DIY Investor 2 – Pensions and Funds

Today’s post is our second visit to The DIY Investor by Andy Bell.

Contents

Pension transfers

Chapter 6 of Andy’s book is about pension transfers.

- Not surprisingly (since he sells SIPPs), Andy is a fan of transferring old pensions into a SIPP.

To be honest, so am I, given the transfer values on offer at present (driven by low interest rates & low bond yields), but there are two considerations:

- Does the pension have special privileges not available in a SIPP (eg. a greater than 25% tax-free cash lump sum or a guaranteed annuity rate)?

- Can you easily accommodate the pension within your target asset allocation (assuming that you capitalise the present value of the annual income and treat it as a bond portfolio)?

A SIPP will usually be cheaper than a company pension, but you become personally responsible for managing the pot of money and delivering the required returns.

- There may also be a transfer fee (for a DC pension).

SIPPs usually have more options for accessing your money (from age 55) than DB pensions.

- There are also admin savings, but now that paperwork has become electronic, they are not as large as they were twenty years ago.

I have transferred one DB pension into my SIPP but my partner and I are each holding onto one DB pension as a safety net to supplement our state pension income.

If your pension is worth more than £30K, you’ll need an IFA report on the suitability of the transfer.

- This will cost you upwards of 2% of the transfer value, with a minimum cost of around £2K.

- And if the IFA advises against a transfer, most SIPPs won’t accept the pension.

If the transfer goes ahead, it will be in the form of cash.

- In specie transfers are allowed, but they only apply when you are moving one DC pension to another.

- It will also be slower, in all likelihood.

As well as using your own SIPP, you could use a pension consolidation service, such as the one offered by PensionBee.

- Note however that this works best with DC pensions – PensionBee won’t help with the IFA report needed to transfer a DB pension.

DC pensions in drawdown can be transferred, but not annuities or DB pensions once pension income has commenced.

You can also transfer a UK pension into an approved foreign scheme (known as a QROPS) if you plan to move abroad.

- There is now a 25% tax charge for doing this.

Transfer penalties

Old pensions used to have a significant transfer penalty.

When the policy was transferred mid-term, a transfer penalty was needed to ensure that the insurance company was not out of pocket.

The transfer penalty is just a discounted value of charges that you would have paid in any event. That is, you will suffer these charges whether you stay or go.

The government has now introduced a 1% cap on transfer penalties.

Taking benefits

There are three ways to access your SIPP when you reach 55:

- a tax-free lump sum (TFLS – 25%) and a taxable income (from drawdown)

- TFLS and a taxable annuity income

- an uncrystallised fund pension lump sum (UFPLS), which is 25% tax-free and 75% taxable

Regular readers will be aware that annuities are very poor value the moment, because of low interest rates & bond yields and increased lifespans.

- Annuities also prevent you from leaving a bequest on death, whereas pensions in drawdown can be passed on tax-efficiently.

You don’t have to move all of your pension into drawdown, you can use what is known as partial drawdown.

Income tax is deducted at source by your pension provider, and in the case of UFPLS, over-deducted (an emergency rate is used which ignores your tax-free allowance and assumes you will take the UFPLS every month).

- You can reclaim the excess via self-assessment at the end of the year, or by filling in an online form.

Once you take income, your annual pension allowance falls from £40K to £4K.

Lifetime allowance

Every time you take money from your pension (or in the case of drawdown, when you move a sum of money into the drawdown process), it is measured against the lifetime allowance (LTA, currently £1.055M, but indexed to CPI).

The money is converted into a percentage which is deducted from your LTA.

- So if you took £50K as a UFPLS, you would lose 4.7% of your LTA.

When you hit 100% you are taxed an extra 25% on the income (or a flat 55% on a lump sum).

Regular readers will know that I hate the LTA:

- We have an annual contribution limit, so no output limit is needed.

- The LTA penalises good investment.

Some older savers will have protected their LTA at a higher value (£1.8M, £1.5M or £1.25M).

- The downside of protection is that no further contributions are permitted.

Funds

Chapter 8 is about funds, by which Andy means OIECs (formerly known as unit trusts).

- You can read more about them here.

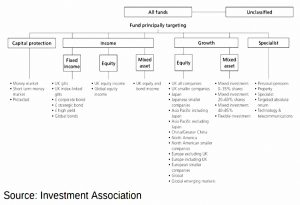

Andy includes a chart of fund sectors:

Trackers

Tracker funds – also known as passive funds – are designed to follow a market index.

- This can be a large, general index like the FTSE-100 or S&P 500 or a more specialised one.

Tracker funds are cheaper than actively managed funds because there is no manager to pay for.

Most tracker funds are ETFs.

- You can read about them here.

After a slow start (trackers were introduced in the 1970s) Index tracking is very popular today.

Note however that the most common form of indexing (market-cap weighting) is inefficient.

Tracker funds overpay for companies that are new entrants into an index and are underpaid for those companies sold when they exit an index.

By constantly rebalancing to an index, you are buying the risers and selling the fallers.

The most readily available alternative is equal weighting.

- These funds are a subset of the “smart beta” or “factor fund” sector.

Investment trusts

Investment trusts are actively managed funds that are listed on the stock exchange.

- This means that the price fluctuates with supply and demand, but also means that the manager doesn’t have to sell assets at sub-optimal times in order to fund redemptions.

They often trade at a discount to net asset value, which means that more assets are working for you than you have paid for.

- ITs are also able to use modest leverage in order to boost returns.

Because of these advantages, they tend to outperform OEICs in the long run.

You can read more about ITs here.

Although they’ve been around for a long time (F&C was founded in 1868), investment trusts operated below the radar for decades

This was largely because they didn’t pay commissions to financial advisors, and so were rarely recommended.

- There was also a scandal in the late 1990s / early 2000s, when split-capital trusts blew up.

They were split into two share classes, with one receiving income and one

receiving capital.

Splits were geared and investing in each other, so it was no great surprise that they eventually collapsed.

- It was a bit of a shame, however, as the capital shares (zero-interest shares, or zeros) were quite useful as a way of employing your CGT allowance.

Splits have slowly returned, but they are a much more niche product these days.

With the rise of the internet, ITs have become much more well known.

I use them a fair amount, particularly for access to some asset classes not easily available through ETFs (hedge funds, private equity, P2P etc).

- Some investors like to use ITs in less liquid and not-so-well understood geographies (EMs, right up to say Japan).

There are also quite a few useful “theme” ITs, mostly in tech and biotech.

REITs

Real estate investment trusts (REITs) are ITs that hold property assets and pay out at least 90% of the rental income they receive.

There are now many flavours of REIT on the UK stocks exchange:

- student accommodation

- medical surgeries

- “big box” internet retail warehouses, etc.

Since property is so illiquid, REITs have an advantage over property OEICs in that you will always be able to trade them.

VCTs

Venture capital trusts are ITs that invest in (risky) early-stage companies.

- As an incentive, they come with 30% income tax relief (on initial subscriptions, not purchases in the secondary market).

- And tax exemption on both dividends (which are often generous at around 5% pa) and capital gains (much less common).

VCTs fell out of favour when Gordon Brown relaxed the pension limits in 2006, but now that pensions have been tightened up again, they are becoming more popular.

- 2017/18 and 2018/19 were the second and third best years for VCT fundraising, topped only by the final year when 40% tax-relief was available (2005).

That’s it for today – we’re about half-way through the book now.

- It remains an easy read and a useful primer for novice investors.

In the next article, we’ll look at stocks, bonds, cash, alternatives and tax.

- Until next time.