Retirement Money Show, June 2015

A couple of weeks ago I went along to the Retirement Money Show over at the QEII Centre in Westminster.

They told us at the show that we’d have all the presenters’ slides within a few days. No need to take notes they said, so I didn’t.

I put off writing about the show until the slides turned up. But they didn’t turn up, so I waited. Eventually I got fed up of waiting and contacted the organisers.

It seems that not everyone gave permission for their slides to be distributed, so instead they were being added to the website one presentation at a time.

You can find them here – at the time of writing this, 12 of the 21 presentations ((There were 22 presentations, but one person gave the same presentation twice)) have slides, so the organisers have managed to get past the 50% line.

Contents

Overview

I don’t have the space to write in much detail about 22 presentations, so I’ve organised them into groups as follows:

- host stuff (the show was organised by AJ Bell / YouInvest / Shares magazine, so all their presentations are here)

- people we’ve met before (I’ll normally refer you back to a previous post, unless they had something new to say)

- industry regulators

- property stuff (quite a few of these, none of which are interesting to me)

- presentations that I saw (and that I have the slides for, if there are any)

- presentations that I missed, but I have slides for

- presentations that I don’t have slides for (there won’t be much about these guys)

Within this structure I’ll approach things in chronological order as far as possible.

Before we begin I want to say that the organisers in the main did a very good job. I’ve been to several shows at this venue and they had the best layout of the common space that I’ve seen so far.

The second stage had better acoustics than normal, and there was a lot more comfortable seating.

The one bad point in terms of organisation was that none of the presentations allowed any time for Q&A. The organisers realised on the day that this was a bad idea, and converted the afternoon’s main stage panel discussion into a 30 minute Q&A session.

Another strange thing about the show was the number of presenters who had mis-judged the audience.

Attendees were generally over 50 years of age, and many were closer to 70, yet several presenters had anti- baby-boomer material in their presentations. Perhaps they normally present to a younger crowd, but a few judicious edits might have been a good idea.

Host stuff

Introductory remarks

Mike Boydell – the MD of Shares magazine – gave the opening remarks. I can’t recall much of this apart from the statutory warnings that the rest of the day was all about education, that none of it was advice, and you must DYOR.

Should you cash in your pension?

Mike Morrison was session number nine on the main stage. Mike is Head of Platform Marketing at AJ Bell YouInvest and his talk was called “Should you cash in your pension?” This was one of several presentations about the new pension freedoms.

The short answer to the question in Mike’s title was “No”:

- Don’t cash in your pension, unless you have a very good reason.

- Mind the tax.

- He was particularly scathing about cashing in so that you can get into buy-to-let.

While I totally agree with him, you would expect someone who works for a funds and shares platform to say that.

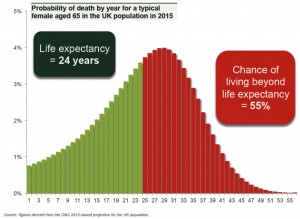

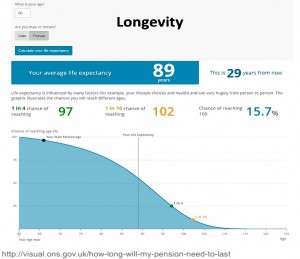

He warned about longevity risk, with the average 65-year-old woman now expected to live for another 24 years, and having a 55% chance of living longer than that. He also warned about scams.

Should you use an ISA to save for retirement?

Russ Mould is Investment Director at AJ Bell, and he was the last presenter on the small stage. His talk was called “Should you use an ISA to save for retirement?”

This is something that I’ve looked at before, and the short answer is no. The tax advantages of a pension outweigh the flexibility and early access of an ISA, particularly for higher-rate tax payers.

Russ looked at the tax advantages of both products and came to the same conclusion.

Those who want to retire before age 55 should use ISAs alongside SIPPs to get them through the early years of their retirement, before they can access their pension pot. Similarly, those who might come up against the lifetime allowance cap in a SIPP (£1M from 2016) should use ISAs alongside their pension.

People we’ve met before

Nutmeg

Number two on the main stage was Nick Hungerford of Nutmeg. As previously reported, their product is slick but expensive, and the asset allocation range is too narrow.

I look forward to YouInvest, Fidelity or HL entering this space to generate some price competition.

Regulators

Pensions Advisory Service

Number three on the main stage was Michelle Cracknall of the Pensions Advisory Service (PAS). Her presentation was called “Helping people with their retirement choices”.

Michelle’s presentation was all about the pension freedoms. She recommended three sources of advice (sorry, I mean guidance, don’t I?), all of which we have come across before:

- Pensionwise

- the PAS itself

- the Money Advice Service

I now know that the PAS has a slogan: “People first, pensions second.” I truly have no idea what that means, or what its opposite might mean, which is always a bad sign.

