How to Get Rich 1 – Obstacles

Today’s post is our first visit to a new book – How to Get Rich by the late Felix Dennis.

Contents

Felix Dennis

Felix Dennis is most famous for being one of the three publishers of Oz magazine who were prosecuted in the 1960s for printing pornographic drawings.

He served time but made a success of his life when he emerged, publishing magazines like Maxim, along with The Week and Money Week.

- He was also famous for drinking, drug-taking and what we might call a bachelor lifestyle.

In his later years, he turned to planting trees and writing poetry – organising tours under the catchy title “Did I Mention the Free Wine”?

- He died young (67) so I never got around to sampling the wine, which I heard was pretty good.

Most importantly for our present purposes, Felix was one of the richest self-made men in Britain, worth hundreds of millions of pounds, and he wrote a book about how to do it.

According to the book:

Making money is a knack. A knack that can be acquired…

Felix says:

I believe that almost anyone of reasonable intelligence can become rich, given sufficient motivation and application.

Let’s see if we agree.

How to get rich

Felix assures us that this book is not:

- a con-job

- ghost-written

- a messianic self-improvement manual

- selling anything (other than the book)

Instead, it will tell us how he managed to get rich without a college education or any starting capital.

- But he warns that is not likely that anyone will get rich quick – there are no short cuts.

I got rich my way. You might even say the old-fashioned way. By making errors, lots of errors, and learning from them.

What kind of people get rich?

The key, I think, is confidence. Confidence and an unshakeable belief it can be done and that you are the one to do it.

Tunnel vision helps. Being a bit of a shit helps. A thick skin helps. Stamina is crucial, as is a capacity to work so hard that your best friends mock you.

Not those who want to and not those who need to, but those who are utterly determined to whatever the cost.

Myths

1 – people do not set out to get rich but become rich “by accident”

Some people are merely better at disguising desire, that’s all.

2 – people got rich by having a `great idea’.

All of us have had great ideas from time to time. The follow-through, the execution, is a thousand times more important.

3 – that it was easier starting out in the 1960s, and that “you couldn’t do it that way today.”

Perhaps not, but you can certainly do it some way. Times change, but human nature remain[s] a shining constant.

How rich?

The next section examines how rich you might become.

- Allowing for inflation, Felix’s preamble seems to have in mind the tens of millions to hundreds of millions of pounds.

We can settle for a lot less than that.

- At the time of writing, even in London, a family could be financially independent (FI) with perhaps £3M to £4M.

- In cheaper parts of the country, £1M could be enough.

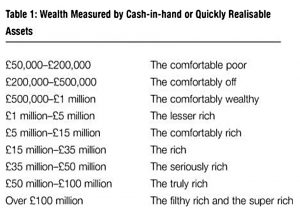

Deeper into the book, Felix provides a table of how much cash is needed for each level of wealth.

- Remember this is from 2006, so each pound is now worth £1.45 because of inflation.

So Felix would describe my FI targets as part of the comfortably wealthy or the lesser rich, even if they held all their money as cash.

- Given that most people hold say 10% of net worth in cash, my audience of FI chasers remains firmly in the “comfortable” brackets.

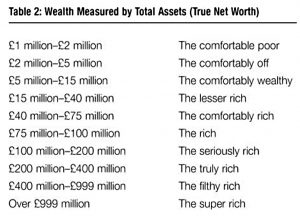

This is confirmed by the second table of net worth levels.

Felix notes that without careful tax planning, IHT will gobble up much of your net worth upon death.

He also says that becoming rich will not make you happy:

In fact, it is almost certain to impose the opposite condition - if not from the stresses and strains of protecting wealth, then from the guilt that inevitably accompanies its arrival.

And he finally settles on a target value:

Rich starts at a total asset value of £15 – £40 million (also known as `the lesser rich’). So that’s where we’re aiming.

We’ll call that £20M to £60M in today’s money – nice work if you can get it.

Reasons not to

In the next chapter, Felix looks at the reasons people never begin their journey to riches.

Young and penniless

If young and relatively penniless, many will argue their lack of experience and capital (especially capital!) dooms them to decades of wage slavery.

But with nothing to lose, Felix sees the young as well placed to get rich.

Not knowing that something cannot be done, you are likely to waltz into uncharted minefields where angels before you have feared to dance.

Along with risk-taking, he cites ambition, fearlessness, stamina, a willingness to learn and technical currency as advantages.

