Fidelity – Bitcoin First

Today’s post looks at a report from Fidelity called Bitcoin First.

Contents

Bitcoin First

The report comes from Fidelity’s Digital Assets subsidiary and is written by Chris Kuiper and Jack Neureuter.

- It’s aimed at investors who have already made the decision to invest in digital assets and aims to reassure them that it’s safe to choose the first and most recognisable crypto.

The report has six main conclusions:

- Bitcoin is a monetary good in the sense of being a store of value

- No other digital asset is likely to improve upon bitcoin as a monetary good because bitcoin is the most secure, decentralized, and “sound money” of digital assets.

- “Improvement” in some of these areas will mean tradeoffs in others.

- Success for Bitcoin does not mean failure for other assets.

- Different digital assets can serve other needs and solve other problems

- Non-bitcoin projects should be evaluated from a different perspective than bitcoin.

- Bitcoin is the entry point for asset allocators looking for crypto exposure.

- Investors need two frameworks for investment in digital assets.

- Bitcoin as an emerging monetary good, and other digital assets with venture capital-like properties.

Bitcoin as money

The paper separates the bitcoin token from the Bitcoin network/payment system by capitalising the asset. (( I’m afraid I’m not very disciplined in this respect, so let me know if you spot any mistakes ))

- A core point is that although the Bitcoin code is open source, the network stands alone.

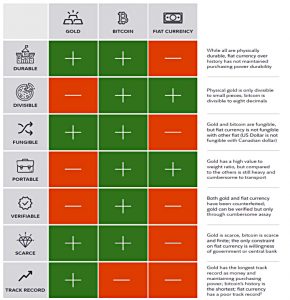

The paper makes the case that bitcoin is a monetary good.

- I would argue that the “non-fungibility” of the dollar or pound mentioned in the table is misleading, as in practice it’s easier to exchange fiat than BTC.

- The risk of counterfeiting is also vanishingly small for most fiat users, particularly since Covid killed cash.

Bitcoin is clearly not money in the way that most people understand it, since you can’t go any buy stuff in the supermarket with it.

- The price of bitcoin (relative to dominant fiat money like dollars) is also way too volatile for BTC to be used as a unit of account.

But it might potentially work as a store of value (time will tell).

- The key advantage here over fiat is a limited supply, which should protect against inflation.

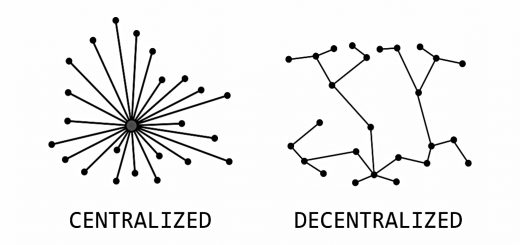

BTC supply is capped at 21 million coins, and a decentralised network means that no single entity can change this limit.

- The entire network (or at least a majority of the network) could vote to move (fork) to a higher limit, but this would risk undermining BTC’s credibility (and would not be in the best interests of current network participants).

Bitcoin prime

The paper does not go full “bitcoin maxi” and insist that BTC will become the only monetary asset on the planet.

- But the authors do believe that network effects will mean that there is only one digital monetary asset and that BTC is best placed to be that asset.

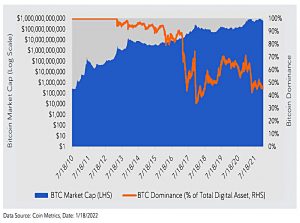

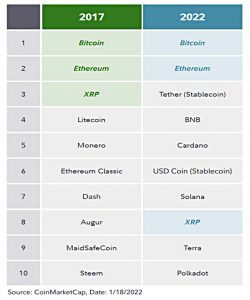

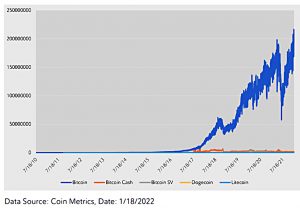

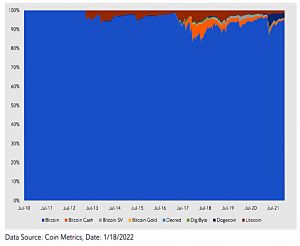

That position is slightly undermined by BTC dominance (market share) falling from close to 100% to “only” 50% as the overall market has expanded.

- The authors would argue that the other coins solve different problems (which is clearly true to some extent).

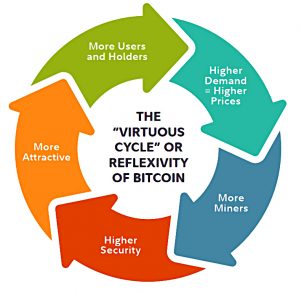

The authors believe in a virtuous circle of BTC reflexivity.

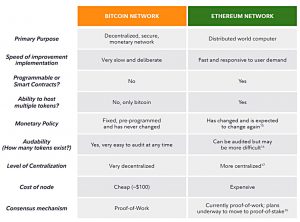

Because Bitcoin is currently the most decentralized and secure monetary network, a newer blockchain network and digital asset that tries to improve upon bitcoin as a monetary good will necessarily have to differentiate itself by sacrificing one or both of these properties.

A competitor that tries to merely copy Bitcoin’s entire code will also fail as there will be no reason to switch from the largest monetary network to one that is completely identical but a fraction of the size.

The Lindy Effect

The Lindy Effect is a theory that the longer some non-perishable thing survives, the more likely it is to survive in the future. For example, a Broadway play that has run for ten years is likely to run another ten years compared to one that has run for only one year. We believe the same may apply to Bitcoin.