Steve Webb, former pensions minister

Steve Webb was session seven on the main stage, and his presentation was called “Pension reforms: what they mean and why the changes were made.” He covered the three main reforms:

- the new £8K pa state pension from 2016

- longer working lives – increase in the state retirement age

- automatic enrolment in workplace pensions

- pension freedoms – flexible drawdown and cash withdrawals

He expects more changes:

- reduction in the lifetime allowance (now announced in the Summer Budget 2015)

- regulation of the decumulation phase of pension

- more protections against pension scams

Property firms

Select Property Group

Giles Beswick of Select Property Group was the first presenter on the secondary stage (known as the “exhibition stage”).

Giles was pushing a managed buy-to-let service. The slides give the impression it might be based around student accommodation, but Select also offer CitySuites, a short-term (one month to one year) rental for young professionals.

I can see the appeal of property as an asset class in a diversified portfolio, but why go through a third-party when you can simply buy shares in ETFs, REITs and property investment trusts?

Seed Property Consultants

Umesh Raghwani of Seed Property Consultants was the seventh presenter on the smaller stage. He was pushing managed buy-to-let as well.

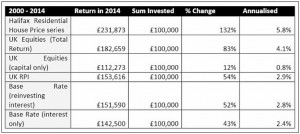

Umesh’s slides use some selective comparisons (in terms of timescale and comparators) to make property seem like the best available investment. This is not the case.

Sessions I attended

Panel #1 – DIY or get advice

Session four on the main stage was a panel discussion:

- Dan Coatsworth – Editor of Shares

- Ed Bowsher – Share Radio Analyst

- Rachel Lacey – Editor of How to Retire in Style

- Simon Lambert – Editor of This is Money

- Adam Ryan – Portfolio Manager at BlackRock

This was a very disappointing session. The panel heavily pushed getting advice from IFAs.

This sounds like a good idea in theory, but with the average UK pension pot at £30K, most people simply can’t afford IFA fees.

Paradoxically, those people who have built up large-enough pots to withstand the cost of an IFA probably don’t need one. There are no secrets in investment.

Panel #2 – Q&A

The afternoon panel – slot number eleven on the main stage – was converted into a Q&A session by popular demand. The panel comprised:

- Russ Mould from AJ Bell

- Paul Lewis from Radio 4’s Money Box (more from him later)

- Francis Moore from European Pensions Management

- Mike Morrison from AJ Bell (who we’ve already met above)

It was a very enjoyable session, and a lot of audience members got good answers from the panel. As none of it was new to me, I didn’t take notes so I’m afraid I can’t provide the specifics.

Paul Lewis – Lucky or Unlucky?

Paul Lewis is the presenter of Radio 4’s Money Box programme, and he had slot twelve on the main stage. His presentation was entitled “Today’s pensioners: lucky or unlucky generation?”

He started with some reasons why pensioners might be considered lucky:

- lots of them own their own home, compared with younger people

- they are retiring on average between age 60 and 65, which many younger people won’t manage

- they have better health than the pensioners before them (though quite possibly worse health than pensioners to come, if recent medical advances continue into the future)

- they have benefited from pension increases linked to RPI inflation, rather than the lower CPI inflation which is used now

- the triple lock on state pensions remains in place, which should mean they increase significantly over the next few years ((But as previously discussed on this blog, state pensions have been allowed to wither since the 1990s and the recent increase are only taking us back to the 1980s position – the 2016 new state pension is only £8K pa))

Paul then went on to some reasons why they might not be considered so lucky:

- they are believed to have “gold-plated” pensions, but in fact the average pension is £7K pa in the public sector, and only £3.5K pa in the private sector

- low interest rates and increased longevity mean that the amount of annuity income that a pension pot of £100K would buy at age 65 has fallen £3,600 pa with inflation linking, a massive decrease on a generation ago

- the governments “financial repression” policies (QE, low base rates, funding for lending etc.) have kept interest rates on savings artificially low (though not mortgage rates)

- the new pension freedoms don’t apply to:

- anyone already drawing a pension

- anyone who has already bought an annuity (though this may change)

- most public sector schemes

So I guess the answer to Paul’s question is a bit of both.

It was an entertaining presentation, but I can’t recommend Paul’s general advice.

He is a big believer in getting advice from an IFA, which I am not, and in low-risk investments (particularly savings accounts), which again I am not. He doesn’t think the market can be beaten, and I do.

David Jones – Investing for income and growth

David Jones is the presenter of a show on BBC Radio 5 Live called Wake Up to Money (sounds like it’s too early in the morning for me), and he had slot number thirteen – the last of the day on the main stage.

