Boring Money Conference 2018

Today’s post is about the Boring Money Conference 2018, which I attended back in September. Its themes were language, risk and trust.

Boring Money Conference 2018

The Boring Money Conference 2018 was organised and presented by Holly Mackay, the CEO of Boring Money.

- It’s an industry conference for asset managers, with few private investors present.

It was held at etc venues in the old London County Hall (next to Westminster bridge).

- I highly recommend the venue (and the catering).

Agenda

The conference was divided into four sections:

- Opportunities and Change

- Holly provided a market update from both provider and consumer angles. What are consumers saying? What are the opportunities? What does good look like?

- Then Tom Savigar from the Future Laboratory looked at the “overarching technological, social, economic, political and environmental eventualities” that are “shaping the brand landscape”.

- Next Holly interviewed Chris Hill, the CEO of Hargreaves Lansdown.

- Finally there was a discussion with representatives from two new robo advisers – Tony Triebel from Wealthsimple and Nikolai Hack from Exo.

- Talking to Consumers

- Chris Duncan, MD of Times Newspapers discussed the changing role of the media.

- The Chris got together with Tara Evans from The Sun and Mark Atherton, Investment Editor for the Times, to talks about the relationship between newspapers and their readers.

- Ben Hookway of Relative Insight spoke about “new ways to understand audiences through their language”.

- The final session of the morning was a panel about the issues women have with the investment industry.

- Delivering Value and Relevance to Customers

- Herman Brodie from Prospecta looked at the behavioural science behind how asset managers win and keep clients. He explained how trust is won and what asset managers can do to improve trust.

- Next there was a panel discussion on how asset managers can assess what constitutes value for customers. Interestingly, everyone on the panel thought that the industry did provide value for money, whereas 95% of the audience thought the opposite.

- Then Holly interviewed Simon Rogerson from Octopus on the topic of earning trust from your customers.

- Tricky Questions

- The final session began with Holly plus Lucian Camp, and behavioural psychologist Paul Davies talking about risk.

- Next there was a panel on whether the insights from the previous session could be implemented.

- The last speaker was Roger Cayless from LEAP Creative, who spoke about the ways in which financial advertising and communications is changing.

I don’t have the space to cover the entire day, so I’m going to focus on the sessions that weren’t product- or service-centric, which means: (( They are also the sessions from which I have the slides ))

- Tom Savigar on brands.

- Ben Hookway on language.

- Herman Brodie on trust.

- Holly on the market, and on risk.

Brands

Tom began with a quote:

The experience that is being designed for in banking is the same as in Candy Crush. It’s about looping people into these flows of incentive and reward. Every consumer interface is becoming like a slot machine – Natasha Dow Schüll, author, Addiction by Design

I can’t say that I’ve noticed, but then I’ve never played Candy Crush, and I do very little in the way of finance on my phone.

Tom says that in a couple of years we’ll all be talking to “bots” online more than we talk to people.

- I guess that’s possible – I certainly talk to Alexa a fair bit, but I haven’t yet conquered my embarrassment at talking to a machine when out in public.

He also says that most people will pay for extra convenience.

- I think that’s true in some situations (shopping, restaurants) but it’s not such a good proposition in finance, where the end goal is to keep more of your money.

More from Tom:

Consumers live in a state of constant distraction. Switching between activities can take up as much as 40% of a person’s productive time. Second-screening lowers a person’s IQ more than smoking marijuana.

Economic decisions are now wrapped up in the meaning they impart. 40.6% of people under 30 believe a sense of purpose is the most important criterion when considering a job. More young people than previous generations say they save not to accumulate, but to live their desired lifestyle.

Tom also thinks that a lot of branding will move to the digital space (which seems to mean inside video games).

He thinks that consumers want “seamless digital payment systems” (I know I do), and that autonomous driving will be the end of destination retail (let’s hope so).

He sees AI as playing a big role in wealth management, and predicts that socially responsible investment will grow in importance.

