Weekly Roundup, 15th February 2021

We begin today’s Weekly Roundup with news of a sentiment ETF.

Sentiment ETF

In the FT, Steve Johnson reported that New York asset manager VanEck is planning to launch a social media sentiment ETF.

- The fund will invest in the most talked-about stocks on platforms like Twitter and StockTwits.

- Reddit is not a big driver, since trends are measured over weeks or months rather than days.

The ETF will track the Buzz NextGen AI US Sentiment Leaders Index created by Periscope Capital, a Toronto hedge fund.

- An earlier ETF – the Sprott Buzz Social Media Insights ETF – tracked the same index from 2016 to 2019.

The index uses AI and machine learning to identify patterns in social sentiment and translate these into the 75 most bullish-looking US large caps.

- The index is rebalanced on a monthly basis, and typically 15 to 20 stocks are swapped out each month (not unusual for what is essentially a momentum strategy.

Periscope describes the index as a mixture of momentum and value since a lot of online conversations are about whether a stock has become cheap enough to buy.

- Facebook, Zoom Video, Apple, Amazon, Twitter and Tesla are some of the largest current holdings.

- But so are Boeing and Carnival.

The index has outperformed the S&P 500, most notably since the Covid lockdowns began.

- The number of posts analysed has risen from about 2M a month in 2016 to 50M today.

It sounds interesting, but I think the initial listing will be US-only.

Happiness

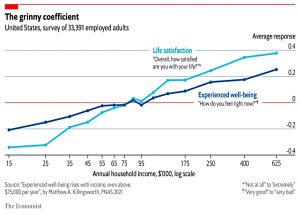

The Economist reported that the increase in happiness associated with an increase in income might not top out at $75K pa (now $90K pa) after all.

- A new paper suggests that happiness increases even at many multiples of this level.

- This report used real-time smartphone prompts rather than the end-of-period recollections of the earlier study.

The caveats to the new higher limit are that extra happiness becomes increasingly expensive and that other factors matter a lot more than money.

- Health, religion, employment and family were the main external factors.

And each extra dollar brought diminishing returns in extra happiness – there’s still tailing off, even if the ceiling has disappeared.

- The happiness gap from $40K to $60K matched that between $80K and $160K.

Commodities

Following up on last week, Neil Hume in the FT wrote about the prospects for a commodities bull run.

- The potential drivers are the recovery from the pandemic downturn and the prospect of continued high levels of government spending.

Underlying those are the fear that inflation is about to return.

- And the move from a carbon economy to one base on renewables should increase demand for raw materials like copper.

On the demand side, years of low prices mean chronic underinvestment, which will only be rectified by higher prices.

Some [Wall Street banks] are predicting a prolonged period of commodity-intensive growth – a repeat of the so-called “supercycle” of the 2000s, where oil and metal prices hit record highs as China’s rapid industrialisation caught the industry napping.

Asset manager SummerHaven noted that all 27 commodities they tracked showed positive returns over the six months to mid-Jan. Partner Kurt Nelson commented:

This is really unusual. We’ve looked back 50 years and we’ve never seen this basket of commodities all go up at once.

Eliot Gelle of CoreCommodity Management points to the positive macroeconomic backdrop:

Since 2010, we have seen equity markets rally, a strong US dollar, interest rates trend lower and inflation expectations decline. Today, we have the threat of rising inflation, a weaker dollar and interest rates that are already zero or negative.

The main argument against a new supercycle is timing.

- They tend to happen every 30 to 40 years and we’re only a decade past the end of the last one.

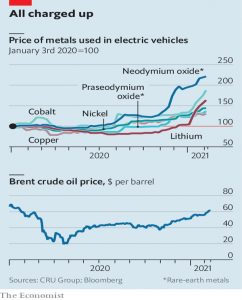

The Economist looked at why both oil and the metals used in electric vehicles (EVs) are rising in price.

- Rising demand is behind both rises – from China, India and the US (boosted by the Biden stimulus) in the case of oil.

- EV metal demand comes largely from China, where they make up 9.4% of sales.

On the supply side, Saudi has cut oil production and Iran sanctions remain in place.

- There are EV metal supply constraints too, from disrupted South African ports (cobalt) and China (rare earths).

- Nickel mines in the Pacific Islands were also affected.

Whilst you might expect the two prices to diverge over the next few years, supply constraints might mean that doesn’t happen for a while.

In MoneyWeek, Alex Rankine also looked at the prospects for a new commodities supercycle.

Burger FX

The Economist’s latest visit to the Big Mac index, which looks at FX rates through the prism of burger prices, found that despite recent weakness, the dollar remains strong.

Of the currencies of the 20 trading partners studied by America’s Treasury, our measure suggests that all have gained relative to the greenback since July, but that all apart from the Swiss franc are still cheap.

After adjusting for GDP per person, eleven currencies remain undervalued relative to the dollar.

- If you are interested in which countries may be manipulating their currencies (and hence might face penalties from the US, check out the article.

Morningstar rating

Our recent focus on Gamestop, Bitcoin, bubbles, commodities and inflation means that we’ve built up quite a backlog of the great stuff covered on Joachim Klement’s blog.