His presentation was called “Investing in the stock market for income and growth”, and it was much more like the sort of thing you might see at the traditional investor shows.

David uses a combination of trend following and buying dividend stocks. His simple filters for buying a stock are:

- price change over previous 12 months is positive

- price change over previous 6 months is positive

- dividend yield is greater than 2%

At the time of preparing his presentation, these three rules produced a starting list of 239 shares.

His next step is to look for a support level on the chart (which is where David will put his stop loss). If the support level is more than 15% below the current price, he rejects the share, and moves to the next one on the list.

David didn’t say explicitly, but I presume the starting list is sorted by maximum price change and maximum yield, in some combination or other.

Once he has a full portfolio, David uses trailing stop losses, moving them up as the share price moves in his favour.

Douglas Lawson – AIM

Douglas Lawson of Amati Global Investors was up fourth on the smaller stage. His presentation on using the AIM market as part of your retirement planning was very entertaining and deserves to be more widely seen.

So I will be dedicating a future post to that one – look out for it in the near future.

Sessions I have slides for

Simon Lambert – This is Money

Simon Lambert from This is Money, the Daily Mail finance website was session six on the main stage. Simon had a presentation called “How to be a smarter pension investor and avoid the pitfalls”.

He warned about scams and con-men, the risk of paying too much tax if you cash in your pension pot to invest in buy-to-let, and the risk of giving in to human nature.

He went on to discuss shares, and passive and active funds as better homes for your pension cash.

Frances Moore – SIPPs

Francis Moore is MD of European Pensions Management, and he was presenter number six on the small stage.

His presentation was about SIPPs, which I would have imagined were well known by now. I certainly didn’t pick up anything new from the slides.

Sessions I missed (no slides)

Birthstar – Target Date funds

Henry Cobbe, MD of Birthstar was session five on the main stage. Birthstar sells target date funds, which I don’t like. They reduce your exposure to equities as you close in on retirement.

This was a good idea when everyone was forced to buy an annuity, but thanks to the pension freedoms we no longer have to, and we shouldn’t because they are poor value.

For some better ideas on how you should manage your money during decumulation (retirement) – and why – start here.

Adam Ryan – BlackRock

Adam Ryan was session eight on the main stage. I’m pretty sure that I did see this session, but in the period spent waiting for other people’s slides I’ve forgotten most of it.

Adam is head of Diversified Strategies and BlackRock, responsible for “developing and managing strategies that look to deliver capital growth by investing across multiple asset classes”.

His talk was called “Managing your nest egg: How many baskets do you need?”, so it’s a fair bet it was about asset allocation and multi-asset strategies. It’s a shame he didn’t issue his slides, as this is an interesting area.

Adam is also the new manager of the British Assets Trust, with a mandate to change it from being a global equities fund to a multi-asset fund. The trust has since been renamed the BlackRock Income Strategies Trust (BIST).

The goals of the new fund are:

- capital preservation in real terms

- dividend growth in line with inflation

- total returns of CPI plus 4% pa, over a five- to seven-year cycle

The trust will invest around 40% in UK equity income stocks, and 60& in other assets (international equities, government and corporate debt, and commodities).

Alan Higham – Fidelity

Adam Highham was session number ten on the main stage. This is another session I attended, but can’t remember the details from.

I do remember it was very entertaining, even though Alan confessed to being an actuary. Without the slides I don’t have too much to add.

Alex Edmans – Equity Release

Alex Edmans from Saga was up second on the small stage.

We all know what equity release is. For me it’s very much a product of last resort.

I’m glad it exists, in the same way that I’m glad that pawnbrokers and Dignitas exist. I very much hope I never have to find out any more about any of them, let alone use their services.

Simon Longfellow – Investment Trusts

Simon Longfellow of Henderson Global Investors was the third presenter on the small stage.

I’m a big fan of investment trusts, and I find it very surprising that 30 years after I started investing in them, there are still lots of people who don’t know what they are, and many who don’t use them.

For more on investment trusts, take a look at our IT portfolio, and its impressive 10-year track record.

Jan Holt – Annuities

Jan Holt of Just Retirement was the fifth presenter on the small stage.

Regular readers will know how I feel about annuities. They are a bad idea, at least for anyone under 75.

I hope that gives you a flavour of the show. If any of the presentations caught your interest, take a look at the slides on the conference website.

Until next time.

Hi Mike, thanks for the review and presentation links. I almost went to this myself, but then didn’t, so I’m glad you did.

Also, I’m not sure of the logic of doing a presentation and then not allowing the related slides to be made public?

Surely it’s all publicity and therefore good (assuming the slides don’t contain complete twaddle which is supposed to amaze people on the day but then not be available for further scrutinity)?

Keep up the good work,

John