Bitcoin and the blockchain – time to invest?

Today’s post is an introduction to Bitcoin and the blockchain.

Contents

What is Bitcoin?

Bitcoin is not about making money digital. Money is already digital – only 3% of pounds and dollars exist as paper or coins.

We use online accounts, we have supermarket rewards points and air miles. We have Oyster cards. We use (contactless) credit cards. Some of us use our phones. They’re all tokens that can be exchanged for goods or services.

But they all use a middleman – a bank, a credit-card firm, London Transport or a supermarket.

Cash on the other hand has no middleman – I can just hand it to you. It is private, immediate and cheap to use (therefore ideal for low-value transactions). It’s not so great for large purchases though – say for buying a car or a house.

Bitcoin is digital cash – (almost) immediate, cheap to use (it costs about a third of a penny) and private. It also scales well (if you’re prepared to take the risk).

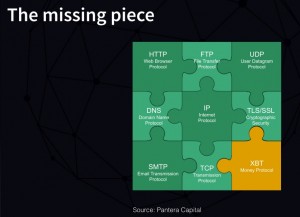

It’s also like the internet of money. Money is currently fragmented, just as telecommunications was before the internet (and in particular, the world wide web) came along.

Every kind of content (video, text, long-distance, images, person-to person) had a different network:

- segregated by speed

- segregated by cost

- segregated by convenience

Now everything can travel the same way, and in principle, the same is true of Bitcoin – it could be used for all financial transactions. It offers a unified protocol.

Bitcoin was created in October 2008 by an unknown person calling himself Satoshi Nakamoto. Nakamoto was interested in cryptography, and Bitcoin was described as “a new electronic cash system that’s fully peer-to-peer, with no trusted third-party”.

The idea was a currency with no government backing. And possibly with no banks or credit card companies, since they are traditionally the trusted third parties.

The blockchain

It’s possible that the underlying “blockchain” technology could prove more useful than Bitcoin itself. The blockchain is an enormous ledger that keeps track of who owns how much Bitcoin. Coins do not exist, there is just a list of who owns them, and who has owned them in the past.

This sounds like traditional banking, except that a bank’s records are private and held within the bank. The blockchain is public and anyone can download a copy. There is security to hide personal identities, but the transactions are public.

The Bitcoin sequential blockchain solves the problem of “double spending” that had stopped earlier forms of digital cash.

The problem with keeping all the transactions in the blockchain is that it keeps growing – new “blocks” of transactions are constantly added to the end of the chain. It’s currently many thousand times the size of the Bible.

Validating transactions

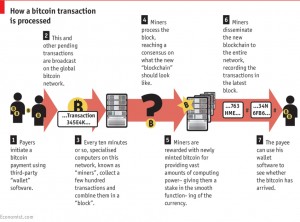

Rather than a central banker or credit company, a network of around 10,000 computers validate the transactions by voting on them (through the solving of complicated mathematical problems).

This is a slow process, and takes a lot of power. Bitcoin can only process 7 transactions per second, compared to tens of thousands for Visa. Users sometimes wait 30 minutes for a transaction to be validated.

When a consensus is reached, the transactions are added. To tamper with the system, the majority of computers in the network would need to be compromised.

The validating computers (often large dedicated server farms) are known as miners, since they are rewarded with new Bitcoins.

The maths problems get increasingly hard, making the rate at which Bitcoins are added slower each year. Eventually no more coins will be added to the ones already in circulation. ((The very opposite approach to that being used currently for so-called “fiat” money, where QE is in wide use))

The security of the blockchain process itself is undermined by the need to move real-world currency in and out of the Bitcoin system. The exchanges and “wallets” this requires have proved much less secure.

What is Bitcoin for?

