Budget 2016

Today we’re going to look behind the headlines at what yesterday’s Budget 2016 from George Osborne means for private investors in the UK.

Contents

The headlines

This was a busy budget, with lots of significant changes, but the mainstream media have fixated on just a couple of the announcements:

- The newspaper front pages are dominated by the sugar tax while the financial pages have focused on the Lifetime ISA.

Some people seem to be outraged over the sugar tax, but it looks like a no-brainer to me.

- Everyone is getting fatter, and the existing taxes on fags and booze cover the moral objections.

- Fruit juice and “milk-based drinks” are exempted.

- It’s not great for anyone holding masses of shares in drinks companies, but there can’t be many people in that situation.

I only wish it had been extended to cover all foods rather than just fizzy drinks.

The Lifetime ISA

The general consensus is this is a good thing, but I’m not so sure.

- It’s a good thing if you will be under 40 in 2017 when it will be introduced, but it’s not a good thing if you are older than that. ((I waved goodbye to 40 many years ago ))

- It’s a good thing that young people are being incentivised to save, but it’s not a good thing that this is at the expense of the pensions regime, which has only just been made fit for purpose.

For most of my career, you could only contribute a pittance and had to buy an annuity when you retired.

- Gordon Brown fixed the input side and Osborne fixed the output side, but now that it works, it seems to have fallen out of favour.

It seems ironic to me that the mooted move to a Pensions ISA created such an uproar – admittedly one mainly generated by the investment industry that stood to lose financially if pensions were killed off – that the Chancellor had to leak a U-turn before his speech.

- What is the Lifetime ISA if not the Pensions ISA Lite (lite because it is restricted to the under-40s, and the tax relief rate is the lowest conceivable at 20%).

- It’s also the Son of the Help-to-Buy ISA, or more accurately the Help-to-Buy ISA killer, since it will replace it.

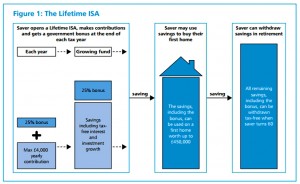

How the Lifetime ISA will work

The idea behind the Lifetime ISA (LISA) is that it helps young people save either for a first home or for their retirement.

- It will be available from April 2017 to people under 40 at that time

- Each year you can pay in £4K and receive a 25% bonus on that at the end of the year

- Note that this is equivalent to 20% tax relief, so the LISA is less attractive than a company pension with matched employer contributions

- You can only contribute up to the age of 50

- It can be invested in cash, or in stocks

- You can take it out when you buy a first home, or when you hit 60

- The house / flat has to cost less than £450K, so the LISA won’t be much use in London

- It seems that a couple will be able to use two LISAs on the same property purchase (ie. receive two sets of bonuses, not but a flat worth £900K)

- You can also take out the money early, but unless you have a terminal illness, the bonus will be withheld and you have to pay a 5% charge

- It’s not clear what would happen to the accrued interest on the bonuses under these circumstances

The good news for us oldies is that this is likely to underpin house prices.

Savings

As previously leaked, there were no other changes to the pensions regime

- The annual allowance, lifetime allowance, 25% tax-free lump sum and tax relief rates on contributions all remain the same

Salary sacrifice escaped for another year at least.

- The government said it was considering excluding certain benefits (eg. extra holidays) from the process, but that pension contributions, childcare and health-related benefits (eg. Cycle To Work) would be permitted.

The annual ISA limit (across all the many types) will go up to £20K from April 2017.

- But it’s frozen at £15,240 for next year

The chart below ((thanks to FinanceZombie for this )) shows how nicely this has gone up since 2009, after decades of stagnation.

To me, this is yet more evidence that the Government wants to shift us across from costly pensions (for them) to cheaper ISAs.

There was also a new Help to Save scheme for low-paid workers on tax credits:

- they can save £50 a month (£600 a year) and will receive a 50% bonus after two years

Against this, the Money Advice Service is being scrapped. ((Never fear, come to 7 Circles instead for all your financial news and education ))

Tax allowances

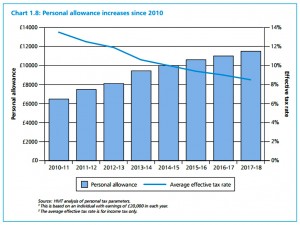

The personal allowance will go up again – to £11.5K – in 2017.

The chart below shows how well this has grown in recent years.

A significant step towards the manifesto commitment to raise the 40% tax threshold to £50K pa was also announced, with the limit rising from £42.5K today to £45K from 2017.

Other tax changes

Capital gains tax is coming down by 8%

- Basic rate taxpayers will now pay 10% and higher rate taxpayers 20%

- Unfortunately for those with a Buy-to-let empire, there is a surcharge on profits from residential property to keep effective rates unchanged

- This does not apply to your primary residence, which remains tax-sheltered.

- Even more bad news for buy-to-letters was confirmation that the Stamp Duty surcharge will apply to “large” property investors

Entrepreneur’s Relief (10% CGT, less attractive after today) has been extended from companies you own to unlisted companies you invest in, provided you hold the shares for 3 years.

Two new “micro entrepreneur’s” allowances were introduced:

- the first £1K of earnings from each of renting property (AirBnb) or selling services online (eBay? goods not allowed?) will be tax-free

Tax-free gains on Employee Shareholder schemes were capped at £100K.

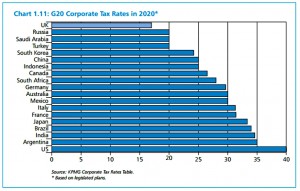

Corporation tax is also coming down, to 17% eventually.

The chart below shows how the UK will lead the developed word by 2020.

The oil and gas industry had a “supplementary charge” tax cut from 20% to 10%.

Small business rate reliefs were doubled.

Against this, restrictions were announced on how companies can offset interest charges and losses from previous years against future profits.

Class 2 NICs for self-employed workers will be abolished from 2018.

Apart from the new sugar tax, most other sin taxes (on booze and fuel) were frozen.

- tax on cigarettes went up 2% and that on rolling tobacco was increased by 3%

Insurance premium tax was increased from 9.5% to 10%.

Growth forecasts

The OBR has lowered its growth forecasts, and some nifty re-jigging has been required to enable George to hit his target of eliminating the deficit by the end of the parliament.

- forecast GDP growth is now 2% for this year, 2.2% in 2017 and 2.1% after that

- this is below the long-term trend growth of 2.5%

In response, Osborne introduced a lot of new measures – together with a lot of infrastructure spending and a lot of spurious hypothecation – but they seem in total to be fiscally neutral.

Conclusions

This feels like a Budget that has been softened up to suit a Government desperate to win the Brexit referendum.

- How many of the last-minute changes have been taken off the table forever?

The good:

- the ISA increase to £20K

- the increase in tax allowances and thresholds

- the sugar tax

- no more changes to pensions

- capital gains tax cuts

- corporation tax cuts

The good for some:

- the LISA

- Help to Save

- Entrepreneur’s Relief extension

- micro-entrepreneur’s allowance

- small business rate relief increases

- abolition of Class 2 NICs

The bad:

- the death by a thousand cuts of a pensions regime that finally works

- restrictions on offsetting losses against future profits

Until next time.