Weekly Roundup, 2nd November 2020

We begin today’s Weekly Roundup with a look at emotions.

Contents

Traders are different

Joachim Klement explained that traders are different.

- He looked at lab experiments which ask students to simulate trading activities,

In every round, the stocks pay a random dividend and at the end of round 10, the trading will stop, and the stocks are worthless. The fair value of the stocks in every round is given by the sum of all future dividends and easy to calculate.

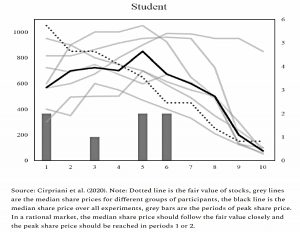

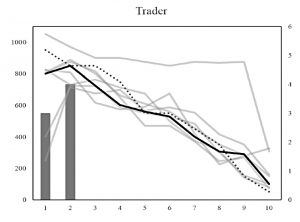

Despite this, students typically create price bubbles and then price crashes as the experiment comes to an end and the fair value of the security trends to zero.

But Cipriani et al (2020) found that traders behave differently – they behave rationally and don’t create a bubble.

Joachim mentions an old experiment by Lo and Repin:

They wired up traders and measured blood pressure, heart rate, and other physiological signals. Experienced traders are cool as a cucumber and do not show the typical emotional reactions to high volatility events.

Interestingly, younger traders do not exhibit this coolness, which suggests that it’s either learned through experience or the result of survivorship bias.

- Whichever the reason, I’m pleased to hear that there are some other rational investors out there.

In the FT, Madison Derbyshire also looked at the impact of emotions.

- Investment risk adviser Oxford Risk has found that investors lose an average of 3% pa because of emotional decisions, rising to 6-7% during times of crisis and high volatility.

Greg Davies, head of behavioural finance said:

Many people in down markets will hold on to losing assets, and instead sell the things that are going up. Which is, of course, the wrong way round.

I’m stumped why people find it so hard to Cut Their Losses, but it seems to still be the case.

Marcus Querin, the CEO, said:

Retail investors should avoid watching the markets day-to-day as this will only increase anxiety to no useful end, and make you feel like you should be doing something, without any useful guidance to what that should be.

The main investor error is holding too much cash.

- This costs investors 4-5% pa over the long run.

Davies explains:

[Investors] are buying themselves the ability to sleep better at night. Investors fail to deploy their cash because in the short term it’s easy to find an excuse not to.

[But] you have to get things spectacularly wrong in terms of timing in order to justify not being invested for the long term.

The average UK investor holds 14% cash, which is too high for me (I’m at 7% currently, and might go down to 5%).

PayPal crypto

PayPal has announced that is will start to support cryptocurrencies.

- The platform has been granted a “Bitlicense” by the New York State Department of Financial Services – the first of its kind – which allows it to trade and hold cryptocurrencies.

Within weeks, it should be offering its US customers the ability to buy sell and hold four cryptocurrencies, in partnership with startup Paxos:

- bitcoin

- ethereum

- bitcoin cash and

- litecoin

From next year, PayPal users will be able to spend their balances at the 20M online retailers which support PayPal.

- Merchants will still be paid in their default fiat currency, with Paxos handling the currency exchange (and no doubt charging substantial FX fees).

The devil could be in the detail here – customers like me will be looking to PayPal to indemnify losses arising from any issues with Paxos.

PayPal also signalled support for future digital currencies issued by governments. Dan Schulman, president and CEO, said:

The shift to digital forms of currencies is inevitable. We are eager to work with central banks and regulators around the world to offer our support, and to meaningfully

contribute to shaping the role that digital currencies will play in the future of global

finance and commerce.

Which is interesting, given that it was of the first companies to withdraw from the Libra Association in October 2019.

The move to digital – and away from physical cash – has been accelerated by the Covid-driven move to online retail, and the infection risk from notes and coins.

- Bitcoin is also having one of its periodic booms, up 70% since the start of the year.

PayPal has 350M users globally, but it’s not clear when the new services will arrive in the UK.

- I’ve been looking for a safe way to store crypto, so I’ll have a closer look when it does.

It appears that PayPal’s smaller rival Square already offers bitcoin support, so I’ll need to do some digging there also.

- This could be the catalyst for mainstream adoption of bitcoin as cash, as well as a store of value.