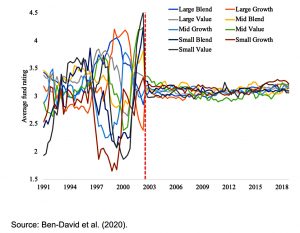

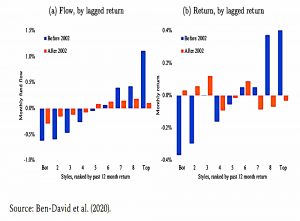

- At the start of the year, he looked at the influence of Morningstar ratings.

Until 2002, Morningstar rated all funds based on past performance, volatility, consistency of returns, etc. independent of the fund’s style. That meant that as one style started to outperform, the funds following this style started to get four- and five-star ratings, while funds following underperforming styles got worse ratings.

In 2002, the firm switched to ratings within a style.

Since investors who follow Morningstar ratings were previously chasing past performance, in-style ratings made this more difficult.

If investors put a lot of funds to work in funds that had strong performance in the past, they create a herding effect that perpetuates the price momentum of past

winners. As a result, value stocks, small cap stocks and other styles tended to have longer-lasting trends in the past and outperformed for longer before mean reversion kicked in.

The change in fund flows appears to be an influence on the lack of outperformance from small-cap and value stocks over the past two decades.

Gold

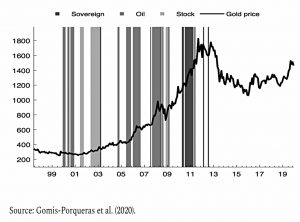

Joachim’s second article revisited the idea of gold as a crisis hedge.

- He has previously written a paper on the metal:

I think gold is predominantly driven by inflation expectations and real rates (with real rates typically being the flip side of inflation expectations priced in bond markets).

But things change in a crisis:

Gold reacts far more in situations of extremely negative real rates such as an acute crisis or an unexpected spike in inflation expectations. There is little to no evidence that gold acts as a hedge against Dollar exchange rate fluctuations or to equity market volatility.

A new paper disagrees somewhat:

In calm markets, there is no link between gold prices and equity markets or sovereign bond markets.

But once a crisis hits and markets move fast, gold starts to become a good crisis hedge for shocks in equity markets, bond markets, and oil markets. Gold prices are always a good hedge against a stronger US Dollar.

Joachim notes that most of this hedging happened during the last gold supercycle (1999 to 2103):

If gold is anyway in a multi-year bull market, it shouldn’t be too surprising that gold hedges against extreme market declines in other asset classes.

But gold also worked during the Covid crisis of 2020, so it remains a good source of crisis alpha.

Bitcoin

The big news last week was Tesla announcing that they had taken bitcoin on to their balance sheet, taking the BTC price back up over $47K.

We also had the news that Mastercard will join Visa in providing crypto payments at some point in the future, and an announcement from BNY Mellon that they will store, transfer and “issue” crypto for their clients.

Roman Regelman, head of digital, said:

BNY Mellon is proud to be the first global bank to announce plans to provide an integrated service for digital assets.

And according to journalist Carl Quintanilla, PayPal is planning to add crypto to its UK platform later this year.

- PayPal also plans to allow spending of crypto at all of it’s 29M merchants by 2Q21.

US users of PayPal have been able to buy crypto since November 2020.

- No doubt BTC will be at $500K by the time we in the UK can join them.

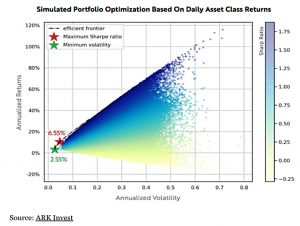

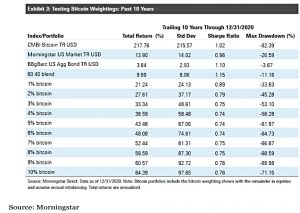

Popular UK finance blog Monevator looked at how much Bitcoin you should have in your portfolio.

- ARK’s Big Ideas document (( More on this in a future post )) contains a Monte Carlo analysis which suggests that somewhere between 2.5% and 6.6% is optimal.

From historical data, the problem – as documented above by Morningstar – is volatility.

- Even a 2% weighting increases your volatility (vs the US market) by 150% and reduces your Sharpe Ratio by 20%.

- On the plus side, returns are doubled.

We might expect BTC volatility to decrease somewhat as the price increases, but perhaps not.

- I’ll think about that more when I pluck up the courage to take even a half-per cent position in bitcoin.

Since I first took a serious interest, the price has been on a rocket ship ride.

- I can usually get behind momentum but the potential for a Tether-driven collapse is still an issue for me.

Quick Links

I have just two for you this week:

- Musings on Markets had Data Update 4 for 2021 – on the hurdle rate question

- And the UK Value Investor explained how to value shares with the Dividend Discount Model.

Until next time.

RE: Happiness

Interesting.

To my eyes Fig 1 in the original (Killingworth) paper – which I guess The Economist has re-worked above – is more compelling of a log(income) relationship. But that could be just me.