies that appear in “professional” IHT portfolios.

- Create a similar “Silver” list of AIM companies tipped in articles, on Twitter and that show up in the amateur portfolios that I have access to.

- Hunt around in the Stockopedia bulletin boards and blogs – and on rival tool ShareScope – for hints about how people screen for AIM stocks.

We clearly won’t get through all that today, but let’s get started.

Economic moats on AIM

We’ll begin at the bottom of the list, with the blog posts from Stockopedia.

As I mentioned in the first article in this series, I’ve been lurking around on Stockopedia for close to three years.

- I like Ed’s seminars – whether online or at the trade shows

- And I really like Paul Scott’s (and now Graham Neary’s) daily Small Cap Value Report (SCVR)

The SCVR is widely read (thousands of views per day) and there are regularly dozens of comments below the report.

- So I had gained the impression that Stockopedia was the home of lively debate on investment techniques.

Not so much.

- The only “quality AIM” articles were both by in-house writer Ben Hobson:

- The good news is that they are both less than a month old at the time of writing this article.

The first (older) article talks about moats.

- Ben references a third (and old – 2012) article by Ed on moats – The 5 Key Signs of an Economic Moat

- And he also mentions a recent article that he wrote on the transformation of Games Workshop – How Games Workshop made the leap from contrarian value to soaring super stock

The five signs from Ed are:

- Intangible assets (brands, patents and regulatory approvals etc)

- Switching costs

- Network effects (quite similar to switching costs)

- Low cost advantage (cheaper operations, location, or unique assets)

- Scale economies (distribution networks, manufacturing, profitable niche markets)

This is all good stuff, but less applicable to AIM than to the main market, and Ed doesn’t provide a screen.

He makes two suggestions of things to look for:

- Free cash flow to sales or 5% or more

- ROE of 12% or more (over the long-term)

We might come back to these later.

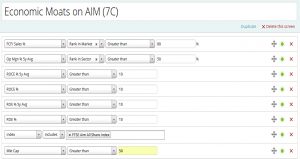

Ben’s first article does provide a stock screen, called Economic Moats on AIM.

- I took a copy of it so that I could play around with the rules.

Here’s the default screen.

- The only thing that I’ve changed here is the minimum market cap, highlighted in yellow – Ben used £10M but I prefer £50M.

- Note also that Ben filters using the AIM index, whereas I have used the Exchange field to date.

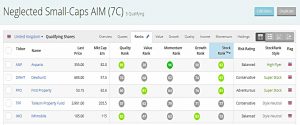

Eighteen shares qualify, but there’s more orange and red on the table than I expected, particularly in the value column:

There are also a couple that would likely not qualify for BPR – there’s a property fund and a securities firm towards the top of the list.

Neglected small-caps

Ben’s second article is about how a lack of analyst coverage can be a good sign in a small cap.

- Lots of small-cap fund managers agree, though the academics struggle to separate the “neglected” effect from the “small” effect.

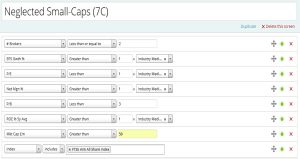

Either way, Ben has another screen.

- Once again, I’ve increased the minimum market cap to £50M (this time from £25M).

- I’ve also restricted the stocks to AIM only – Ben included small caps from the main market also.

This screen only produces five results, and two of them are property companies.

On we go.

Richard Beddard

Now let’s move over to Stockopedia’s great rival – ShareScope.

- As luck would have it, resident analyst Phil Oakley has just been joined by Richard Beddard, who used to write for interactive investor.

For his maiden article, Richard was invited to describe his stock picking strategy.

- The article is called shares to hold to the grave.

He uses a few financial ratios to measure profitability, financial strength and value:

- for profitability he uses ROCE

- for financial strength he uses gearing

- for value, he uses an earnings yield of more than 5% (ie. a PE below 20)

These ratios are similar to those used in strategies like Greenblatt’s “Magic formula”, and Richard refers us to an article by Phil which looks at this in more detail:

My plan was to put together a simple AIM screen on this basis, even though Richard doesn’t give target values for the ROE and earnings yield.

But it turns out that Stockopedia already has a Richard Beddard Screen, called Nifty Thrifty.

- It uses the Magic Formula rank from Greenblatt, which combines the ROCE and earnings yield

- And the Piotroski F-score to avoid weak companies (a proxy for low gearing, therefore)

As usual, I’ve modified the screen to only look at AIM stocks.

- I’ve also added the standard £50M minimum market cap.

And since the initial screen returned 184 stocks, I’ve added minimum earnings yield of 5%, as per Richard’s rules above.

- That only got us down to 70 stocks, so I took out the sectors we don’t like (financials, basic materials and energy).

Now we have a more manageable 49 results.

- Richard sorts by Magic formula rank, but I’ve used Stock Rank for now, to be consistent with the other screens.

- When buying the stocks, you would want to focus on those with lower magic formula ranks.

Conclusions

I’m going to leave it there for today – too many stock screens make your head spin.

- The priority for next time is to look at consolidating the output from the screens we’ve looked at so far.

- Then we can analyse the Gold and Silver portfolios, and the AIM stocks from 51 to 100.

Until next time.