Social Care

The Economist wrote about a report from the House of Commons health and social care committee which recommends spending £7bn more on social care by 2023-24, an increase of a third.

- £3.9 bn of this would cover demographic changes – more old people needing more care

More pertinently for private investors, the other £3.1 bn would be used to cap the lifetime amount individuals pay towards care at £46K, the revised figure from the Dilnot report way back in 2011.

- Anything more would be paid for by the state, which currently only funds care for those with assets of less than £23.3K.

Since the cost of care is so hard to predict, insurance is not available for the rest of us.

When the Tories won the 2019 election with a sizeable majority, Boris Johnson pledged to sort out social care after a decade of delays.

- But monumental Covid spending and an inability to make long term plans in the pandemic environment mean that things might well get kicked down the road once more.

The high net worth exemption

In FT Adviser, Chloe Chung (( I couldn’t find a picture )) wrote about the Financial Conduct Authority’s review of the high net worth exemption.

- This allows HNW individuals to access investments which are not available to regular private investors, usually after ticking a box to self-certify.

- I use it to invest in VCTs and occasionally EIS.

The threshold is currently an income of £100K pa or net assets of £250K, but it hasn’t changed in twenty years.

- Adjusting for inflation, the corresponding numbers are around £175K pa and £436K.

Financial advisers are delighted by the prospect of an investor having to pay for their advice before they can move their own money around (as happens at present before, say, DB pension transfers).

Piers Mepsted, MD of the Financial Advice Centre said:

Investments are by nature sophisticated. As an adviser permitted to make recommendations on these plans I have had to pass stringent industry exams and commit many hours each year to recorded and structured CPD programmes to keep this knowledge up to date.

Objectively, unless a client has these similar qualifications and is also committed to a maintenance regime to keep this knowledge up to date it is hard to see how they can use a tick box exercise to self-certify their credentials simply by being high net worth.

In my experience, IFAs know little about investment, often farming it out to third parties.

- Their exams and CPD focus on regulation – largely how to avoid being sued when things go wrong – sales and client management (psychology).

Rather than raise the HNW bar, the FCA would be better employed in restricting access to products unsuitable for beginners (and sometimes, for anyone) – like mini-bonds and equity crowdfunding.

Property funds

Speaking of which, here’s a potential ban that I am in favour of.

- Also in FT Adviser, Imogen Tew reported that HMRC is planning to exclude new investments in open-ended property funds (OEICs) from ISAs.

The FCA is proposing that investors give 180 days notice to redeem an investment in such a fund.

- But ISA legislation requires that an ISA can be transferred to another prover with 30 days.

And Lifetime ISAs need to be redeemed sharpish in order to fund a house deposit.

It’s possible that HMRC will allow existing investments to remain, but that no further investments could be made.

- Or even that existing holdings could be topped up, but no new funds could be purchased.

The HMRC consultation ends in December, but whatever the outcome, illiquid asset classes and OEICs don’t mix.

- Stick to REITs and ETFs.

Pension deposits

To balance things out, here’s a rule change that I don’t want to see.

- Josephine Cumbo (amongst others) wrote about a suggestion from pensions minister Guy Opperman that first-time buyers might be allowed to access their pensions early in order to funds their property deposits.

Apparently, the US and New Zealand allow you to do this.

Apart from the fact that most people will only have their workplace auto-enrolment pot, and that the 8% pa contributions aren’t nearly enough to provide for retirement in the first place, this proposal breaks the contract between the pension saver and the rest of society.

- The deal is that you save enough so that you won’t become a burden on the state, and you are incentivised with tax relief to do that.

Hence the c. £1M LTA, which translates to an indexed lifetime income of around £25K pa.

In return, you can’t access the pot until 10 years before state pension age (55 at present, rising to 57).

- If you want to retire earlier than that, you’ll need another pot to bridge the gap – ISAs being the obvious approach.

This seems fine to me, and there’s no need for a retirement product to be available before retirement.

- But of course, this country depends on the housing market being supported by any means necessary, and this is just the latest wheeze.

Let’s hope this idea is quietly dropped.

Quick Links

I have five for you this week, the first three from The Economist:

- The newspaper claimed that innovation is an essential part of dealing with climate change

- And that climate-conscious venture capitalists are back

- And that Rishi Sunak has got the Furlough wrong.

- Alpha Architect looked at combining the Value and Profitability factors

- And at portfolio timing based on volatility signals.

Until next time.