There are three things that Bitcoin (or any new currency) might be used for:

- as a long-term store of value (like gold)

- as a short-term store of value / medium of exchange (like cash)

- as a medium of settlement for transactions (like a credit-card)

Long-term store of value

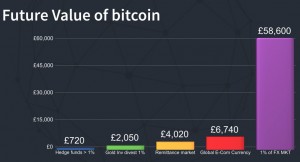

Bitcoin is unlikely to take over as a long-term store of value. This is a somewhat misleading definition in any case. Income producing assets (stocks, property) will produce higher returns over the long run than gold – they are a better long-term store of value (purchasing power).

It’s interesting in this context that Bitcoin’s perceived high volatility should work in its favour here. Financial assets have a trade-off between expected returns and volatility. People will only hold volatile assets (usually stocks) if they think that the long-term return will be higher.

Gold is effectively an alternative to risky local paper money – a currency of last resort. In this context it is conceivable that Bitcoin might take a share of this role from gold. ((Though if the financial system is collapsing, what is happening to the internet?))

Short-term store of value

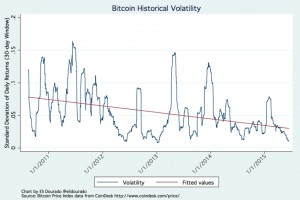

Over the short-term, volatility works the other way. A volatile asset is a poor short-term store of value. This perceived volatility is hurting Bitcoin’s adoption.

In fact, Bitcoin volatility is coming down, possibly as the Bitcoin ecosystem grows. But it’s still at a 1.1% standard deviation, about twice the level between two normal fiat currencies. ((It’s also possible that the current low volatility is a blip, but the trend seems clear))

This is not perfect for people in the UK or US, but for certain areas of the world (Argentina, Zimbabwe, Greece) this level of volatility would already be useful, were the necessary infrastructure in place, since it is lower than the volatility of the regular currency.

So there is potential for Bitcoin to become a short-term store of value in some countries at least.

Settlement

The other role for Bitcoin relies on the almost instant settlement of transactions as discussed above. A credit card bill will be paid six weeks after the transaction, but Bitcoin is like cash.

Except that it’s cash that can be used online without an intermediary. Ignoring the privacy issue for a moment, the chief drawback of using intermediaries is that it limits the pool of people you can transact with. Both parties need a relationship with the same intermediary.

With Bitcoin, though each party will use an intermediary to convert their local currency into Bitcoin, it does not need to be the same intermediary.

This will help people without credit histories suitable for approval by western agencies. Two and a half billion adults in the world are considered to be unbankable, and are therefore unable to fully participate in the global economy.

Young people and people in emerging economies might use local intermediaries with whom they have a physical, face-to-face relationship. This in turn might lead to an increase in direct transactions between rich countries and less developed ones.

It might also lead to machine to machine – robot to robot – transactions (see below).

Why is Bitcoin a good thing?

Bitcoin has three main advantages:

- costs – (almost) no credit card charges or foreign exchange fees

- scale – the lack of charges means that “micro-payments” (fractions of a penny) become possible

- privacy – once the preserve of the paranoid, but in the age of increasing government and corporate surveillance, becoming a mainstream concern

Goldman Sachs calculated that in 2013 $550bn in remittances were sent around the world, generating $49bn in fees. Using Bitcoin would have saved 90%+ of these fees.

Micropayments

Micropayments could end email spam. Spam depends upon the spammer being able to send as many emails as possible for as low a cost as possible.

If sending an email involved a micropayment, there would be no effect of those of us who “only” send a few dozen emails a day. But spamming would become expensive.

It would also probably mean the end of free online content. Videos, news and even blogs would all involve a small, automatic one-click payment to view. Tips to content producers might become a thing (yay!).

Disintermediation and privacy

It’s not just financial transactions that involve middlemen. To send a message, I have to use Gmail or Twitter of Facebook. These companies have access to my message, and use it (at a minimum) to sell advertising .

The blockchain could be used to send secure messages without a middleman. To take it a step further, Trustronic is a blockchain-based mobile-phone operating system (still under development).