A related concept is Sturgeon’s Law, which states that “ninety per cent of everything is crap.”

- The idea is that most of what we celebrate today is merely novel and will fall by the wayside, leaving only the superior ten per cent (or these days, more likely 1%).

Every minute, hour, day, and year that Bitcoin survives increases its chances of continuing into the future as it garners more trust and survives more shocks.

This is linked to Taleb’s idea of antifragility, where things become stronger each time they are under some form of stress.

- The authors provide a solid list of things that BTC has survived, albeit in a small time frame.

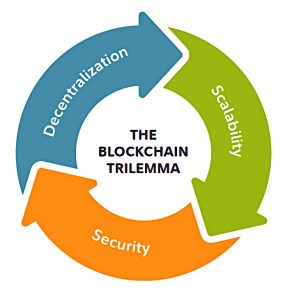

The blockchain trilemma

Any improvement in one characteristic of bitcoin, such as improving its speed or scalability, leads to a reduction in another characteristic, such as bitcoin’s level of decentralization or security.

This “Blockchain Trilemma” comes from Ethereum creator Vitalik Buterin, who said that a decentralized can only deliver on two of three guarantees at one time: decentralization, security, or scalability.

- This is reminiscent of the quick, good, cheap triangle of project management.

Security in BTC comes from the computer power of the network (known as the hash rate).

- The more power, the harder it is for a single entity to control 51% of it.

Since BTC has the largest network, it can be considered the most secure digital asset.

Because of the differences in hashing algorithms, bitcoin’s hash rate cannot be directly compared to the hash rate of other digital assets. However, we can compare total annual energy usage as a proxy for security.

BTC famously “wastes” a lot of energy, but here this is seen as a positive.

- The report says that BTC uses 137 TWh pa, compared to 25 TWh for ETH.

Bitcoin is the most decentralized digital asset based on many factors.

These include the number of active addresses and the recent fragmentation of mining pools following the Chinese ban on mining.

Scalability is BTC’s weak spot.

- BTC can handle a lot of users, but only seven transactions per second.

Visa processes 1,700 transactions per second but could handle a lot more.

The paper describes the “block wars” when BTC proposed increasing the block size to increase throughput.

- This would also have reduced transaction fees (another weakness of BTC and crypto in general) which perversely would disincentivise miners who provide much of the hash rate which secures the network.

The blocksize war demonstrates the blockchain trilemma. Larger blocks could increase scale or throughput, but at the potential loss of decentralization and security.

The paper also notes that forks of the BTC blockchain have failed to gain traction.

Ethereum

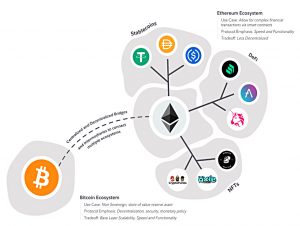

The next section of the paper compares BTC to ETH, a blockchain that supports smart contracts and multiple tokens.

A multi-chain world

The paper moves on to consider how BTC would survive/thrive in a couple of plausible future scenarios.

- The first is a multi-chain world with bridges between chains.

Here users and investors prefer different tokens based on a trade-off between centralisation and features.

In a world of multiple winning chains, it still appears that Bitcoin is likely the best equipped to fulfill the role of the ecosystem’s non-sovereign monetary good with relatively less competition than other digital assets attempting to fulfill alternative use cases.

This thesis is based once again on security, scarcity and decentralisation.

Any project or other blockchain network that requires its users to believe they are transacting with a token that has real monetary value likely needs to be directly or indirectly connected to bitcoin as the ultimate monetary good.

Winner take most

There is another scenario that could arise due to the ability for applications and scaling solutions to be built on top of the “base layer” or “layer one” blockchains. Users would arguably want to build on top of the strongest, most secure networks.

Here the authors see BTC as a prime candidate for layer one.

- The main layer two solution here is the Lightning network, which batches transactions together before settling them on the BTC network.

The authors draw an analogy with the internet.

An investor can own part of the base layer of this new technology and can be

relatively agnostic about what specific applications are built on top of it. It would be akin to being able to own the base layer of the internet and getting exposure to all of the innovation on top (e.g., Google, Amazon etc.) without having to try to pick the specific winners and losers.

Crypto in a portfolio

The paper warns against applying a technology investing framework to bitcoin:

[This leads] to the conclusion [that] bitcoin as a first-mover technology will easily be supplanted by a superior one or have lower returns. However, bitcoin’s first technological breakthrough was not as a superior payment technology but as a superior form of money. As a monetary good, bitcoin is unique.

The returns part might be true:

Bitcoin with a market capitalization of around $1 trillion may have a harder time appreciating by a factor of 100 compared to its early history when it did go up by a factor of 100 (more than once) but from a much smaller market capitalization base. However, these rewards were accompanied by a lot more risk at the time.

So the risk/reward relationship might remain intact.

Returns would be driven by the general growth of the digital asset ecosystem, so you need to believe in that.

- A less likely driver is financial repression (negative real interest rates), which is likely in itself, but unproven to drive BTC returns.

BTC has recently acted much more like a “risk-on” asset than as a currency hedge (as gold used to do, ironically until crypto appeared on the scene).

Conclusions

The paper makes a decent case for sticking with BTC, assuming that you believe in any future for crypto.

- BTC is likely to survive as the store of value within the crypto-sphere.

Whether we end up with any form of digital money beyond our credit cards and phone chips is another question.

- Until next time.