Felix mentions his own experience in the 1980s in launching successful computer magazines (and indeed, “poster-magazines”) which no-one in the industry thought would sell.

On the way up

If slightly better off and on the way up with a halfway decent job and perhaps the probability of further advancement, the problem is often considered to be the loss of what they have already achieved. Plus the lack of capital.

Felix says that these people have a fear of failure, which will be dealt with in the next chapter.

- He employs a lot of people like this to run his own companies, and he is always pleased when they leave to set up their own.

Senior professionals

By the time one is a senior manager or professional, probably with a decent house, a mortgage and children, it is the risk to the security and happiness of the latter (and maybe to a spouse), plus the usual lack of capital, which are most often cited as insuperable difficulties to taking the plunge.

Felix is quite cynical about the chances of this group.

In nearly forty years of doing business, I know of only six senior managers or professionals between forty and fifty who struck out on their own. And two of those were lawyers.

And none of them became really rich.

Your chances are slim, but they are not impossible. My earnest advice is to get yourself a young and fearless partner with tons of stamina.

Million to one

In chapter two, Felix looks at the odds of getting rich.

By my earlier definition, only 0.000016 per cent of 60 million British citizens are rich.

That’s 16 in a million, or 1,000 people in the UK when Felix was writing.

- And a quarter of these places were filled by those who inherited their wealth (that proportion is constantly falling, though the media rarely notices).

Felix runs through a couple of things that work against you:

- poor health (physical or mental)

- advanced age or very young age

He estimates that this rules out around 40% of the population.

Another 8.3% work in the public sector and can also be ignored.

- Official government statistics for June 2020 put this figure at 17% of the workforce, which is still around 8.3% of the population.

And Felix reckons that a maximum of 3% of the remaining 51.7% has the necessary drive or ambition.

- Which is 1.6% of the population, or around 1M people.

Which makes the odds of making the top thousand (roughly the Sunday Times Rich List) around 1 in 1000.

Felix notes at this point that getting really rich is not a great idea:

If I had my time again, I would dedicate myself to making just enough to live comfortably (say £30 or £40 million), as quickly as I could - hopefully by the time I was thirty-five years old. I would then cash out immediately and retire to write poetry and plant trees.

But like an old, punch-drunk boxer, I couldn’t quit. I always craved just one more massive pay-day. One more fight, so I can retire as the champ. There is no such thing as a permanent champ.

Making money is a drug. Whoever dies with the most toys doesn’t win. Real winners are people who know their limits and respect them.

Fear of failure

This is the 800lb gorilla.

Felix paraphrases Keats:

Once begun - the job’s half done. Taking that first, irrevocable step has proved to be the most difficult part of nearly every venture I have been involved in.

The only way to conquer the fear of failure is to get started.

I regret the majority of the times I acquiesced in shilly-shallying and a retreat to safety. I would rather have tried and failed, in most cases, than have taken the safer course that so often appears to be wiser in the abstract.

Felix recalls the time a senior manager at WH Smith talked him out of launching a computer magazine just before the launch of Personal Computer World.

- Luckily the publisher ran out of capital and Felix bought him out before selling on to a conglomerate.

- Listening to the WH Smith guy cost Felix £4M.

Fear of failure has two parts:

- letting others down and the associated financial impact

- the embarrassment of the whole world knowing about your failure.

Fear of attempting something, the result of which cannot be easily hidden, weighs whether we are aware of it or not. This applies to almost all business and career-related decisions.

So to be rich, you need to develop a thick skin.

Thick enough to shrug off the inevitable sniggering and malicious mockery that will follow your inevitable failures, not to mention the poorly hidden envy that will accompany your eventual success.

Felix ends the chapter with a list of test that the wannabee rich must pass:

- be willing to publicly fail

- not care what the neighbours think

- tolerate the worries of your family and spouse as you plough a “lonely, dangerous road” rather than take the safe option

- not worry that the search for wealth will coarsen or degrade your artistic talents (it will)

- work longer hours than everyone you know

- be sure you are “good enough” to be rich

- see the quest for riches as a game

- face up to your fear of failure

Getting rich means sacrifice. And it isn’t always you that’s doing the sacrificing.

And that’s it for today.

- Although it’s a chatty book, it’s quite long for a finance text.

We’re only one-seventh of the way through so far, and we could be looking at another six articles (plus a summary) in this series.

- It’s been an entertaining read so far, but I can’t help feeling that Felix is describing the kinds of people who get rich, rather than really helping those who would otherwise not make it.

Until next time.