The blockchain could also change the way we register ownership of physical and financial assets. Nasdaq is looking at this, as is the Honduras land registry. Property ownership is a key driver of development in emerging economies, and this could help.

Reputation

If identity were to be proven using blockchain, then online reputation (think TripAdvisor reviews, or eBay rating) would become vital in allowing you to undertake transactions with strangers. It would replace your credit score and credit card limit.

There is even discussion of using blockchain applications for voting systems. No need to stay up late for the count in that case. This could also lead to the widespread use of referenda on individual issues, rather than the wholesale adoption of a party manifesto.

Where are we now?

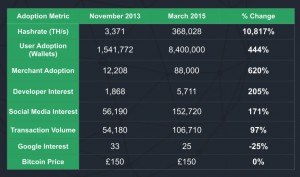

Bitcoin hasn’t taken over yet. You can use it on-line and in a few coffee bars. There is a crowdsourcing funding platform, but your mother doesn’t have a Bitcoin wallet. ((It is thought to be widely used in illegal transactions, for things like drugs)) Cash and credit cards (contactless, sometimes) are still king. Pay by phone is the new kid on the block.

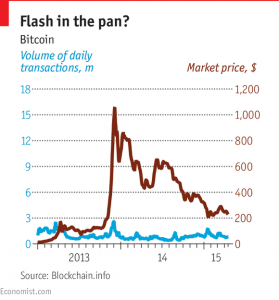

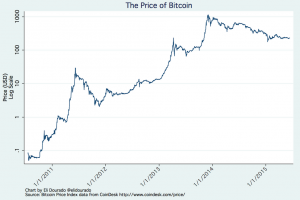

It doesn’t help that the value of Bitcoin is unstable. From 2008, the Bitcoin price took until 2011 to break through $1. It hit $30 before falling back, then hit $200 in 2013.

It then fell back under $100 before the famous spike through $1000 in November 2013. Since then it has fallen back to just over $200.

Having said that, the price looks a little more stable against a log scale.

The killer app

It is generally agreed that the lack of a “killer app” for this envisaged “internet of value” is one thing that is holding it back.

At the same time, few of the applications that dominate the world wide web (Facebook, Google Netflix, blogging etc.) would have been conceivable in the early 1990s. Even before that, email has done a lot more than replace stamps and envelopes for occasional letters.

Several avenues other than Bitcoin as a universal crypto-currency are being explored:

- Coinspark wants to add messages to the Bitcoin blockchain to notarise information ((Geeks already post wedding vows there))

- Ethereum aims to verify if a party to a contract has fulfilled its side of the bargain. These “smart contracts” would allow robots to go into business for themselves (eg. a server renting out capacity, and using the profits to upgrade itself); smart contracts would also have serious implications for the legal industry.

- Banks and credit / payment networks looking at using private blockchains because of their low transaction costs ((Though they are reportedly finding it difficult to recruit staff – the kind of people who understand blockchains don’t want to work for banks))

- Ripple labs aims to disintermediate the “correspondent banks” used to transfer money between two banks in different countries

Using Bitcoin

The first thing to say is that you don’t need to understand Bitcoin to use it. Most people have no idea how the internet works, but they are pretty happy with it. The same goes for a modern car. ((And in fact, the same goes for “traditional” money, which is created by a system that few people understand))

The second thing is that although a Bitcoin is still worth more than $200, you don’t need to but a whole one. Bitcoins trade fractionally, so you can just by £20 worth if you like.

There are three ways to get Bitcoins:

- We can rule out mining them. The days of running a mining server in your bedroom are over. Industrial amounts of processing are needed now.

- You can earn them for services (instead of being paid in pounds).

- Or you can buy some.

Let’s look at how you buy some. That in turn will show us how to earn them.

There are four steps:

- Get a web wallet from coinbase.com or blockchain.info.

