Autumn Statement 2015 – U-turn or spin?

Yesterday saw the Autumn Statement 2015 from the Chancellor, so today we look at what surprises he sprang, and what had been expected but didn’t turn up.

Autumn Statement 2015

Apart from the Shadow Chancellor quoting Chairman Mao, the biggest surprise was what the media are describing as a U-turn on cuts to tax credits. It doesn’t feel like a U-turn to me, but rather a delay.

No doubt George Osborne didn’t fancy going back to the Lords after the recent defeat, at least until the Upper House can be reformed in some way.

It’s also true that the government will as a result temporarily breach its own cap on welfare spending. But the £12bn of welfare cuts promised in the manifesto will happen in some way, at some time before the end of the parliament.

Tax credits are being replaced by the Universal Credit before the end of this parliament, and so the cuts – possibly watered down – will be folded in at that point.

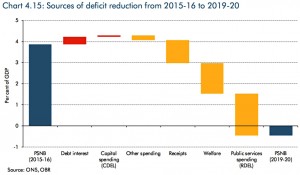

The flexibility to take such an apparently conciliatory approach comes about because the Office for Budget Responsibility (OBR) now predicts that the UK’s finances will be £27bn better off by 2020 than previously forecast. We’ll look at that in more detail later.

- Spending will rise from £756bn this year to £821bn by 2019-20

- Departmental spending falls by 0.8% pa until 2020

- Police, health, education, international aid and defence are protected

- Transport, energy, business and the environment are hardest hit (average 19% cuts over the life of the parliament)

- Government borrowing will be £8bn less than previously forecast

- The target is a £10.1bn budget surplus by 2020

- State spending will fall from 45% under Labour in 2010 down to 36.5% in 2020

There was more devolution to local government. Councils and elected Mayors can add a 2% surcharge to their Council Tax in order to fund local social care, and business rates will be set (and spent) locally, to compete for business.

This is probably good news for London, which currently only keeps 7% of the tax revenue raised there.

There is also a plan to pool local authority pension assets into regional investment funds (“British Wealth Funds”) which can put money into infrastructure projects.

Property

The big news was the 3% surcharge on buy-to-let (BTL) properties and second homes.

I must declare an interest here, as I had been planning to reward myself for reaching retirement age with a holiday cottage in Cornwall.

I did suspect something might be in the works when Osborne complained on a visit to Cornwall in April that he wanted to make sure that local families weren’t crowded out by second home owners.

Unfortunately, that isn’t how the local economy works. The pretty old fisherman’s cottages near the sea need to be sold to incomers so that there are people to spend money in the cafes and restaurants, the museums and souvenir shops that the locals work in.

They live a mile up the hill at present, but if the London types leave, there’ll be no economic reason ((There’s always the world-class scenery to think of )) for them to move down.

So anyway, that’s another £10K on the top of what I already regard as ludicrously high stamp duty. I’ll either have to rush in before next April, or wait to see whether sale prices fall afterwards to compensate. First world problems.

The effect on BTL is also difficult to predict. If the costs to all landlords increase, the perhaps some of them will be passed on through higher rents. Alternatively, the growth of the BTL market – in terms of property numbers – may be over.

Regardless of the impact, I don’t like tariffs that apply to only some participants in a market.

In London, the Help-to-Buy scheme has been enhanced with an interest-free loan worth up to 40% of the value of a newly built home (up from 20% outside London).

With a 5% mandatory deposit, the mortgage need only be 55% of the purchase price. That should provide some under-pinning to the new-build market at least.

Right-to-buy is being extended to housing association tenants, with a pilot scheme in five associations.

There was also a plan to fund £2.3bn of private housing development (400,000 homes) but there are few details at present:

- half of them will be starter homes for first-time buyers

- these will be capped at £250K outside London and £450K in the capital

- another 135,000 of them will be shared ownership homes, for those on household incomes below £80K outside London or £90K inside

Where has the money come from?

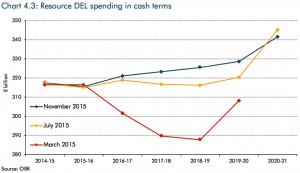

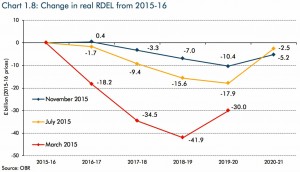

Although the headline figures for public spending go up over the parliament, in real terms there is still a projected cut, but a much smaller one than previously forecasted.

As Flip Chart Fairy Tales points out, there are three reasons for the changes:

- (slightly) higher growth

- lower welfare costs (ie. welfare cuts)

- higher tax receipts (including the new stamp duty hike and a payroll apprenticeship levy)

Interest charges on existing government debt are also a little lower.

Let’s hope that everything goes according to plan. Being so generous so early in a parliament doesn’t leave much room for manoeuvre.

Politics

This government has the opportunity – provided by a surprise majority and weak opposition – to become a genuinely reforming (free-market, state-shrinking) right-wing administration.

It seems clear from this speech that the Tories will instead tack Left to leave less space for Labour under whichever leader follows Corbyn. Blairites would feel at home in a Tory party led by Osborne. We will have aspiration, but not too much of it – just enough to keep people off the welfare system.

The scrapping of the tax-credit cuts was one signal, and the sight of a Tory chancellor explicitly ear-marking funds from the EU-imposed “tampon tax” (VAT on sanitary products) to women’s health charities was another.

I would also chuck in the commitment to increase spending on mental health and the 30 hours of free childcare for any parent working 16 hours a week and earning less than £100K. The latter is certainly not the way to encourage a high-wage, low-welfare economy.

Blanket protection of an increasingly unaffordable and abused NHS is also a problem.

Against this, sticking with the triple lock on the state pension lays the chancellor open to charges of supporting old Tory voters at the expense of young Labour voters. There are two points against this:

- the state pension in the UK remains significantly below that of most developed countries, as well as being much less than the minimum wage and the benefits cap

- the state pension is contributory – to receive the full amount from next year (£8.1K pa) you will need 35 years of non-contracted-out contributions

On balance, these measures possibly add up to good politics from the man who would be PM in 2020, but many are hard for me to get behind.

What didn’t turn up?

Not much. Cuts to the police budget had been widely touted, but in the light of the recent Paris terror attacks, George presumably thought that might not look clever.

A cut to 40% tax relief on pension contributions, and a cut to Entrepreneur’s tax relief (10% tax on the first £1M from the sale of a business) had both been mooted, but neither appeared. ISA allowances were instead frozen for 2016/17.

Apart from the scrapping rather than re-scheduling of the Tax Credits cuts, that’s about all that was missing.

Until next time.