- I can see that ESG is a big deal for millennials (and hence for the media), but I’ll know it’s really arrived when all the passive indexed solutions are replaced with ESG versions.

Finally, Tom hadn’t quite given upon crypto.

He ended with a page of “thought starters” grouped around more convenience and higher purpose:

Language

The title of Ben’s talk was “Making sense of Language to understand Audiences”.

- Apparently the technology was developed to help catch criminals online.

Ben looked at the language used in three types of online forums:

- MSE (Money Saving Expert) – engaged consumers

- Mumsnet – mothers

- Student forums

Comparing mothers to MSE:

- Mothers are more interested in advice and talk more about risk.

- They are interested in basics like paying the mortgage and only “want to” invest.

- MSEs are product-aware and fact / data oriented.

Ben also note that for mothers, risk is not a metric (ie. volatility).

- It’s an emotion – fear / worry.

- I agree in principle, though I don’t personally find worry a productive use of my time.

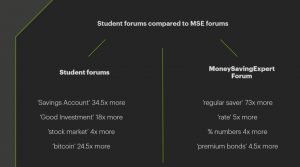

Comparing students to MSE:

- Students talk more about generalised savings and investments.

- They are more into the stock market and much more into bitcoin.

- MSEs are good on detail and numbers, and like premium bonds.

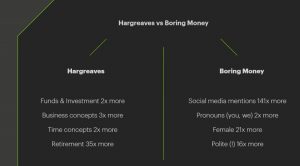

Ben also compared Hargreaves Lansdown (HL) to HSBC:

- I’m no fan of HL, but they come out well from this analysis.

- HL use relevant concepts and information much more.

- HSBC focus on hashtags, pronouns, boosters and “happy!”

Finally, he compared HL to Holly’s firm – Boring Money:

- Sadly (for me – your mileage may vary), Boring Money came out towards the HSBC end of the spectrum.

I’m not sure whether Ben thought this was a good or a bad trend, but personally I’m not keen on the idea of increasing emotional engagement with finance.

- Money is one of the few areas in life where lack of emotion is a plus point.

Trust

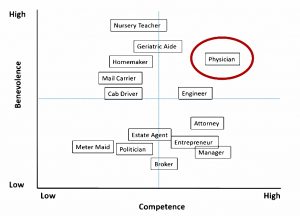

Herman’s talk was called “What’s the formula to prove trust?”

- It turns out that it’s a combination of competence and benevolence.

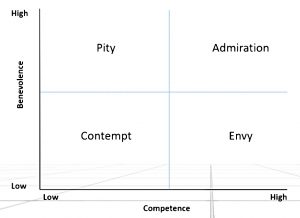

This rainbow also comes in the ever-popular form of a 2 x 2 grid:

So we need to demonstrate both benevolence and competence to be admired.

- I’ve always struggled with the benevolence side myself – that just isn’t the way I come across.

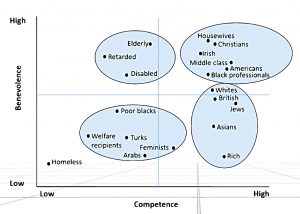

Here’s how people perceive various social groups.

- Not too many surprises here.

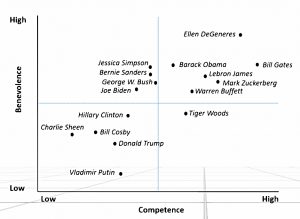

Here’s how it maps to celebrities.

- This is a far cry from my own perceptions of people.

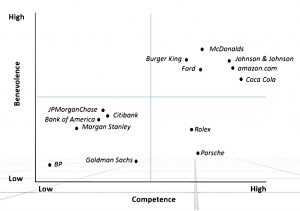

Here it is for brands.

- People really like fast food, cars, home products and Amazon.

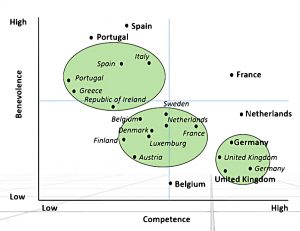

This one is interesting and semi-topical – EU countries.

