DIY Investor 1 – SIPPs and ISAs

Today’s post is our first visit to a new book – The DIY Investor by Andy Bell.

Contents

DIY Investor

The tag line for the book is:

How to get started in investing and plan for a financially secure future.

So it’s an entry-level book and we shouldn’t be expecting anything too earth-shattering.

- In fact, given that the author is the boss of the UK share platform that would like to be Pepsi to Hargreaves Lansdown’s Coke, I’m expecting a subtle push towards AJ Bell YouInvest’s SIPPs and ISAs. (( Disclosure – I like the YouInvest platform and both myself and my partner have SIPPs there; they are too expensive for ISAs ))

Andy Bell

Andy Bell is from Liverpool and younger than me.

- He still lives in Lancashire.

He has a maths degree and started out as an actuary before starting his investment platform.

- As well as DIY investors, AJ Bell also looks after advised clients.

- The firm recently listed on the stock exchange.

Preface

Andy’s motives for writing the book are clear from the start:

I can’t abide intellectual arrogance. Most subject matter, when explained well by someone who understands it, makes sense.

When I don’t understand something then it must be the fault of the person who has just explained it to me.

Hmm, I’m not too sure about that – maths in particular is a blind spot for a lot of people, as is long-term thinking.

- And unfortunately, both are pretty important in investing.

He has a point about jargon obscuring meaning, but its common to all fields because it saves practitioners time.

According to Andy:

Being a DIY investor can be as simple or complicated as you want it to be.

Up to a point – you will need to master asset classes, products and tax wrappers, and develop the confidence to place trades.

Andy is a big fan of stocks:

The best way to grow your assets is through the stock market, which is statistically proven to have beaten returns from banks and building societies over long periods for more than a century.

This is not a get rich quick book, nor is it anti-establishment. Financial advisers, wealth managers and fund managers all have a vital role to play in managing investments and many do a fantastic job.

More bad news – perhaps it’s not really a DIY investing book, but more a way to give people the confidence to graduate from cash savings into the markets (and onto Andy’s platform).

DIY investing

Why be a DIY investor? Because nobody cares as much about my money as I do.

This comes from one of AJ Bell’s investor surveys, but it accurately describes my own motivations.

- The subtext is that DIY investors save money and therefore should outperform in the long run.

Yet most people have no interest in some of the most important decisions in their lives.

Andy thinks there is no minimum pot size for a DITY investor:

It is not about size, it is about your state of mind.

To an extent, that’s true, but in practice, managing a pot of less than £25K is tedious work for small benefits.

- And for the effort to be life-changing, you need to be working towards life-changing sums of money – hundreds of thousands of pounds and upwards.

People who aren’t saving for retirement (or financial independence, as many people call it today) won’t get the most out of being a DIY investor.

Taking responsibility for your future is more important than it used to be, with the demise of jobs for life and DB pensions, and increases to the state pension age as life expectancy (and retirement duration) creeps ever upwards.

- Workplace pensions may fill the gap over time (if contribution rates increase) but this will take decades.

You can read more about the advantages of being a DIY investor here.

Financial advice

Even DIY investors may still need financial advice. Being a DIY investor means making your own financial decisions, but it doesn’t mean you are an expert at everything.

Inheritance tax is a classic example of where it can pay to seek advice from an expert. Divorce is another situation where you may need the help of a financial adviser.

Once again, I’m not convinced.

- IHT is not that complicated, and what you need in a divorce is a good lawyer.

IFAs don’t sell investment advice, they sell (expensive) reassurance.

- If you can get the psychological and behavioural side of investing right, the technical side is relatively straightforward.

Maintenance

You could set up a well-researched, low-maintenance investment portfolio from scratch in less than an hour, which only needs an hour or two every six months or so to review it.

Or you can create a more complex portfolio that may require daily or weekly monitoring.

True enough.

- Or you can do both, as I do (because I have the time to kill).

Platforms and accounts

Platforms are the providers (like AJ Bell) that offer investment accounts.

- The accounts themselves are what I would call products.

See here for more on how they fit into the hierarchy of investing elements.

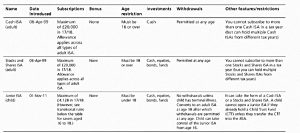

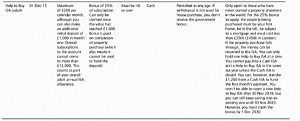

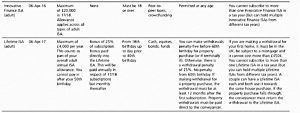

There are three types of account in the UK (plus some sub-types):

The difference is in their tax treatment:

SIPPs receive income tax relief on contributions, but withdrawals are taxable.