- You’ll need an email address and a password, and you get a wallet address in return. ((You can also have a local wallet under your own control, but if your computer crashes, you’ve probably lost your Bitcoins; try localbitcoins.com if you are interested ))

- Swap some pounds for Bitcoins at a site like bittylicious.com

- You’ll need your wallet address from step one and a bank account that you can make an online transfer (Faster Payments) from. ((You can also use a credit card or even the Barclays Pingit service, but you will get a lower exchange rate))

- Convince a friend to sign up too, so that you can practice with a few safe transactions.

- You can make these transactions on coinbase.com ((And possibly on bittylicious also – I’m new to all this myself)) for a 1% fee. ((With a 15¢ minimum for up to the first $15, then 1% after that))

- If you can’t find a friend who wants to do this, and you want to practice with me, just let me know.

- Find a physical location that accepts Bitcoins, and buy yourself a cup of coffee or something.

- In London, physical locations are mostly east of Soho.

- The nearest place to me was a distillery in Battersea, but I think that was online only. Next closest was a barbecue pub (?) in Charing Cross.

Once you have a wallet, earning Bitcoins is as simple as providing your wallet address to the person who wants to pay you.

Investing in Bitcoin

You have to decide yourself whether this is a good time to invest in the market. From the chart the Bitcoin price looks to be in decline at the moment. Perhaps it all depends on whereabouts you see Bitcoin on the hype cycle.

There’s certainly growing venture capital interest, perhaps comparable to internet companies around twenty years ago.

If you want to invest in a small way, and you have an account with a major US bank, there is a “spare change” model available at Lawnmower:

- This is an Android / iOS app linked to a bank account that sweeps an average of $0.50 into a coinbase wallet after each transaction on your account (by rounding up to the next whole dollar)

- The idea is to counteract the volatility in Bitcoin by investing every day ((In practice, the money accumulates until it reaches $4, so it’s more probably every few days)) – it’s a form of dollar cost averaging

- There’s no indication when / if this might be extended to UK banks

Other ways to get involved (other than directly with a Bitcoin wallet) include:

- IG has a contract for difference that tracks the Bitcoin price

- there is also a trust in the US (the Bitcoin Investment Trust – OTCQX: GBTC)

The alternative would be to invest in blockchain technology, but there are no UK listed companies at the moment. A few Nasdaq-listed firms have some exposure:

- WPCS International (Nasdaq: WPCS), which has developed a Bitcoin trading application,

- gaming giant Zynga (Nasdaq: ZNGA), which hopes to use Bitcoins can be used for in-app payments

- online retailer Overstock (Nasdaq: OSTK), which is developing a blockchain-based securities system

I must also mention Bitstocks, who presented at the Alternative Investing Show, May 2015.

- Their service appears to be a UK alternative to coinbase, but aimed at the serious Bitcoin investor – they have a minimum transaction size of £5K

- The offer an advisory service as well as execution only

- For security, all accounts are multi-signature with 2-factor authentication, Bitcoins are held in “deep cold storage”,((I believe this amounts to offline) and “bank grade” encryption is used.

Conclusions

- Bitcoin penetration has been hit by the price crash in 2014

- If Bitcoin is a success (becomes widely adopted) then the price will almost certainly rise again

- Bitcoin volatility is decreasing and is already lower than the most unstable fiat currencies

- Bitcoin has limited usefulness as a micropayment technology online at the moment

- The Bitcoin system is secure, but it’s interface to the real-world is not so much

- The underlying blockchain technology is fascinating, and will probably lead to something significant in the future

- The companies involved in this space are too early stage for a UK Private Investor to access at the moment

Until next time.

Sources

- The Next Big Thing – The Economist

- Join the Bitcoin revolution – Dominic Frisby, MoneyWeek

- Bitcoin as a medium of settlement – Eli Dourado, Medium

- How to Time the Bitcoin Market? – Alex Sunnarborg, Medium

- Presentation from Michael Hudson of Bitstocks at the Alternative Investing Show, May 2015 ((The majority of the slides illustrating this post come from here – I’m grateful to Michael for sending them to me))