- No-one trusts the Germans or the British.

- And the French have a very high opinion of themselves.

Finally we get to the professions.

- Finance people are low on benevolence.

- They need to work out how to move towards doctors.

If they can, the increased trust will make clients more likely to:

- seek “care”

- disclose sensitive information

- submit to “treatment” (without second opinion)

- this includes coping with the perceived “riskiness” of the solution

- adhere to treatment

- remain with the adviser

- recommend the adviser to others

- accept the adviser’s fees

Interestingly, trust is not “patient-specific”.

- It’s not linked to the length of the relationship or the number of visits.

- Instead it’s based on recommendations and communication / interpersonal skills.

It was an interesting presentation, but short on the practicalities of how to “express benevolent intentions”.

If you want to know more, Herman has a book out (warning – it’s pricey):

[amazon template=thumbnail&asin=085719643X]

Risk and the market

Holly’s first session was about the state of the UK asset management market:

- Assets under management (AUM) were up 15.3% to 2Q18, at £219 bn.

- There are 4.5 million customer accounts.

- Robo-adviser assets are up 80% but they still have only 1.2% market share.

- The average customer age is down to 48.

- There is a move to mobile (phones and tablets).

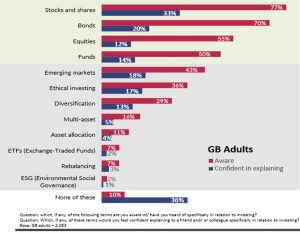

- Terminology is not well understood.

Holly’s theme was clarity – she thinks that the breakdown of index funds into their constituent firms will drive the move to ESG.

- I think that’s a reasonable view for customer-facing firms, but most companies are not consumer brands.

Holly’s also concerned that fewer women than men have stocks and shares ISAs, and that their balances are lower.

- She was clever enough to frame it as an opportunity to increase AUM by another £100 bn.

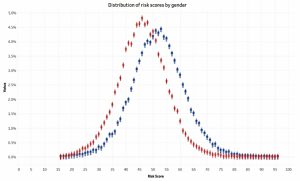

It turns out that women are more risk averse (shock, horror).

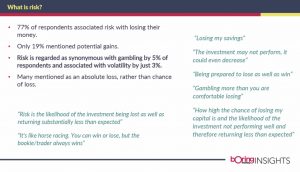

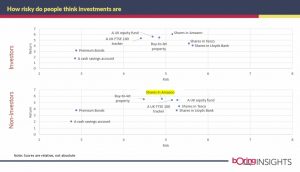

Holly’s second session continued the risk theme, presenting the results of a survey carried out in conjunction with the Times and Sunday Times in August 2018.

- There were 926 respondents.

- 84% had a savings account, 57% had a pension, 33% had shares and 18% had funds.

Risk was seen as the chance of loss – no bad thing in my opinion.

- But it was binary (yes/no) rather than probabilistic.

- And the threat of loss overshadowed the prospect of gains.

Those who are already investors are more focused on gains, particularly amongst the under 55s.

- Investors are better able to identify which investments are more or less risky.

- Returns are less well understood, with branding influencing return assumptions.

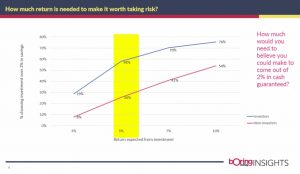

Enthusiasm for investing increases with returns up to 5% pa, then tapers off.

- Even at 10% pa, 24% of “investors” were not convinced.

Control is also important.

- 19% of respondents would pay twice as much for a lottery ticket where they were able to choose their own numbers.

Conclusions

I had a good time at the conference, and hope to attend again next year.

- The content was slightly depressing however, with the general tone being that the finance industry is wasting its time on being competent (or value for money).

Instead it needs to focus on more touchy-feely messaging to appear benevolent.

- Oh, well, there’s always the DIY route.

Until next time.