- ISAs receive no relief, but withdrawals are not taxable

- taxable accounts have no tax advantages

Neither SIPPs nor ISAs need to be reported on the capital gains pages of your tax return.

The downside of SIPPs is that you can’t take the money out until you are 55.

- There are no access restrictions for the other account types.

Another advantage [of ISAs] introduced in recent years is that if you die, your spouse can effectively inherit your ISA on your death they become entitled to an additional subscription allowance equal to the value of your ISA.

Whilst the value of your ISA still falls within your estate for inheritance tax purposes, it can be transferred into an ISA in your spouse’s name, thereby retaining the tax advantages, without affecting your surviving spouse’s annual ISA allowance.

SIPPs can also be passed on as a pension account to a descendent, with the contents taxable on withdrawal.

Despite some shrinkage in pension allowances in recent years, most new investors will not need a taxable account:

- you can put £40K per (tax) year into a SIPP (and carry forward any unused allowance from the three previous tax years)

- and you can put another £20K into an ISA

That’s more than anyone needs to save.

- Note that high earners may have issues, as the tapered annual allowance for those with an income above £150K pa means that their SIPP allowance can be reduced to as little as £10K pa.

ISAs

There are lots of flavours of ISA, but the only one that most people need is the Stocks and Shares (S&S) ISA.

- Cash ISAs are very popular, but a bad idea over the long run.

Innovative Finance ISAs (which invest in loans to individuals and companies, sometimes involving property) are riskier than they seem.

- They offer nothing that can’t be accessed via ETFs and investment trusts within S&S ISAs and SIPPs.

Help to Buy ISAs and Lifetime ISAs are aimed at young people saving a deposit for a house.

- Everyone else can ignore them.

Junior ISAs are for children, and have a £4K annual cap.

- They would be a great idea if the child didn’t get access to the money at age 18.

SIPPs

There are two kinds of SIPP:

- “low-cost” or online SIPPs, offered by most platforms

- these let you invest in exchange-listed assets (see below)

- full or “full-fat” SIPPs

- these are more expensive and let you invest in commercial property as well (including a company office)

Assets

Here are the main assets you might buy:

- ETFs

- OEICs (formerly known as unit trusts)

- Investment Trusts

- Stocks

- Bonds

You can read more about each of them – including the costs involved – by clicking on the links.

Costs

As we have previously pointed out, Costs Matter.

Over 30-years 0.5% pa in charges will mean the difference between a pension fund of £505,365 and £459,946, on a £5,000-a-year contribution, assuming 7% a year net growth.

Tax

Taxes matter – which is why you should always use ISAs and SIPPs.

- When you are starting out, the sums saved will seem small, but after 30 years, they will be crucial.

Investment objectives

Most goals boil down to an income or a capital sum at some point in time in the future.

- Andy makes a distinction between income and capital growth, but I don’t.

Your income is up to 3.25% pa of your capital sum – that’s the fail safe withdrawal rate (which means that you won’t run out of money).

For me, the overarching investment objective is financial independence (FI), or retirement as it used to be called.

- You make have intermediate goals along the way (a house, a wedding, or school fees), but FI is the goal.

To work out how much you will need, you have to Do The Math.

And you need to get used to the idea that investing is for the long-term.

- You shouldn’t need the money back in five or even ten years.

Andy recommends visualising your goals using a timeline on a piece of paper.

I’m more of spreadsheet person, so I have a yearly cash flow statement out to my expected year of death.

- You might not want to go to all that trouble, unless you are trying to assess the impact of a big financial decision.

Avoiding emotion

Andy has a few rules for avoiding emotion, some of which are worthy of discussion:

- He thinks that past performance is no guide to the future.

- He likes pound cost averaging, even though it usually doesn’t work.

- He likes diversification and tracker funds (I prefer ETFs)

- He likes model portfolios – so do we.

Risk appetite

Andy stresses that you must know how much risk you are prepared to take to achieve your objectives.

- We agree – you can take our risk tolerance questionnaire here.

That’s it for today.

- We’re about a quarter of the way through the book, so I expect to write another three articles (plus a summary).

I did warn you that it was an entry-level book.

- If you were already familiar with SIPPs and ISAs, you probably haven’t picked up much.

In the next article, we’ll look at pension transfers, decumulation and funds.

- Until next time.