DIY Investor 4 – IHT, Risk, Diversification, Strategies and Platforms

Today’s post is our fourth visit to The DIY Investor by Andy Bell.

Inheritance tax

Chapter 14 of Andy’s book looks at what happens when things go wrong.

- He starts with death.

The IHT regime works as follows:

- the first £325K of your estate is free (this is the nil-rate band) and your entire estate can be passed tax-free to your spouse

- this allowance can be passed on to your spouse so that her allowance becomes £650K

- you can extend your allowance to £500K (from April 2020) by passing a house or the proceeds of its sale to your children or grandchildren

- your spouse can do the same, which allows the government to claim that a family can pass on £1M tax-free

- DC pensions (but not ISAs) are outside the IHT regime (but not the income tax regime)

- business property (farms and forests, but also most AIM stocks) are IHt exempt if held for more than 2 years

- EIS and SEIS (but not VCTs) also have IHT exemptions

- everything else is taxed at 40%, or 36% if you leave 10% to charity

- note that 64% of 90% is 57.6%, so your descendants will receive less money

- this includes any gifts you have made in the seven years before your death

- these are known as potentially exempt transfers

- you also have an annual £3K gift allowance

Note also that all capital gains are reset on death, with IHT taking the place of CGT as the capital tax.

Divorce

ISA and SIPPs count as assets in a divorce.

- SIPPs can be split between the divorcing partners via pension sharing.

FSCS

The government covers £85K of your investments per platform, a recent increase from £50K.

- In practice, this applies to cash balances as stocks and funds should be ring-fenced in nominee accounts.

Risk-adjusted portfolios

Returns follow risk, but everyone has a different risk appetite.

- Take our Risk Tolerance Questionnaire to find out yours.

Andy has a list of risks to think about:

- Inflation risk

- Economic and political risk

- Credit or default risk

- Currency risk

- Liquidity risk

Andy mentions a lot of industry websites at this point.

- But I’m going to recommend that you keep reading this one instead.

Like most people, Andy is a fan of diversification:

My golden rule, above all others, is to diversify.

Spread your assets across several sectors and investment types and you are less likely to come unstuck than someone who puts everything they have on a punt on a specific sector of the market.

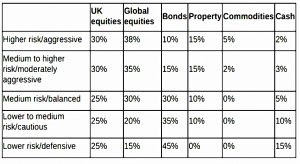

He has a table of asset allocation targets:

Unfortunately, I don’t think these allocations are very good:

- stocks range from 40% up to only 68%

- cash plus bonds range from 12% to a high 60%

- there’s generally too much property

- and there are too few asset classes

Look at the slides on this page for a better (albeit more complicated) approach.

In a second table, Andy splits EM stocks from developed world stocks, but that still only takes us to seven assets.

- A third table looks at correlations between asset classes but uses only three years of data.

You can read more about Lazy Portfolios (simple portfolios) here.

- Andy also talks about portfolio rebalancing, which we have covered here.

Strategies

In chapter 18, Andy briefly looks at a variety of approaches to investing:

- the fund investor

- the frequent trader

- the day trader

- the long-term buy and hold investor

- the passive investor

- the momentum investor

- the regular investor

- the income investor

- the growth investor

- the value investor

- the ethical investor

I didn’t get much out of this.

My own approach is a core buy and hold passive portfolio, with overlays/satellites of trend (momentum) and factors (including growth and value).

- Longer-term, I plan to add more systematic trading.

I think income investing and day trading, in particular, are misguided.

- Andy recommends that we avoid trying to catch a falling knife, and also early-stage energy and mining stocks.

Choosing a platform

We need to tread carefully with chapter 19 since Andy runs one of the largest platforms in the country.

A few of the things to look for are:

- product range (ISAs and SIPPs, at least, but also the rand of funds traded)

- model portfolios and recommended funds lists

- linked accounts

- service levels

- prices (charges)

Conclusions

That’s it – we’ve finished the book.

- The last quarter was fairly superficial and somewhat disappointing.

I’ll be back in a few weeks with a summary of the four articles to date.

- Until next time.